Earlier this month, CardUp became the first to launch a YA2023 income tax payment offer with a 1.75% fee, valid for Singapore-issued Visa cards.

This offer is currently set to lapse on 19 April 2023, and while there’s no word yet on an extension, MileLion readers can use the code MLTAX23 to enjoy a 1.75% fee all the way till 31 August 2023, regardless of whether they’re new or existing CardUp customers.

Even better- while the public offer is valid for a one-off payment or the first in a series of recurring payments, the MileLion offer is valid for a one-off payment or an entire series of recurring payments.

Pay income tax via CardUp with a 1.75% fee

Here’s the key details of CardUp’s 1.75% income tax payment promotion for MileLion readers:

- Use code MLTAX23

- Payments must be scheduled by 31 August 2023, with a due date on or before 31 March 2024

- Promo code can be used once per customer, either for a one-off payment or entire series of recurring payments

- No maximum or minimum spend

- Valid for Singapore-issued Visa cards only

This code is valid for both new and existing CardUp users, but if you’re a new user, be sure to read the box below.

| ❓ First-time user? |

|

If this is your first time using CardUp, use the code MILELION to save S$30 off your first transaction with no minimum spend required. This allows you to earn free miles on a payment of up to S$1,154 (based on CardUp’s regular admin fee of 2.6%). You can subsequently use the MLTAX23 code to pay the rest of your balance, since this code is valid for both new and existing customers. |

Terms & Conditions

The T&Cs of this offer can be found here.

What’s the cost per mile?

Here’s the cost per mile for various Visa cards in Singapore, given the earn rates and a 1.75% admin fee.

| Card | Earn Rate | Cost Per Mile (1.75% fee) |

DBS Insignia DBS Insignia |

1.6 | 1.07 |

UOB Reserve UOB Reserve |

1.6 | 1.07 |

OCBC VOYAGE OCBC VOYAGE(Premier, PPC, BOS) |

1.6 | 1.07 |

Citi ULTIMA Citi ULTIMA |

1.6 | 1.07 |

SCB VI SCB VI |

1.4* | 1.23 |

DBS Vantage DBS Vantage |

1.5 | 1.15 |

UOB PRVI Miles Visa UOB PRVI Miles Visa |

1.4 | 1.23 |

UOB VI Metal UOB VI Metal |

1.4 | 1.23 |

OCBC VOYAGE OCBC VOYAGE |

1.3 |

1.32 |

OCBC 90°N Visa OCBC 90°N Visa |

1.3 | 1.32 |

OCBC Premier VI OCBC Premier VI |

1.28 | 1.34 |

SCB X Card SCB X Card |

1.2 | 1.43 |

DBS Altitude Visa DBS Altitude Visa |

1.2 | 1.43 |

| *1.4 mpd applies with minimum S$2K spend per statement month, otherwise 1.0 mpd (1.72 cpm). CardUp spending counts towards the minimum spend. |

||

| 💳 OCBC customer? |

|

OCBC cardholders can take advantage of a lower fee, provided they’re new to CardUp: |

Remember, both the tax payment amount and the CardUp fee are eligible to earn miles.

For example, someone who pays a S$1,000 tax bill via CardUp would pay S$1,017.50 after fees. If he uses a 1.4 mpd card, he will earn 1,425 miles (ignoring rounding), for which he has paid a fee of S$17.50. The cost per mile is therefore 1.23 cents each.

Depending on what card you use, the cost per mile can start from as low as 1.07 cents each, which is a very compelling price to pay. Assuming your tax bill is large enough, you could be buying a Business Class ticket to Japan or South Korea for just over S$1,110 plus taxes (Business Saver @ 104,000 miles @ 1.07 cents each).

Even if you have one of the more basic 1.2 mpd earning cards, you can still enjoy a relatively competitive price of 1.43 cents per mile.

How to setup income tax payments

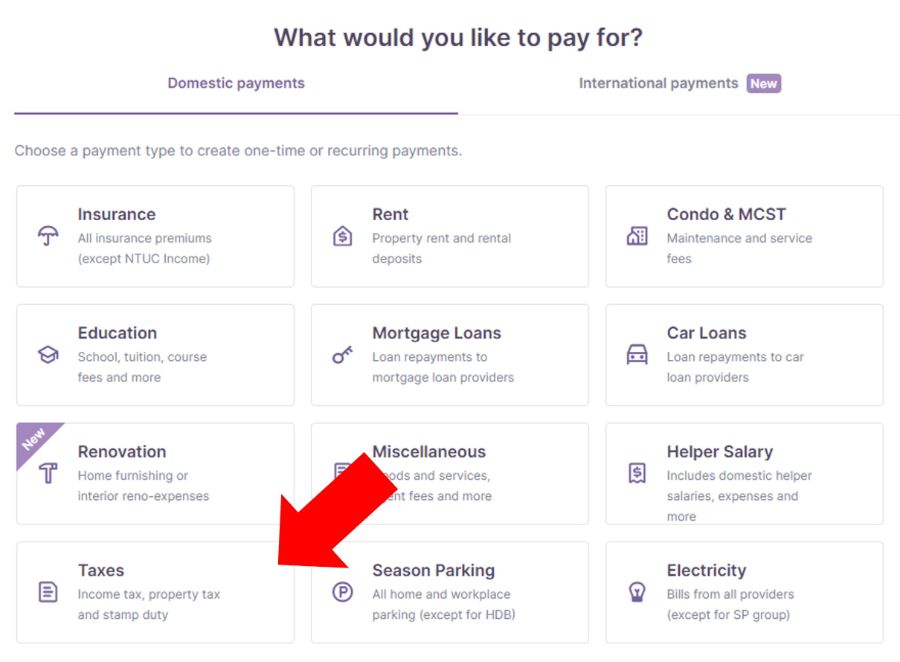

To schedule an income tax payment, login to your CardUp account and click on Create Payment > Taxes > IRAS-Income Tax

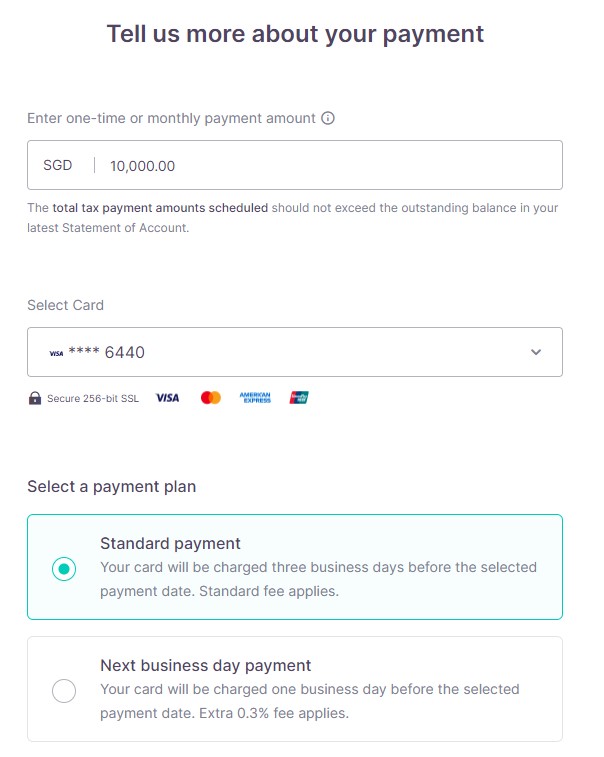

On the next screen, you’ll be prompted to enter the payment amount, choose a card (remember: Visa only), and a payment plan (the code is only valid for Standard payments).

Your payment reference number will be automatically filled based on the NRIC number registered to your CardUp account (this also means you can’t use CardUp to pay someone else’s taxes).

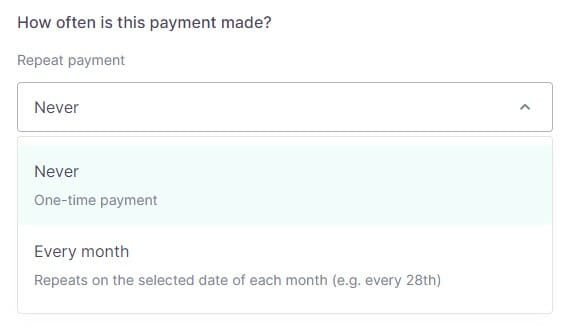

You’ll also be prompted to choose whether you want this to be a one-time payment, or recurring payment.

One-time payment

Under this option, you can pay any amount up to the total tax due on your NOA.

In other words, if your tax bill is S$10,000, you can pay any amount up to S$10,000.

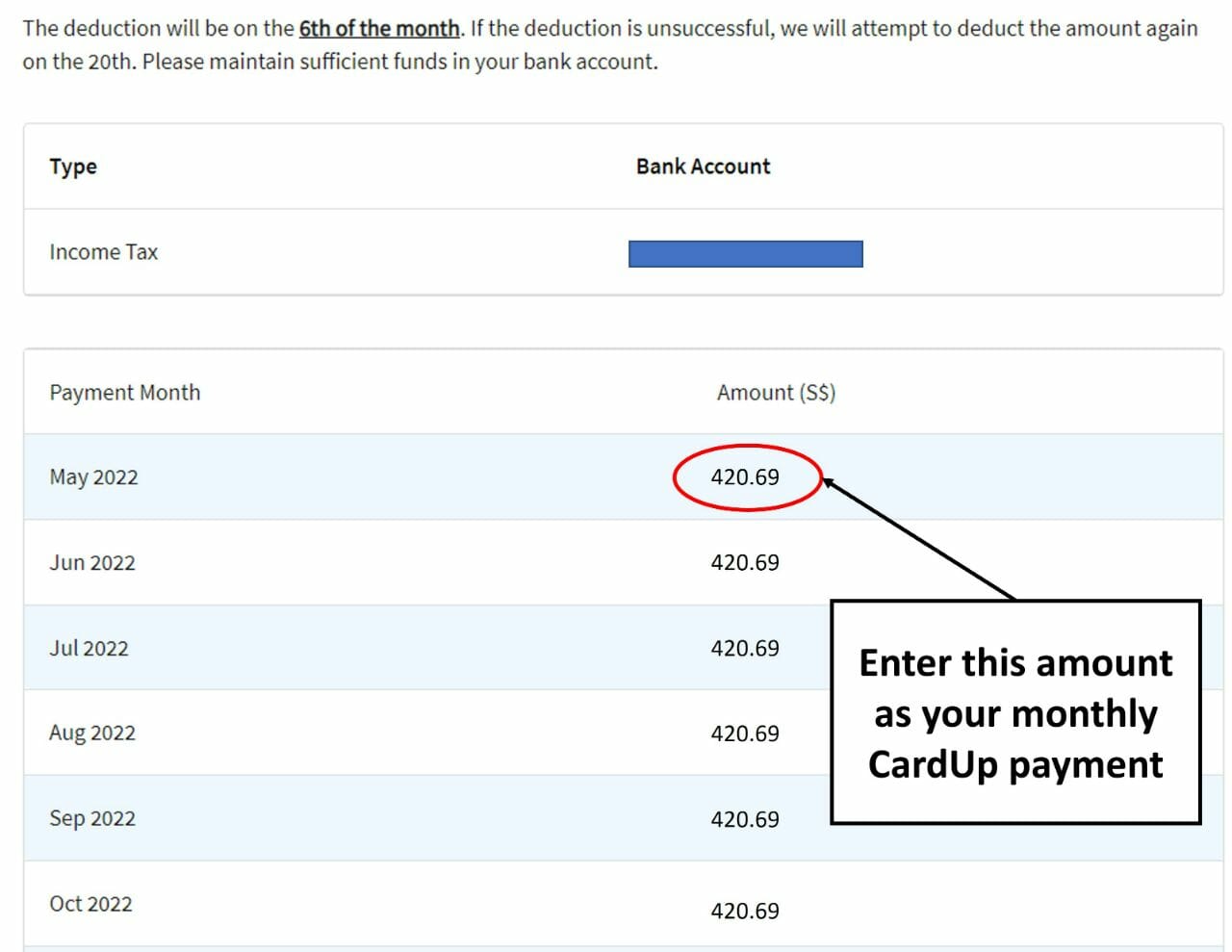

Recurring payment

Under this option, you can use CardUp to pay your monthly instalment under a GIRO plan with IRAS.

This can be set up via the following methods:

- Instant

- myTax portal (DBS/POSB and OCBC customers)

- Internet banking (DBS/POSB, OCBC and UOB customers)

- AXS stations (DBS/POSB customers)

- 3 weeks processing

- GIRO application form (all bank customers)

Once your GIRO arrangement has been approved, you can view the monthly instalment by logging to myTax Portal, selecting Account > View Payment Plan > View Plan.

This is the figure you need to enter as the payment amount in the CardUp portal.

You’ll also need to select the date of the first and last monthly payment. Do note that first and last few dates of every month will be blocked off. That’s because IRAS does their deductions on the 6th of every month, and CardUp payments need to arrive in advance of that to avoid double deductions.

Regardless of whether you choose one-time or recurring, don’t forget to enter the promo code MLTAX23. Don’t worry that the total fee doesn’t reflect the discount yet- that will appear on the final screen.

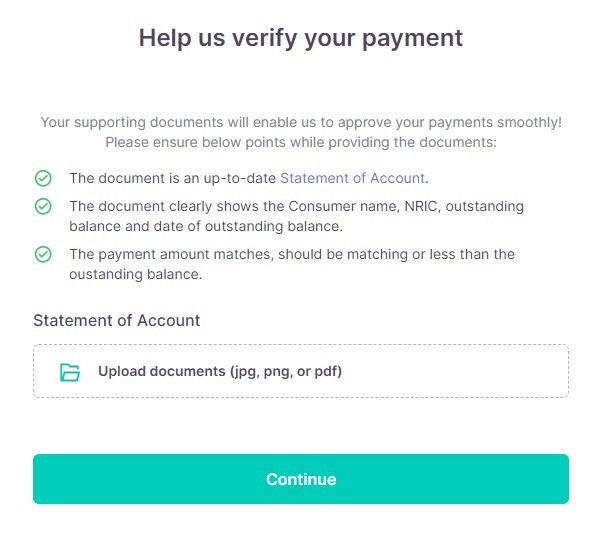

On the next screen, you’ll be prompted to upload a copy of your NOA for verification. This is to ensure you aren’t using CardUp to overpay your tax bill, which is a big no-no from an IRAS point of view.

Finally, you’ll be able to review the payment schedule before confirming it.

If you chose a one-time payment, you’ll see something like this:

If you chose a recurring payment, you’ll see something like this:

Make sure that every payment in the recurring series enjoys the 1.75% rate (remember, the last payment due date must be on or before 31 March 2024).

Income tax guide 2023

I recently finished compiling The MileLion’s Income Tax Guide 2023, which gives a rundown of options for earning miles when paying income tax with credit cards. Be sure to bookmark that post for further updates!

Conclusion

MileLion readers can enjoy a 1.75% promotion for income tax payments made with Visa cards, for any payment (whether one-time or recurring) set up by 31 August 2023. This allows the purchase of miles from as little as 1.07 cents each, depending on card.

It remains to be seen what other providers (especially Citi PayAll) come up with, but if your first instalment payment is due soon, it doesn’t hurt to use this code to cover it first.

Hi hi, is this workable if I prefer to opt for cashback instead of miles for my credit card?

We don’t do cash back on this site!

But out of curiosity, you have a cashback card that offers a return exceeding the admin fee?

Maybank’s Visa Platinum!

Hi ML, hope you are able to clarify. If I’m already on Giro arrangement. Do I need to cancel it first? Or I just need to ensure the CardUp recurring payment date for each month supersede the Giro deduction date? i.e. Giro won’t perform another deduction.

do not cancel your existing giro arrangement with IRAS. instead, use cardup to make payment each month ahead of the giro deduction date, and you won’t get a double deduction.

https://carduphelp.zendesk.com/hc/en-us/articles/115007653967-Can-I-schedule-my-tax-payment-as-monthly-instalments-on-CardUp-

instructions

Thank u both ML & OJW! =)

You do not need to cancel the GIRO arrangement. In fact, please do not cancel it if you are intending to pay in instalments. When you create the payment on CardUp, there would be certain dates that CardUp has blocked out to prevent any accidental GIRO deduction. As long as you select a date before those blocked-out dates, you would be safe.

How about Maybank Visa Infinite?

Works for Maybank VI.

Suddenly I am all excited and eager to receive my NOA so that I can arrange the payments! 🙂

If I set up the recurring installment with cardup and later Citi payall comes out with a better rate, can I still be able to cancel the cardup arrangement and opt for Citi payall? Thanks in advance

Yes, there is no obligation to finish a payment series

Given that SCB VI card already has an income tax feature at 1.6% fee, isn’t that cheaper than the 1.75% CardUp fee? The only advantage I see for CardUp is that if income tax >$24k, then use that for recurring >$2k monthly payment on CardUp linked to SCB VI card, as a result of which the $2k threshold which triggers 1.4x local & 3x foreign currency transactions are met.

Any reason why Citi PremierMiles Visa not listed in your analysis above? Thanks.

Anything for Amex Plat? worth waiting a month for anything to arrive or this is it?

cardup is in discussions with amex, but nothing official yet.

Does this work for the HSBC revolution card as well? What would be preferred between HSBC and DBS Altitude visa card?

Is citi premiermiles VISA eligible for the CardUp promotion and able to get 1.2 mpd as well?