The DBS Vantage Card normally offers a sign-up bonus of up to 60,000 miles, but this is periodically upsized to 80,000 miles, with a frequency that suggests it’s really meant to be the “de facto” offer!

The last 80,000 miles acquisition offer ended on 6 June, but DBS has brought it back just weeks later, this time valid for applications till 10 July 2023.

New customers who spend S$5,000 within 30 days of approval and pay the first year’s S$594 annual fee will receive 80,000 bonus miles, while existing customers will receive 60,000 bonus miles for meeting the same criteria.

|

| Apply |

| Offer ends 10 July 23. Min. spend of S$5,000 within 30 days of approval required. Apply with promo code FLASHVTG |

For the sake of comparison, this is even better than the acquisition offer we saw when the Vantage first launched in June 2022, which required a minimum spend of S$8,000 for the same bonus!

DBS Vantage Flash Deal

DBS Vantage Card DBS Vantage Card |

||

| Apply |

||

| Card T&Cs | ||

| Flash Deal T&Cs | ||

| Income Req. | Annual Fee | FCY Fee |

| S$120,000 |

S$594 | 3.25% |

| Local Earn | FCY Earn | Miles with AF |

| 1.5 mpd |

2.2 mpd | 25,000 miles |

From 27 June to 10 July 2023, new DBS Vantage Cardholders who spend S$5,000 within 30 days of approval and pay the first year’s S$594 annual fee will receive the following:

| New Customer | Existing Customer | |

| Pay S$594 annual fee | 25,000 miles | 25,000 miles |

| Spend S$5,000 within 30 days | 55,000 miles | 35,000 miles |

| Total | 80,000 miles | 60,000 miles |

| Must apply with promo code FLASHVTG |

||

| ❓ “New Customer” Definition | ||

|

New customers are defined as those who:

For avoidance of doubt, holding a supplementary DBS/POSB credit card does not, in and of itself, make you an existing customer. |

||

New customers will receive 80,000 miles, while those who already hold other DBS/POSB cards will receive 60,000 miles.

Do remember the “real” bonus is 55,000/35,000 miles for new/existing customers, since cardholders receive 25,000 miles for paying the annual fee every year anyway.

This bonus is on top of whatever base miles you normally earn with the DBS Vantage, so you’re looking at at least 87,500 miles (new) or 67,500 miles (existing) in total, based on S$5,000 spent locally at 1.5 mpd.

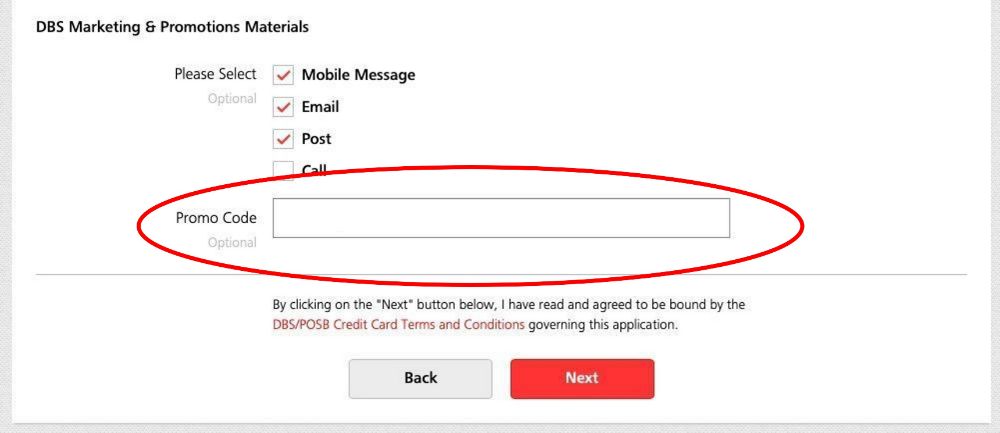

You must enter the promo code FLASHVTG when applying, and all applications must be approved by 24 July 2023. The promo code field can be found towards the bottom of the application page, under the “DBS Marketing & Promotions Materials” section.

If you forget to enter the code, you can do so later via this link.

Given the annual fee of S$594, the cost per mile is:

- New customer: 0.74 cents (S$594/80,000 miles)

- Existing customer: 0.99 cents (S$594/60,000 miles)

Is this a good deal?

Back when the DBS Vantage Card first launched, the sign-up offer was:

- New customers: 80,000 bonus miles with S$8,000 spend in 60 days

- Existing customers: 60,000 bonus miles with S$8,000 spend in 60 days

The current offer keeps the same bonuses, but cuts the minimum spend to S$5,000 in 30 days.

The regular sign-up offer (which used to require a promo code, but no longer does) gives 60,000 miles with a minimum spend of S$4,000 in 30 days, and is currently set to end on 30 June 2023 (though it’ll almost certainly be extended).

When you do the math, the current offer is still better.

| Spend | Miles (New Customer) |

Miles per S$1 | |

| Regular Offer (no code required) | S$4K in 30 days | 60,000 | 15 |

| FLASHVTG | S$5K in 30 days | 80,000 | 16 |

What counts as qualifying spend?

Cardholders are required to spend at least S$5,000 within 30 days of approval.

Qualifying spend includes both local and foreign retail sales and posted recurring bill payments, excluding the following:

| ⚠️ Excluded transactions |

| a. posted 0% Interest Instalment Payment Plan monthly transactions; b. posted My Preferred Payment Plan monthly transactions; c. interest, finance charges, cash withdrawal, balance transfer, smart cash, AXS payments, SAM online bill payments, bill payments via internet banking and all fees charged by DBS; d. payments to educational institutions; e. payments to financial institutions (including banks, online trading platforms and brokerages); f. payments to government institutions and services (court cases, fines, bail and bonds, tax payment, postal services, parking lots and garages, intra-government purchases and any other government services not classified here); g. payments to hospitals; h. payments to insurance companies (sales, underwriting and premiums); i. payments to non-profit organisations; j. payments to utility bill companies; k. payments to professional service providers (including but not limited to accounting, auditing, bookkeeping services, advertising services, funeral service and legal services and attorneys); i. any top-ups or payment of funds to payment service providers, any prepaid accounts or purchase of prepaid cards/credits (including but not limited to EZ-Link, GrabPay, NETS FlashPay, Transit Link, Razer Pay, ShopeePay, Singtel Dash, AMAZE*); m. any betting transactions (including levy payments to local casinos, lottery tickets, casino gaming chips, off-track betting and wagers); n. any transactions related to crypto currencies; o. payments made to CardUp, FavePay, iPaymy and SmoovPay are also subject to the exclusions listed in Clauses 9 (a) to 9 (o) above; and p. any other transactions determined by DBS from time to time |

DBS has previously clarified that only rental transactions made via CardUp will count towards the sign-up bonus; all other payments will not count (though they will still earn the base rate of 1.5 mpd).

For the avoidance of doubt, supplementary and principal cardholder spending will pool when calculating whether the minimum qualifying spend has been met.

When will the miles be credited?

The 25,000 miles for paying the S$594 annual fee will be awarded immediately (in the form of 12,500 DBS points) when the annual fee is charged.

The bonus of 35,000 miles (existing) or 55,000 miles (new) will be credited within 90-120 days from the date of fulfilling the qualifying spend (in the form of 17,500/27,500 DBS points).

What can you do with DBS Points?

DBS Points earned on the DBS Vantage expire in three years, and can be converted to any of the following frequent flyer programmes with a S$27 admin fee.

| Frequent Flyer Programme | Conversion Ratio (DBS Points : Miles) |

| 5,000 : 10,000 | |

| 5,000 : 10,000 | |

| 5,000 : 10,000 | |

|

500 : 1,500 |

Transfer to KrisFlyer and Asia Miles are typically processed within 3 working days.

Terms & Conditions

The full T&Cs for this flash deal can be found here.

Overview: DBS Vantage Card

|

|||

| Apply | |||

| Income Req. | S$120,000 p.a. | Points Validity | 3 years |

| Annual Fee | S$594 |

Min. Transfer |

5,000 DBS Points (10,000 miles) |

| Miles with Annual Fee |

25,000 | Transfer Partners |

|

| FCY Fee | 3.25% | Transfer Fee | S$27 |

| Local Earn | 1.5 mpd | Points Pool? | Yes |

| FCY Earn | 2.2 mpd | Lounge Access? | Yes: 10x Priority Pass |

| Special Earn | 6 mpd on Expedia | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

The DBS Vantage Card offers 1.5 mpd on local spend and 2.2 mpd on FCY spend. Unfortunately, the DBS Vantage Card no longer offers 4 mpd on dining and petrol spend, ever since 1 January 2023, though some lucky cardholders were recently targeted for 4 mpd on dining.

Cardholders enjoy benefits such as:

- A Priority Pass membership with 10 free lounge visits per year (which can be used by the main cardholder or his/her guests)

- Accor Plus Explorer membership with Accor Silver status, up to 50% off dining and one complimentary hotel night at selected Asia Pacific hotels

- Dining discounts via Dining City

While the card’s annual fee cannot be waived in the first year, it will be waived subsequently when you spend at least S$60,000 in a membership year. Should the fee be waived, you will not receive the 25,000 miles, though you will receive the rest of the benefits like the Accor Plus membership and lounge passes.

You can read my full review of the DBS Vantage Card below.

Conclusion

The DBS Vantage Card is running an enhanced sign-up offer of up to 80,000 bonus miles with S$5,000 spend in 30 days, valid for applications submitted by 10 July 2023 and approved by 24 July 2023 with the code FLASHVTG.

The minimum spend requirement is now 38% lower than the launch offer, though in fairness you also have half the time to meet it. Assuming that’s not an issue, then this would be a good opportunity to hop onboard.

Be aware that DBS cannot be relied upon to award bonus points. I have had a ticket open for weeks, and that has now been closed with the message that my “27000 bonus points have been awarded”. Buyer Beware, DBS is not to be trusted.

Please delete previous comment, I didn’t know the conversion ratio was 1:2. I also probably don’t know my arse from my elbow.