In June 2022, DBS finally entered the $120K segment with the launch of the DBS Vantage Card. This was an altogether better product than what initially leaked in February, in no small part due to the addition of a bonus 4 mpd earn rate on dining and petrol, both local and overseas.

The catch was that this was a promotional rate, and while there was hope that DBS might grant a last-minute extension, 1 January has come and gone with no joy. As it stands, DBS Vantage Cardholders will earn a fixed 1.5/2.2 mpd on all local/overseas spend, period.

| ⚠️Technically Speaking… |

| …there’s also 6 mpd on Expedia bookings till 31 March 2023, capped at the first S$5,000 per month. However, you’ll need to be careful with these bonus miles offers, because the hotel prices are usually inflated somewhat. |

Is the card still worth keeping, then?

DBS Vantage Card ends 4 mpd on dining and petrol transactions

Apply Here Apply Here |

|||

| Income Req. | S$120,000 p.a. | Points Validity | 3 years |

| Annual Fee | S$594 |

Min. Transfer |

5,000 DBS Points (10,000 miles) |

| Miles with Annual Fee |

25,000 | Transfer Partners |

|

| FCY Fee | 3.25% | Transfer Fee | S$27 |

| Local Earn | 1.5 mpd | Points Pool? | Yes |

| FCY Earn | 2.2 mpd | Lounge Access? | Yes: 10x Priority Pass |

| Special Earn | N/A | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

Up till 31 December 2022, DBS Vantage Cardholders earned 4 mpd on local and overseas dining and petrol transactions, with a combined cap of S$2,000 per calendar month.

| 🍽️ Dining | ⛽ Petrol |

|

|

This promotion has lapsed, which means that cardholders now earn a standard 1.5 mpd on all local spending, and 2.2 mpd on FCY spending. There is no minimum spend required to trigger these rates, nor caps.

For what it’s worth, these rates would put the DBS Vantage among the highest-earning cards in the $120K segment; the highest, actually, if you consider the fact it has no minimum spend requirement.

| $120K Cards by Earn Rates |

||

| Card | SGD | FCY |

SCB VI SCB VI |

Up to 1.4 mpd* | Up to 3 mpd* |

DBS Vantage DBS Vantage |

1.5 mpd | 2.2 mpd |

OCBC VOYAGE OCBC VOYAGE |

1.3 mpd |

2.2 mpd |

HSBC VI HSBC VI |

Up to 1.25 mpd^ | Up to 2.25 mpd^ |

UOB VI Metal Card UOB VI Metal Card |

1.4 mpd | 2 mpd |

Citi Prestige Citi Prestige |

1.3 mpd | 2 mpd |

Maybank VI Maybank VI |

1.2 mpd | 2 mpd |

AMEX Plat. Reserve AMEX Plat. Reserve |

0.69 mpd | 0.69 mpd |

| *Min. S$2,000 spend per statement month, otherwise 1 mpd for both SGD and FCY ^Min S$50,000 spend in the previous membership year, otherwise 1 mpd (SGD) and 2 mpd (FCY) |

||

The loss of 4 mpd on petrol and dining is no doubt disappointing, though it should be noted that DBS’s definition of dining wasn’t the widest to begin with.

DBS only included MCC 5811 (Caterers), 5812 (Eating Places & Restaurants), and 5813 (Drinking Places), excluding MCC 5814 (Fast Food), MCC 5462 (Bakeries), MCC 5451 (Dairy Products Stores) and some other MCCs used by eateries. This tended to create a fair bit of anxiety amongst DBS Vantage Cardholders (who, I assume, hadn’t read this article).

Is it worth keeping?

The DBS Vantage Card’s annual fee for the 2023/24 membership year will increase from S$588.50 to S$594, thanks to the GST hike. The first year’s fee must be paid, but subsequent years’ fees can be waived if cardholders spend at least S$60,000 per membership year.

DBS Vantage Cardholders continue to receive:

- Accor Plus membership with 1 complimentary hotel night

- 10x Priority Pass lounge visits

- 25,000 miles per membership year (unless annual fee is waived)

- DiningCity discounts (which are really underwhelming, mentioned more for completeness’ sake)

Would I pay S$594 for that? Personally, no. I already enjoy Accor Plus thanks to my AMEX HighFlyer Card (which, I’ve discovered, does offer annual fee waivers on a case-by-case basis), unlimited lounge access from my AMEX Platinum Charge, and I daresay I’m well-stocked in the miles department.

But everyone’s situation will be different, and given that the Accor Plus membership has a retail value of S$408, and 25,000 miles are worth about S$375, there’s certainly ways for cardholders to earn back their fee and then some.

Alternative cards to use for dining

If you’re looking for alternative cards to use for dining, my picks would be the HSBC Revolution or UOB Lady’s Card/Lady’s Solitaire. These earn 4 mpd on dining transactions, subject to the caps and restrictions below.

| 🍽️ Best Cards to use for Dining |

||

| Card | Earn Rate | Remarks |

HSBC Revolution HSBC RevolutionApply |

4 mpd | Max S$1K per c. month. Must use contactless Review |

UOB Lady’s Card UOB Lady’s CardApply |

4 mpd | Max S$1K per c. month. Must choose dining as 10X category. Review |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4 mpd | Max S$3K per c. month. Must choose dining as 10X category. Review |

| C. Month= Calendar Month, S. Month= Statement Month | ||

As always, be on the lookout for opportunities to stack cards with Kris+ for bonus miles!

Alternative cards to use for petrol

If you’re looking for alternative cards to use for petrol, my picks would be the Maybank World Mastercard, UOB Lady’s Card/Lady’s Solitaire, or UOB Visa Signature. These earn 4 mpd on petrol transactions, subject to the caps and restrictions below.

| Card | Earn Rate | Remarks |

Maybank World Mastercard Maybank World MastercardApply |

4 mpd | No cap |

UOB Lady’s Card UOB Lady’s CardApply |

4 mpd | Max S$1K per c. month. Must choose transport as 10X category Review |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4 mpd | Max S$3K per c. month. Must choose transport as 10X category Review |

UOB Visa Signature UOB Visa SignatureApply |

4 mpd | S$1K-2K on petrol + contactless per s. month. Ex. SPC, Shell Review |

| C. Month= Calendar Month, S. Month= Statement Month | ||

DBS Vantage sign-up bonus

If the loss of the 4 mpd earn rate hasn’t deterred you, DBS has extended its sign-up bonus on the DBS Vantage Card till 31 January 2023.

New-to-bank cardholders who spend S$8,000 within 60 days of approval and pay the first year’s annual fee will receive the following:

| Bonus | |

| Pay annual fee | 25,000 miles |

| Spend S$8,000 within 60 days | 35,000 miles |

| Total | 60,000 miles |

| Must apply with promo code VANMILES | |

| ❓ “New” Definition | |

| New cardmembers are defined as customers who are currently not holding on to any Principal DBS/POSB Credit Card and have not cancelled any Principal DBS/POSB Credit Card within the last 12 months. | |

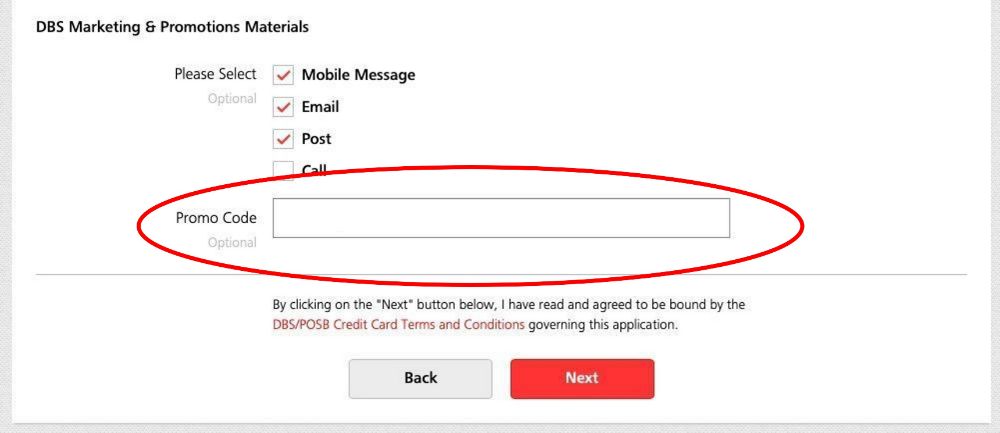

You must enter the promo code VANMILES when applying. No code, no bonus! The promo code field can be found towards the bottom of the application page, under the “DBS Marketing & Promotions Materials” section.

The 25,000 miles for paying the annual fee will be awarded immediately (in the form of 12,500 DBS Points) when the annual fee is charged. This happens at the time of card approval.

The 35,000 miles for the sign-up bonus will be credited within 120-150 days (in the form of 17,500 DBS Points) from the date of fulfilling the qualifying spend.

T&Cs for the sign up offer can be found here.

Conclusion

DBS Vantage Cardholders no longer enjoy 4 mpd on dining and petrol transactions, effective 1 January 2023. In the cold light of day, I’d still consider the regular Vantage earn rates to be competitive enough, though it’s certainly harder to make the case for the card now than at launch.

Between this and the OCBC VOYAGE’s upcoming limo benefit nerf, 2023 has been short on good news for $120K cardholders so far. Any bank want to step up and buck the trend?

How easy is it to register a business and use that to obtain a highflyer card VS renewing this card (signed up with the initial 80k bonus)

Highflyer card is no longer attractive. No more AF waiver. Only worth if you can find someone to split the $300 referral vouchers.

it is the only card that lets you earn miles on grabpay top-ups. i don’t see how that is not attractive.

and AF waiver is still available.

You clearly don’t know any better.

Is it still possible to get the AF waiver?

Amex lists a 15k bonus with AF bonus. No where near as attractive as before.

Oh sorry I meant, like is it possible to get the AF waived for the highflyer card? Im not interested in any rewards gotten from paying the AF

If there is any consolation, Amex Plat Charge income requirement has just been lowered to 120k per annum

Are we sure DBS is not awarding 2.2 mpd?

T&Cs are updated Jan 1st. https://www.dbs.com.sg/iwov-resources/pdf/cards/vantage-card-FAQs.pdf

Wow it does say 2.2 for dining and petrol

this is…interesting.

main T&Cs has no reference at all to petrol or dining: https://www.dbs.com.sg/iwov-resources/pdf/cards/vantage-card-T&Cs.pdf

i’m leaning towards that being some sort of typo, since the landing page makes no mention of it either.

Let us know if your contact at the bank clarifies.

Seems like no response

imo it could go both ways. 2.2 sounds a little much. Yet 1.5 will see me removing this card. If there is any Capt, do let us know (:

Hi Aaron, on your page on “which card to use”, DBS Vantage still shows as 4MPD for dining.

the page was last updated 31 july. will update it again shortly

Sorry, but in what universe is 25k miles worth $375? Have you taken into account the devaluation? What about the total lack of Saver availability? I wouldn’t touch this card unless and until they opened up other airlines, as SIA is essentially pointless for miles earners.

If you don’t value even 1.5 cents per mile, then better off with cashback. In which case, don’t even need to read this blog. And thus no need for your angry sounding tone.

Most miles chaser value at 1.5. I personally derived significantly more than 1.5 historically.

Had an invitation from DBS to sign up before 31 Jan and get a 80,000 sign up bonus (25k +55k for spending 8k within 60 days)