The UOB Lady’s Cards are among the best rewards cards on the market right now, thanks to their 4 mpd earn rates on up to two bonus categories, as well as the opportunity to earn an extra 2-6 mpd with the UOB Lady’s Savings Account.

| Card | Income Req. | Annual Fee |

UOB Lady’s Card UOB Lady’s CardApply |

S$30K | S$196.20 (FYF) |

UOB Lady’s Solitaire Card UOB Lady’s Solitaire CardApply |

S$120K | S$414.20 (FYF) |

If you’re just getting started with this card, here’s a complete guide to everything you should know.

| 💳 UOB Lady’s Card FAQs |

Application

Q: Are there any sign-up offers for the UOB Lady’s Cards?

Yes, but they’re the usual UOB “first X” nonsense.

From now till 31 July 2023, the first 200 new-to-UOB credit card customers who successfully apply and spend a minimum of S$1,000 for 2 consecutive months will get S$350 cash credit. That’s a great- if you actually get it!

If you count as a new-to-UOB customer, it’s much better to apply for the KrisFlyer UOB Credit Card or UOB PRVI Miles Card first as these are running uncapped sign-up offers.

- KrisFlyer UOB Credit Card: Spend S$2,000 in 60 days for 25,000 bonus miles, first year fee waived

- UOB PRVI Miles Card (AMEX, MC, Visa): Spend S$1,000 per month for the first 2 months and pay a S$259.20 annual fee for 45,200 bonus miles

The above offers end on 31 July 2023, but are subject to further extension.

After your card has been approved, you can then sign up for a UOB Lady’s Card as an existing customer.

By the way, don’t sit around waiting for a bonus miles sign-up offer to come by for the UOB Lady’s Card. It won’t. The UOB Lady’s Card is positioned as a rewards card, not a miles card.

Q: Can I apply for the UOB Lady’s Solitaire Card if I don’t meet the minimum income requirement?

Yes. Based on personal experience and data points I’ve received, UOB is not strict with enforcing the S$120,000 minimum income requirement, especially if you’re an existing UOB cardholder.

It’s not clear what the unofficial cut-off is, but there’s really no harm applying- the worst they can say is no.

|

⚠️ Update: Based on recent data points, UOB has become more strict with the income requirement for the UOB Lady’s Solitaire Card. Applicants who do not meet the S$120K p.a. threshold now receive the following rejection SMS: Dear customer, your UOB Lady’s Solitaire Card application is unsuccessful as your income on our records does not meet the min S$120K p.a income requirement. If applicable, please visit our official UOB webpage > Cards > Card Services > Credit Limit Review to update your income and submit a new application. Alternatively, SMS <Yeslady>space<last 4 digits of existing UOB Credit Card>space<NRIC#>to 77672 to apply for the UOB Lady’s Platinum card. |

Q: Can I hold both the UOB Lady’s Card and UOB Lady’s Solitaire Card?

By right, you can only hold one or the other.

UOB says (at point 20 of the T&Cs) that any existing card will be automatically terminated within one month of upgrading (from UOB Lady’s Card to Lady’s Solitaire Card) or downgrading (UOB Lady’s Solitaire Card to UOB Lady’s Card).

In practice, it seems like some customers fly under the radar and end up holding both, even after one month from upgrading/downgrading has elapsed.

But even if that happens, there’s no upside because the 4 mpd earn rate is still capped at S$2,000 per calendar month, and you can still pick a maximum of two bonus categories.

Q: Do I need to wait for the physical card to arrive before I can start earning bonuses?

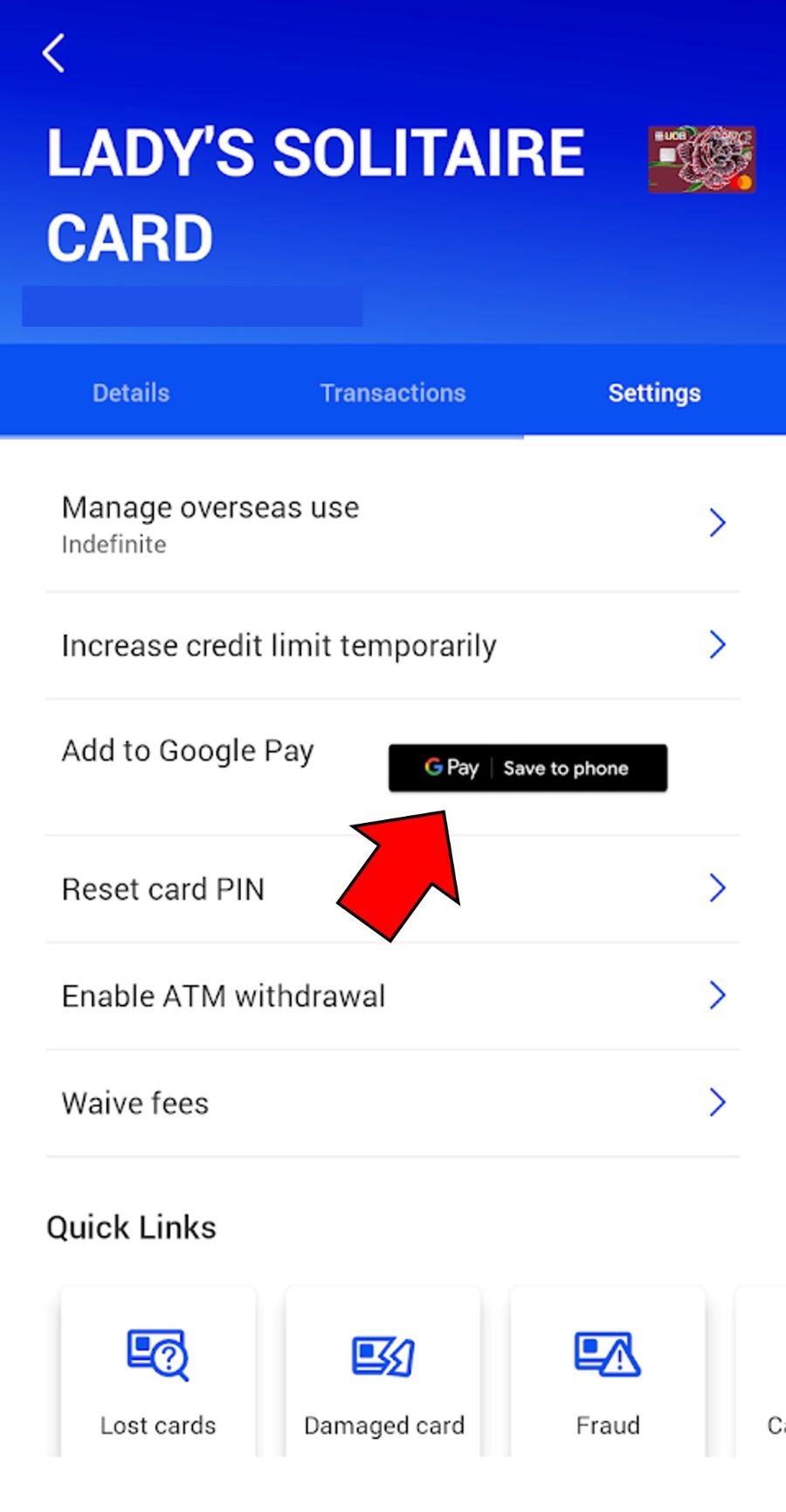

Not if you have an Android phone.

Open the UOB TMRW app, tap on Accounts, then look for your Lady’s Card. Tap on Settings, then Add to Google Pay

Once that’s done, you can use your UOB Lady’s Card anywhere contactless payments are accepted.

Unfortunately there’s no such option for Apple users.

Q: How do I apply for the UOB Lady’s Solitaire Metal Card?

You don’t. It’s by invitation only, and the qualifying criteria is not made public.

For what it’s worth, I’m not convinced it’s worth paying the S$593.50 fee for the UOB Lady’s Solitaire Metal Card, because there are other $120K cards that offer more benefits at that price point.

Annual Fees

Q: Do the UOB Lady’s Cards offer the first year free?

Both the UOB Lady’s Card and UOB Lady’s Solitaire Card offer a waiver of the first year annual fee.

Q: Can subsequent year’s annual fees be waived?

I cannot promise the same will apply in your situation, but from personal experience both the UOB Lady’s Card and UOB Lady’s Solitaire Card annual fees can be waived.

Don’t forget that UOB’s default behaviour is to deduct UNI$ from your account for a “fee waiver”, so be sure to monitor your balance around your card’s anniversary date and request a waiver when that happens.

4 mpd earn rate

Q: How is the 4 mpd rate awarded?

UOB Lady’s Cardholders who spend on their bonus category/categories will earn:

- 1 base UNI$ for every S$5 spent (0.4 mpd)

- 9 bonus UNI$ for every S$5 spent (3.6 mpd)

Base UNI$ will be awarded at the time the transaction posts.

The bonus 9 UNI$ will be awarded at the start of the following calendar month.

You can check the breakdown via the UOB TMRW app. Instructions are provided in this post.

Q: Is any minimum spend required?

No.

Q: Do I need to pay by any particular method to enjoy the 4 mpd?

No. The bonus rate is valid regardless of whether you pay with the physical card or a virtual card on your mobile wallet.

Q: Is the 4 mpd rate valid for online and offline spend?

The bonus rate is valid for both online and offline spend. All that matters is the MCC.

Q: Is the 4 mpd rate valid for local and overseas spend?

The bonus rate is valid for both local and overseas spend. All that matters is the MCC.

Q: Is the 4 mpd rate valid with Amaze?

Yes. You will earn 4 mpd with Amaze, subject to the MCC falling within your selected bonus category or categories.

Q: Is the 4 mpd rate valid with Kris+?

Yes. You will earn 4 mpd with Kris+, subject to the MCC falling within your selected bonus category or categories.

Q: Is the 4 mpd earn rate capped?

Yes.

UOB Lady’s Cardholders will earn a maximum of 2,800 bonus UNI$ per calendar month, which means you’ll max out the bonus with S$1,000 of spend.

UOB Lady’s Solitaire Cardholders will earn a maximum of 5,600 bonus UNI$ per calendar month, which means you’ll max out the bonus with S$2,000 of spend. For avoidance of doubt, this cap is shared by both bonus categories.

Any spending beyond the cap will earn 1 UNI$ per S$5, i.e. 0.4 mpd.

Q: Is the 4 mpd rate capped by calendar month or statement month?

Calendar month.

Q: Can I double my bonus cap by getting a supplementary card?

No. A supplementary card shares the same bonus pool as the principal card, as well as the same bonus categories.

Q: What happens if I upgrade from the UOB Lady’s Card to the UOB Lady’s Solitaire Card?

If you upgrade from the Lady’s Card to the Lady’s Solitaire Card, your additional bonus cap will apply immediately.

For example, suppose I currently hold the UOB Lady’s Card, with ‘Family’ selected as my bonus category. On 15 July 2024, I am approved for a UOB Lady’s Solitaire Card. I will be able to earn 4 mpd on up to S$2,000 of ‘Family’ transactions for the month of July 2024. This S$2,000 includes any spend on ‘Family’ already incurred on the UOB Lady’s Card.

However, your additional bonus category will only apply from the following quarter.

Bonus categories

Q: How are bonus categories defined?

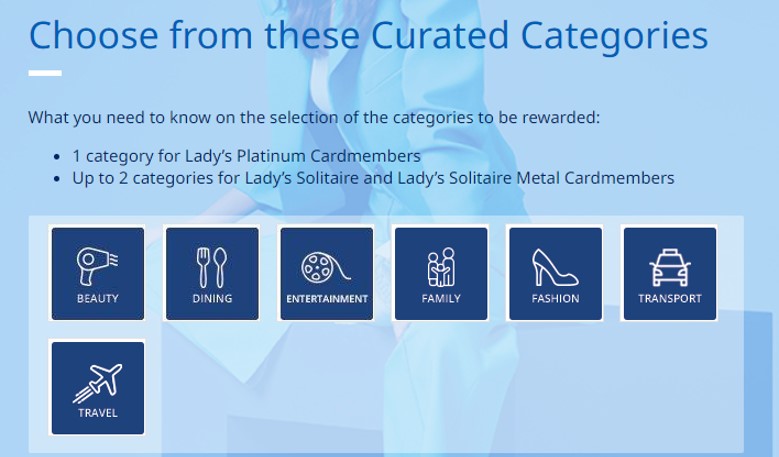

A total of seven bonus categories are available, defined by the following MCCs.

| Category | MCCs | Description |

| (1) Beauty & Wellness | 5912, 5977, 7230, 7231, 7298, 7297 | Discount, Mass and Drug Stores, Cosmetics Stores, Barber and Beauty Shops, Health and Beauty Spa, Massage Parlours |

| (2) Dining | 5811, 5812, 5814, 5499 | Caterers, Eating places and Restaurants, Fast food restaurants and food deliveries |

| (3) Entertainment | 5813, 7832, 7922 | Bars, Taverns, Lounges and Nightclubs, Motion Picture Theatres, Theatrical Producers and Ticket Agencies |

| (4) Family | 5411, 5641 | Grocery stores, Children and Infants wear store |

| (5) Fashion | 5311, 5611, 5621, 5631, 5651, 5655, 5661, 5691, 5699, 5948 | Department Stores, Men’s and Boy’s Clothing and Accessories Store, Women’s Ready-to-wear Stores, Women’s Access and Specialty, Family Clothing Stores, Sports and Riding Apparel Stores, Shoes Stores, Men’s and Women’s Clothing Stores, Miscellaneous Apparel and Accessories Shops, Luggage and Leather Stores |

| (6) Transport | 4111, 4121, 4789, 5541, 5542 | Local Commuter Transport, Taxi, Cabs, Limousines and Travel Service, Service Stations and Automatic Gas Dispensers |

| (7) Travel | See here | Airlines, Hotels, Cruise Liners, Duty-free Stores, Online and Regular Travel Agencies |

| Both local and foreign currency transactions are eligible for bonuses, whether online or offline | ||

Q: How is ‘Travel’ defined?

‘Travel’ is unique in that it’s the only bonus category not defined by a specific MCC range.

Fortunately, I have obtained greater clarity from the UOB team regarding the MCCs which qualify:

- Airlines (MCC 3000-3299)

- Cruise liners (MCC 4411)

- Duty-free stores (MCC 5309)

- Hotels (MCC 3500-3999)

- Online and offline travel agencies (MCC 4722)

Bus liners, rental cars, trains and private hire cars are not included in travel.

For more information, refer to the post below.

Explained: Which MCCs are included in the UOB Lady’s Card “Travel” category

Q: How do I select my bonus categories?

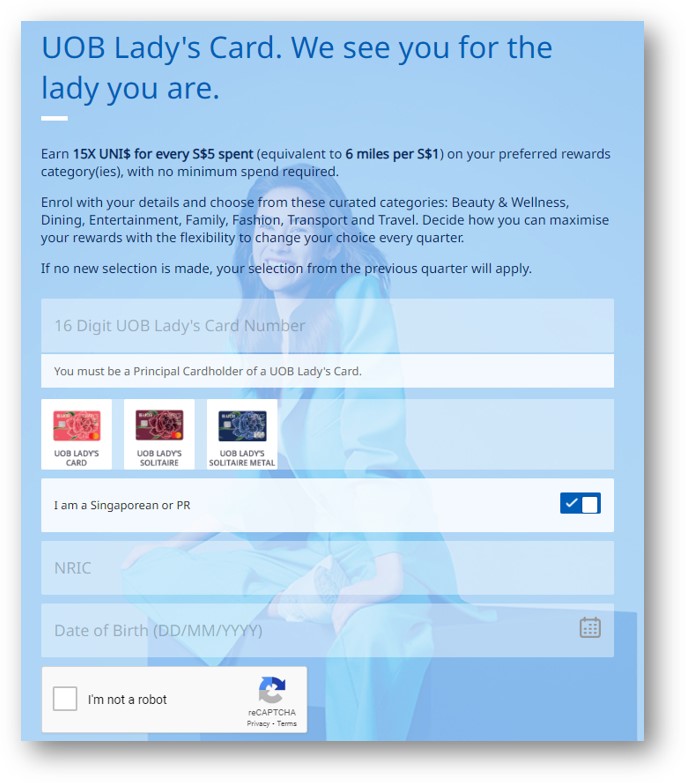

To select your bonus categories, visit this webpage.

Selecting bonus categories requires entering your 16-digit card number. Even if you don’t have the physical card yet, you can obtain this from your internet banking or the UOB TMRW app. However, if you were recently approved (<24 hours) the system may throw an error message when registering your bonus categories. Try again after 24 hours.

Once your details have been entered, you’ll receive an OTP. After that, you can submit your bonus category selections.

Q: Do I start enjoying my bonus categories immediately?

The first time you choose your bonus categories, they are effective immediately.

Any subsequent selections will be effective from the first day of the following quarter.

For example, if I’m approved for my UOB Lady’s Card on 2 July and choose ‘Family’ as my bonus category, I will start enjoying 4 mpd on supermarket spend immediately.

If on 5 August I change my bonus category to ‘Dining’, I will need to wait till 1 October to start enjoying 4 mpd on restaurants. In other words, the ‘Family’ selection is valid till the end of the current quarter (30 September)

Q: What’s the deadline for selecting bonus categories?

Bonus categories can be selected up till 2359 hours (SGT) the day before the first calendar date of the following calendar quarter.

For example, I can submit my bonus categories up till 2359 hours on 30 September 2023, which will then be effective from 1 October to 31 December 2023 (Q4).

Q: Can I change my selection?

Bonus categories can be re-selected at any time, but the new selection will only take effect from the start of the following calendar quarter.

Q: What If I change my mind regarding my selections?

If you’ve changed your mind, simply resubmit your selections. UOB will take your most recent selection as the binding one.

However, do remember that the new bonus categories will only take effect from the following quarter.

Q: Do I need to re-select my bonus categories every quarter?

No. If you do not manually re-select your bonus categories, the choices from the previous quarter will be automatically carried over.

Q: What happens if I upgrade from the UOB Lady’s Card to the UOB Lady’s Solitaire Card?

If you upgrade from the Lady’s Card to the Lady’s Solitaire Card, your additional bonus category will only be effective from the following calendar quarter.

For example, suppose I currently hold the UOB Lady’s Card, with ‘Family’ selected as my bonus category. On 15 July 2024, I am approved for a UOB Lady’s Solitaire Card, and select ‘Dining’ and ‘Family’ as my bonus categories. ‘Dining’ will only be effective from 1 October 2024.

However, the increased bonus cap will apply immediately; i.e. I will be able to earn 4 mpd on ‘Family’ transactions on up to S$2,000 in the month of July 2024.

Q: Can I select two more bonus categories for my supplementary cardholder?

No. The supplementary cardholder’s bonus categories mirror those of the principal cardholder.

Q: Is the bonus cap based on posting date or transaction date?

The bonus cap is based on the posting date of transactions.

Q: I’ve forgotten what my bonus categories are. How do I check?

You won’t be able to view your bonus categories online, so the only option is to contact UOB customer service.

UOB shenanigans

Q: I heard UOB has these S$5 earning blocks. Is that going to be a problem?

It really depends on what UOB card you’re using. For the UOB PRVI Miles Card or UOB Preferred Platinum Visa Card, those S$5 earning blocks can lead to a lot of lost miles.

However, the effect is much more benign on the UOB Lady’s Cards, because bonus points are awarded as a consolidated lump sum the following month. In calculating this lump sum, all eligible transactions (unrounded, including cents) are summed up and then rounded down once to the nearest S$5.

If you want the full details, refer to the post below. But long story short, I wouldn’t worry about it with the UOB Lady’s Card specifically.

Q: I heard I should avoid using UOB cards at UOB$ merchants. Is that true?

Generally yes, but it’s not so bad for the UOB Lady’s Cards.

When shopping at UOB$ merchants like Cold Storage and Giant, UOB Lady’s Cardholders will earn 3.6 mpd (assuming they have ‘Family’ chosen as their bonus category) instead of 4 mpd. The missing 0.4 mpd is because base UNI$ are not awarded on transactions at UOB$ merchants. It’s annoying for sure, but 3.6 mpd is still a very good earn rate, all things considered.

For more details on how this works, refer to the post below.

Confirmed: UOB$ merchants qualify for bonus miles with UOB cards

I’ve also written a separate post on some workarounds for earning miles at UOB$ merchants with UOB cards.

Workarounds: How to earn miles at UOB$ merchants with UOB cards

UOB One Account

Q: Is the UOB Lady’s Card eligible to earn bonus interest on the UOB One Account?

Yes. Spending on the UOB Lady’s Card, UOB Lady’s Solitaire Card or UOB Lady’s Solitaire Metal Card will count towards the minimum S$500 spend per calendar month required to trigger bonus interest on the UOB One Account.

By crediting your monthly salary of at least S$1,600 via GIRO or PayNow (with the code SALA/PAYNOW SALA) and spending S$500 on the UOB Lady’s Card, you could earn up to 5% p.a. on the first S$100,000 in your account.

Conclusion

So that’s my attempt at providing a list of FAQs for the UOB Lady’s Card. Obviously I won’t have covered everything, so if there’s something else you feel should be included, do give a shout out below!

Any other UOB Lady’s Card FAQs that should be added?

Have you guys met a situation in which you only get 9x bonus and not 5x bonus? I have Travel and Family selected. And for the past 2 months, Travel nets me 9x and 5x as described correctly. But Family nets me only 9x and missing the 5x. My assumption is that if there is 9x given I should be getting those extra 5x; else it’d be none at all.

Tried calling the hotline, as usual they are useless in answering questions on their own products.

my 9x and 5x post at the same time like clockwork. not to insult your intelligence, but don’t forget to tap “view all” under UNI$ history.

Hi Aaron, thanks for the reply. Yes exactly, the 9x and 5x for my Travel category has come in like clockwork in the past 2 months. Only for Family, I got 9x and no 5x. Of course I did check all transactions, no 5x just for that Family category.

At first I thought it could be an MCC issue. But if it were MCC issues, then I won’t be getting 9x in the first place.

Aaron, are the spendings and the award of the bonus Uni captured based on transaction date or posting date ? Had some spending which was transacted before month end but only posted the next month.

Hi Aaron, thank you for the detailed FAQ. For the quarters, I just checked with the UOB chat agent and they told me that the quarters is based on when I signed up for the card. So in my case where I signed up on Sept, my current quarter is Sep – Nov. Any changes to the bonus cateogory I made in Sep will only take effect from Dec – Feb.

But the T&C for the Lady’s card put calendar quarter. Has anyone else asked about this?

CSO is wrong, simple as that.

Shopee, Lazada and Qoo10 etc are under which category? or they dont qualify as a bonus category?

Hi, do you know if overseas dining spending still counts towards the bonus miles category?

anyone tried canceling the card and reapplying it in hopes of changing their category?

Hi Aaron, with the 6 mpd becoming 4 mpd after 29 Feb 2024, do you think there is any point getting the UOB Lady’s cards now (Jan 2024)? Or just use other cards that give 4mpd such as HSBC Revolution, UOB PPV, DBS WWMC?

I forgot the categories selected initially at point of card sign up and literally went in 2ce to the portal to reselect options.

is there a better way to check which options have been selected?

Hello, can I confirm that the contactless payment also get miles? Apple wallet can store this card.