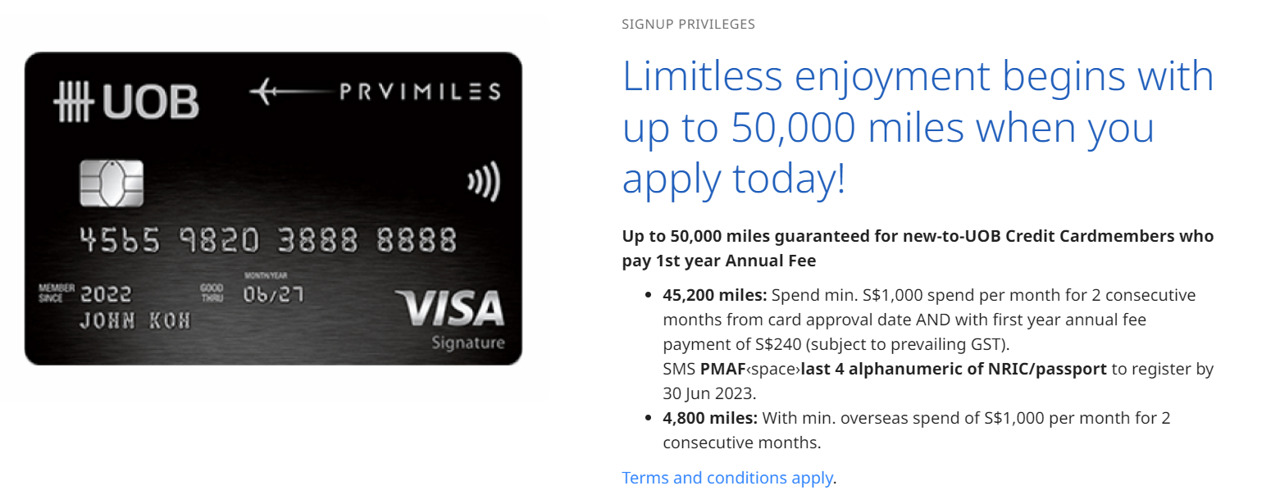

Back in April, the UOB PRVI Miles Card launched a rare no-cap offer of 45,200 bonus miles with S$1,000 spend per month in the first two consecutive months of approval. It’s one of the better offers we’ve seen in recent times, especially for a bank that loves its “first X” promos.

This offer was originally set to run for just one month, but has now been renewed three months in a row, with the latest extension bringing it all the way till 31 July 2023.

UOB PRVI Miles 45,200 miles sign-up bonus

|

| Details |

New-to-bank UOB PRVI Miles Cardmembers who apply and get approved from 1-31 July 2023 will enjoy up to 45,200 bonus miles, split into:

- 20,000 miles for paying the S$259.20 annual fee

- 25,200 miles for spending S$1,000 per month for two consecutive months

| ❓ New-to-bank |

|

New-to-bank customers are defined as those who:

When the offer first launched on 1 April, UOB defined “new-to-bank” as anyone who did not currently hold a principal UOB credit card, and had not cancelled a UOB PRVI Miles Card in the past 6 months. On 3 April, they quietly changed “UOB PRVI Miles Card” to “any principal UOB credit card” and backdated the T&Cs to 1 April! |

There is no cap on the maximum customers eligible for either component. However, do note that you must be approved by 31 July 2023, so don’t leave your application till the last minute.

The S$2,000 minimum spend will earn:

- 2,800 base miles, if spent locally @ 1.4 mpd

- 4,800 base miles, if spent overseas @ 2.4 mpd

UOB assumes the latter scenario in its marketing, which is why you’ll see claims of a 50,000 miles sign-up bonus (45,200 bonus + 4,800 base) on its website.

This offer applies to all three versions of the UOB PRVI Miles Card, namely:

Annual fee bonus

Cardholders who pay the first year’s S$259.20 annual fee will receive UNI$10,000 (20,000 miles).

Since the first-year annual fee is waived by default, cardholders must opt in by sending the following SMS to 77862 by 31 August 2023.

| 📱 SMS to 77862 |

| PMAF<space>Last 4 alphanumeric digits of NRIC/Passport (Example: If your NRIC is S1234567A, send “PMAF 567A”) |

S$259.20 for 20,000 miles works out to 1.30 cents per mile, which is one of the cheapest opportunities to buy miles on the market right now.

Spending bonus

Cardholders who spend S$1,000 in eligible transactions per month for two consecutive months following approval will receive UNI$12,600 (25,200 miles)

For example, if your card is approved on 10 July 2023, you will need to fulfil the minimum spend criteria as follows:

| Min. Spend | Qualifying Spend Period |

| At least S$1,000 | 10 Jul to 9 Aug 2023 |

| At least S$1,000 | 10 Aug to 9 Sep 2023 |

For avoidance of doubt, you cannot simply spend S$2,000 in the first month of approval and say to yourself “job done”. The minimum spend of S$1,000 needs to be clocked in each of the two spending periods.

What counts as qualifying spend?

Eligible transactions include all retail transactions in local or foreign currency, and a full list of exclusions can be found at point 1.4(c) in the T&Cs.

The key exclusions to highlight are:

- Charitable donations

- Education

- Government payments

- Hospitals

- Insurance

- Prepaid account top-ups (e.g. GrabPay or YouTrip)

- Utilities

For avoidance of doubt, CardUp transactions are eligible to earn miles, and will count towards minimum spend. Don’t forget that CardUp has launched a 1.75% promotional fee for income tax payments with Visa cards (use code MLTAX23), so a UOB PRVI Miles Visa cardholder could buy miles from as little as 1.23 cents each, while clocking spend towards the sign-up bonus requirement.

Mastercard cardholders have access to a 1.99% promotional offer for income tax payments (use code MCTAX23), so a UOB PRVI Miles Mastercard cardholder could buy miles from 1.39 cents each.

Supplementary cardholder spending will be pooled with the principal cardholder’s in determining if the minimum spend has been met. And before you say “isn’t that obvious?”, remember that UOB is not above such shenanigans.

When will the bonus miles be credited?

Annual fee bonus

The S$259.20 annual fee will be posted to your account by 25 September 2023, and the UNI$10,000 will be credited by 30 September 2023.

Spending bonus

The UNI$12,600 from meeting the 2x S$1,000 minimum spend will be credited by 30 November 2023.

Terms and Conditions

The full T&Cs for this offer can be found here.

I would recommend saving a copy of the document for your own reference, since the link will be replaced with a newer promotion after the current one ends.

Annual fee waiver option

UOB has a separate offer which allows cardholders to receive a first-year fee waiver and earn 25,200 bonus miles with the same 2 x S$1,000 minimum spend. However, this offer is capped at the first 200 cardholders.

I’m of the opinion that it’s less risky (and more worth it) to apply for the fee-paying option, but if you’re interested in the waiver you can read the T&Cs here.

Overview: UOB PRVI Miles Card

|

|

|||

| Apply (AMEX) | |||

| Apply (MC) | |||

| Apply (Visa) | |||

| Income Req. | S$30,000 p.a. | Points Validity | 2 years |

| Annual Fee | S$259.20 (FYF) |

Min. Transfer |

5,000 UNI$ (10,000 miles) |

| Miles with Annual Fee |

N/A | Transfer Partners |

|

| FCY Fee | 3.25% | Transfer Fee | S$25 |

| Local Earn | 1.4 mpd | Points Pool? | Yes |

| FCY Earn | 2.4 mpd |

Lounge Access? | No |

| Special Earn | 6 mpd on Agoda, Expedia, UOB Travel | Airport Limo? | Yes (AMEX only) |

| Cardholder Terms and Conditions | |||

UOB PRVI Miles Cards are issued across all three networks: American Express, Mastercard, and Visa. Earn rates are the same for all (1.4 mpd local, 2.4 mpd overseas), though the American Express version has two unique features:

- 20,000 bonus miles for spending at least S$50,000 in a membership year

- Complimentary airport limo transfers with a minimum spend of S$1,000 in foreign currency per calendar quarter

UOB UNI$ can be converted to either KrisFlyer, or Asia Miles at a 1 UNI$= 2 miles ratio, with a S$25 conversion fee.

Be sure to check out my full review of the UOB PRVI Miles Card below.

Conclusion

|

|

|||

| Apply (AMEX) | |||

| Apply (MC) | |||

| Apply (Visa) |

The UOB PRVI Miles Card has extended its uncapped sign-up bonus for July, with approved applicants getting 45,200 miles for paying the S$259.20 annual fee and spending S$1,000 per month for two consecutive months.

If you meet the eligibility criteria, then this is a great opportunity to pick up some bonus miles in the process- just be sure to apply as early in the month as you can since approval needs to come by 31 July 2023.

UOB has been very cunning and sneaky. I applied during 1st July only to get approved 3rd August. I am pretty sure they are withholding the applications on purpose and drag it. Been asked to submit additional documents on 7th July but despite every week asking them for status, they did not even bother to service, reply email or callback the customer despite promises. Also, I have submitted an email in the morning of 31st July to ask for application withdrawal and also called them for withdrawal. But they still go ahead to approve it on 3rd August. In your… Read more »