Back in April 2023, the AMEX HighFlyer Card added utilities to its rewards exclusion list, along with GrabPay top-ups (RIP) and public hospital transactions.

However, American Express has now brought back rewards for utilities until the end of 2023, albeit at a lower rate than its usual 1.8 mpd. The first 10,000 AMEX HighFlyer Cardholders who register via the AMEX Offers portal will earn 0.5 mpd on selected utilities retailers, capped at S$6,000 of eligible spending.

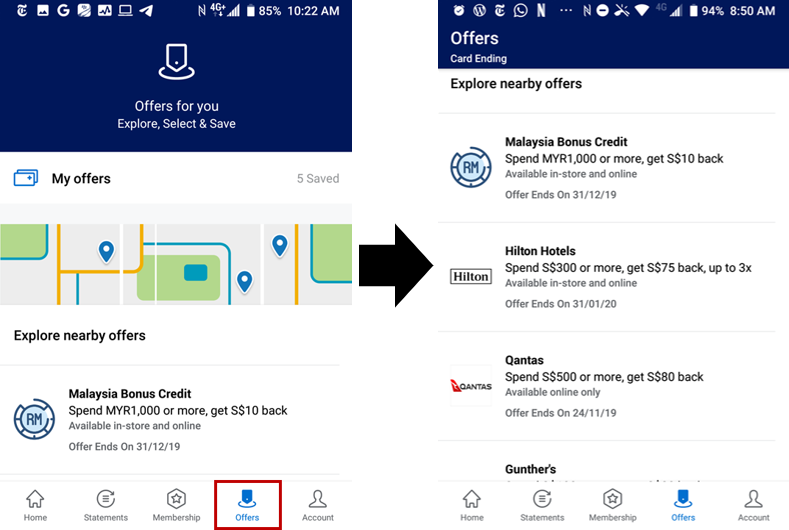

| ❓ What are AMEX Offers? |

|

AMEX Offers are opportunities to earn bonus miles or Membership Rewards points, or discounts in the form of statement credits. These are available to Platinum, True Cashback, and KrisFlyer cardholders, and can be found in the “Offers” section of the AMEX app or web portal. Registration is required, and some offers may be targeted. These are not applicable to DBS, Citi or UOB AMEX cardholders. |

Earn 0.5 mpd on utilities with the AMEX HighFlyer Card

From 4 July to 31 December 2023, registered AMEX HighFlyer Cardholders will earn 1 HighFlyer point per S$2 spent on utilities payments, capped at 3,000 HighFlyer points.

1 HighFlyer point is worth 1 KrisFlyer mile, so that’s an effective earn rate of 0.5 mpd, capped at S$6,000 of utilities spend. Unless you’re running the Large Hadron Collider at home, it’s highly unlikely you’ll breach the cap.

All transactions must be made in-app or online with the following utilities retailers:

| Merchant | Type | Payment Type |

| PacificLight | Online only | Recurring only |

| Senoko Energy | Online & in-app | One-time or recurring |

| SP Group | In-app only | One-time or recurring |

Bonus HighFlyer points should appear on your billing statement within 15 business days from qualifying spend, but may take up to 90 days from the offer end date. In practice, the bonus points post very quickly, so I wouldn’t be too worried.

What are my alternatives?

Apart from the AMEX HighFlyer Card, the following credit cards also offer rewards for utilities.

| 🚰 Credit Cards for Utilities Bills | |

| Card | Earn Rate |

Maybank Manchester United Card Maybank Manchester United Card |

2.0 mpd + 3% cashback (on days where Man Utd win) 0.4 mpd + 1% cashback (otherwise) |

UOB Reserve UOB Reserve |

1.6 mpd |

SCB Visa Infinite SCB Visa Infinite |

1.4 mpd (With min S$2K spend per statement month, otherwise 1 mpd) |

SCB Journey Card SCB Journey Card |

1.2 mpd |

Maybank Visa Infinite Maybank Visa Infinite |

1.2 mpd |

Maybank Horizon Visa Signature Maybank Horizon Visa Signature |

0.4 mpd |

Maybank World Mastercard Maybank World Mastercard |

0.4 mpd |

SCB Rewards+ SCB Rewards+ |

0.29 mpd |

It’s possible to earn up to 1.6 mpd on utilities payments if you have the UOB Reserve Card, or even 2 mpd if you fancy taking a punt on Manchester United, but a more realistic figure would be 1.2-1.4 mpd.

For more details on earning rewards on utilities bills, refer to the post below.

2023 Edition: Best Credit Cards for Electricity & Utilities Bills

Conclusion

AMEX HighFlyer Cardholders can register to earn 0.5 mpd on utilities payments with selected merchants till the end of 2023, which if nothing else is 0.5 mpd more than usual.

If you don’t have an alternative card that earns points on utilities, then this would be something to take note of.