If you’ve decided to join the ranks of the American Express Platinum Charge, the non-waivable S$1,728 annual fee will no doubt be looming large in your mind.

A four-digit membership fee is no small amount of money, but AMEX dangles a big carrot to offset the pain: S$1,354 of annual statement credits, broken down into:

- S$200 local dining credits

- S$200 overseas dining credits

- S$400 lifestyle credits at participating retail partners

- S$204 entertainment credits for news or music streaming services

- S$200 airline credits for Singapore Airlines or Scoot

- S$150 fashion credits for NET-A-PORTER and MR PORTER

This replaces the previous scheme of S$800 airline and hotel statement credits, which was discontinued in February 2023.

These statement credits are a key part of how you’ll recover your annual fee (and then some), so it’s imperative you make full use of them. In this guide, I’ll go through the details of each of the credits, and answer some FAQs regarding their use.

Overview: AMEX Platinum Charge statement credits

|

|||

| 💳 The Platinum Card Annual Statement Credits |

|||

| Credit | Amt. | Min. Spend | No. of Trxns. |

| Local Dining | S$200 per yr. | N/A | Multiple |

| Overseas Dining | S$200 per yr. | N/A | Multiple |

| Lifestyle | S$400 per yr. | S$600 | Single |

| Entertainment | S$17 per mo. | N/A | Multiple |

| Airline | S$200 per yr. | S$600 | Multiple |

| Fashion | S$150 per yr. | N/A | Multiple |

The AMEX Platinum Charge’s S$1,354 statement credits are disbursed on an annual basis with the exception of:

- Fashion Credit: Issued as S$75 credit each half year (1 Jan to 30 Jun & 1 Jul to 31 Dec)

- Entertainment Credit: Issued as S$17 credit each calendar month

Registration is required, and can be done via the AMEX Offers portal on the desktop website or AMEX SG mobile app. You’ll need to register for each credit separately, so that’s a total of six registrations- it’ll take less than a minute to complete.

Registration will remain in effect till 31 December 2024 (except the Fashion credit, where it’s in effect till 31 December 2025). In other words, if you register in 2023, there’s no need to re-register come 1 January 2024.

Once registered, statement credits will be automatically triggered upon meeting the eligibility criteria.

Statement credits officially appear on your billing statement within 30 days from the date of transaction, but in practice often appear much sooner. In my experience, it takes no more than 3-4 days to post.

Only the principal cardholder may enrol for statement credits, and only spending on the principal card will trigger statement credits.

S$200 Local Dining Credit

|

|

| Local Dining Credit | |

| Awarded | Per calendar year |

| Minimum Spend | None |

AMEX Platinum Charge cardholders receive a S$200 local dining credit every calendar year that can be used at any of the following restaurants in Singapore. No minimum spend is required.

| 🍽️ Participating Restaurants (Singapore) | |

|

|

| When the credits initially launched in February 2023, Basque Kitchen by Aitor was also on the list. Unfortunately, the restaurant permanently closed on 28 May 2023 | |

For avoidance of doubt, this statement credit can be stacked with:

- The Mikuni voucher received as part of the AMEX Platinum Charge yearly renewal pack

- Love Dining discounts (Si Chuan Dou Hua)

- Chillax benefits (Botanico, The Riverhouse)

The statement credit will be applied to the nett amount charged to the card.

For example, if I spend S$400 on food at Si Chuan Dou Hua with a 50% Love Dining benefit, S$237.60 (S$200 + 10% service charge + 8% GST) will be charged to my card. That will then trigger a S$200 statement credit for local dining, making my nett out of pocket cost S$37.60.

S$200 Overseas Dining Credit

|

|

| Overseas Dining Credit | |

| Awarded | Per calendar year |

| Minimum Spend | None |

AMEX Platinum Charge cardholders receive a S$200 overseas dining credit every calendar year that can be used at any participating restaurant worldwide. No minimum spend is required.

The credit can be used at over 1,400 restaurants in the following countries:

| 🍽️ Platinum Global Dining Countries | |

|

|

The credit is only valid for dine-in services and excludes purchases of gift cards and vouchers, transactions made towards deposits charged upfront by the participating restaurants, cancellation and no-show charges, take away or dine-at-home services.

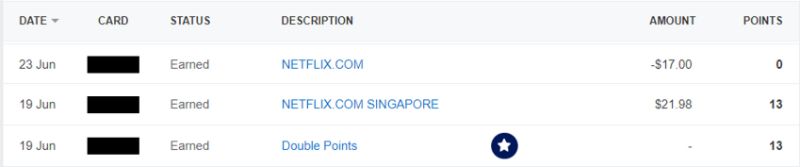

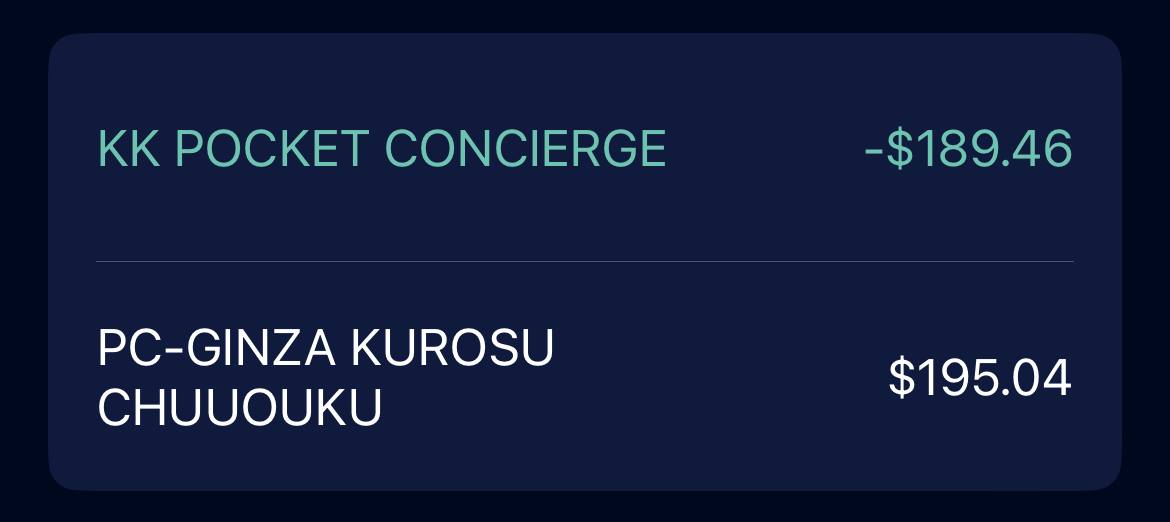

Do note that if you want to book restaurants in Japan, you must go via the Pocket Concierge service and make a prepaid reservation. I tried this out during a trip to Osaka earlier this year, and the process was very smooth.

S$400 Lifestyle Credit

|

|

| Lifestyle Credit | |

| Awarded | Per calendar year |

| Minimum Spend | S$600 in single trxn. |

AMEX Platinum Charge cardholders receive a S$400 lifestyle credit every calendar year that can be used at the following merchants, with a minimum spend of S$600 in a single transaction.

- Adeva Spa

- Follicle at Adeva

- Spa Rael

- The Ultimate

- The Spa by The Ultimate

- Grand Cru Wine Concierge

I personally would ignore the spa options, since I’m not in the mood to get hard sold on a package.

|

| Grand Cru Platinum |

That leaves Grand Cru. To utilise your AMEX credit, you will need to visit this special website for Platinum cardholders.

While I appreciate that it lets you mix and match what you like, you should always make sure to check the prices against Grand Cru’s public website to make sure the Platinum prices are not inflated. I’ve spotted a few instances of these in the past, though there’s no consistent pattern and I can’t say whether it’s accident or design.

Don’t forget, you need to spend the S$600 in a single transaction in order to trigger the credit!

S$204 Entertainment Credit

|

|

| Entertainment Credit | |

| Awarded | Per calendar month |

| Minimum Spend | None |

AMEX Platinum Charge cardholders receive a S$17 entertainment credit every calendar month that can be used at the following merchants. No minimum spend is required.

- Audible

- Eventbrite

- Disney+

- Netflix Singapore

- SPH Media (Straits Times, Business Times, Lianhe Zaobao, Shin Min Daily News, Berita Harian, Tamil Murasu, Tabla!)

- Ticketmaster

At S$17 per month, this credit would just about cover a Standard Netflix plan (S$17.48), or could be used to offset a Basic Netflix plan (S$12.98) plus Digital Straits Times subscription (S$9.90- yes, people actually subscribe to The Straits Times).

Remember that the credit is disbursed every calendar month, so if you sign up for an annual subscription, you’ll only enjoy a single S$17 statement credit (because the full year’s subscription is charged all at once).

S$200 Airline Credit

|

|

| SIA Credit | |

| Awarded | Per calendar year |

| Minimum Spend | S$600 in one or more trxns. |

AMEX Platinum Charge cardholders receive a S$200 airline credit every calendar year that can be used at Singapore Airlines or Scoot. A minimum spend of S$600 in one or more transactions is required (for example, two separate transactions of S$300 and S$400 would trigger the credit).

The following terms apply:

- Tickets must be purchased in-app or online at the Singapore Airlines or Scoot websites (i.e. you cannot book IAP rates via the AMEX Travel Portal)

- Tickets must be purchased in Singapore Dollars for flights departing from Singapore

- Transactions on KrisShop, Kris+ and any purchase of trip add-ons or purchases via phone, email, or other payment links do not count

This credit will be triggered when paying for taxes and surcharges on award tickets, but take note of the following:

- The charge must be in SGD, which means you must either redeem a one-way or round-trip ticket from Singapore (the credit would not be triggered if you redeemed a one-way LHR-SIN ticket and paid for taxes and surcharges in GBP, for example)

- The award ticket need not be on Singapore Airlines; if you were to redeem a Lufthansa award ticket via KrisFlyer, the charge would still come from Singapore Airlines (the previous point about the charge being in SGD still applies, however)

- Even though the terms say that tickets must be for flights departing Singapore, there are data points saying all that matters is the payment currency- if you change the payment currency to SGD (SIA’s website gives you the option), the statement credit will be triggered. Do make sure the rate on offer is reasonable, however

- The charge must be from the Singapore Airlines website, which means the credit will not be triggered if you call up customer service and enter your card details over the phone

As a side note, the opportunity cost involved with using the AMEX Platinum Charge for Singapore Airlines/Scoot transactions isn’t quite as bad as other categories, since you earn 1.95 mpd. Moreover, you will also trigger the very comprehensive travel insurance coverage by using your AMEX Platinum Charge to pay (even if it’s an award ticket).

S$150 Fashion Credit

|

|

| Fashion Credit | |

| Awarded | Twice a year (1 Jan-30 Jun/1 Jul-31 Dec) |

| Minimum Spend | None |

AMEX Platinum Charge cardholders receive a S$150 annual fashion credit that can be spent at NET-A-PORTER & MR PORTER, with no minimum spend.

This is split into two bi-annual credits of S$75 each that must be used during the following periods:

- 1 January to 30 June

- 1 July to 31 December

Purchases must be made:

- online at net-a-porter.com/en-sg/ or mrporter.com/en-sg

- via the NET-A-PORTER or MR PORTER phone apps

For the uninitiated, NET-A-PORTER is for women, and MR PORTER for men. And even if you have no interest in clothes, the website also sells bags, sunglasses, watches, shoes and bathroom amenities. Think of this as an opportunity to pick up some discounted Aesop, if nothing else!

Free shipping is normally offered for orders above 200 GBP, but the code mrp10pmx (no idea when it expires) removes the minimum spend requirement. There are also other promo codes out there that help you stretch your credit, so do some Googling before buying. Don’t forget that NET-A-PORTER and MR PORTER are both on ShopBack, so you can earn extra cashback on your order too.

FAQs

Q: I’m a cardholder approved from February 2023 onwards. Do I get two sets of statement credits in my first year of membership?

Yes. Because statement credits are awarded based on calendar year, a newly-approved cardholder would essentially enjoy two sets in his first membership year.

For example, a cardholder approved on 1 June 2023 would be able to register immediately for Set #1, which needs to be utilised by 31 December 2023. On 1 January 2024, he can register for Set #2, which needs to be utilised by 31 December 2024.

When his card anniversary comes round on 30 May 2024, he can choose not to renew his membership, notwithstanding the fact that 2024’s statement credits have been used.

Do remember that the Entertainment Credit is awarded by calendar month, however, so you won’t be able to utilise the full amount at one go. The same goes for the Fashion Credit, which is awarded on a half-year basis.

Q: I’m a cardholder approved prior to February 2023. Does using the annual statement credits prevent me from cancelling my card during the upcoming renwal cycle?

No. Some CSOs have wrongly informed cardholders that they are not allowed to cancel their AMEX Platinum Charge if they have used any of the credits for that particular calendar year.

I’ve raised the matter with American Express, who have provided the following instructions.

|

For issues with regards to Platinum Card cancellation fee waiver please send an email to voiceofcustomer@aexp.com Do indicate “Milelion Platinum” in the subject line so that the emails will be routed to the relevant teams to review. Please only send emails related to this topic; any non-related emails will be ignored and routed to the normal channels. This only applies to existing cardholders who were cardmembers prior to February 2023, who have registered and used the $1,354 statement credits prior to the end of their 2022-2023 membership year, and who do not wish to renew their card for the 2023-2024 membership year. |

Q: Do I still earn points for the full amount of spend, or is there an offset for the amount covered by statement credits?

You will earn points for the full amount of spend; the statement credit does not lead to a deduction in points.

Q: Do supplementary cardholders enjoy statement credits?

No. Supplementary cardholders cannot register for statement credits, nor will their spending trigger the statement credits.

Q: Why wasn’t my full Overseas Dining Credit rebated?

If you spend <S$200 on overseas dining, you might notice that not the entire amount of your spend was rebated via a statement credit.

That’s because the statement credit does not apply to the 2.95% foreign currency transaction fee that applies to all AMEX cards.

Q: Must I pay by a specific method to enjoy the statement credits?

No. Statement credits will be triggered regardless of how you pay, e.g. card swipe, tapping the card, adding the card to a mobile wallet.

Conclusion

The AMEX Platinum Charge’s S$1,354 annual statement credits help take a big bite out of the annual fee, but with six categories instead of the previous two, there’s a lot more cognitive load on the cardholder.

That makes it all the more important to take the time to plan and use your credits, and preferably not at the last minute!

Any questions about the AMEX Platinum Charge’s statement credits?

can the $200 local dining statement credit be stacked with the 2 x $50 JAAN vouchers?

I don’t see the offers in my app? Just got the card today

it takes about a week to appear

Does the statement credits spend add towards the qualifying 6k spend?