Last month, DBS teased some upcoming changes to the DBS Altitude Card from August, in what would be the first major product update since March 2015.

Well, the cat’s now out of the bag, and unfortunately from where I sit this looks like a pretty bad nerf.

While the DBS Altitude Card has increased its earn rates for local/FCY spend from 1.2/2 mpd to 1.3/2.2 mpd, it’s come at the cost of removing the 3 mpd rate for online flights & hotels completely. It all feels very “given chicken wing, take back whole chicken”.

If it’s any consolation, DBS has improved the sign-up offer, with new cardholders now enjoying up to 25,600 bonus miles with a minimum spend of S$2,000 (compared to 21,000 before).

What’s even more confusing is that DBS doesn’t appear to be done yet. The website positions the 1.3/2.2 mpd rates as valid till 31 January 2024, which means further changes are afoot.

Inside the FAQs accompanying the change, DBS says “watch this space”….again!

|

What are the card benefits from 1 February 2024? Watch this space in January 2024! We will be sharing more details on the card benefits you can enjoy from 1 February 2024. |

Overview: DBS Altitude Card changes

|

||

| 💳 DBS Altitude Earn Rates | ||

| Till 31 Jul 23 | From 1 Aug 23 | |

| SGD Spend | 1.2 mpd | 1.3 mpd |

| FCY Spend | 2 mpd | 2.2 mpd |

| Online Flights & Hotels |

3 mpd | Removed |

From 1 August 2023 to 31 January 2024, DBS Altitude Cardholders will earn:

- 3.25 DBS Points per S$5 spent in local currency (1.3 mpd)

- 5.5 DBS Points per S$5 spent in foreign currency (2.2 mpd)

As before, no minimum spend is required to enjoy these rates, nor is there any cap.

Even though this is a slight boost from the previous rates of 1.2/2 mpd for local/FCY spend, the bonus rate of 3 mpd for online flights & hotel bookings has been removed.

That stings, to say the least. While it’s true that you could earn a superior 4-6 mpd on flight and hotel bookings with the right cards, the DBS Altitude Card offered a fall-back solution for those who had bust their bonus caps. And with a relatively generous monthly cap of S$5,000, it could soak up a good amount of flight and hotel spending too.

The other key features of the card remain unchanged:

- DBS Points earned on the Altitude card never expire

- DBS Altitude AMEX and Visa cardholders receive 10,000 bonus miles (in the form of 5,000 DBS Points) for paying the S$194.40 annual fee

- DBS Altitude AMEX and Visa cardholders earn 6 mpd on Expedia and 10 mpd on Kaligo till 31 March 2024 (with a further extension likely)

- DBS Altitude Visa cardholders receive two free lounge visits each membership year via Priority Pass

With these changes, here’s how you calculate the points earned on the DBS Altitude Card, effective 1 August 2023:

| Local Spend | Divide transaction by 5 and multiply by 3.25. Round down to the nearest whole number |

| FCY Spend |

Divide transaction by 5 and multiply by 5.5. Round down to the nearest whole number |

Or if you prefer it in Excel vernacular:

| Local Spend | =ROUNDDOWN ((X/5)*3.25,0) |

| FCY Spend |

=ROUNDDOWN ((X/5)*5.5,0) |

| Where X= Amount Spent |

|

Thanks to the revised earn rates, the minimum spend required to earn points on the DBS Altitude Card has been reduced from S$1.67 to S$1.54 (1.54/5*3.25=1; any transaction smaller than S$1.54 would be rounded down to 0 points).

It’s also worth pointing out that even though the headline earn rate has increased from 1.2 to 1.3 mpd, DBS’s rounding policy means you might not actually see a whole lot more miles, especially on smaller transactions.

What happens after 31 January 2024?

Here’s the head scratcher: DBS is positioning these changes as “valid till 31 January 2024”, which implies that further changes are coming from 1 February 2024.

Why do this as a two-step process? That’s the part I’m struggling to understand. Is DBS trying to hedge its bets here by waiting to see what customer response is? What the competitor response is? Is this the corporate equivalent of edging?

Those questions are beyond my pay grade, but either way it means that cardholders are in limbo for a further six months. Whatever changes DBS ultimately has in mind, they’d better be worth this kind of teasing.

How does the DBS Altitude Card measure up?

These revised earn rates put the DBS Altitude above the Citi PremierMiles and StanChart Journey, and second only to the HSBC TravelOne Card and UOB PRVI Miles in terms of aggregate earn rates (I sum up the local and FCY earn rates as a quick-and-dirty way of determining the rankings).

| 💳 Earn Rates for General Spending Cards (income req.: S$30K) |

||

| Cards | Local Spend | FCY Spend |

UOB PRVI Miles UOB PRVI Miles |

1.4 mpd | 2.4 mpd |

HSBC TravelOne Card HSBC TravelOne Card |

1.2 mpd | 2.4 mpd |

DBS Altitude DBS Altitude |

1.3 mpd | 2.2 mpd |

OCBC 90°N Card OCBC 90°N Card |

1.3 mpd | 2.1 mpd |

Citi PremierMiles Citi PremierMiles |

1.2 mpd | 2 mpd |

StanChart Journey StanChart Journey |

1.2 mpd | 2 mpd |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

1.2 mpd | 2 mpd* |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

1.1 mpd | 2 mpd* |

BOC Elite Miles BOC Elite Miles |

1 mpd | 2 mpd |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

1.2 mpd | 1.2 mpd |

| *In June and Dec only, otherwise 1.1 mpd | ||

However, make no mistake: the nerfing of bonuses for online flights and hotels is a big loss, since the DBS Altitude was one of the few general spending cards on the market to offer a bonus category.

If you’re looking to buy Singapore Airlines or Scoot tickets specifically and have already maxed out the 4-6 mpd opportunities with other cards, my advice would be to fall back on the KrisFlyer UOB Credit Card instead, which earns an uncapped 3 mpd.

DBS Altitude sign-up offers

|

| DBS Altitude Offers |

| DBS markets this as “up to 40,000 miles” because their working assumes that you pay the annual fee (10,000 miles) and spend the entire S$2,000 on foreign currency spend (4,400 miles @ 2.2 mpd). My workings below have assumed the base case of local general spend @ 1.3 mpd. |

The DBS Altitude Card has launched a new set of sign-up offers, which are valid for applications till 30 September 2023.

Cardholders can earn up to 25,600 bonus miles, depending on which card they apply for, and whether they’re a new or existing DBS/POSB customer. On top of this, an additional 10,000 miles will be awarded if they choose to pay the first year’s S$194.40 annual fee.

|

|

|

| DBS Altitude AMEX | DBS Altitude Visa | |

| New Customers | 25,600 bonus miles (+10,000 miles with AF payment) |

22,600 bonus miles (+10,000 miles with AF payment) |

| Existing Customers | 11,600 bonus miles (+10,000 miles with AF payment) |

N/A |

| ❓ New-to-bank |

|

DBS defines “new-to-bank” as customers who do not:

|

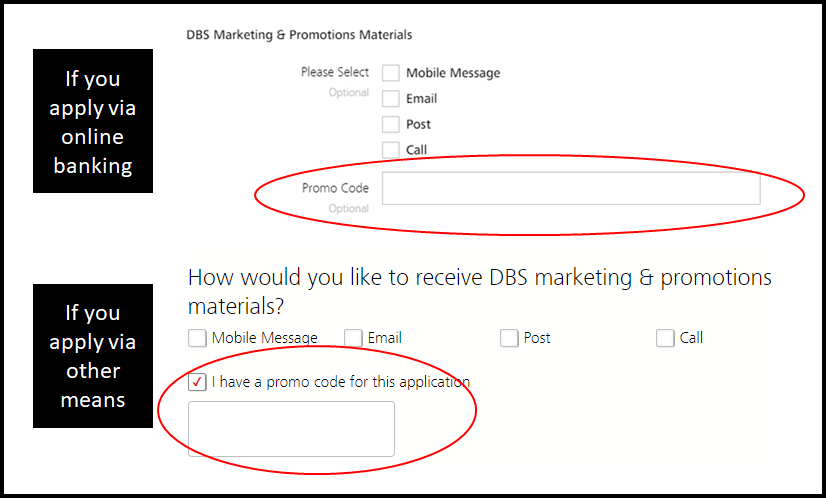

To enjoy these bonuses, customers must enter a certain promo code at the point of application (see below for details). Make sure to do this; no code, no bonus!

There’s nothing stopping you from signing up for both the AMEX and Visa cards. However, you will only enjoy the new-to-bank bonus on the first card that’s approved, and therefore you should apply for the Visa fist, then the AMEX, should you go down this route.

DBS Altitude AMEX sign-up offer

New-to-bank customers

DBS Altitude AMEX DBS Altitude AMEXApply |

||

| Promo Code | ALTMEX | ALTMEXW |

| Bonus Miles | 25,600 | 25,600 |

| Base Miles From S$2,000 Spend (@ 1.3 mpd) | 2,600 | 2,600 |

| Miles From S$194.40 Annual Fee | 10,000 | Fee waived |

| Total Miles | 38,200 | 28,200 |

New-to-bank customers who apply for a DBS Altitude AMEX by 30 September 2023 (with approval by 14 October 2023) and spend S$2,000 within 30 days of approval will receive 25,600 bonus miles, on top of 2,600 base miles (assuming the entire S$2,000 is spent locally at 1.3 mpd).

If they pay the S$194.40 annual fee, they’ll receive an additional 10,000 miles.

Customers who wish to pay the annual fee can apply with the promo code ALTMEX, while those who want a first year fee waiver can apply with the promo code ALTMEXW.

The T&Cs of this offer can be found here.

Existing customers

DBS Altitude AMEX DBS Altitude AMEXApply |

||

| Promo Code | ALTMEXA | ALTMEXAW |

| Bonus Miles | 11,600 | 11,600 |

| Base Miles From S$2,000 Spend (@1.3 mpd) | 2,600 | 2,600 |

| Miles From S$194.40 Annual Fee | 10,000 | Fee waived |

| Total Miles | 24,200 | 14,200 |

Existing customers who apply for a DBS Altitude AMEX by 30 September 2023 (with approval by 14 October 2023) and spend S$2,000 within 30 days of approval will receive 11,600 bonus miles, on top of the 2,600 base miles (assuming the entire S$2,000 is spent locally at 1.3 mpd).

If they pay the S$194.40 annual fee, they’ll receive an additional 10,000 miles.

Customers who wish to pay the annual fee can apply with the promo code ALTMEXA, while those who want a first year fee waiver can apply with the promo code ALTMEXAW.

The T&Cs for this offer can be found here.

DBS Altitude Visa sign-up offer

New-to-bank customers

DBS Altitude Visa DBS Altitude VisaApply |

||

| Promo Code | ALTVIS | ALTVISW |

| Bonus Miles | 22,600 | 22,600 |

| Base Miles From S$2,000 Spend (@ 1.3 mpd) | 2,600 | 2,600 |

| Miles From S$194.40 Annual Fee | 10,000 | Fee waived |

| Total Miles | 35,200 | 25,200 |

New-to-bank customers who apply for a DBS Altitude Visa by 30 September 2023 (with approval by 14 October 2023) and spend S$2,000 within 30 days of approval will receive 15,000 bonus miles, on top of the 2,600 base miles (assuming the entire S$2,000 is spent locally at 1.3 mpd).

If they pay the S$194.40 annual fee, they’ll receive an additional 10,000 miles.

Customers who wish to pay the annual fee can apply with the promo code ALTVIS, while those who want a first year fee waiver can apply with the promo code ALTVISW.

The T&Cs of this offer can be found here.

Existing customers

There is no offer for existing DBS customers who sign up for a DBS Altitude Visa card.

What counts as qualifying spend?

Cardholders are required to spend S$2,000 within 30 days of approval.

Qualifying spend consists of local and foreign retail sales and recurring bill payments, excluding the following:

| ⚠️ Excluded transactions |

|

For avoidance of doubt, CardUp transactions will only count towards the minimum spend if they are made in respect of rental payments (though all CardUp transactions are still eligible for base miles with DBS cards).

When will the bonus miles be credited?

Miles from the payment of the S$194.40 annual fee will be credited once the annual fee is charged.

Bonus miles will be credited within 90-120 days from the date of card approval, assuming the minimum spend requirement has been met.

What can you do with DBS Points?

DBS Points earned on the DBS Altitude do not expire, and can be converted to any of the following frequent flyer programmes with a S$27 admin fee.

| Frequent Flyer Programme | Conversion Ratio (DBS Points: Miles) |

| 5,000: 10,000 | |

| 5,000: 10,000 | |

| 5,000: 10,000 | |

|

500: 1,500 |

DBS also offers automatic conversions to KrisFlyer for a 12-month period with a S$43.20 annual fee.

In my opinion, it’s only worth transferring miles to KrisFlyer or Asia Miles. AirAsia BIG is more of a rebates program than a traditional frequent flyer scheme, and Qantas Frequent Flyer doesn’t have any real sweet spots for Singapore-based travellers (unless maybe you want to book a round-the-world trip, or domestic flights within Australia).

Conclusion

The DBS Altitude Card now offers 1.3/2.2 mpd on local/FCY spend, with the 3 mpd for online flight and hotel bookings sadly eliminated. DBS has attempted to cushion the blow by upsizing the sign-up bonus somewhat, but it’s cold comfort for existing cardholders who walk away worse off than before.

With 4-6 mpd opportunities so plentiful, I hardly use general spending cards these days. My main use case for the DBS Altitude was its 3 mpd for air tickets, when caps on other cards had been exhausted. With this no longer on offer, it’s off to the sock drawer- unless 1 February 2024 brings some truly valuable enhancements.

What do you make of the DBS Altitude Card’s changes?

Disappointing to be honest. Was dependable backup as u mention although still had to chase for the right number of DBS points.

Sock drawer for now I guess.

Confirm that those with existing Altitude Visa cards are not eligible for the Altitude Amex bonus offer

Any max amount that will earn 1.3 mpd?

Oh no… I just purchased a flight ticket on Jul 31st, does this mean I’ll only earn 1.3mpd for this?

Same here. Did a last min clearing of miles and booked yesterday. Suspect we will be on the new perks

needless to say, DBS is being a bit disingenuous here by not providing adequate notice of the changes. i’m sure they will say “well, we said on 1 july that the card is changing from 1 aug”, but i’m sure it goes against the spirit of ABS rules to say “changes are coming! what changes? we’ll tell you when it happens!”

Still some use case for me as I don’t have any other cards with lounge access. Helps with WWMC rounding for conversions as well.

I don’t use this card very often, but I’m quite happy with the change. The new foreign spending rate goes nicely with the power up your travel promo. 4.2 mpd is better than many other cards. A good option for foreign spendings in the next few months.

Given that all hotel and flight bookings are online, you can instead just use the DBS womans card and earn 4mpd. Although I suppose this is limited to $2k/month whereas the Altitude was $5k/month.

Well, it just removes any value of the Altitude card completely as far as I can see. Why would you use it for 1.3mpd when you can just use a standard UOB card and get 1.4mpd?

Try again DBS. You failed this time.

No good for me. I got this card just 2 months ago only because of the 3mpd flight bonus, and will now cancel it. I typically spend ~$4k per month on flight bookings, which will now go elsewhere. Just not sure where!

$2k to DBS womans (4mpd) and $2k to UOB Lady’s Card (6mpd for 2023) – make sure you select the travel category on the Lady’s Card.

I’m not really sure if I’m viewing it wrongly, but I still see the 3 mpd rate for online flights & hotels on their website?