Back in 2003, the UOB Visa Infinite Card was unveiled, marking the launch of Visa’s highest-tier product in Singapore.

At the time, this was positioned as “an exceedingly exclusive card for the mega-rich”, targeting the top 0.1% of the elite circle in Singapore. The annual fee was S$1,500, with a minimum income of S$350,000— roughly equivalent to S$550,000 after adjusting for inflation!

Fast forward to today, and it’s safe to say that Visa Infinite now courts a much wider audience. While it’s not quite an entry-level card, it’s also not the sort of thing that warrants a black-tie gala anymore.

So is this still a card worth adding to your wallet?

Which cards belong to the Visa Infinite tier?

There are at least 18 Visa Infinites in Singapore, or 20 if you count subvariants like the Maybank Diamante Metal Visa Infinite and UOB Reserve Diamond Card, or even 21 if you include the “stealth Visa Infinite” UOB PRVI Miles Visa.

| 💳 Visa Infinite Cards in Singapore |

||

| Card | Annual Fee | Qualification |

BOC Visa Infinite BOC Visa InfiniteApply |

S$381.50 (FYF) |

S$120K p.a. |

BOS VOYAGE BOS VOYAGEApply |

S$498 | US$5M AUM |

CIMB Visa Infinite CIMB Visa InfiniteApply |

Free | S$120K p.a. |

Citi ULTIMA* Citi ULTIMA*Apply |

S$4,237.92 | S$500K p.a. |

DBS Insignia DBS InsigniaApply |

S$3,270 | S$500K p.a. |

DBS Vantage DBS VantageApply |

S$599.50 | S$120K p.a. |

HSBC Visa Infinite HSBC Visa InfiniteApply |

S$662.15 | S$120K p.a. |

Maybank Diamante Visa Infinite Maybank Diamante Visa InfiniteApply |

S$654 (FYF) |

US$1M AUM |

Maybank Visa Infinite Maybank Visa InfiniteApply |

S$654 (FYF) |

S$150K p.a. |

OCBC VOYAGE^ OCBC VOYAGE^Apply |

S$498 | S$120K p.a. |

OCBC Premier VOYAGE OCBC Premier VOYAGEApply |

S$498 | S$350K AUM |

OCBC PPC VOYAGE OCBC PPC VOYAGEApply |

Free | S$1.5M AUM |

OCBC Premier Visa Infinite OCBC Premier Visa InfiniteApply |

Free | S$350K AUM |

StanChart Priority Banking Visa Infinite StanChart Priority Banking Visa InfiniteApply |

Free | S$200K AUM |

StanChart Visa Infinite StanChart Visa InfiniteApply |

S$599.50 | S$150K p.a. |

UOB Privilege Banking Card UOB Privilege Banking CardApply |

Free | S$350K AUM |

UOB PRVI Miles Visa^ UOB PRVI Miles Visa^Apply |

S$261.60 (FYF) |

S$30K p.a. |

UOB Reserve Card UOB Reserve CardApply |

S$3,924 | S$500K p.a. |

UOB Visa Infinite Metal Card UOB Visa Infinite Metal CardApply |

S$654 | S$120K p.a. |

| *All new applicants will only be eligible for the Mastercard version; existing cardholders can continue on the Visa platform until further notice ^Not an official Visa Infinite |

||

In general, a Visa Infinite requires a minimum income of at least S$120,000 a year, or a privilege banking relationship. That said, hefty annual fees aren’t always necessary; in fact, there are several Visa Infinite cards which are free for life!

Whether it’s “worth it” to get a Visa Infinite depends on which card you’re talking about. Each bank adds their own features, so some Visa Infinites come packed with perks, while others are more basic.

But there’s a core set of benefits that all Visa Infinites share, and that’s what I want to focus on below.

What benefits does a Visa Infinite offer?

Visa Infinite Concierge

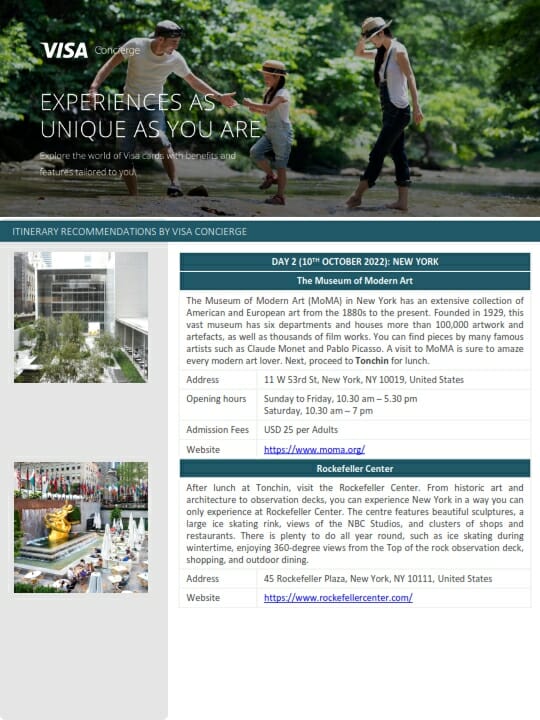

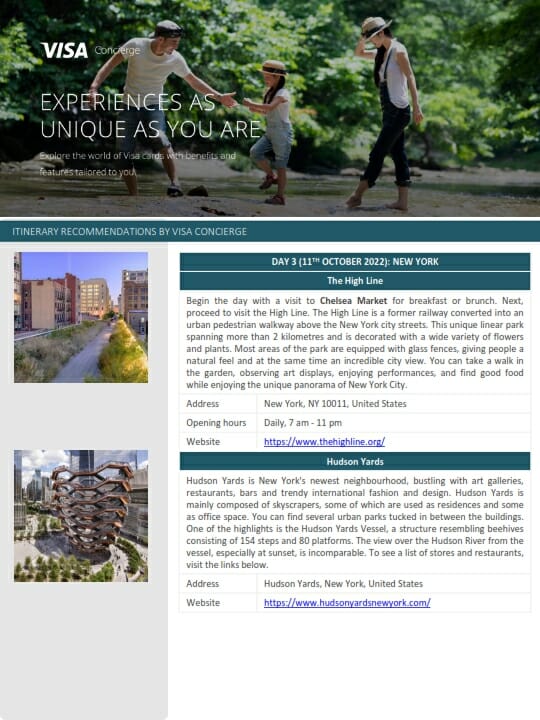

All Visa Infinite Cardholders have access to the Visa Concierge, which can provide assistance with flight, hotel and activities bookings, restaurant reservations, itinerary planning, securing concert tickets, and sourcing hard-to-find items.

They don’t work miracles though, and you shouldn’t expect Centurion-level service like getting a table at a fully-booked restaurant, or tickets to a sold-out event.

That said, I have found it useful for making reservations in countries where online bookings aren’t a thing, and English isn’t widely spoken (e.g. Japan, though keep in mind that they won’t be able to book restaurants which only open slots to high-end hotels). Here’s an example of an itinerary they put together for my trip to New York in 2022.

You can contact the concierge via the following channels. I particularly like that they’re on WhatsApp, which saves you the time lags of communicating over email.

- Phone: 1800 8232 049

- WhatsApp: +65 800 4481 292

- Email: SGInfinite@concierge-asia.visa.com

Back in 2017, I put the concierge through the paces with a series of tests, and the results were hit and miss. Granted, a lot of time has passed since then, but in case you were curious, do check out the article below.

GHA DISCOVERY Titanium

|

| Details |

Visa Infinite cardholders are eligible for an instant upgrade to GHA DISCOVERY Titanium status, the highest (published) tier in the programme.

Cardholders must contact the Visa Concierge to request their GHA status upgrade. Upgrade requests must be submitted by 31 December 2026, and once upgraded, your status will be valid till 31 December 2027. There’s no real incentive to delay, since the expiry is the same regardless of when you submit your request.

The offer is valid for both new and existing GHA DISCOVERY members. If you’re a new member, you’ll need to create an account before registering. If you’re an existing member, simply provide your existing account number for the upgrade.

GHA DISCOVERY elites can look forward to the following benefits. While room upgrades, early check-in and late check-out are subject to availability, breakfast is a guaranteed perk for Titaniums at selected brands including Capella, Pan Pacific and PARKROYAL.

| 🏨 GHA DISCOVERY Benefits |

|||

|

|

|

|

| Gold | Platinum | Titanium | |

| Earn D$ | 5% | 6% | 7% |

| D$ Validity | 18 mo. | 24 mo. | 24 mo. |

| Room Upgrade | – | Single* | Double* |

| Early Check-in | – | – | From 11 a.m* |

| Late Check-out | – | Till 3 p.m* | Till 4 p.m* |

| Welcome Amenity | – | Yes | Yes |

| Share Status | – | – | Yes# |

| Breakfast | – | – | Yes^ |

| *Subject to availability #Status sharing only applies to members who earned their status through regular means, not fast-track promos ^Selected brands only |

|||

Avis President’s Club

|

| Details |

Visa Infinite cardholders are eligible for an instant upgrade to Avis President’s Club status, which grants benefits such as:

- Priority service at the counter

- Priority rental car availability

- Free additional driver

- Single upgrade guaranteed at rail stations and airports, upon availability at downtown locations

- Double upgrade for select car classes upon availability on weekends

Do note that benefits vary by location, so the treatment you receive as a President’s Club member in Europe may be different from the USA.

Even though Avis President’s Club is marketed as “by invitation only”, you might want to moderate your expectations. Avis has been very liberal with the invitations, such that PC members are almost a dime a dozen when renting from some airports. Based on my experiences so far, recognition has gone from excellent (served immediately, upgraded to a luxury vehicle) to non-existent (“what’s President’s Club?”).

But here’s the thing: you don’t need a Visa Infinite card to enjoy this perk, because it’s equally applicable to Visa Signature cardholders too. Yes, Visa Signature, which anyone can get with a minimum income of S$30,000 in Singapore!

Visa Infinite Luxury Hotel Collection

|

| Details |

The Visa Luxury Hotel Collection is comprised of more than 900 upscale hotels worldwide. Bookings made through this programme enjoy:

- Automatic room upgrade upon arrival, when available

- Complimentary in-room Wi-Fi, when available

- Complimentary breakfast for two

- $25 USD hotel credit

- VIP Guest status

- Late check-out upon request, when available

Visa Infinite Cardholders enjoy an additional benefit at a smaller selection of ~200 Visa Infinite Luxury Hotel Collection hotels, which upgrades the credit to US$100.

I’m not convinced this is much of a perk, because you can book similar luxury travel advisor rates through Classic Travel or HoteLux for free— no Visa Infinite Card necessary. Moreover, these platforms let you book the chain’s own advisor rates (e.g. Marriott STARS), which will generally be prioritised for upgrades over Visa Infinite.

Visa Infinite Golf

|

| Details |

Visa Infinite cardholders enjoy complimentary green fees on weekdays at Sentosa Golf Club and Tanah Merah Country Club. A minimum of one paying guest per cardholder is required.

The catch is that a maximum of 20 rounds per month are available to cardholders, and with so many Visa Infinite cards out there, slots go fast. Bookings must be made at least five working days in advance, and no more than 14 calendar days in advance, so that effectively means you can forget about playing in the second half of the month (since all slots will surely be taken by the time the booking window opens).

This benefit is capped at four bookings per year, and one booking per month.

There is a separate benefit which offers 50% off weekday golf at 50 participating golf clubs across Southeast Asia.

Harrods Rewards Gold

|

| Details |

Visa Infinite cardholders get an instant upgrade to Harrods Rewards Gold Tier, bypassing the usual £5,000 spending requirement.

Benefits include:

- 2 Rewards points for every £1 spent

- Two personal 10% discount days per year

- Exclusive discount days

- Complimentary UK delivery of in-store purchases of £250+

- Complimentary tea or coffee in-store

- Complimentary basic alterations with The Tailors (up to £30 credit)

I suppose it doesn’t hurt to have this, but once upon a time, Visa Infinite got you fast-tracked all the way to the Black tier!

Other perks

You can find a full list of perks for Visa Infinite cardholders here. Here are a few that caught my eye:

- 15% off car rentals with Klook (with a min. spend of S$250, and capped at S$40)

- 20% off selected restaurants at Singapore Changi airport (though all of these are on Dragon Pass/Priority Pass anyway, so you could potentially get free food with the right credit card)

- 25% off rates and complimentary breakfast at Frasers Hospitality properties

- 8% off Japan Airlines tickets from Singapore to Japan in all cabins

- Complimentary Gold Tier membership upgrade with Lotte Duty Free Korea

- eCommerce Purchase Protection with up to US$1,000 of coverage for non-delivery or malfunctioning items

A tier beyond Visa Infinite?

With so many Visa Infinite Cards on the market, differentiation has become a real problem. After all, there’s premium, and there’s premium. It’s safe to say the no-annual-fee CIMB Visa Infinite is a very different beast from the S$4K+ by-invite-only Citi ULTIMA.

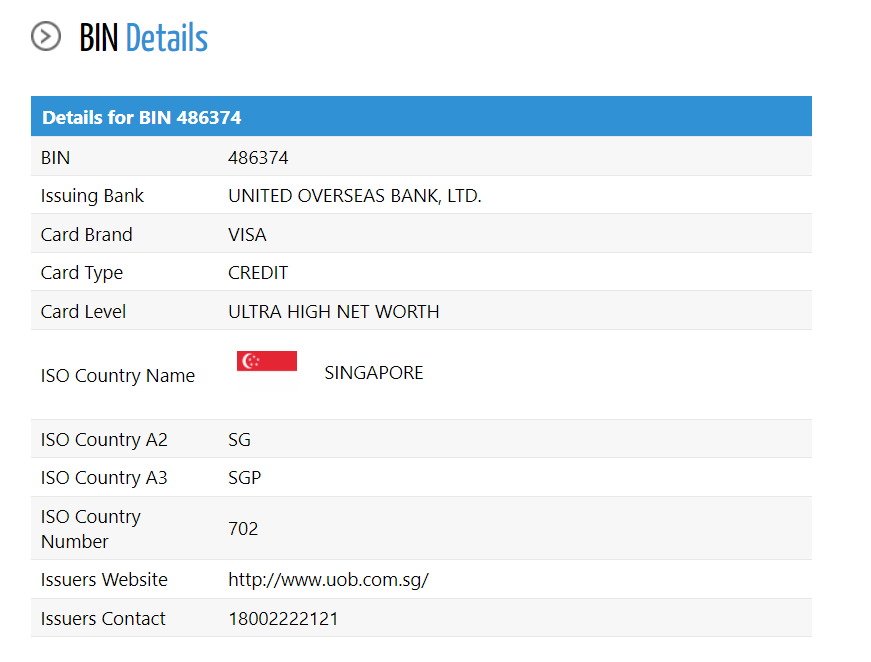

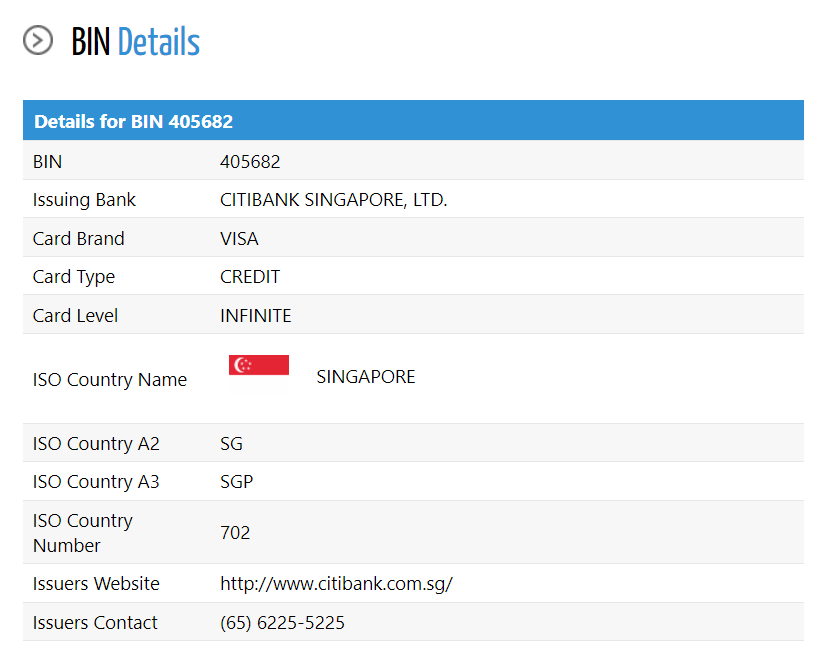

This begs the question as to whether Visa needs a tier beyond Infinite, or in fact already has one.

The UOB Reserve Card’s T&Cs provide a hint. At point 4.5.8.4, mention is made of a special booking website for golf. Instead of the usual https://promotions.visa.com/campaign/discounted_golf/ that regular Visa Infinite Cardholders use, UOB Reserve Cardholders are directed to https://promotions.visa.com/campaign/UHNW_golf

Notice how the URL mentions UHNW, or Ultra High Net Worth. That’s another type of Visa, which hasn’t officially launched in Singapore. As far as I know, Visa Ultra High Net Worth is only issued in the Middle East to moneyed private banking clients. But could it be that some of the higher-end Visa Infinites in Singapore are actually part of this tier?

As it turns out, yes! If you look up the BIN (please don’t say BIN number; that’s like saying ATM machine) of the UOB Reserve Card, you’ll notice it’s tagged as “Ultra High Net Worth”.

In contrast, the DBS Insignia, Citi ULTIMA and OCBC PPC VOYAGE are merely part of the oh-so-plebeian Infinite tier.

I suppose the question then is whether Visa Ultra High Net Worth offers anything worth shouting about. So far the only thing I’ve been able to find is the golfing benefit, where the availability for golf is much better for UHNW compared to regular Visa Infinite (probably because there’s less competition for slots).

If anyone knows better, please sound out!

Is the World Elite Mastercard a better bet?

Compared to Visa Infinite, I’d argue that Mastercard’s top tier has more to offer. World Elite Mastercard cardholders enjoy elite status with numerous hotel chains, Avis President’s Club status, an annual Flexiroam data package, complimentary travel insurance and more.

| 🏨 Hotel Elite Status | |

| 🚗 Rental Car Elite Status | |

| 👍Other Perks |

There are also things that aren’t unique to World Elite Mastercards but are still nice to have nonetheless, like the Mastercard One Dines Free programme.

Refer to the article below for more details.

Conclusion

Visa Infinite might not be mass market the way Visa Signature has become, but it’s nowhere near the ultra-exclusive status symbol it was once upon a time.

The core privileges aren’t much to get excited over — for my money, World Elite Mastercard is better — but this says nothing of the benefits that banks add on, and I think you’ll still find many happy Visa Infinite cardholders out there.

All the same, two decades ago, having a Visa Infinite Card was a big thing. Today, I can’t say the chiobu really care.

Any other Visa Infinite benefits worth mentioning?

Revolut metal is world elite. And a pretty hefty metal card too. You know, if you think that you get better service from waiters by dinging your metal card on your plate as opposed to clicking your fingers… Personally I prefer the loud don’t-you-know-who-I-am, but some people stupidly assume it’s a rhetorical question.

didn’t know about revolut metal! thanks for the dp. but $19.99 for 1.5% cashback per month is, well…probably not ideal.

Yeah, that’s why to me, it’s not an option at all

Oh it went up to 1.5%… I used to recover the fee plus a bit more under the 1% off the back of big insurance premiums in the family but that stopped, plus the card top up charges so I dropped metal.

It should be a world card (check the back of the card if it’s not stated). Revolut offers a paid metal world card.

Both of my revolut metal cards are world elite

Even the SCB X card that “anyone” could get was a Visa Infinite card!

Wondering if these cardholders still get the perks as they can still use their existing “infinite” metal card while earning SCB journey rewards.

my x card is still recognised as a VI when i did dummy bookings for golf etc, so my guess is yes

In Canada, there’s Visa Infinite Privilege. One tier above Infinite, it seems 😮

yup i saw that in my research, but Visa’s product guide (https://usa.visa.com/content/dam/VCOM/download/about-visa/visa-rules-public.pdf) seems to treat VI and VI Privilege as one and the same.

Happy with my fee free CIMB VI. Comes with 3 DragonPass passes.

Very helpful when Plaza Premium lounges (eg Penang & KL) were not accessible with Priority Pass.

CIMB has world Mastercard per my understanding

everyone has world mastercard. world elite mastercard is much more rare

PRIV too gives the same 1.4mpd. I am about to cancel my uob infinite card after using it for half a decade. I honestly do not find much benefits given that the annual fee is non-waivable. I rarely use lounge too. I think $650 can be better spent else where.

Might be useful if one still have education/enrichment payment to do.

I understand that some credit cards allow the purchase a free business class companion ticket when you purchase a full-fare business class ticket. Is this a real perk, easy to purchase and is a real value?

The problem we have today is 120k is no longer consider exclusive, statistically speaking. A 120k and above annual income in Singapore as per 2022 statistics will put an individual at the top 22% of all tax payers in Singapore. That’s not what exclusive looks like. We desperately need a new category in between the plebeian 120k and the OMG 500k tier. Banks are experts in inflationary management, (think interest rate hike) but the weirdest thing is ‘exclusive’ credit cards are deflationary! A top 10% income in Singapore in 2022 is 191k so if any bank wants to shake up… Read more »

it’s an interesting point you raise, because it’s been rumoured that AMEX (and citi) is looking to introduce an inbetween card that will straddle the plat charge and centurion segments. maybe $300k?

Can we request MileLion to write a satire article for bank to consider issuing a new tier between the boring 120k income segment (represented by the top 22% income earners) and the unattainable 500k (represented by the top 1.5% HNWI)? I am waiting as I truly enjoy MileLion and a OG fan here!

The Visa Infinite concierge is miles ahead of the Amex Platinum concierge today. The WhatsApp accessibility, the standard of the itineraries they do, it’s miles ahead of anything I’ve experienced with Amex.

The concierge is the one thing I miss after having cancelled my only VI card.