In June 2019, I received a mysterious pitch from a media agency: a bank was about to launch a new premium credit card in Singapore, and they wanted me to write about it.

After some back-and-forth plus an NDA, I finally got the details: In July, the brand new Standard Chartered X Card (for “affluent millennials”, they constantly emphasised) would launch with a 100,000 miles sign-up bonus. In the lead-up, the plan was to generate buzz by getting interested customers to join a waitlist.

I got the 100,000 miles bit just fine. What I didn’t understand was the point of a waitlist.

“Remind me again why this card has a waitlist?”

“Oh, everyone who joins the waitlist gets to apply one day earlier.”

“OK, and this is a perk because the 100,000 miles bonus is in limited quantity or something?

“No, it’s uncapped.”

“Right…but in that case, what’s the point of the waitlist?”

There was a silence, or as big a silence as you can imagine over email. I revisited the topic a few times, but one thing was clear: Standard Chartered loved the idea of a pre-launch waitlist, and nothing I could say would make them change their mind.

And yet the waitlist wasn’t my biggest concern. Yes, it was silly and superfluous, but it was ultimately harmless. My bigger concern was what happened after the first year.

I mean, sure. I’d pay a S$695.50 annual fee to enjoy a 100,000 miles sign-up bonus, but in the second year, what did the card offer except two lounge visits? I distinctly remember pursuing this line of enquiry too, though the conversation was somewhat unfruitful.

But fine. Maybe they were being deliberately tight-lipped. My job here wasn’t to audit their product strategy after all, and there was nothing objectionable about the first year’s value proposition. So I wrote the post, which marked the launch of the waitlist on 20 July 2019.

I guess it’s funny in retrospect- for all the NDAs and secrecy surrounding the project, it was Standard Chartered which spilled the beans by uploading the X Card’s full T&Cs a few days ahead of the 25 July 2019 launch. These were duly discovered and dissected by the community in record time (and if you think this was a deliberate 200 IQ move to feed the hypebeast, I think that might be giving them a little too much credit).

Oh, and the waitlist? Let’s just say it turned out to be even more pointless than I originally imagined. Because of various technical snafus, the supposed “priority application” emails for those on the waitlist only went out after the X Card’s public landing page and application link had gone live.

But bungled launch aside, the X Card received a massive response. How could it not? While the lack of benefits beyond the sign-up offer made it easy fodder for punchlines (“the X Card”, said one of my favourites, “because just like your ex, you’ll soon forget about it” / “the X Card,” went a slightly less polite version, “because just like your ex, it’s all about pump and dump”), no one in the right mind would pass up the opportunity to buy 100,000 miles at a mere 0.7 cents apiece.

Standard Chartered launches SC Visa Infinite X Card with 100,000 miles sign-up bonus

It really was a case of making hay while the sun shines, or like noted theologian Martin Luther once said, “See the sunlight / We ain’t stopping / Keep on dancin’ ’til the world ends”.*

*I admit this is historically inaccurate; Martin Luther spoke German, and thus would have said these lines in his native tongue.

And to be fair, the X Card did bring some new things to the table: Standard Chartered used the launch to introduce its new rewards platform, with 11 additional transfer partners. In typical Standard Chartered fashion, however, it also created a lot of unnecessary complication because the bank now had two different points portals- leading confused cardholders to accuse the bank of removing KrisFlyer transfers!

So overwhelming was the response that less than a week after launch, Standard Chartered announced it would be ending the 100,000 miles sign-up bonus a full month ahead of schedule. Interested customers had just one day more to sign up before the door slammed shut.

From 1 August 2019, the sign-up bonus was cut to 60,000 miles– still good, in and of itself, but therein lies an interesting psychological experiment: would you take a good deal, knowing that an even better one had just disappeared forever?

|

||

| Launch Offer |

Revised Offer |

|

| Pay $695.50 Annual Fee | 30,000 | 30,000 |

| Spend $6K in first 60 days | 70,000 | 30,000 |

| Total Bonus Miles | 100,000 | 60,000 |

While pulling the 100,000 miles offer early was entirely Standard Chartered’s prerogative, the move came off a little panicky, as if someone had epically miscalculated their sums. It could hardly have been a surprise that this offer would be ravenously received and expensive to fulfil- so why make the application period so long in the first place?

If you ask me, the whole thing would have gone much better if the messaging went something like “X Card: Regular sign-up bonus of 60,000 miles, but for early birds we’ll upsize it to 100,000 miles!” This gives you the scope to play good cop and extend the early bird offer if sign-ups don’t meet expectations, and also heads up everyone that 60,000 miles is the regular offer.

And yet things were to get stranger still. On 20 August 2019, just 27 days after its launch, Standard Chartered announced a suspension of all new X Card applications. Interested parties were directed to add their name to a waitlist; maybe that pre-launch campaign was prescient after all.

Even though the suspension of sign-ups was unexpected, all the warning signs were there.

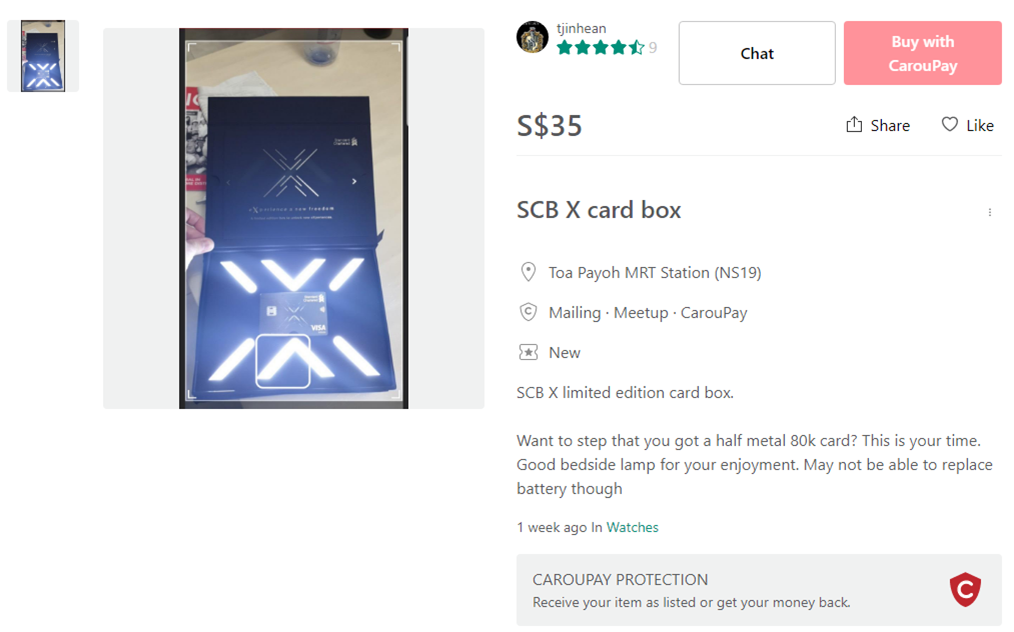

The first batch of applicants received their X Card in a snazzy box that lit up when opened, displaying the card in dazzling LED lights. The second batch got their X Card in a regular box, sans lights. The third got theirs in a nondescript white envelope, together with an apology that the bank had run out of boxes- but hey, you could buy one on Carousell if you really wanted.

So would-be applicants added their names to the waitlist and…waited. At one point in time, the X Card had been unavailable for twice as long as it’d been on the market, and I genuinely wondered whether Standard Chartered had decided to pull the plug altogether.

X Card applications eventually reopened on 16 October 2019, with the 60,000 miles sign-up offer intact. Cardholders would receive a plastic card first, with the metal card on backorder.

As metal X Cards need a longer time to produce, we thought it is better for you to receive a plastic card first to experience the power of X. You can still enjoy all X Card privileges, the metal X Card will be sent to you as soon as it is ready.

-Standard Chartered

As much as applicants lamented missing the boat on the 100,000 miles sign-up offer, they should count their lucky stars they got something. In January 2020, the X Card removed its 60,000 miles sign-up offer, meaning that cardholders would receive only 30,000 miles for paying the S$695.50 annual fee.

You’re walking down the street when someone comes up to you and says “hey buddy, I’ll sell you 30,000 miles for 700 bucks, whaddya say?”

You pause and do some mental sums. That’s more than 2.3 cents per mile. Given what you know about the landscape for buying miles in Singapore, it’s a poor deal. You politely decline and walk away.

“Come on guy, I’ll sweeten the deal,” he says. “Two free lounge visits every year!”

You scoff because you know you can get that with free cards like the DBS Altitude or the Citi PremierMiles Card. You start walking faster.

“Fullerton dining benefits! Complimentary travel insurance! Redeem your miles for statement credit at 1 cent each!” he shouts after you.

You disappear around the corner, just as he says, almost pleadingly, “Instant digital card?”

Without the sign-up bonus, the X Card became a paperweight- and not a particularly good one at that, since cardholders were still receiving plastic cards upfront instead of metal!

And then: hope.

In February 2020, Standard Chartered discontinued applications for the Visa Infinite, the X Card’s closest internal competitor.

Was this it? Was this the catalyst for a dramatic improvement in X Card benefits? I certainly thought so:

Think about it: the SCB Visa Infinite had been on the market for more than 3 years at the time the SCB X Card launched. It would stand to reason that there’d be a good number of SCB Visa Infinite cardholders already, who’d be pretty ticked off if the “inferior” (in terms of income requirement) X Card offered better benefits.

If that’s true, then the SCB X Card couldn’t offer more than 1.4/3.0 mpd on local/overseas spend; and it couldn’t have more than six free lounge visits. It basically couldn’t have anything the SCB Visa Infinite didn’t have, and given how mediocre those benefits already were, it’s not surprising how underwhelming the eventual offering was.

The discontinuation of the SCB Visa Infinite would make the SCB X Card the bank’s top-tier offering. We already knew that despite the SCB Visa Infinite’s official S$150,000 income requirement, SCB was more than happy to offer it to those earning at least S$80,000, the same income as the SCB X Card.

This suggests they see the target group as one and the same (so much for all that millennial branding, eh?), and my sense is we’ll see some higher-end perks popping up for the SCB X Card in the near future.

Man, reading the last part makes me cringe. Not one of my prouder moments.

That said, the X Card did offer occasional transfer bonuses, and one of them, in March 2020, was simply sensational: a 100% transfer bonus to Accor Live Limitless (ALL).

Given the buffed conversion rates and ALL point value, your entire X Card sign-up bonus plus base points would be worth an astounding €2,144 (~S$3,200) of hotel stays, spa treatments and dining. I jumped on this opportunity, earning back my annual fee and then some. These points helped fund a few of my stays, including a very memorable Raffles Hotel staycation.

The problem was: these transfer bonuses were reasons for people to cash out their existing points balances, not necessarily spend more. And apart from a rather anaemic “anniversary spending promotion” — spend S$20,000 over a five-month period to get 10,000 bonus miles, whoo! — there was no real incentive to renew the card.

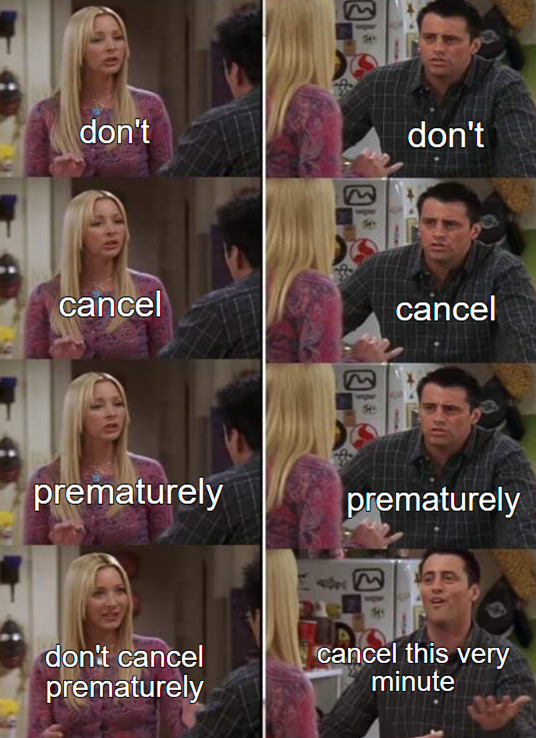

So as the first year anniversary of the X Card drew near, the “keep or cancel” discussion was only ever headed in one direction.

The sign-up bonus brought in the crowds, but crowds are fickle creatures. No one’s going to say come renewal time, “well, they did give me 100,000 miles when I signed up, so I suppose I owe them one”.

And yet it seemed like Standard Chartered was banking on exactly that. As the days ticked down to renewal, it became increasingly apparent that the Hail Mary I was so sure was coming (“They’re just delaying the announcement to sift the true believers from the plastic fans”, I said. “Plastic, get it?”) was more like Waiting for Godot, only Godot didn’t charge you S$695.50.

But in the end there was no need to enhance anything, because Standard Chartered resorted to the deus ex machina of an “exceptional” annual fee waiver for the 2020-2021 membership year.

Surprise! Standard Chartered X Card waives 2nd year annual fee

As a 1st year anniversary appreciation of your support for StanChart X Card, we will be giving you an exceptional waiver of the annual fee. Have a great day!

-Standard Chartered

Truth be told, they probably had little choice. In the run up to July 2020, a lot of cardholders were cancelling their X Card ahead of schedule, despite my sagely advice that there was little benefit in doing so.

I had hoped the annual fee waiver was a stalling tactic by the product team to buy them another 12 months of breathing space, during which they would, surely and decisively, improve the X Card’s value proposition.

That might have been wishful thinking on my part, because the rest of 2020 passed with no further X Card developments. Then in January 2021, Standard Chartered revived the Visa Infinite. You can’t make this stuff up.

Standard Chartered did experiment with airline-specific sign-up bonuses for the X Card, offering 45,000 EVA Air miles or 50,000 Qantas Frequent Flyer points with payment of the S$695.50 annual fee. Neither was compelling, however, and neither addressed the root problem of no recurring benefits.

And that was all that happened till July 2021, when the “keep or cancel” question came round again.

Standard Chartered’s resolution? Another “exceptional” waiver.

Surprise (again): Standard Chartered X Card waives 3rd year annual fee

Yes, they actually called it “exceptional” again.

In the words of one wiseguy:

What happened in the 12-month period after that? You’re really not getting the hang of this, are you?

Absolutely jack all. The only time the X Card crossed my mind in the 2021-2022 membership year was when I penned an updated review calling it “the card you had every reason to get, but little reason to keep” (note the past tense- “had” in July 2019, not now).

By the time the “keep or cancel” question came around for the third time in July 2022…

…the resulting waiver was pretty much a fait accompli, so much so I didn’t even bother writing an article about it.

What’s kind of hilarious, if you think about it, is that for virtually its entire lifespan, the X Card never dropped the pretence of the annual fee being mandatory. It’s always been there on the website, and its customer service officers have sung it in perfect tune: the annual fee is strictly non-waivable.

Why “virtually”? Because in November 2022, the X Card finally started offering a first-year fee waiver option, which actually made it a very decent general spending option: a favourable rounding policy, wide range of transfer partners, 2 free lounge visits, non-expiring points, and a free metal card to boot!

I declared, half in jest and half serious, that the X Card was now Singapore’s best general spending card. But as it turned out, all this was doing was laying the ground work for its final form: the Journey Card.

StanChart X Card rebranded as Journey; now offers up to 3 mpd

Gone are the lofty dreams of pursuing “affluent millennials”, replaced with a much more down-to-earth S$30,000 income requirement. The annual fee has been cut by 70%, metal is substituted by “carbon neutral plastic”, and a (temporary) bonus category added for online groceries, food delivery and transport. If the X Card is what you dreamt your career would be like when you graduated, the Journey Card is the harsh reality.

Now, I tease hard, but don’t you think for a minute that this was the ending I wanted for the X Card. Far from it.

I wanted the X Card to be a success. How can you not root for a card that offered a 100,000 miles sign-up offer, unprecedented in Singapore and yet to be bested by any bank? How can you not applaud the efforts to expand transfer partner variety, beyond the drudgery of mere KrisFlyer?

But here’s the problem: the X Card didn’t know where to go after that, kind of like the aquarium fish in Finding Nemo. The sign-up offer put us front and centre in the minds and wallets of everybody. Now what?

When I first wrote about the X Card, I had no idea what it would offer beyond the first year.

Apparently, neither did Standard Chartered.

What an eXceptional write up of the arduous journey the X Card took.

I actually took out my metal X Card from the drawer, blew off the dust and wave it in the air a few times and flick it across the room to practise my card flicking skills.

That is how useful the card has been for me

I’ve been with you on this Journey all the way, but the reminder that it even existed prompted me to cancel in the hope we can do it all over again in the near future.

“ I distinctly remember pursuing this line of enquiry too, though the conversion was somewhat unfruitful.”

You mean conversation?

indeed. fixed!