Lord Barrington Wealthyhouse The Third, Esq., sighed grandiosely as he wondered when the next opportunity to squander his prodigious wealth would come along.

For you see, Lord Barrington had so much money, he often amused himself by finding the most exquisite ways to relieve himself of it. He tried burning it, shredding it, buying shares in Grab, but no sooner had he done so that more rolled in. He sought to invest in the world’s most foolhardy ventures, such as university degrees that expire and cotton-yielding sheep, but when he woke on the morrow, that big pile of cash was still there, nay, increased.

“Will I ever be unencumbered by these earthly shackles?” he lamented.

On cue, a telegram slid under his door.

He furrowed his unibrow. What was this? A relaunch of the UOB Reserve Card, for those who value exclusivity in it’s most extinguished form?

Lord Barrington was, of course, familiar with the UOB Reserve, having previously failed to secure a Bavarian steamer trunk because he was the 301st cardmember to spend S$150,000 (confound that infernal Lady Wealthierhouse and her 299 vile cousins!) .

While he was less than impressed by their duplicity, he had to admire how the bank continually found new ways of tormenting their customers, and making them dance for its general amusement. After all, he himself had once corralled an entire troop of younglings and forced them to listen to the hapless crooning of Sir Bruno of Mars. There were no survivors.

And so he gazed upon the new-and-improved UOB Reserve, clad as always in brilliant Alpaca Silver (which to Lord Barrington’s great disappointment, was not the result of smelting down alpacas):

UOB Reserve Card UOB Reserve Card |

|||

| Apply | |||

| Income Req. |

S$500K p.a. | Annual Fee |

S$3,888 (with 100K miles) |

| Spending Bonus |

Spend S$250K in a year for 100K bonus miles | Earn Rates |

|

|

|||

His eyes lit up. Why, this might be just the thing!

With a non-waivable annual fee of S$3,888 and a list of benefits more scanty than a pair of Chinese High pantaloons, it would stand to reason that this would be a most excellent way of wasting money.

After all, the perks really were lacklustre.

|

| 🚕 Limousine Transfers and Expedited Immigration |

|

Arrive in style for your dinner dates and staycations, or on your journey to the airport for your upcoming travels with four complimentary limousine transfers per calendar year. Enjoy the convenience and efficiency of fast-track immigration at over 450 international airports with yQ (meet & assist).

|

As Lord Barrington valued the ability to flee the country at short notice in the event of a peasant revolt, limo transfers and fast-track immigration clearance were of paramount importance.

But four complimentary limo transfers and two complimentary fast-track clearances per year? Plebus, his plebeian butler, already enjoyed four of each on his HSBC Visa Infinite (annual fee: S$492.56)!

|

| 🛋️ Airport Lounge Access |

|

Get access to VIP airport lounges worldwide for you and a guest the next time you travel, with Priority Pass™.

Supplementary cardmembers will also be able to apply for unlimited lounge access with Priority Pass. |

While Lord Barrington refused to fly commercial on general principle (if Kylie Jenner could take a private jet to the grocery store, so could he), the idea of a lounge pass intrigued him nonetheless.

The UOB Reserve Card offered an unlimited-visit Priority Pass with one guest for the principal cardholder, and an unlimited-visit Priority Pass sans guests for supplementary cardholders.

And yet, the vassal kingdom of the AMEX Platinum Charge (annual fee: S$1,728) offered its subjects unlimited free visits to Priority Pass, Plaza Premium, American Express and Centurion Lounges plus a guest, even for supplementary cardholders!

|

| 🏌️♂️ Golf Benefit |

|

Perfect your swing at premier golf clubs at home and in Southeast Asia – an exclusive VISA offer.

Limited rounds available and subject to a first-come, first-served basis. |

Like all men of wealth and taste, Lord Barrington enjoyed a good jaunt on the links. Golf was an opportunity to exercise, enjoy nature, and make off-colour passes at his caddy about wanting her “hole in one” and requesting she “fetch his wood”, all while retaining plausible deniability.

But four complimentary golf games? When those feckless Citi Prestige riffraff (annual fee: S$540) enjoyed six free games per year? Preposterous!

|

| 🍽️ Reserve Dining |

|

Skip the waitlist and dine at highly coveted Michelin-starred restaurants in Singapore. Pre-booked tables available for reservations, every Wednesday at the following restaurants:

|

Ever since he failed to secure a seat at The Last Supper, Lord Barrington had a perpetual fear of having to visit a restaurant that — gasp — took walk-ins, where he would no doubt have to “eat ze bugs”.

Guaranteed tables sounded good, until he read the fine print and saw that the Reserve Dining privilege was only available on Wednesdays, and not if said Wednesday was the eve of a public holiday or public holiday, or a special occasion such as Easter Weekend, Mother’s Day, Father’s Day, F1 Weekend and Thanksgiving, which, come to think of it, were probably the days when a guaranteed table would come in the most useful.

Moreover, each booking was limited to two diners per reservation, and had to be prepaid with no refunds, amendments or cancellations permitted. “The only place where you pay before eating is a McBurger Hut!” he fumed (Lord Barrington hadn’t quite grasped the concept of fast food).

|

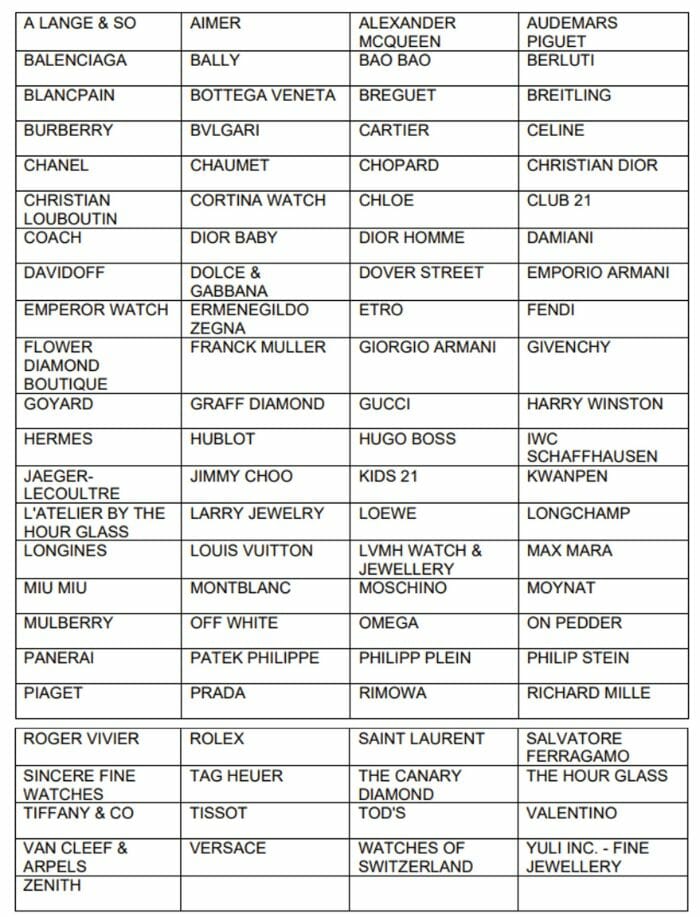

| 💍 2 mpd on Local Luxury |

|

Cardmembers shall be awarded with an additional UNI$1 for every S$5 spent on Local Luxury Card Transactions for each calendar month (“Additional UNI$”); provided always that the Additional UNI$ will only be awarded for the first S$20,000 spent on Local Luxury Card Transactions for each calendar month (“Qualifying Amount”). Each Cardmember is limited to a maximum of Additional UNI$4,000 for each calendar month.

|

Lord Barrington often used Burberry scarves as kindling, so the opportunity to earn 2 miles per dollar on his purchases seemed enticing.

Alas, the bonus miles were capped at 8,000 per month, which meant a mere S$20,000 transaction— roughly what he spent on his daily breakfast at Tiffany’s (diamonds made surprisingly effective colonics)— would max it out.

But wait, there was more! Lord Barrington flipped the telegram and stumbled upon the UOB Reserve Diamond Card, offering an even higher level of extinguishing.

|

|

|

| UOB Reserve | UOB Reserve Diamond | |

| Earn Rate |

|

|

| Points Expiry | 2 years | None |

| Lounge Access | Principal: Unlimited Priority Pass (+1 guest) Supp: Unlimited Priority Pass |

|

| Limo Transfers | 4 per year | |

| Meet & Assist | 2 per year | 8 per year |

| Golf Games | 4 per year | 6 per year |

| Free 2nd Hotel Night | N/A | Once per quarter |

| Meal On Us | N/A | Once per quarter |

| Mandala Club Invite | N/A | Yes |

By spending…

- $1 million a year on the UOB Reserve Card (basically the change behind the fainting couch), or,

- $10 million a year via the UOB Payment Facility (basically the change behind 10 fainting couches; yes, Lord Barrington had 10 fainting couches, what kind of almsman did you take him for?)

…a diamond-embedded UOB Reserve Diamond Card would be his!

As a UOB Reserve Diamond Cardholder, he would enjoy non-expiring UNI$, which sounded great until you realise it meant that UNI$ on the regular UOB Reserve expired after two years (even the serfs had access to credit cards with non-expiring points).

There were other benefits too.

|

| 🏨 Complimentary Second Night Hotel Stay Privilege |

| Each principal Diamond Cardmember will be entitled to one (1) complimentary night per stay per calendar quarter, capped at S$400 per night stay booked with no black-out dates, with every two (2) consecutive nights booked at any hotel worldwide through UOB Travel Planners. |

Having narrowly missed out on Frogmore Cottage, Lord Barrington was searching for alternative accommodation, and the UOB Reserve Diamond Card’s complimentary second night was alluring.

Or was it? He would only enjoy the benefit once per calendar quarter, capped at S$400 per night, with full upfront payment required (and if said stay were changed or cancelled, the benefit night would be forfeited).

Good heavens. Even though the Citi Prestige proletariat were constantly bleating about the degradation of their 4th Night Free benefit, at least that came with no caps on usage, or rebate amounts!

|

| 🏨 Mandala Club Invitation |

| A community that inspires meaningful moments and connections that matter. Be part of the elite private club where UOB is fully funding the associated joining costs, including one year’s subscription to the club community if you are a UOB Reserve Diamond Cardmember. |

Lord Barrington already held memberships in numerous exclusive clubs such as the Knights Templar, the Freemasons, and the Most Grand Exalted Order of People Who Can Hear A Joke And Not Be Offended.

But the Mandala Club was new to him (that’s “Mandala”, not “Mandela”; Barrington Heavy Industries and Amalgamated Plantations wish to reiterate that Lord Barrington has the utmost respect for the life and work of Mr. Mandela, and his remarks at the country club were off the cuff and intended to be private, and in fact some of his best friends are…well, not really, but he once helicoptered over a predominantly minority area en route to repossessing their homes).

Disregarding the wise counsel of Groucho Marx, he looked up the expression of interest form and saw that it required a LinkedIn profile. Unfortunately, Lord Barrington had not been particularly active on the platform ever since he penned his latest thought leadership piece:

|

On the way to a job interview, I saw an injured dog and stopped to help. When I got to the interview, the interviewer was the dog! #alwaysbekind |

He made a mental note to spruce up his account to weapons-grade cringe. After all, he could hardly let this tone-deaf buffoon outdo him, could he?

Having fully perused the telegram, he considered the benefits in their entirety.

| Limo Rides |  UOB Reserve UOB Reserve (S$3,888) |

HSBC VI HSBC VI(S$493) |

| 4 free rides | 4 free rides* | |

| Fast-track Immigration |  UOB Reserve UOB Reserve (S$3,888) |

HSBC VI HSBC VI(S$493) |

| 2 free uses | 4 free uses* | |

| Lounge Access |  UOB Reserve UOB Reserve (S$3,888) |

AMEX Plat. Charge AMEX Plat. Charge(S$1,728) |

| Principal: ∞ + 1 guest Supp: ∞ |

Principal: ∞ + 1 guest Supp: ∞ + 1 guest |

|

| Golf |  UOB Reserve UOB Reserve (S$3,888) |

Citi Prestige Citi Prestige(S$540) |

| 4 free games | 6 free games | |

| Points Expiry |  UOB Reserve UOB Reserve (S$3,888) |

DBS Altitude, Citi PM, OCBC 90°N DBS Altitude, Citi PM, OCBC 90°N(S$194) |

| 2 years | None | |

| Hotel Status |

UOB Reserve UOB Reserve (S$3,888) |

DISCOVERY Titanium status has been practically given away for the past couple of years |

| Pan Pacific DISCOVERY Titanium | ||

| Dining Discounts |  UOB Reserve UOB Reserve (S$3,888) |

Same benefits can be enjoyed by other UOB Visa Infinite cards |

| 15-50% off hotel dining | ||

| *One additional limo ride and expedited clearance can be unlocked by spending S$2K per calendar month, capped at 24 of each per year (including the complimentary entitlements) | ||

Lord Barrington reclined in his chair, adjusted his ruff, and made a sound that approximated deep contentment.

Yes, this was indeed a peerless way of burning S$3,888.

What bad card!

Peerless indeed, just what the Lord calls for in his indulgence of UOB and the forty thieves.

Lord Barrington would have to wait another indefinite number of weeks and meet clueless csos before the $3,888 is charged tho

OMG epic!! This is probably your best article yet. Looking forward to more musings on Lord Barrington’s quest to waste money!

“This is the way.”

I had this card (non diamond) for a year. What this story doesn’t describe is the appalling concierge service offered by UOB / their outsourced partner. I tried to organise something for my wife’s birthday and it was the most dissapointing experience I’ve had with any card, let alone one with this price tag. Even when I escalated matters I received nothing but empty promises. In the end I reverted to my Amex Charge Card to get the job done properly. Birthday benefits are the typical UOB affair with a plethora of terms and conditions. UOB needs to completely overhaul… Read more »

True. I had this card for quite a few years when metal cards were rare. I was told l could get virtually anything via the concierge and it was bad as calling up singtel customer service. I started with something simple like ‘ can i get a birkin in togo and gold hardware’ it took them many calls to even get the request right. Obviously got nothing. Always sweet words no action. They cant even deliver a cake properly. My only joy is watching the cashier asking me if my metal card can be used for paywave and their endless… Read more »

Lol. Thoroughly enjoyed your article, very well written!

actually, if it defrays all costs of joining mandala for 1 year it’s worth the price.

mandala has a joining fee of maybe 4k, plus monthly of around 200 dollars. So that’s almost 7k of value from that 3888 fees

I…suppose! if joining the Mandala club was always on your bucket list (and if you can get your hands on a Reserve Diamond)

I don’t think need to be diamond. Reserve is also eligible.

that’s not what the T&Cs say

just lol

Does UOB ever have a card worth applying for? Sign up offers are often on “First N people to X” which makes it non-guarenteed. And points earning are usually based on $5 spent blocks.

Is the “buy miles at 1.90 cents each” facility still available?

HSBC’s meet and greet list is limited to APAC and Middle East, but at least this sounds like UOB’s might have more options

hilariously written. What a burn. hahaha

What an enjoyable read! Thanks for the article!

Very entertaining read!

I so enjoyed The Milelion “Take It” recommendation to Lord Barrington in his quest to spend & be rid of some wealth. LOL

What is your take on the DBS insignia card? What would you recommend as an alternative to that card… air miles, gym membership and experiences are high on my priority list

Why Barrington, and not Cardington? Or even Cardigan?

I hope that was cathartic.

This read like the sequel to Crazy Rich Asians: Crazy Rich Ang Mohs 😂

Hilarious article !! Super writing!!

Lord Barrington might need to buy himself some antidepressant medicine 💊

Omg! Best ever!

The only card fit for Lord Barrington is one that allows for last minute reservations at Dorsia.

Maybank VI card offers limo ride by spending 3k in prior month.

UOB like Walmart is one of those companies you are better off being a shareholder than a customer.

Excellent article! Bravo, sir!

Lol! Loved the comparison between burning/shredding money and burning grab shares!

The folks over at UOB must be buying fire extinguishers by the truckload. Such is the burn.

tish. you poor people will never understand rich people love bad deals just to let others know we’re rich. I’m going back to eat my sushi with my US$2K monogram chopsticks.

i see your 2k monogram chopsticks and raise you my 50k jewel encrusted fondue stick

L for Lame.

Your funniest article yet hahahaha

hey aaron i believe even the normal uob reserve card (not just diamond), is eligible for the mandala club invitation. For both cards, the one-time application fee is waived. Only difference is they pay the 1st year monthly sub for you too for the diamond reserve. I’d think this should be a game changer given the mandala club’s application fee?