As you may have noticed by now, I cover quite a few credit card offers on this site (plot twist!), and each of these comes with their own eligibility criteria, qualifying spend, exclusions and other terms and conditions.

While I go through the details in the respective posts, there’s nothing more frustrating than to write “X”, only to have someone write in the comments or on Telegram “but the CSO said not-X”.

At this juncture, I heave a genial sigh and wonder:

- Is it the CSO’s fault for communicating the wrong info?

- Is it the product manager’s fault for not properly briefing the CSOs?

- Is it the reader’s fault for being so insecure? (I already wrote it in black and white, call CSO for what!)

- Is it my fault for not providing the requisite assurance? (I have checked this information with all relevant authorities and if it doesn’t work you can parade me naked through the town square while the villagers hurl excrement and shout “shame!”)

Still, the apprehension is understandable. At the end of the day, the CSO is an official bank representative, and I’m just some basement-dweller with a website. If things go pear-shaped, you can’t exactly say “but I read on a blog…”

Unfortunately, what CSOs say isn’t always gospel truth!

When CSOs get things wrong

Let me start by saying that I don’t envy CSOs. They have a difficult job, bearing the brunt of complaints from customers who may or may not be on their best behaviour. When they get things right, no one remembers their name. When they get things wrong, you can bet everyone will. It’s not a job I’d want to have.

That said, CSOs sometimes provide information that is flat-out inaccurate. To illustrate, I’ll share a handful of commonly-asked questions, what CSOs have said, and the correct answer (direct from the product team themselves, who I have access to through my work).

| ❓ Who is eligible for the Citi Prestige 71,000 miles welcome offer? | |

| CSO says | This offer is not available to existing Citi credit cardholders |

| Correct answer | This offer is available to anyone who has not cancelled a Citi Prestige Card in the past 12 months |

| ❓ Does CardUp count towards the SC Journey Card 45,000 miles welcome offer? | |

| CSO says | CardUp spending does not count towards qualifying spend for the StanChart Journey Card sign-up offer |

| Correct answer | CardUp spending counts towards qualifying spend for the StanChart Journey Card sign-up offer |

| This particular answer was obtained by the CardUp team, who confirmed it with the SC Journey product manager | |

| ❓ Can SingSaver gifts be stacked with SC welcome offers? | |

| CSO says | SingSaver gifts cannot be stacked with StanChart welcome offers |

| Correct answer | SingSaver gifts can be stacked with StanChart welcome offers (when both are featured on the SingSaver site) |

| ❓ Is there a timeout period to be considered new-to-AMEX? | |

| CSO says | Customers with recently-cancelled cards must wait six months before they count as new-to-AMEX |

| Correct answer | There is no timeout period for customers with recently cancelled cards to be considered new-to-AMEX |

There’s probably more cases like this, but you get my point.

Why CSOs provide wrong answers

How do CSOs, who in theory should have access to the most accurate information, still get things wrong?

There’s several reasons I can think of.

CSOs are not product managers

The crux of the problem is that CSOs are not product managers. No matter what they say, they’re ultimately not the ones who decide whether or not your get your bonus points or sign-up gift. Those decisions are made by the product manager, and unless the CSO is directly communicating with him/her (which they sometimes will), their words have to be taken with a pinch of salt.

This then begs the question: in cases where the CSO provides you with inaccurate information, can you hold the bank to what the CSO said?

It depends. I know of instances where banks, after investigating, have agreed to make good on the CSO’s words. But I also know of other instances where you get nothing more than a boilerplate response to the tune of “oh sorry, we’ll make sure our team receives the relevant training, have an excellent day bye!”

And even if the bank does honour the CSO’s words, it’ll still take a lot of back and forth to get the matter settled. That’s time which could be spent on other productive pursuits, like arguing on the internet.

CSOs are reading the same T&Cs you are

Some people have the impression that CSOs have access to a magic computer where they type in a query and a 100% reliable answer pops up.

Sorry, but no. While some product managers may have circulated a list of FAQs to the call centre, most of the time the CSOs are reading the exact same T&Cs that you are, and offering their own interpretation.

Here’s an example. Let’s say you’re interested in the 45,000 miles welcome offer for the StanChart Journey Card, and want to know whether CardUp payments count towards the S$3,000 minimum spend.

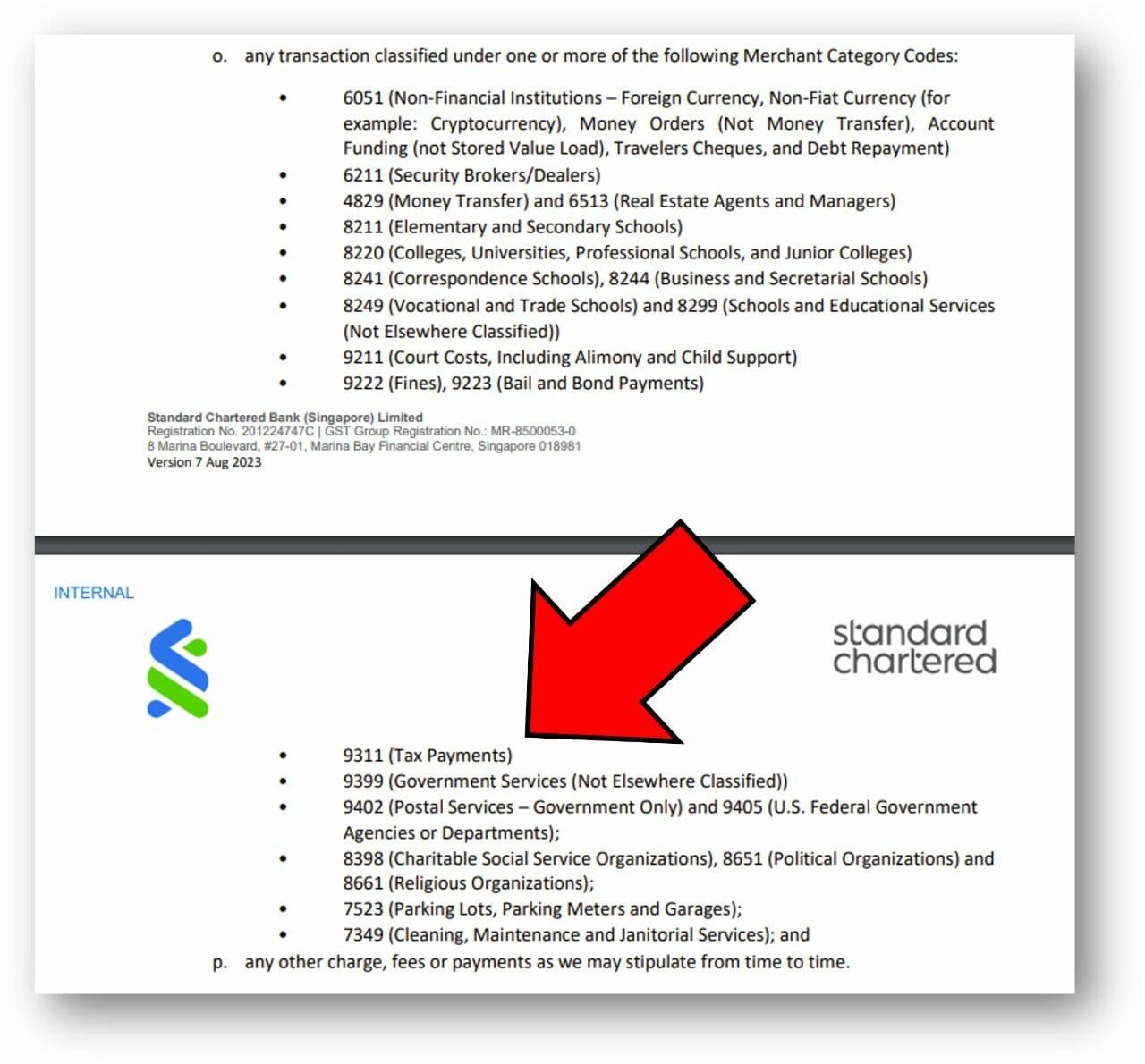

So you call up and ask “do CardUp income tax payments count towards minimum spend?” What may happen is that the CSO pulls up the T&Cs, scans the list and looks for the words “income tax”. And when they spot it, they’ll tell you “no, this will not count”.

But CardUp income tax payments don’t code as MCC 9311. They code as MCC 7399, which will earn points and count towards minimum spend for StanChart cards. In fact, I’m not even sure whether MCC 9311 is used in Singapore, since IRAS doesn’t accept credit card payments. Odds are, the CSO doesn’t even know what CardUp is, but once you mention a trigger word like taxes, you can bet they’ll tell you it doesn’t count.

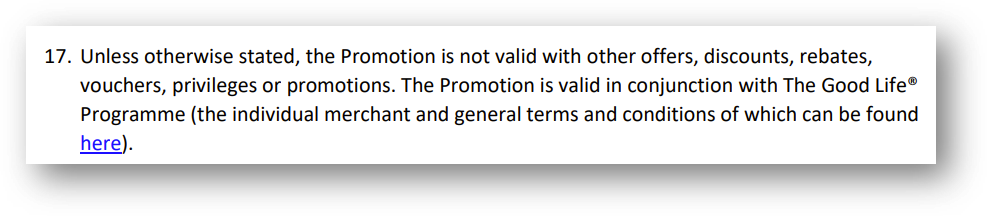

Or as another example, suppose you want to find out whether SingSaver gifts stack with Standard Chartered’s welcome offers. The CSO consults the T&Cs again, and tell you “no” after spotting this line.

But again, that’s not what this clause is intended to mean. This clause is here to avoid a situation where the bank is running several concurrent offers, and a cardholder tries to claim he/she is entitled to all of them (e.g. MGM + targeted offer + public offer). It has nothing to do with gifts offered to applicants via a third-party platform like SingSaver.

| ❓ How to know if an offer stacks? |

|

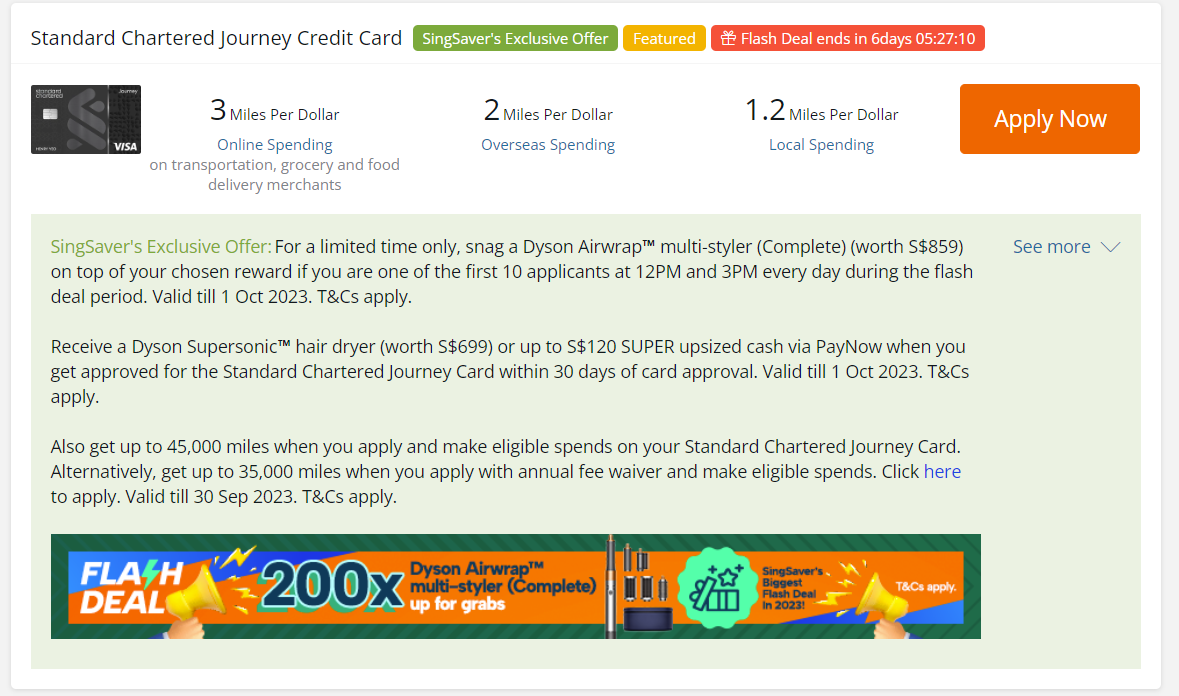

There are situations where the SingSaver offer replaces the bank’s welcome offer. How to tell whether the offers stack is to look at the listing on SingSaver’s website. For example, in this listing below for the SC Journey Card, both the SingSaver offer (Dyson gifts, S$120 cash etc.) and Standard Chartered offer (45,000 miles) are mentioned. This means you can enjoy both.

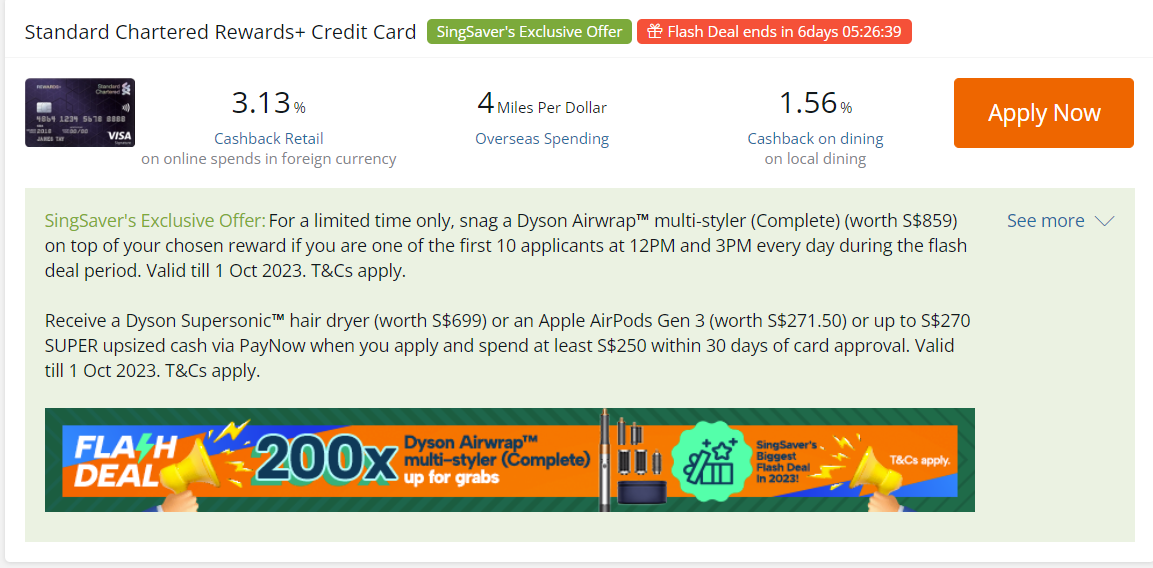

For the SC Rewards+ Card, only SingSaver’s offer is mentioned (Dyson gifts, AirPods, S$270 cash). Standard Chartered’s regular gift of S$200 cashback is not mentioned. In this case, the offers will not stack.

In any case, if the SingSaver offers stack with the bank’s offer I do make it a point to mention it in the relevant articles. |

To be fair, the often-vague wording of T&Cs doesn’t help. I’ve even heard cases of Citi CSOs telling customers that Citi’s own PayAll service won’t count towards qualifying spend, since the T&Cs exclude “bill payments made using the Eligible Card as a source of funds”!

CSOs may err on the side of caution

When in doubt, some CSOs would prefer to err on the side of caution and tell the customer that a transaction does not count towards qualifying spend, or that the customer is not eligible for an offer.

I suppose the thinking is that it’s much worse for a customer to spend on X and find out later that X doesn’t count, than for them not to make that transaction in the first place (or rely on other “safer” transactions to make up the qualifying spend).

Still, I can imagine there’d be some customers who would be unhappy about missing out on a good deal because they were misinformed as to their eligibility.

CSOs may not have received the proper training

The unfortunate reality is that CSOs may not receive the kind of training they need to carry out their jobs.

In fact, it’s not uncommon (especially amongst the hardcore users) to find yourself in a situation where you know the product better than the CSO- because you have much more interest in it than they do.

Among all the banks I’ve dealt with, Citi is probably the worst offender, so much so that “as reliable as a Citi CSO” has become something of a byword among the community. Customers have been told all manner of inaccurate information, like the Citi Rewards Card only earns 10X points on bags, shoes and clothes (no), like Citi Prestige limo rides must be used in the same quarter the minimum spend is made (no), like Citi Prestige lounge access is limited to two visits per year (no).

Again, most experienced miles chasers will know they should adopt an attitude of healthy scepticism towards anything a Citi CSO says. But a newcomer to the miles game would have every right to expect the call centre to dispense accurate information.

What you can do to protect yourself

Since CSOs can and do make mistakes, the best thing you can do to protect yourself is to get all replies in writing. That’s why it’s sometimes better to use the secured mail or live chat feature, where available, over calling in.

Now, this obviously won’t help you in a situation where the CSO says that something wouldn’t count or that you’re not eligible for a promotion (to the extent that you end up not spending/participating), but might in a situation where the CSO says that something will count or that you are eligible for a promotion (and it turns out it doesn’t/you aren’t).

Conclusion

CSOs have a tough job, and make mistakes from time to time just like everyone else.

It’s of course frustrating for customers who miss out on welcome offers or make decisions based on misinformation, but unless the banks are willing to invest the time and money in training, or draft T&Cs with less room for ambiguity, that’s just the way it’s going to be.

For my part, I’m obviously not an official source, but I do communicate with people who are. What I can do (and already do) is that whenever I’ve confirmed something with the product team, I’ll make it a point to mention that explicitly.

And if someone still writes “but the CSO said”, I may or may not edit your username to suggest you have a romantic inclination towards farm animals.

“There is no timeout period for customers with recently cancelled cards to be considered new-to-AMEX” -> I didn’t know this!

#metoo

recently been very frustrated with CSOs from UOB… hate it when im told I’ll get a call back to update me on something, but the call back never comes. I’d rather be told upfront that there will be no call back.

Same here, UOB said will call back to update, but did not receive any call. I had to call again, CSO will arrange call back within 24 hour, another disappointment with no call back received.

E-mail sent, you will receive auto reply. 2 weeks later they will only respond forward to respective personnel for further check. Again, no update.

Has been like this for a year now. Promised to call but you will never receive it. Unless it’s sales related and they need to close it.

Uob has the worse customer service… only if it’s in regard for you to take up a loan they will call you every 1hr…. otherwise forget it. Same with email. The only way is to personally go to the bank

Same here…. Calling UOB doesn’t work… try to online chat function, at least that’s how I got a couple of issues resolved with them

For issues that needs follow up, they will schedule a callback for you. Only for you to wait and wait for that callback that never comes

UOB has an amazing customer service, they make so many mistakes and give you wrong info that you can then use against them in your benefit. and if they don’t want to honor the mistakes they made, lodge a report with MAS (very easy) and rest assured things are being handled very efficient afterwards 🙂

Shame.

Hi Aaron

this article is so true! I applied for a CC on Moneysmart and was told its financial partner says I’m not eligible for the gift cos I did not do min spend. Called the bank to verify, CSO says it is true, so I whipped out the T&Cs and went through the sections with them. Turns out they made a mistake and I finally got my gift!

*Won’t say which bank for fear of POFMA LOL

Bad information I can live with but when a CSO provides bad information and seems so pleased with themselves as to why their bad information means “no bonus for you” that really gets up my nose. I’ve only encountered this twice in the past 10 years but both times it left a really bad taste – so much so I no longer deal with one of the banks in question.

I have checked with Citibank on the PremierMiles Amex Card if the fee is more than the PremierMiles Visa Card. She told me it was the same. In the end, I ended paying more. I did complained and they gave me some gift, which was less than the offset. However, my guess was that the manager did not want to escalate it up and I am not the sort of person who wanted to make everyone feels miserable. So I left it at.

So I can sign up for the 340 PayNow MoneySmart offer with the SC SimplyCash and then also get $500 from SC’s acquisition offer?

i can’t speak for moneysmart, but maybe some additional clarification is needed. whatever offers the singsaver site shows, you get. so if singsaver site mentions both SC’s offer and its own offer, you can count on both. if it only mentions singsaver offer, that’s what you get

Sorry if this is a silly question. If I apply for 2 credit cards at the same time from the same bank, am I considered new-to-bank customer for both? So I’m entitled to sign up offers (free miles for 1 card and cashback for the other card) for both cards?