Citi PayAll has launched a new promotion that offers 1.8 mpd on all payments set up by 29 February 2024. With the admin fee of 2.2%, this works out to 1.22 cents per mile.

This isn’t quite as generous as the 2.2 mpd offer that ran from April to August 2023, but is still a great price to buy miles at, assuming you have a supported bill payment coming up.

|

| Citi PayAll 1.8 mpd Promo |

This is a public offer that applies to all Citi PayAll payments: income tax, rent, insurance premiums, MCST fees, education expenses, utilities bills, miscellaneous invoices, or even friends and family for “services rendered”.

If you’re new to Citi PayAll, be sure to refer to my comprehensive guide below.

Earn 1.8 mpd on Citi PayAll transactions

From 18 October 2023 to 29 February 2024, Citi cardholders will earn a flat 1.8 mpd on Citi PayAll transactions, subject to a minimum aggregate spend of S$8,000 and a cap of S$120,000.

The following cards are eligible:

| Card | Earn Rate | Cost Per Mile (@ 2.2% fee) |

Citi ULTIMA Citi ULTIMA |

1.8 mpd (Base: 1.6 mpd Bonus: 0.2 mpd) |

1.22 cents |

Citi Prestige Citi Prestige |

1.8 mpd (Base: 1.3 mpd Bonus: 0.5 mpd) |

1.22 cents |

Citi PremierMiles Citi PremierMiles |

1.8 mpd (Base: 1.2 mpd Bonus: 0.6 mpd) |

1.22 cents |

Citi Rewards Citi Rewards |

1.8 mpd (Base: 0.4 mpd Bonus: 1.4 mpd) |

1.22 cents |

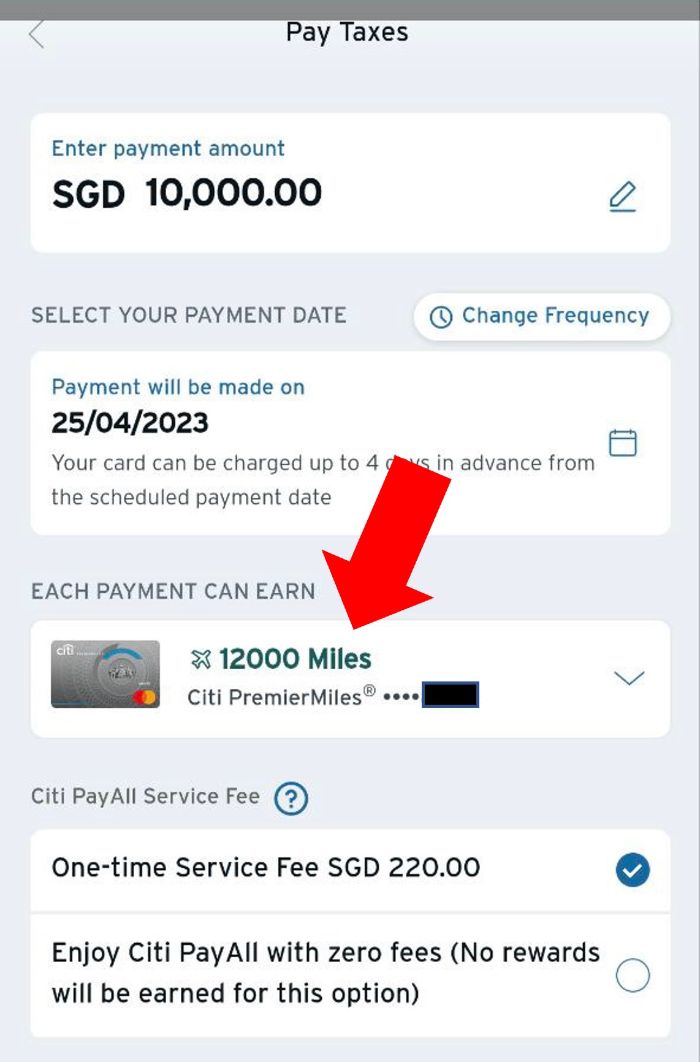

| ⚠️ Citi app shows regular rates! |

|

Be advised that the Citi Mobile App (where Citi PayAll payments are set up) shows the regular earn rates by default. For example, it tells me a S$10,000 payment on my Citi PremierMiles Card will earn 12,000 miles (based on 1.2 mpd), when in fact it should be 18,000 miles (based on 1.8 mpd). You’ll just have to take it on faith that the bonus miles will show up later. |

To illustrate how this works, someone who spends S$10,000 on the Citi PremierMiles Card (or any of the above cards for that matter) would earn 18,000 miles (S$10,000* 1.8 mpd), and pay an admin fee of S$220 (2.2% of S$10,000). The cost per mile is therefore 220/18,000 = 1.22 cents each.

A few important points to note:

- the payment setup date must be on or before 29 February 2024, 11.59 p.m SGT

- the payment charge date must be on or before 6 March 2024, 11.59 p.m SGT

- the S$8,000 need not be in a single transaction; it can be combined across multiple payments on a single card that fall within the promotion period

- the aggregate bonus points or miles earned is capped at S$120,000 on only one eligible card

Since the base earn rate differs for each card, the maximum bonus you can earn per card differs. Don’t get confused though- the overall earn rate for all cards is the same at 1.8 mpd.

Also note that if you spend on multiple cards, only the card with the highest accumulated spend will earn bonus points. In other words: stick to a single card! No matter how many Citi cards you have, the maximum bonus you can earn is capped at S$120,000 on a single card.

Finally, remember that if you already have an existing recurring payment in place before 18 October 2023, you will need to cancel it and set it up again to benefit from this promotion.

New customers: Get S$50 eCapitaVoucher

If you haven’t made a Citi PayAll transaction in the 24-month period preceding 18 October 2023, you’ll receive a S$50 eCapitaVoucher when you make at least S$8,000 of Citi PayAll transactions by 29 February 2024.

For avoidance of doubt, this promotion stacks with the 1.8 mpd offer mentioned above.

When will the bonuses arrive?

Cardholders will receive their regular base rewards when the Citi PayAll transaction initially posts. The bonus component will be credited within 16 weeks from the end of the promotion period, i.e. by 20 June 2024.

| Card | Base | Bonus |

Citi ULTIMA Citi ULTIMA |

1.6 mpd | 0.2 mpd |

Citi Prestige Citi Prestige |

1.3 mpd |

0.5 mpd |

Citi PremierMiles Citi PremierMiles |

1.2 mpd |

0.6 mpd |

Citi Rewards Citi Rewards |

0.4 mpd |

1.4 mpd |

The S$50 eCapitaVoucher voucher will be credited according to the same timeline, i.e. by 20 June 2024.

Terms and Conditions

The T&Cs for this promotion can be found here.

Citi PayAll transactions count towards min. spend requirements

Citibank has confirmed that Citi PayAll transactions will count towards the minimum spend required for card-related benefits, provided the service fee is paid.

This means that you could use your Citi PayAll transaction to meet:

- The S$12,000 quarterly spend required to unlock 2x limo rides with the Citi Prestige

- The minimum spend required to earn the welcome bonuses for the Citi Rewards, Citi PremierMiles and Citi Prestige

What payments does Citi PayAll support?

Here’s a reminder of the full list of payments that Citi PayAll currently supports:

| 💰 Citi PayAll: Supported Payments | |

|

|

Some categories are rather nebulously defined, which means it really isn’t difficult to find something to pay.

Just remember, however, that Citi PayAll T&Cs explicitly prohibit you from sending money to yourself, or using it as a cash advance facility. In other words, whatever payment you make must have some underlying economic substance.

|

|

10.1 When accessing and using the Service, you must comply with any prescribed verification procedures, or other procedures, directions and instructions communicated by us to you. Further, you hereby represent and warrant that you shall not, in connection with your use of the Service: (b) send money to yourself or recipients who have not provided you with goods or services (unless expressly allowed by us); (c) provide yourself or any other party a cash advance from your card (or help other parties to do so); |

Is it worth it?

While it isn’t as good as the previous PayAll promotion, buying miles at 1.22 cents each would be a good deal for most people.

Don’t forget that in addition to KrisFlyer, Citi Miles and ThankYou points can be converted to 10 other frequent flyer programmes and one hotel programme, with a S$27 conversion fee.

| Frequent Flyer Programme |

Conversion Ratio (Citi: Partner) |

|

| Citi Miles | TY Points | |

|

1:1 | 2.5:1 |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

|

1:1 | 2.5:1 |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

|

1:1 | 2.5:1 |

| 1:1 | 2.5:1 | |

| All conversions in blocks of 10,000 partner miles/points |

||

Conclusion

Citibank has launched a new Citi PayAll promotion that offers a 1.8 mpd earn rate with a 2.2% admin fee. This represents a cost of 1.22 cents per mile, and is certainly worth considering if you’re able to meet the S$8,000 minimum spend.

If you haven’t made a Citi PayAll transaction in the past 24 months, then you can sweeten the deal further with a S$50 eCapitaVoucher as well.

Do note that the bonus miles will only arrive in June 2024, however, so don’t expect to use them for a year-end getaway!

Why does PayAll not allow me to set up recurring income tax payments (possible for rent)?

Can I use my wife’s prestige card to pay for my income tax and qualify for free limo and get $50 vouchers as she’s a first timer?

Yes

The citipayall promotion is getting worse with each iteration…was 2.5miles(?), Then 2.2..and now 1.8…;(

mai hiam buay pai

Fee goes up (2.0% -> 2.2%) and bonus goes down (2.5 -> 1.8). At one time Payall was a bit of a bargain – no longer.

I’ve set recurring payments since the previous promo. Do I get this promo rate with my recurring payments or I need cancel them and re-setup the payments again?

I have same question, I set up 12 month payment from previous promotion period, which will end in July/Aug respectively next year. I presume if I will continue to get benefit under the previous scheme?

Hi.. does anyone know if the promo rate of 1.8 mile per dollar apply to future monthly payments set up during the promo period ie: prior 29 Feb 24. Thanks

Was checking SIN-PER SQ economy prices for 2A2C.

$3600 or $520 + 296000 miles.

This translate to around $0.0104/mile.

But I have to buy $0.0122/mile. Don’t seems right.

Am I missing something here?

SQ Economy Advantage is never worth it. Saver is barely worth it. Only when you have specific dates and the cash fare is ridiculous does redeeming Economy Saver make any sense (like you need to go one way).

Does it means we should redeem for business or first class to be worthwhile?

Yes. That’s what miles are mainly for.

Economy Advantage is worth it only if you are booking a flight date very close to your booking date. Those are very expensive, cash-wise. I doubt you can find economy saver by then unless it is a very unpopular date/location but even economy advantage can be somewhat economic.

Someone remind me: the previous PayAll due ended August 2023, those additional bonus miles has NOT been credited to our accounts yet right?

IIRC the T&Cs gave them up to December 2023 to credit it but have not went to do a detailed search on my Citi points.

Not yet. Should arrive before mid Dec.

Hi, I wanted to ask the experts here if they tried using Citi payall to pay for road tax? I noticed that there is an Other Taxes category for Tax payments.

Thanks