Here’s a protip: if you ever receive an unexpected credit on your card statement called “Mccashback”, it’s not from McDonald’s. Rather, it’s Mastercard Travel Rewards, something I myself was ignorant of until recently.

Mastercard Travel Rewards allows Mastercard credit and debit cardholders to earn bonus cashback when they spend at participating merchants, on top of whatever usual rewards their card gives.

Some offers require registration, but others are entirely passive- which means that swiping your Mastercard might lead to a pleasant surprise down the road!

Overview: Mastercard Travel Rewards

|

| Mastercard Travel Rewards |

Mastercard Travel Rewards gives cardholders extra cashback when they spend at participating merchants.

There are three types of offers:

- Ready to Use Offer: Offers can be enjoyed without any additional action

- Add to Card Offer: You must click “add to card” prior to purchase for the offer to be valid

- Click to Use Offer: Offer can be accessed by clicking on merchant’s store link through the Mastercard Travel Rewards site

(1) is a complete no-brainer, requiring no action from you (not even registration on the Mastercard Travel Rewards portal) other than to swipe your Mastercard.

(2) requires you to create an account on the Mastercard Travel Rewards portal, link your card, then register for a specific offer (just like AMEX Offers).

(3) is similar to ShopBack, with the added advantage of cashback being credited directly to your card (instead of having to accumulate a minimum amount to cash out).

Offers can be filtered by country, so you can quickly see what’s available for the next destination you’re headed to.

Some offers that caught my eye include:

- JPY 200 cashback for topping up your Suica with at least JPY 3,000 via Apple Pay

- JPY 875 cashback for spending at least JPY 17,500 at BicCamera

- JPY 1,000 cashback for spending at least JPY 10,000 at Don Quijote

- US$30 cashback for spending at least US$150 with Avis in the USA

- US$30 cashback for spending at least US$150 with Hilton in the USA

- IDR 1 million cashback for spending at least IDR 15 million at Andaz Bali

- IDR 1 million cashback for spending at least IDR 15 million at Hyatt Regency Bali

- THB 1,000 cashback for spending at least THB 10,000 at JW Marriott Hotel Bangkok

Offers are revised every quarter and there’s plenty more to choose from, so do take some time to browse the website.

Despite the name of the programme, there’s nothing stopping you from earning cashback on purchases in your home country with Mastercard Travel Rewards, provided all the other eligibility criteria are met.

Registering for an account

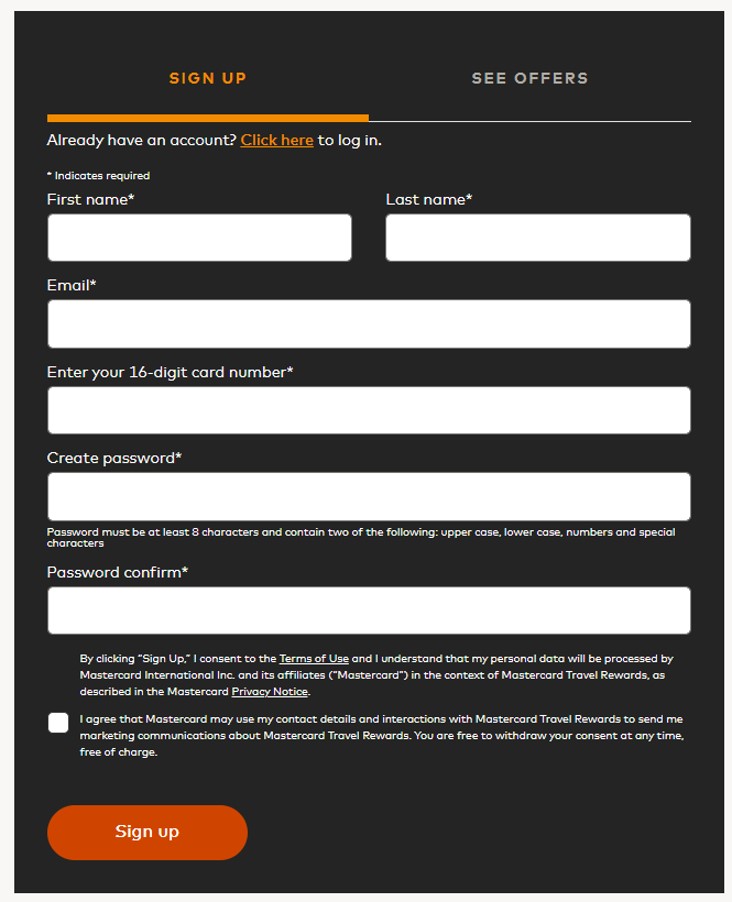

To add offers or track existing cashback, you’ll need to create an account and provide your 16-digit card number at the time of registration.

Now, here’s the slightly annoying thing. While you can add up to five Mastercards per account, they must all be from the same issuer.

For example, if you add a UOB Lady’s Card as your first card during registration, you can add a UOB PRVI Miles Card as your second, but not an Amaze Card. So you basically need to create one account per card issuer.

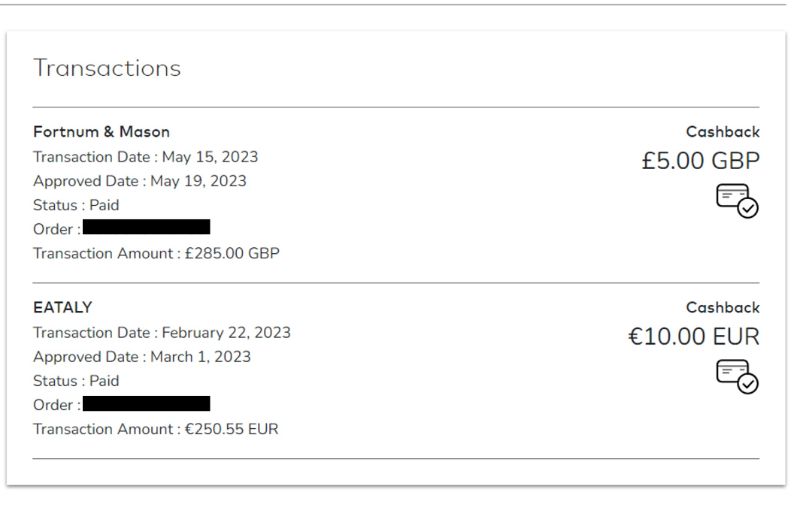

That’s a pain, but once you do you’ll be able to track your cashback online via the Account Summary section. I was pleasantly surprised to see that I’d earned some cashback from Ready to Use Offers I wasn’t even aware of at the time.

You’ll also be able to register for Add to Card Offers with just one click. If you have multiple Mastercards on your account, remember that you’ll need to register each card separately.

There is no limit on the number of offers you can activate at one time, so go crazy.

How long does cashback take to credit?

Cashback from Ready to Use or Add to Card Offers typically take up to 30 days to be processed.

In reality it appears to be much faster. Based on what I can see in my account, one of my transactions was processed in just four days, while the other took a week.

What Mastercard should I be using overseas?

I typically default to using Amaze for most of my overseas transactions, swapping out the linked card as necessary. This allows me to earn up to 6 mpd on my overseas spend, with an implicit FCY fee of about 2% over Mastercard rates.

For a rundown of the best cards to use for different types of overseas spending, refer to the post below.

Conclusion

Mastercard Travel Rewards is a cool little feature that can earn you some extra cashback on top of your credit card rewards. Even better, you might have already earned some without knowing, since some offers don’t need registration.

I’d highly recommend creating an account and registering your cards for additional offers depending on where you’re heading. Offers run by calendar quarter, so if your trip straddles a quarter be sure to re-register if necessary.

Any other Mastercard Travel Reward offers worth noting?

This does not work for my Citi premiermiles mastercard. When I tried to sign up it says “The card number you provided has been entered incorrectly or is not eligible for this program. Please try again or contact the bank that issued your Mastercard to inquire about eligibility.”

yeah i had issues with my citi cards too. dbs, uob, amaze all tested and ok.

Same issue with all my Citi cards

Does not work with OCBC TR cards too.

was browsing thru the offers for japan,

most of the spendings require to be in JPY,

assuming if it is Amaze, then it wouldnt be valid right, since it converts to SGD?

It will work for amaze because your transaction is still in fcy. Amaze bills you card in sgd

Hi Aaron, would you suggest to register with Amaze mastercard instead of bank credit card?

Hi Aaron,

If I use my Amaze card which is pointing to my UOB Ladies card. The rebate will come back to the Amaze card or the UOB Ladies card?

it will go to amaze, and then to whichever card you have linked at the time

Thanks 👍

Hello, I have two questions that I would appreciate your help with:

Thanks 😀

hihi, i recently had a reissued WWMC due to fraud, and this new card cannot be registered, anyone managed to successfully register a DBS card recently?

Just tried:

Citi prestige, Citi rewards, Amaze, Maribank Credit Card, all says not eligible.

HSBC TravelOne works.