The Maybank Horizon Visa Signature has been reborn, and while this card has been on the periphery for many years, there’s a few things well worth getting excited about now.

I’ve already written about the limited-time 3.2 mpd earn rate for new and existing Maybank Horizon Visa Signature Cardholders on:

- air tickets (capped at S$10K per month)

- FCY transactions (uncapped, including charitable donations, education, insurance, private hospitals, and utilities!)

In this post, I’ll cover a rather lucrative acquisition offer for new-to-bank customers; lucrative perhaps not in terms of sheer quantum, but rather in terms of how straightforward the minimum spend requirement is to hit.

|

||

| Apply Here | ||

| 🎁 SingSaver Gift | & | 🎁 Maybank Gift (pick one) |

|

|

|

| ❓ Definition: New-to-bank | ||

|

New-to-bank customers are defined as those who:

|

||

SingSaver gift

|

| Apply Here |

From now to 20 December 2023, new-to-bank customers who apply for a Maybank Horizon Visa Signature Card (with approval by 31 January 2024) will receive S$60 cash from SingSaver, as well as a chance to win additional lucky draw prizes in the ongoing 101 Milestone Giveaway.

And if you happen to find a higher offer elsewhere, SingSaver’s Best Deal Guarantee programme will reward you with at least 2X the difference in Grab vouchers, capped at S$300.

Application steps

- Apply via the links in this article

- Note down the application reference number at the end of your submission

- Complete the SingSaver Rewards Redemption Form that is sent to your email, within the first 14 days of application. Ensure that the name, mobile number and email address submitted to SingSaver are the same as that used in the credit card application

No minimum spend is required to receive this gift.

Maybank gift

From now till 31 December 2023, new-to-bank customers who apply for a Maybank Horizon Visa Signature Card will have a choice of one of the following gifts:

- 2x American Tourister Linex 66/24 Luggage (worth S$336)

- Apple AirPods (3rd Gen) with Lightning Charging Case (worth S$261.40)

- S$200 cash credit

- 10,000 KrisFlyer miles (in the form of 25,000 TREATS points)

You need not select your gift at the time of application; rather, you’ll select it at the time of fulfillment.

Cardholders must spend a minimum of S$600 per month for the first two consecutive months after approval. For example, if your card is approved on 15 November 2023, your spend periods are:

- Spend Period 1: 15 November 2023 to 14 December 2023

- Spend Period 2: 15 December 2023 to 14 January 2024

It may sound almost blasphemous, but my recommendation is not to take the miles. 10,000 KrisFlyer miles are worth around S$150 (based on my valuation of 1.5 cents per mile), so the S$200 cash credit feels more enticing to me. Of course, if you fancy a pair of AirPods or luggage, those two would be much better deals than the miles as well.

Per clause 4(a) of the T&Cs, you also need to apply for a CreditAble account to be eligible for the gift. However, there is no need to charge anything to this facility if you don’t wish to.

If you’re approved for the Maybank Horizon Visa Signature but rejected (or forget to apply) for the CreditAble account, you can still qualify provided you spend S$650 per month for the first two consecutive months.

Qualifying spend is extremely broad!

Now, here’s the beautiful thing: Maybank’s exclusion list is very forgiving.

Exclusion List

- NETS and eNETS transactions;

- Payments made to government or government‐related institutions and services (court cases, fines, bail and bonds, tax payment, postal services, parking lots and garages, intra‐government purchases and any other government services not classified here);

- Betting or gambling transactions;

- Brokerage/securities transactions;

- Transactions classified under the following Merchant Category Codes (“MCC”):

- MCC 6012 – Financial Institutions – Merchandise, Services and Debt Repayment

- MCC 6051 – Non‐Financial Institutions – Foreign Currency, Non‐ Fiat Currency (including but not limited to Cryptocurrency), Money Orders, Account Funding, Travelers Cheques, and Debt Repayment

- MCC 6540 – Non‐Financial Institutions – Stored Value Card Purchase/Load (including by not limited to Grab mobile wallet top‐ups)

- Transactions made via AXS or SAM;

- FlexiCash, FlexiPay, 0% Interest Instalment Plans, funds transfers, cash advances, finance charges, late payment charges, annual fees, reversals, interest charges, or any other miscellaneous charges charged to the Applicant;

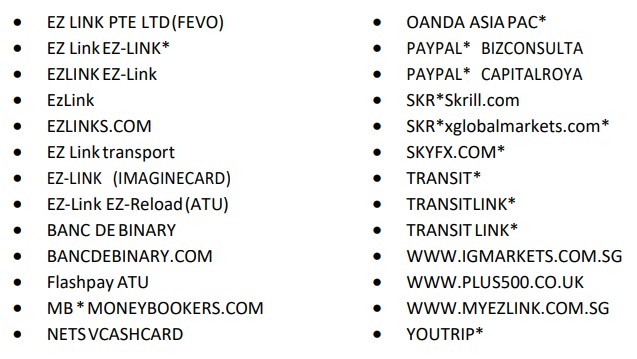

- Payment of funds to prepaid accounts such as those listed below (such list is not exhaustive and Maybank reserves the right to amend the list from time to time without giving prior notice or reason to any party)

- Any transaction deemed by Maybank at its sole discretion to be of a business and/or corporate nature; and

- Any other transaction which Maybank may reasonably determine to be unsuitable to, or

should not, be counted towards the Minimum Spend

Notice the absence of charitable donations, education, insurance premiums, hospitals, and utilities. These are usually excluded by other banks, but will count towards the minimum spend for this offer (a fact I’ve confirmed with a Maybank spokesperson).

So, you could clock the S$600 per month entirely on these categories, incurring very little opportunity cost in the process.

| SGD | FCY* | |

| Charitable donations | 0.4 mpd | 3.2 mpd |

| Education | 0.24 mpd | 3.2 mpd |

| Insurance Premiums | 0.24 mpd | 3.2 mpd |

| Private Hospitals | 0.24 mpd | 3.2 mpd |

| Utilities | 0.24 mpd | 3.2 mpd |

| *With min. S$800 spend per calendar month |

||

If these are charged in SGD, you’ll earn a rather underwhelming rate of 0.24 mpd on insurance, medical, education and utilities (donations still seems to be 0.4 mpd), but:

(1) that’s still better than most other options, and

(2) the miles aren’t really the point here

And if you can charge these in FCY, even better- you’ll earn 3.2 mpd, subject to meeting a minimum spend of S$800 per month.

Gift Fulfilment

SingSaver gift

The S$60 cash gift will be fulfilled within four calendar months of approval, via PayNow.

Maybank gift

Maybank’s T&Cs do not state a fulfillment timeline, but a spokesperson confirmed that the gift will be fulfilled within five business days after meeting the minimum spending requirement. That’s surprisingly fast actually, so much so I’m a little suspicious, but in any case I’ve already applied and will report back on my experience.

Cardmembers will need to download the TREATS SG application to select their preferred gift. A push notification will be sent when the gift is available for selection.

Terms & Conditions

Conclusion

The Maybank Horizon Visa Signature Card is now offering a welcome gift of S$60 cash + S$200 cashback, Apple AirPods, American Tourister luggage or 10,000 KrisFlyer miles for new-to-bank cardholders.

The minimum spend of S$600 per month for two months should be simple enough to hit, since you can clock it via donations, education, insurance premiums, hospital bills, or utilities- categories that are often excluded by other banks.

If nothing else, you could see this as a S$260 rebate of S$1,200 of spending that is normally ineligible for rewards.

The new to bank definition is strange and not quite what you described. It is:

not currently holding any principal card or creditable account; and

did not cancel any card or creditable account prior to the start of the PROMOTION (which was in May 2023).

Which means if you cancelled last month you technically qualify. I know it doesn’t make sense but that’s what the T&Cs say.

yeah that is weird. will check with maybank and see what they say. i’m using the SS definition in the interim.

The application form doesnt work for foreignors

Hi Aaron, what do you mean by “No minimum spend is required to receive this gift. “, but the section after, you mentioned we still need to spend $650 ?

Singsaver cash needs no min spend. Maybank gift needs min spend

Insurance doesn’t take direct credit card payments. Does CardUp/ipaymy qualify?

Hi Kyle, did you find the answer? I have the same question too.