If you’ve been shopping and eating out lately, or buying stuff online, you may have noticed more ShopBack Pay and PayLater standees and icons as ShopBack makes an aggressive push for the offline and online payments space.

There’s often some confusion between these two options, as well as the best card to use with each. Here’s a high-level summary of the differences.

|

||

| ShopBack Pay | ShopBack PayLater | |

| Availability | In stores & Online | In stores & Online |

| Processing | Online | Online^ |

| MCC | Follows underlying merchant | 5999 |

| Payment Schedule | Full | 3 monthly instalments |

| Earn ShopBack Cashback | Yes | Yes |

| Offset ShopBack Cashback | Yes | Yes |

| ^2nd and 3rd instalment may not be processed online unless manually triggered | ||

Read on for my recommended cards, as well as the advantages of using ShopBack Pay/PayLater over swiping your card directly.

What payment methods do ShopBack Pay and PayLater support?

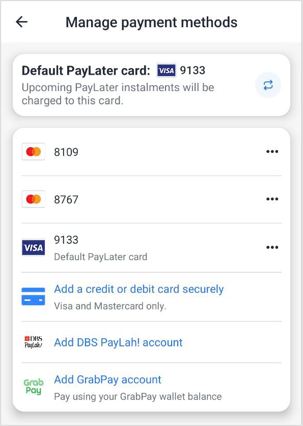

In order to use ShopBack Pay or PayLater, you need to add your cards to the ShopBack app (tap on Account > Linked Payment Methods).

The following payment methods are supported:

- Visa

- Mastercard

- Apple Pay

- GrabPay

Note the absence of American Express cards, which aren’t supported directly or via Apple Pay. It’s not that big a loss if you ask me, since these wouldn’t be the best cards to use on ShopBack transactions anyway.

ShopBack Pay

ShopBack Pay transactions, whether in-store or online:

- Code as online spend

- Retain the MCC of the underlying merchant (in most cases, though there can be the odd exception here and there)

You should therefore use a card that gives a blanket bonus for online purchases, or a card that awards bonuses for the relevant category.

| 💳 Best Cards for ShopBack Pay | ||

| Card | Earn Rate | Remarks |

Citi Rewards Card Citi Rewards CardApply |

4 mpd | Max. S$1K per s. month |

DBS WWMC DBS WWMCApply |

4 mpd | Max. S$1.5K per c. month |

Other cards like the HSBC Revolution or UOB Preferred Platinum Visa would also earn 4 mpd, depending on whether the merchant’s MCC falls within their respective whitelists.

What are the main advantages of using ShopBack Pay versus directly swiping your card? I can think of a few:

- Some merchants may not accept credit cards, but accept ShopBack Pay

- Earn additional ShopBack cashback from your transaction, on top of credit card rewards

- Offset orphan ShopBack cashback on your transaction

- If you’re physically in a store, it’s an opportunity to convert the spend into an online transaction, saving the limited 4 mpd cap on your UOB Preferred Platinum Visa or UOB Visa Signature for other brick-and-mortar merchants

ShopBack PayLater

ShopBack PayLater transactions, whether in-store or online:

- Are split into three equal interest-free instalments

- Code as online spend (for the first payment at least; see below)

- Code as MCC 5999: Speciality and Misc. Retail Stores

You therefore approach this the way you would any other BNPL service, using cards that award bonuses for online spend or MCC 5999.

| 💳 Best Cards for ShopBack PayLater | ||

| Card | Earn Rate | Remarks |

Citi Rewards Card Citi Rewards CardApply |

4 mpd | Max. S$1K per s. month |

DBS WWMC DBS WWMCApply |

4 mpd | Max. S$1.5K per c. month |

HSBC Revolution HSBC RevolutionApply |

4 mpd | Max. S$1K per c. month |

UOB Pref. Plat. Visa UOB Pref. Plat. VisaApply |

4 mpd | Max. S$1.1K per c. month |

KrisFlyer UOB Card KrisFlyer UOB CardApply |

3 mpd | Min. S$800 spend on SIA Group in m. year |

| C. Month= Calendar Month | S. Month= Statement Month | M. Year= Membership Year | ||

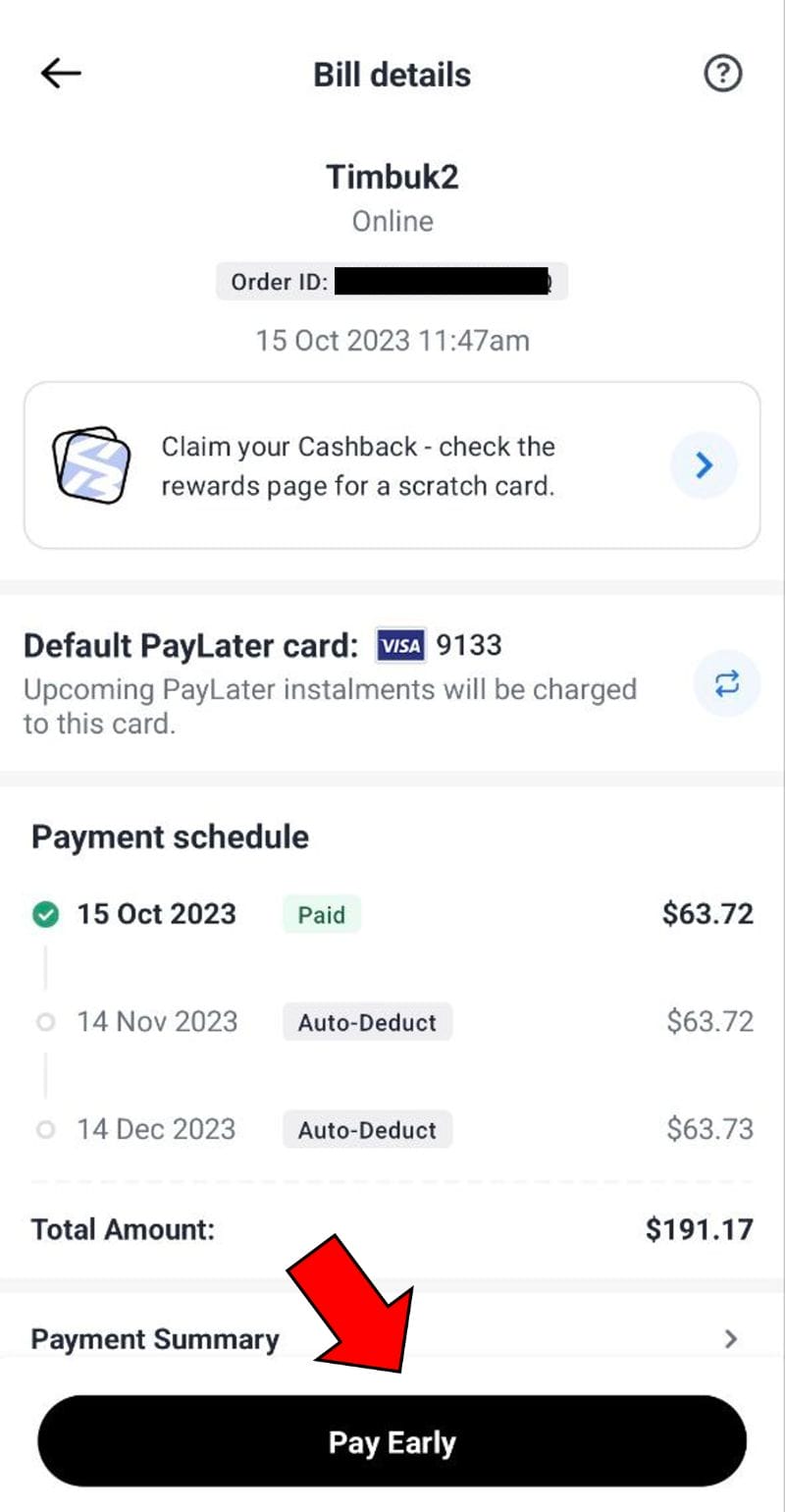

Remember: it’s best practice to manually trigger the following month’s payment a few days ahead of time, instead of letting it be billed automatically. Customers who don’t have sometimes reported not earning bonus points on the 2nd and 3rd month’s installments because they code as offline (this would be a problem for the Citi Rewards and DBS WWMC).

| ❓ Why not use Amaze? |

|

If the problem is that 2nd and 3rd instalments aren’t coded as online, then won’t pairing the Amaze with the Citi Rewards Card solve the problem? Yes, but at a price. Ever since 13 October 2023, Amaze has imposed a 1% transaction fee for SGD payments made to MCC 5999 (and others) funded by a linked credit card. That’s why it’s better to just use a “naked” card and trigger the payments manually yourself. |

To trigger a manual payment for ShopBack PayLater, go to the PayLater tab, tap on Upcoming payments, select the bill and tap Pay Early.

As for the advantages of using ShopBack PayLater versus directly swiping your card:

- All the aforementioned advantages of using ShopBack Pay (see previous section)

- Enjoy interest-free instalments that conserve your cashflow, while still earning regular card rewards

- Better manage the bonus caps on your specialised spending cards

While cashflow is always important, it’s the last point that most miles chasers will particularly value. Suppose you’re making a S$3,000 purchase and only have a Citi Rewards Card.

- Charging the entire amount upfront would be a waste, because you’d earn 4 mpd on S$1,000 and 0.4 mpd on S$2,000, for 4,800 miles total

- With a BNPL service that breaks it down into three payments, you can earn 4 mpd on S$1,000 a month for three months, for 12,000 miles total

I’ve written a separate article about splitting up big ticket purchases across multiple cards using BNPL platforms and gift cards.

How to maximise miles by splitting payments across multiple cards

Conclusion

ShopBack Pay and PayLater offer extra cashback on top of your usual credit card rewards, turn offline payments into online ones, and, in the case of PayLater, stretch your cashflow while helping you better manage the bonus caps on specialised spending cards.

It’s a simple one-time exercise to pair your cards with the ShopBack app, so why not?

“(ShopBack Pay transactions).. Retain the MCC of the underlying merchant” From my experience, this is not always true. I’ve come across restaurants that code as 5814 with ShopBack Pay, and even clothing stores that code as 5814! Not only that, MCC under ShopBack Pay for the same merchant can sometimes change over time – found this out the hard way when recent transactions at a restaurant I’ve seen coded as 5812 in the past suddenly don’t get rewarded anymore, and only knew they’ve now been coded as 5814 after I called bank to ask! So now I’ll always play it… Read more »

a few similar comments like that in the telegram group- will put a note

Does that mean using citi rewards x paylater for OTA like agoda will get 10x??

OMG! I didn’t know the 2nd and 3rd payment auto codes as offline. Why didn’t I read your article ytd. ;( sobx! I just had a 3rd payment auto deducted today… cries in regrets.

it *may* code as offline. worth checking whether that’s actually the case

for posted txn, how to check if coded online or offline? call CSO to check?

if it maintains the underlying MCC, how about using the UOB lady’s and lady’s solitaire?

Same question here. What if I select dining and use ShopBack pay at restaurants?