Back in May 2023, HSBC launched the TravelOne Card, its first-ever mass market miles card. This had a lot of things going for it: a 20,000 miles welcome offer for both new and existing customers, eight lounge visits in the first membership year, instant transfers with no conversion fees, and conversion blocks of just two miles after the first 10,000 miles.

But the thing that intrigued me the most were the transfer partners. At the time of launch, HSBC TravelOne Cardholders could transfer points to 12 different airlines and hotels, snatching away Citi’s “most transfer partners” crown. And HSBC made it clear that they weren’t done yet, because the plan was to have more than 20 airline and hotel partners by the end of 2023.

HSBC has now made good on their word by adding eight new airline and hotel partners to the TravelOne’s stable, including a Singapore debut for Air Canada Aeroplan and Japan Airlines Mileage Bank, as well as miles community favourites Qatar Privilege Club and Turkish Airlines Miles&Smiles.

| ✈️ Airline Partners |

|

| 🏨 Hotel Partners |

|

Unfortunately, it’s not all good news. While I always welcome new transfer partners, the conversion ratios at which many of these are being offered threaten to nerf any potential value.

Let’s dive into the details.

HSBC TravelOne Card new partners

Effective immediately, HSBC TravelOne Cardholders can transfer their points to 16 airlines and 4 hotel programmes.

Conversions can be made at the following ratios.

Airlines (16)

| ✈️ HSBC TravelOne Airline Partners | |

| Frequent Flyer Programme | Conversion Ratio (HSBC Points : Partner) |

| 50,000 : 10,000 | |

| 40,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

New New |

30,000 : 10,000 |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 |

|

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

|

25,000 : 10,000 |

Hotels (4)

| 🏨 HSBC TravelOne Hotel Partners | |

| Hotel Programme | Conversion Ratio (HSBC Points : Partner) |

New New |

30,000 : 10,000 |

| 25,000 : 5,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

All HSBC TravelOne Card partner transfers are processed instantly, with the exception of the following:

- Accor Live Limitless: Within 5 business days

- Club Vistara: Within 5 business days

- Hainan Fortune Wings Club: Within 5 business days

- Qatar Privilege Club: Within 5 business days

- Japan Airlines Mileage Bank: Within 21 business days

All transfers are currently processed free of charge until 24 January 2024. Following this, HSBC will impose an (absurdly) expensive fee of 10,000 points per transfer, which I’ve talked about in the post below.

My thoughts on the new transfer partners

Partners

Let’s ignore transfer ratios for a minute and just talk about the new partners.

![]()

For me, the biggest excitement is undoubtedly Air Canada Aeroplan. This is the first time it’s been available through a Singapore credit card, and it’s well-loved by the miles and points community, for good reason.

- No fuel surcharges

- More airline partners than any programme (including non-Star Alliance partners like Air Mauritius, Azul, Gulf Air and Oman Air)

- Stopovers can be added on one-way awards for just 5,000 points

- Virtually all partner awards can be booked online

- Access to Singapore Airlines award space can be better than KrisFlyer even

Japan Airlines Mileage Bank is another first for Singapore. This used to be an excellent programme for redeeming Emirates First Class awards, but that’s no longer been possible since September 2021. You can still redeem Emirates Business Class awards, but you’ll have to pay some very hefty fuel surcharges. Domestic Japan awards start from 6,000 miles.

Qatar Privilege Club offers competitive Business Class redemption rates between Singapore and Europe (70,000-75,000 miles) and North America (95,000 miles), and the best part is that Qatar does not impose fuel surcharges for redemptions on its own flights. This can save you hundreds of dollars compared to booking through Asia Miles or another oneworld programme.

However, this shouldn’t be seen as a new addition per se, since HSBC TravelOne Cardholders already have access to British Airways Executive Club, and Avios can be transferred between the programmes at a 1:1 ratio.

![]()

Turkish Miles&Smiles offers great value Business Class awards between Singapore and Japan/Europe, which cost just 35,000 miles/45,000 miles respectively.

Club Vistara is an odd addition, particularly since Vistara is living on borrowed time. It’s already been announced that Air India will discontinue the brand once the merger with Tata SIA Airlines is completed. This presumably means that Club Vistara members will become part of Air India’s Flying Returns programme.

![]()

From what I know, there isn’t really anything to get excited about Hainan Fortune Wings or THAI Royal Orchid Plus, so I wouldn’t waste time studying their award programmes if I were you.

Transfer ratios

If you were waiting for the other shoe to drop, here it is: the transfer ratios are poor.

The seven new airline partners have ratios ranging from 30,000 to 50,000 points to 10,000 miles, 20%-100% more than the 25,000 points to 10,000 miles that was the standard for all nine airline partners prior to this.

To put it another way, HSBC TravelOne Card cardholders currently earn:

- 3X HSBC points per S$1 on local spend

- 6X HSBC points per S$1 on foreign currency spend

That works out to 1.2 mpd/2.4 mpd, but only if you’re choosing a partner with a 25,000 points to 10,000 miles ratio.

Otherwise, the earn rates can fall as low as 0.6 mpd/1.2 mpd respectively.

| If the transfer ratio is | Local Spend | FCY Spend |

| 25,000 : 10,000 | 1.2 mpd | 2.4 mpd |

| 30,000 : 10,000 | 1 mpd | 2 mpd |

| 35,000 : 10,000 | 0.86 mpd | 1.71 mpd |

| 40,000 : 10,000 | 0.75 mpd | 1.5 mpd |

| 50,000 : 10,000 | 0.6 mpd | 1.2 mpd |

This problem is compounded by the fact that it’s not easy to accrue HSBC TravelOne points:

- HSBC points don’t pool — the bank says they’re working on adding this, but it won’t be coming in 2023 — so you can’t tap the 4 mpd earning power of the HSBC Revolution

- HSBC does not have an equivalent of Citi PayAll; in fact, they ended their income tax payment facility for credit cards in January this year

- HSBC does not allow cardholders to earn points on CardUp/ipaymy transactions

Therefore, it’d take a significant amount of spending to reach the critical mass required for a long-haul Business Class award, let alone several, let alone if you’re looking at a frequent flyer programme with a 30,000-50,000 points : 10,000 miles ratio!

| ⚠️ Don’t transfer to Qatar Privilege Club! |

|

If you want to convert points to Qatar Privilege Club, it’s better to transfer them to British Airways Executive Club first, then port them over at a 1:1 ratio. That’s because the conversion ratio is better from HSBC TravelOne points to British Airways Executive Club (25,000 pts : 10,000 Avios) compared to Qatar Privilege Club (35,000 pts: 10,000 Avios). |

The Aeroplan silver lining

| Aeroplan Award Chart |

Now, all that having been said, I want to spend a little time talking about Aeroplan specifically, because that can be the potential silver lining here.

This probably deserves a separate post on its own, but here’s a quick idea of how Aeroplan’s award pricing for one-way Business Class flights compares to KrisFlyer.

| ✈️ One-way Business Class awards (Unadjusted) |

||

| Aeroplan | KrisFlyer | |

| Singapore to Europe | 80,000 miles | 103,500 miles |

| Singapore to USA | 87,500 miles | 107,000 – 111,500 miles |

| Singapore to Japan & South Korea | 45,000 miles | 52,000 miles |

| Singapore to Australia | 45,000 miles | 68,500 miles |

Now, this would be phenomenal if you could earn Aeroplan and KrisFlyer miles at the same rate. But you can’t, and since Aeroplan is 3.5:1 versus KrisFlyer 2.5:1, we need to increase the Aeroplan figures by 40%.

| ✈️ One-way Business Class awards (Adjusted for T1 transfer ratios) |

||

| Aeroplan | KrisFlyer | |

| Singapore to Europe | 112,000 miles | 103,500 miles |

| Singapore to USA | 122,500 miles | 107,000 – 111,500 miles |

| Singapore to Japan & South Korea | 63,000 miles | 52,000 miles |

| Singapore to Australia | 63,000 miles | 68,500 miles |

This narrows the use cases significantly, though it doesn’t destroy them altogether.

Look at Australia, for example. Not only is Aeroplan cheaper than KrisFlyer, it sometimes has better access to Singapore Airlines award space than KrisFlyer! Yes, you read that right: Aeroplan members can sometimes see Singapore Airlines award space that KrisFlyer members can’t.

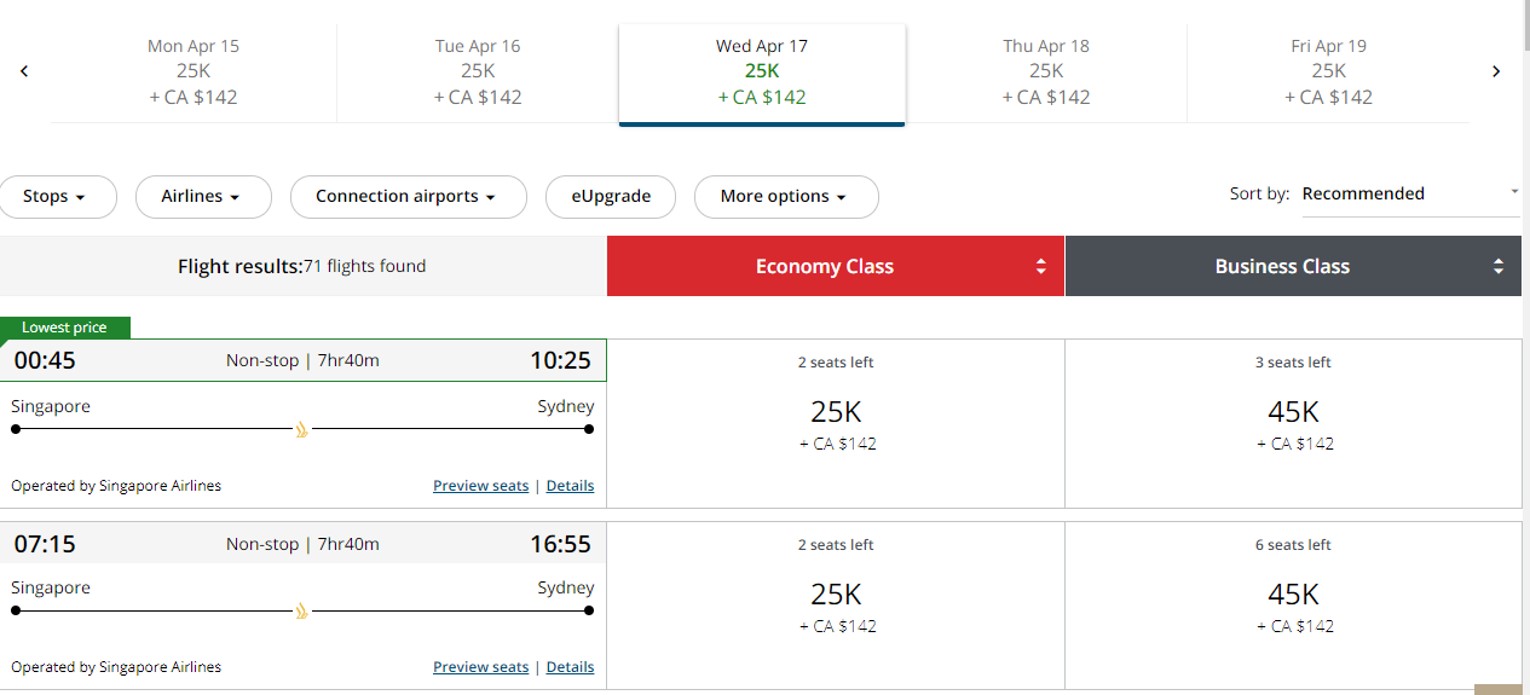

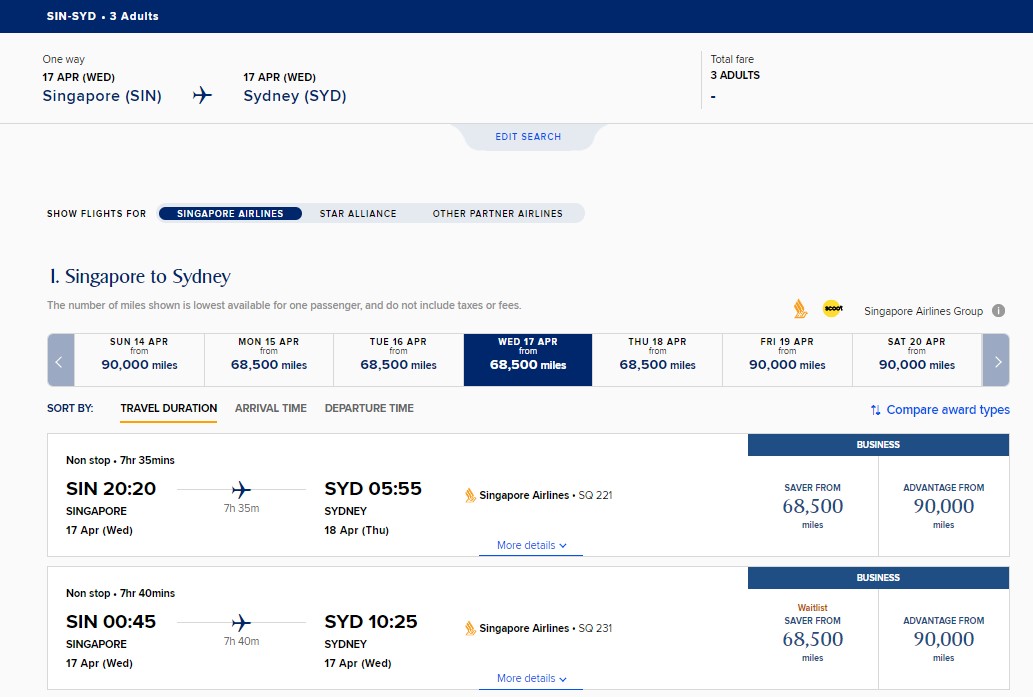

Here’s an example from April 2024. Notice how Aeroplan can see three Business Class seats on the 0045 SQ231 flight from SIN-SYD.

If you try to book three Business Class seats on the 0045 SQ231 flight from SIN-SYD via KrisFlyer, you’ll have to waitlist.

And that’s not even taking into account fuel surcharges. Singapore Airlines does not impose these on its own flights anymore, but if you’re redeeming KrisFlyer miles for Star Alliance partners like ANA, Lufthansa or Turkish, you still need to pay.

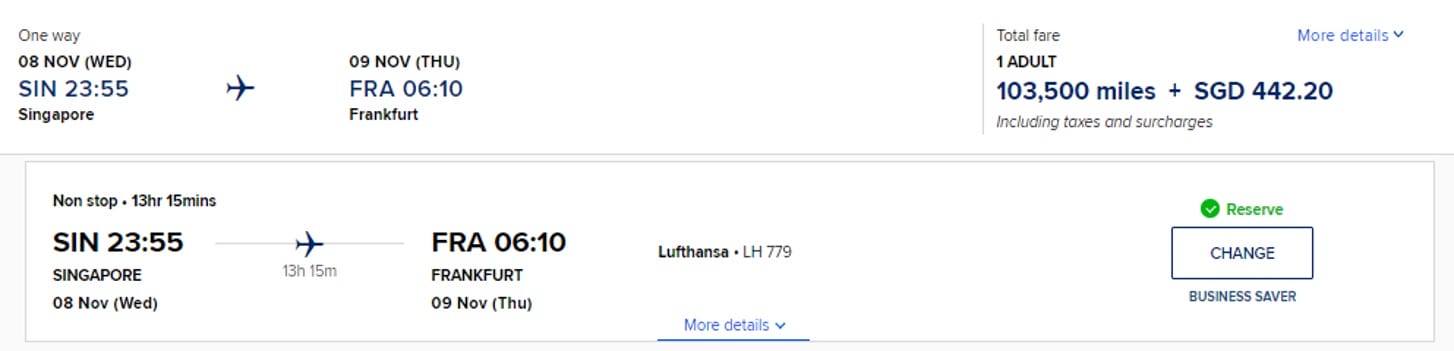

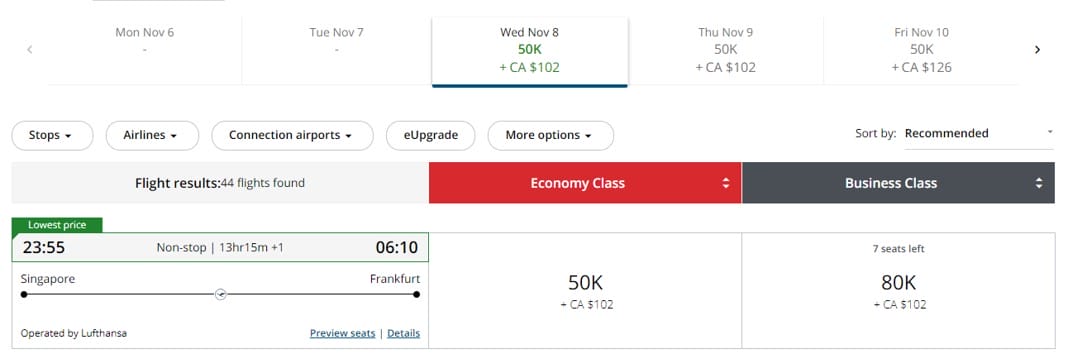

For example, it will cost 103,500 miles + S$442 to redeem a one-way Business Class award from Singapore to Europe on Lufthansa.

With Aeroplan, the equivalent cost is 112,000 miles (80,000 + 40%) + S$100.

I think it says quite a bit about how good Aeroplan is that even with a 40% handicap, it can still be competitive with KrisFlyer!

Conclusion

The HSBC TravelOne Card has added eight new airline and hotel partners, bringing its total options to 20.

As excited as I am to see new faces like Air Canada Aeroplan and Japan Airlines Mileage Bank, the transfer ratios make them relatively unattractive. There could still be some cases for transfers to Aeroplan, but otherwise most people would do better by sticking with 25,000 pts: 10,000 miles partners like KrisFlyer, Asia Miles, British Airways, Flying Blue and EVA Infinity MileageLands.

What do you make of the new TravelOne partners?

Should revolution be given this redemption list, it will change the environment of redemptions in Singapore quite a bit with Aeroplane. SQ should be concerned about this.

How is HSBC able to transfer miles instantly when others take up to X days. What’s the barrier preventing others from doing the same? More fees for the bank?

This is made possible via api integration provided by ascenda loyalty. Ocbc and scb use the same platform too (though not for krisflyer miles, which is why those still require a few days)

Oh, interesting! I’m not sure if there’s value in it for the site, but I would love to read a Milelion article on how the backend points/miles system works today (ie APIs, banks, third parties, airlines, etc).

I would be interested to know how things work too! But you are right that it might not of value for this site.

try this: https://milelion.com/2023/01/30/behind-the-scenes-how-do-airlines-tie-up-with-credit-cards/

Thanks!

Thanks, but the miles earn rate is extremely slow. With UOB PP or citibank rewards card, I can easily earn 4mpd.

when will the HSBC point pools ready? Do you have any information?