This week saw the launch of the TravelOne Card, HSBC’s first mass market miles card in Singapore. HSBC certainly took its time entering this segment — almost every other bank already has one — but hey, there’s no harm in being fashionably late.

I’ve spent the past couple of days poring over the details of this card and analysing its use cases. Like every new launch, the TravelOne has generated a ton of online discussion, which has been very helpful in spotting things I missed the first time round!

HSBC TravelOne Card HSBC TravelOne Card |

||

| Apply | ||

| Income Req. | Annual Fee | FCY Fee |

| S$30,000 |

S$194.40 | 3.25% |

| Local Earn | FCY Earn | Lounge Visits |

| 1.2 mpd |

2.4 mpd | 4 per calendar year |

| Transfer Fee | Min. Transfer | Transfer Partners |

| Free till 31 Dec 2023 |

10,000 miles (beyond this, the min. block reduces to 2 miles) |

12 |

And as I was drafting this post, I suddenly had an epiphany.

The biggest strength of the HBSC TravelOne? It’s a great general spending card. The biggest weakness of the HSBC TravelOne? It’s a great general spending card.

If that sounds confusing, don’t worry- it’ll get clearer as we go along.

The earn rates are great (for a general spending card)

HSBC TravelOne Cardholders earn:

- 3X HSBC points per S$1 (1.2 mpd) on local spend

- 6X HSBC points per S$1 (2.4 mpd) on foreign currency spend

There is no minimum spend required, nor cap on the points that can be earned.

It speaks volumes about where the market is right now that more than a few comments have basically said “Not 4 mpd? Pfffft”. But that’s understandable in a way. Cards like the UOB Preferred Platinum Visa and UOB Visa Signature have made us so accustomed to earning 4 mpd almost everywhere that it’s become the de facto expectation for some.

And yet, it’s important to remember that the TravelOne is intended to be a general spending card, and we need to benchmark it to the appropriate segment.

In fact, given its earn rates and rounding policies, I’d say it more than holds its own against the competition; all the more so for HSBC Everyday Global Account customers who can earn a bonus 1% cashback on all transactions (capped at $300 per month).

| 💳 Entry-Level Miles Cards: Earn Rates | |||

| Cards | Local Earn | FCY Earn | Min. Spend to Earn Points^ |

UOB PRVI Miles UOB PRVI Miles |

1.4 | 2.4 | S$5 |

HSBC TravelOne Card HSBC TravelOne Card |

1.2 | 2.4 | S$0.50 |

OCBC 90°N Card OCBC 90°N Card |

1.3 | 2.2 | S$5 |

Citi PremierMiles Card Citi PremierMiles Card |

1.2 | 2.0 | S$1 |

DBS Altitude Card DBS Altitude Card |

1.2 | 2.0 | S$1.67 |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

1.2 | 2.0* | S$0.42 |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

1.1 | 2.0* |

S$0.45 |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

1.2 | 1.2 | S$5 |

| *June and Dec only, otherwise 1.1 mpd ^Assuming SGD spend |

|||

Furthermore, I’m quite amazed that the HSBC TravelOne outearns the top-of-the-line HSBC Visa Infinite (1/2 mpd on local/overseas spend, upgraded to 1.25/2.25 mpd on local/overseas spend with a hefty minimum spend of S$50,000 in a membership year). That must have been a fascinating internal discussion, since product managers are loath to have their baby upstaged- especially by a card for the unwashed masses!

It’s not just raw earn rates, mind you. Quality of points matters as much as quantity.

If HSBC had launched a card with 1.6/2.4 mpd earn rates, yet kept Asia Miles and KrisFlyer as its only transfer partners, I’d be much more indifferent. Yes, those would be excellent earn rates for a general spending card, but at the end of the day what’s changed? It’s not breaking any new ground.

The TravelOne’s claim to fame is not its earn rates, solid though they may be. It’s the new transfer partners it’s added and will continue to add throughout 2023 (more on that later). That, to me, is more important than incrementally higher earn rates.

I’ve often believed that banks are getting the market for general spending cards wrong. It seems as if the thought process goes something like, “What’s better than 1.2 mpd? 1.3 mpd. What’s better than 1.3 mpd? 1.4 mpd…”

While this might be good for consumers in the short run, it’s ultimately not sustainable (just look at the BOC Elite Miles Card as an example). Margins get squeezed, banks have to come up with shenanigans to advertise higher rates while awarding less in practice (e.g. OCBC/UOB and their S$5 earning blocks), and it limits the scope to add other benefits that customers might value more, such as lounge visits or airport limo rides.

A much more sustainable approach would be to compete not on headline earn rates, but card features. In other words: “I can make my 1.2 mpd better than your 1.3 mpd if I offer more partners, if I offer free conversions, if I offer instant transfers.” That’s exactly what HSBC is attempting with the TravelOne.

Still, not everything is hunky dory.

- HSBC TravelOne Card does not have a bonus earn category

- HSBC excludes CardUp/ipaymy transactions from earning rewards

- HSBC no longer offers a tax payment facility

- HSBC points don’t pool (though it’s on the roadmap…more on that later)

This means there’s currently no way of turbocharging your accumulation, and at a pace of 1.2/2.4 mpd, it’d take a lot of spending to reach the critical mass needed for a redemption (especially if you’re redeeming for a family).

It’s what I call the “AMEX Platinum Problem”. While Membership Rewards points are extremely valuable, it’s hard to earn them at a decent rate (0.69 mpd for AMEX Platinum Credit Card, 0.78 mpd for AMEX Platinum Charge). But even then, at least AMEX has 10Xcelerator partners (3.47 mpd for AMEX Platinum Credit Card, 7.8 mpd for AMEX Platinum Charge)- something HSBC lacks!

A solid sign-up bonus, with a quirk

|

| T&Cs |

From now till 31 August 2023, customers who apply for a HSBC TravelOne Card will enjoy 20,000 bonus miles (in the form of 50,000 HSBC points) when they:

- Pay the annual fee of S$194.40

- Spend at least S$800 by the end of the month following approval

- Opt-in for marketing communications during the sign-up process

Since the annual fee must be paid, you’re basically buying miles at a cost of 0.97 cents each (S$194.40/20,000 miles), or 1.09 cents if you want to adjust for the opportunity cost of spending on a 4 mpd card (S$194.40/(20,000-800*2.8) miles).

That’s a very good price indeed, and before someone says “but Citi PayAll”, remember the S$8,000 minimum spend for the current offer.

What’s noteworthy about this offer is that it’s available to both new and existing HSBC cardholders. Most of the time, the latter get left out in the cold.

But offering the same sign-up bonus to new and existing customers also creates a strange quirk. If you count as a new HSBC cardholder, you might want to apply for a HSBC Revolution Card first (seriously, why don’t you have one yet?).

New cardholders will receive:

- S$30 cash from SingSaver, no min. spend (T&Cs)

- S$150 cashback from HSBC with a min. spend of S$1,000 (T&Cs)

After the Revolution is approved, you can then apply for the TravelOne as an existing customer, since you enjoy the same 20,000 bonus miles as a new cardholder anyway.

Don’t sweat the annual fee

And since we’re talking annual fees: the HSBC TravelOne Card is not offering a first year fee waiver option at the moment. In other words, if you want the card, you have to pay the S$194.40 annual fee, though with 20,000 miles + eight lounge visits in the first membership year (not four- see below), I’d argue you’re still coming out on top.

What happens in the second year, though?

At this point, we don’t know. The official stance is that cardholders who spend at least S$25,000 in a membership year will receive a fee waiver for the second year. However, many other banks say similar things, yet offer waivers nonetheless to those who fall short of the minimum spend (either automatically or on request).

I’m not that concerned at the moment, quite frankly. The card is virtually brand new; we’ll cross that bridge when we come to it. I certainly wouldn’t pay S$194.40 just for a few lounge visits, and I suspect that HSBC knows that unless there’s a very compelling reason to pay the second year’s annual fee, the lack of waiver could spark a significant exodus.

The market has already demonstrated it’s not willing to pay annual fees in the S$30,000 card segment. OCBC tried it for a while with their 90°N Card by adding a non-waivable S$53.50 annual fee (with a further S$139 top-up to buy 10,000 miles). That experiment didn’t last very long.

So the way I see it, why not just take it one year at a time? It’s hardly something to get worked up about at this point. If the value proposition doesn’t make sense in the second year, you still have the freedom to walk away.

Expiring points aren’t a deal-breaker

Points earned on the HSBC TravelOne Card expire after 37 months, the same as other HSBC cards.

Some don’t like expiring points, but it’s not that big a deal for me. As I’ve explained in this article, non-expiring points don’t really influence my decision whether or not to get a card. Granted, nothing beats evergreen, but 37 months is a long time, and you still have additional validity once points are transferred to the airline side.

However, an argument could be made that because of the 1.2/2.4 mpd earn rates, you’d need to keep the points on the bank side for a longer time before transferring. Fair enough, though at most it means paying an additional conversion fee at the end of 37 months; not really something to lose sleep over.

Moreover, with the pace of frequent flyer devaluations, holding on to your points too long is a bad idea. The golden rule is still to earn and burn!

First year sweet spot for lounge visits

HSBC TravelOne Cardholders enjoy four lounge visits per year, a relatively generous allowance for the segment in which the card competes.

| 🛋️ Entry-Level Miles Cards: Lounge Access | ||

| Card | Lounge Access? | Network |

HSBC TravelOne Card HSBC TravelOne Card |

✔ (4 per year) |

Dragon Pass |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

✔ (4 per year) |

Plaza Premium |

Citi PremierMiles Card Citi PremierMiles Card |

✔ (2 per year) |

Priority Pass |

DBS Altitude Card DBS Altitude Card |

✔ (2 per year, Visa version only) |

Priority Pass |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

✖ | N/A |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

✖ | N/A |

UOB PRVI Miles UOB PRVI Miles |

✖ | N/A |

OCBC 90°N Card OCBC 90°N Card |

✖ | N/A |

What’s more, the allowances are granted on a calendar year basis instead of membership year. This means that a cardholder can enjoy eight visits in their first membership year, regardless of whether they choose to renew.

For example, when you’re approved in 2023 you get four visits to use till 31 December 2023, and on 1 January 2024 you get another four visits to use till 31 December 2024. Whether or not you renew the card in 2024 is irrelevant.

There’s also a qualitative aspect to this: TravelOne lounge visits are provided by DragonPass, which is the only major lounge network to retain access to Plaza Premium Lounges after the operator terminated its agreements with Priority Pass and Lounge Key. In some airports (e.g. Penang, Phnom Penh) Plaza Premium lounges are the only contract lounge option (or even the only lounge option).

If there’s one fly in the ointment, it’s that lounge visits cannot be shared with a guest. Whether that’s a HSBC or DragonPass restriction I do not know, but it feels odd: if I have four visits in total, who cares whether I use all four on myself or split them with my companion for two visits together?

Fast, free points conversions

There’s three things I look for in a card:

- Conversion speed

- Conversion fees

- Conversion blocks

The HSBC TravelOne gets two out of three right, with the last one coming agonisingly close.

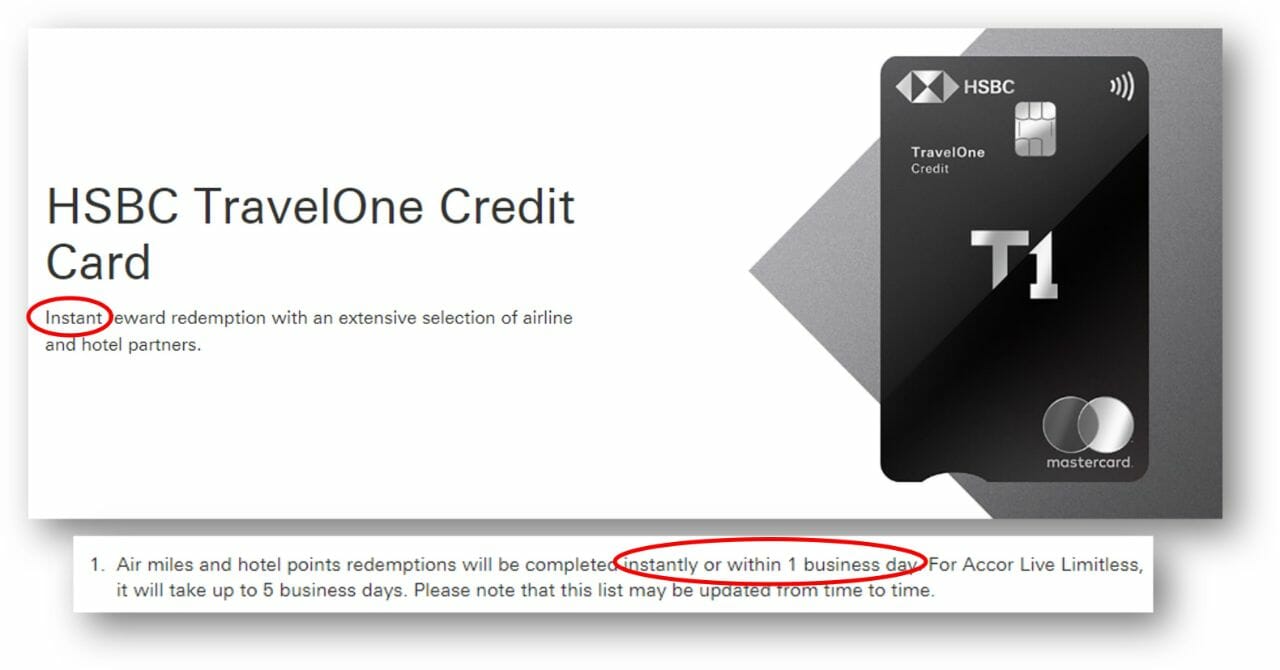

Conversion speed

The HSBC TravelOne Card has a bit of a semantics issue when it comes to conversions.

In some places, it advertises “instant” rewards redemptions. In others, it says “instantly or within 1 business day”. The two, obviously, are not the same, and in the miles game where award space can disappear as fast as it pops up, can make all the difference.

Having spoken to both the product team as well as Ascenda (the loyalty company that’s behind the new partners), the overall sense I got was that this is a CYA thing, just in case something goes wrong.

Given the API integration Ascenda has with its partners, there’s really no reason not to expect instant conversions for all programmes except Accor Live Limitless (where transfers take up to five business days).

In any case, I’ll be testing this soon and posting the results, and I’m sure the Telegram Group will be full of data points as well.

Conversion fees

HSBC normally requires cardholders to join its Mileage Programme to convert points, which costs S$43.20 a year for unlimited conversions to Asia Miles or KrisFlyer. You only pay one fee, regardless of how many HSBC cards you have.

With the TravelOne Card, all conversion fees are waived till 31 December 2023. That reduces the friction in making ad-hoc top-ups to your frequent flyer account.

It’s not been confirmed whether HSBC will switch to a “per conversion” model come 1 January 2024, but if you ask me, it looks more likely than not. I’d expect to pay the usual S$25 + GST.

Conversion blocks

Unfortunately, it’s the last leg of the triangle that’s missing. While the TravelOne offers fast, free top-ups, the minimum conversion block is 10,000 miles.

While that’s on par with the market, I feel they’ve missed a great opportunity here. 10,000 miles, after all, is a significant chunk of change to move at one go. If they broke it down into smaller blocks, the utility of the card would be even greater.

| ✈️ Min. Conversion Blocks for KrisFlyer Miles | ||

| Currency | Miles | Fee |

| OCBC VOYAGE Miles | 1 | S$25 |

| AMEX Membership Rewards | 250 | None |

| OCBC 90°N Miles | 1K | S$25 |

| BOC Points | 10K | S$30 |

| Citi Miles/ThankYou Points | 10K | S$27* |

| DBS Points | 10K | S$27 |

| HSBC Points | 10K | S$43.20@ (annual) |

| Maybank TREATS | 10K | S$27^ |

| OCBC$ | 10K | S$25 |

| SC 360° Rewards |

10K | S$27 |

| UOB UNI$ | 10K | S$25# |

| * Fee waived for Citi ULTIMA cardholders ^Fee waived for Maybank Visa Infinite and World Mastercard cardholders #Fee waived for UOB Reserve, Visa Infinite, Visa Infinite Metal and Privilege Banking Visa Infinite cardholders @ Fee waived for HSBC TravelOne cardholders till 31 Dec 23 |

||

If it’s any consolation, after the first 10,000 miles the subsequent conversion block is just 2 miles. This is confirmed in the FAQs:

|

With my other HSBC credit cards, I need to redeem miles in blocks of 25,000 points to 10,000 airmiles. Does the same apply to my HSBC TravelOne Credit Card? To begin redemption of airmiles or hotel points on your HSBC TravelOne Credit Card, you will need a minimum of 25,000 Reward points to redeem 10,000 airmiles or hotel points. Thereafter, the redemption will be based on blocks of 5 Reward points to 2 airmiles or hotel points. |

In other words, you could convert 25,005 points to 10,002 air miles. This is great news for anyone intending to spend S$800 for the sign-up bonus in local currency then cash out. You’d have:

- 50,000 bonus points (for meeting min. spend)

- 2,400 base points (S$800 @ 3 points per S$1)

52,400 points can be cashed out exactly for 20,960 miles, avoiding orphan points.

I just wish they’d gone one step further and made the minimum conversion block 2 miles, though that may be wishful thinking on my part.

By the way, this also means that if you want an insurance policy against orphan miles, one thing you can do is keep a minimum of 25,000 points in your account at all times.

Transfer partner bonanza

HSBC TravelOne Cardholders can transfer points to a total of 12 different partners: nine airlines and three hotels.

| ✈️ HSBC TravelOne Airline Partners | |

| Frequent Flyer Programme | Conversion Ratio (HSBC Points : Partner) |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 |

|

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

|

25,000 : 10,000 |

| 🏨 HSBC TravelOne Hotel Partners | |

| Hotel Programme | Conversion Ratio (HSBC Points : Partner) |

| 25,000: 5,000 | |

| 25,000: 10,000 | |

| 25,000 : 10,000 | |

This takes the crown of “most transfer partners” from Citi (10 airlines, 1 hotel), and HSBC isn’t done. The plan is to have more than 20 airline and hotel partners by the end of 2023.

That’s the real game-changer here. For too long, we’ve seen new partners added at a glacial pace (Standard Chartered and OCBC (eventually) being the notable exceptions; no surprise it was Ascenda behind those too). Now HSBC has kicked things into overdrive, and while not every new partner will be “useful” from a miles chaser perspective, more options can only be a good thing.

At the same time, there’s one thing I want to make abundantly clear: there’s little point in using the HSBC TravelOne Card if all you want is Asia Miles and KrisFlyer. If that’s your goal, you’d do much better by sticking with other cards on the market. Why earn KrisFlyer miles at 1.2/2.4 mpd when you can earn them at 4/6 mpd elsewhere?

Getting the most out of TravelOne means exploring other programmes, and I can’t help but wonder if there’s an inherent paradox. Are the people most likely to give a general spending card heavy usage also the same people who would default to familiar programmes like Asia Miles and KrisFlyer?

Imagine

How you feel about the HSBC TravelOne Card really boils down to what standards you’re measuring it by.

Compared to general spending cards, it excels: 1.2/2.4 mpd earn rates, 1% extra cashback for EGA customers, a favourable rounding policy, four lounge visits per calendar year, fast and free conversions, and a 20,000 miles sign-up bonus even for existing customers. I’m not about to say it’s the absolute best — the Citi PremierMiles Card may have lower earn rates and fewer lounge visits, but Citi PayAll is a fearsome beast — though it certainly ticks all the right boxes.

Compared to specialised spending cards, it pales in comparison, obviously. No general spending card, no matter how good, is going to beat 4/6 mpd!

Here’s the thing though: even if the HSBC TravelOne isn’t directly competing with a specialised spending card, it’s indirectly competing for share of wallet, because in most cases, every S$1 I put on the TravelOne is S$1 I could have put on a 4/6 mpd card.

That’s a problem that all general spending cards face, not just the HSBC TravelOne. It begs a more existential question: do you even need a general spending card?

To be sure, there are situations where it can come in useful:

- Maybe you’ve busted the 4/6 mpd caps on your specialised spending card

- Maybe the bank affiliated with your general spending card has some sort of tie-up with the merchant that grants an additional discount that would more than offset the lost miles

- Maybe this particular category of spend doesn’t qualify for any bonuses (though it’s hard to think of an example, given the wide coverage of specialised spending cards)

- Maybe you don’t know the MCC of a given merchant, and just want to be safe (but you could always find out for free)

I don’t know how common those scenarios are for you, but keep in mind this won’t even be a dilemma for the vast majority of cardholders out there. If you read this blog, chances are you’re in the minority- not just in terms of looks, charisma and sheer muscle mass, but also in terms of card usage. For every one of us who obsessively optimises each and every transaction, there’s five, maybe ten people who just put everything on their DBS Altitude, Citi PremierMiles or UOB PRVI Miles Card and call it a day.

All the same, it’d be horribly premature to write it off. My understanding is that HSBC is working on adding points pooling, and if they pull that off, a lot of things would fall into place.

Imagine what you could do with Revolution earn rates, 20+ partners and instant transfers. Imagine being able to avoid fuel surcharges and tap new sweet spots by choosing the right frequent flyer programme. Imagine a spillover effect on the rest of the market, where other banks look at the HSBC, StanChart and OCBC case studies and decide there’s value in partnering with a platform like Ascenda and bringing dozens of partners onboard at once instead of negotiating individual contracts.

As John Lennon once said “That’s very nice Yoko but I’m trying to perform with Chuck Berry” “You can say that I’m a dreamer, but I’m not the only one”.

Conclusion

The HSBC TravelOne poses a crucial question: is there space for a general spending card in the wallet of a miles optimiser? Or perhaps more accurately: is there space for another general spending card in the wallet of a miles optimiser?

That’s something well worth thinking about this weekend, but I personally pulled the trigger yesterday and sent in my application. I’m not about to say no to that kind of sign-up bonus, and if things work out the way I hope they will, having an extra 50,000 HSBC points in the bag would be very welcome come end-2023. HSBC has ambitious plans that go beyond just the TravelOne, and if they can deliver on that, it’d be a huge shake-up to the miles game in Singapore.

Scoffers gonna scoff, but I like what I see so far.

Should this be added into the article on how to calculate general spending posted on 10 Jan?

I believe the plaza premium lounge in kuching is no longer around.

You’re right. No more at Kuching airport. Penang Plaza Premium still around.

removed that!

Me again. Interesting follow up. – My biggest gripe about the AF waivability uncertainty was that if you can’t get a waiver, you’d have to cash out and cancel and with usual 10k blocks you’d be hard pressed to meet the next 10k block (most people won’t put $8k+ on a gen spend card in a year given the plethora of 4mpd options). I had missed that it was an effective 10k minimum instead of blocks – thanks for pointing this out. More agreeable that it would be easier to try on this basis. Although by that time, you’ll have… Read more »

For a mass market general spending card that is not even a week old, I think we are being too critical. As far as the annual fee is concerned, if one wants to be safe, they can wait until a year later when data points about waivability become available, but of course, there’s the tantalizing FOMO that the welcome offer might be pulled soon, cause what are the odds that existing-to-bank customers are eligible for such a thing? All in all, I think it’s only fair that we have to “pay” for the 20k miles with a bit of uncertainty… Read more »

If Aeroplan is part of the 20 in the future, I’m in.

Likely. The Malaysian version of the card launched with Aeroplan

Ya, the $800 spending is an issue to hit for a general spending card…

Maybe I’m missing something, but aren’t we buying miles at: [(194.4+800)/20,960] = 4.7 cents per mile?

Can’t count the $800 – you’re not throwing the $800 away, it is expected you are spending $800 on things you would have otherwise spent anyway. But there is an opportunity cost for that $800 if you ordinarily would have earnt 4mpd on it instead.

Fairer to say your are forgoing 800×2.8 miles since $800 spend on a 4 miles/$ card would have yielded 3200 miles so 194.40/ 17760?

Another general spending card split means you have to deal with low usage or manage too many orphan miles and low miles redemption. Unless if HSBC has a killer feature like Citi Payall (where you can almost guarantee miles volume) – I will stick with Citi for the general spending card. How much more do you spend on “general” card if you maximize your 4MPD specialized card?

Orphan miles not really an issue here though, because of how the conversions work

Yes but it is free only until end of the year – afterward it is gonna be pain to transfer if they start imposing fee per transfer. Well technically the jury is still up in the air

yup, got it- but when we use the term “orphan miles”, we’re generally referring to miles that cannot be transferred out because of min. block size, not miles that can be transferred out, but there’s a fee involved. if it were the latter, then virtually every card on the market would suffer from “orphan miles”- even the OCBC VOYAGE with its 1 mile transfer blocks (since there’s still a $25 xfer fee). and just because a card doesn’t have xfer fees doesn’t mean the orphan mile problem doesn’t exist! UOB Reserve cardholders have no xfer fees, but their transfer block… Read more »

I’ll wait till they add points pooling

If I’m HSBC customer, is still a must for me to sign up this via Singsaver or can sign-up with HSBC directly? thanks.

If you are an existing customer, can apply directly with HSBC cuz you are not NTB, hence no incentive to go through SingSaver.

So… is this better than the DBS Vantage, which currently seems like the best general all-around spending card, though with limited partners…?

it would be very difficult to compare this with a $120k card, since the two of them have such different annual fees and benefits

If we were to do that comparison, what would the outcome be?

What I struggle to find is the best overall general spending card if you’ve got a monthly spend in the $20k+ range. Conversion partners become important, and the fee can be justified if it makes sense… Most of the benefits beyond those associated with travel are not really used (e.g. sometimes dining benefits that are hard to use, etc.)

This card seems interesting due to the increased number of conversion partners, as award space with SQ seems quite limited lately.

“If it’s any consolation, after the first 10,000 miles the subsequent conversion block is just 2 miles. This is confirmed in the FAQs” — How does this compare to other cards/banks/points systems? Would be very interested to add this to the table alongside the minimum size and the fee.

Hello, how does one pay the annual fee after just getting the card? Is it similar to how we pay our credit card bills, by transferring the sum to the card account?