CardUp has launched a new promotion called The More We Get Together, which offers both new and existing users a 1.55% to 1.65% promo code for a payment of up to S$10,000 in January 2024, based on the payments they make between now and 26 December 2023.

This presents an opportunity to buy miles from as little as 0.95 cents each, and there’s an extra S$30 off your first payment and a S$20 eCapitaVoucher for new CardUp users too.

This promotion is valid for payments that are:

- Scheduled on CardUp between 10 November 2023 and 26 December 2023 before 6 PM (SGT)

- With due dates between 14 November 2023 and 29 December 2023

Standard payments must be scheduled on CardUp at least three business days in advance of the due date to allow for processing time.

New & Existing users

Promo code for 1.55-1.65% fee

All CardUp users who make cumulative payments of at least S$10,000 during the promotion period will receive a promo code for a 1.55-1.65% fee as follows.

| Total Amount Transacted (Including Fees) |

Promo Code for Jan 2024 |

| S$10,000 to S$29,999 | 1.65% fee |

| S$30,000 to S$49,999 | 1.6% fee |

| S$50,000 and above | 1.55% fee |

The promo code can be used for a single domestic or international payment of up to S$10,000, with a due date between 11-31 January 2024.

Here’s an idea of how the cost per mile scales depending on the fee and your card’s earn rate. You’re basically buying miles anywhere from 0.95 cents to 1.35 cents apiece.

| Card Earns | 1.55% fee | 1.6% fee | 1.65% fee |

| 1.2 mpd | 1.27 cents | 1.31 cents | 1.35 cents |

| 1.3 mpd | 1.17 cents | 1.21 cents | 1.25 cents |

| 1.4 mpd | 1.09 cents | 1.12 cents | 1.16 cents |

| 1.5 mpd | 1.02 cents | 1.05 cents | 1.08 cents |

| 1.6 mpd | 0.95 cents | 0.98 cents | 1.01 cents |

A full list of cards that earn rewards for CardUp payments can be found here.

New Users only

S$30 off first payment

New users who use the promo code MILELION will enjoy up to S$30 off the fee for their first payment of any kind, with no minimum payment required. Payments can be made with any locally-issued Visa or Mastercard.

Given CardUp’s usual 2.6% fee, this represents free miles on a payment of up to S$1,154.

| Payment | CardUp Fee (2.6%) |

Discount | Nett Fee |

| S$500 | S$13 | (S$13) | – |

| S$750 | S$19.50 | (S$19.50) | – |

| S$1,154 | S$30 | (S$30) | – |

| S$1,250 | S$32.50 | (S$30) | S$2.50 |

| S$1,500 | S$39 | (S$30) | S$9 |

| S$2,000 | S$52 | (S$30) | S$22 |

S$20 eCapitaVoucher

But maybe you shouldn’t stop at just S$1,154, because new users who make a first payment of at least S$2,000 will receive a S$20 eCapitaVoucher.

This means your nett fees for a payment of S$2,000 will be around S$2, after adjusting for the S$30 off CardUp fees and the value of the S$20 eCapitaVoucher.

When will the gifts be credited?

The S$20 eCapitaVoucher and 1.55-1.65% bonus promo code will be sent via email to eligible users by 10 January 2024.

Terms & Conditions

The T&Cs for the MILELION promo code can be found here

The T&Cs for the S$20 eCapitaVoucher and 1.55-1.65% promo fee can be found here.

What card should you use for CardUp?

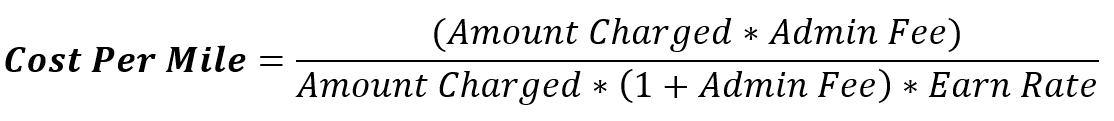

Since CardUp is basically a way of buying miles, the best card to use for CardUp is the one that gives the lowest cost per mile.

|

Two things to note about the above formula:

- Both the amount charged and the CardUp admin fee are eligible to earn miles. For example, if I charge S$1,000 to CardUp with a 2.6% admin fee, the full S$1,026 amount will earn miles

- The formula does not take into account the impact of rounding. For example, if I charge a S$1,026 CardUp transaction to a UOB card, I will only earn miles based on S$1,025 (because UOB rounds all transactions down to the nearest S$5). However, the impact of rounding becomes less significant as the amount charged increases

What this formula shows is that we can lower the cost per mile by:

- Maximising the earn rate

- Minimising the admin fee

Since CardUp transactions do not earn bonus points/miles, the equation becomes very simple: Use the highest-earning general spending card you have.

Refer to the post below for the full list.

Citi PayAll 1.8 mpd offer

|

| Citi PayAll 1.8 mpd Promo |

As a reminder, Citi PayAll is also running a concurrent promotion that offers 1.8 mpd on on all payments set up by 29 February 2024. With the admin fee of 2.2%, this works out to 1.22 cents per mile.

This does require a minimum aggregate spend of S$8,000, however, and there’s also a cap of S$120,000.

Refer to the post below for the full details.

Citi PayAll offering 1.8 mpd on all payments; buy miles at 1.2 cents each

Conclusion

CardUp has launched a new promotion that rewards new and existing users with a promo code of 1.55-1.65% for a payment of up to S$10,000 in January 2024, depending on the payments they make from now till 26 December 2023.

There’s an extra S$30 off your first payment and S$20 eCapitaVoucher for new users too, and since CardUp supports a wide range of payments (including insurance premiums, MCST fees, helper salaries, renovation bills, season parking, rent, car loans, income taxes and utilities bills), it shouldn’t be difficult to find something to charge.

Hi, for existing users, can use amex?

so does it mean that our first $10k transaction got to pay the normal rate i.e.2.6% , and then the promo code for the discount will come in during Jan?

No, you can pay with whatever promo codes are currently on offer eg get225 or saverent179

still not receiced the promo code yet.

No promo code received as at 11 Jan 2024 although I qualify for the 1.65% promo code.