Citi Rewards Cardmembers should know the drill by now: You earn 4 mpd on all online transactions, except those on the general exclusions list, mobile wallet and travel-related transactions.

However, Citi has now published an updated set of T&Cs, which take effect from 1 April 2024.

|

Important updates to Citi Rewards Card 10X Rewards Promotion Terms and Conditions (“Terms”) We wish to inform Citi Rewards Cardmembers that, with effect from 1 April 2024, the Terms will be updated to provide further details on what the bank considers as “travel-related transactions”. Please note that “travel-related transactions” will not earn 10X ThankYou Points under the Terms. You may refer to www.citibank.com.sg/RWD24 to view the revised Terms. |

This adds additional MCCs to the travel-related blacklist, although as we’ll see in a bit, these could very well be in effect already.

Citi Rewards Card updates travel-related blacklist

Citi Rewards Card Citi Rewards Card |

|

| T&Cs till 31 Mar 2024 | T&Cs from 1 April 2024 |

The Citi Rewards Card has a new set of T&Cs, which ostensibly take effect from 1 April 2024. For ease of comparison, I’ve run both the old and new T&Cs through Draftable.

The key changes come at Point 6 (ii), where the parts in blue have been modified.

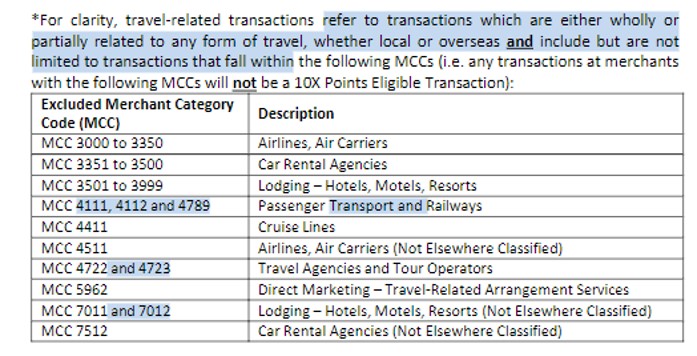

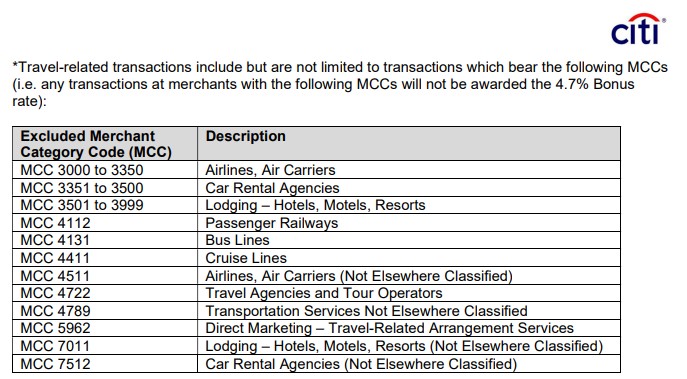

Let’s first talk MCCs. Citi has added the following MCCs to the Travel-related blacklist:

- MCC 4111 Transportation- Suburban and Local Commuter Passenger, including Ferries

- MCC 4789 Transportation Services Not Elsewhere Classified

- MCC 4723 Package Tour Operators (Germany Only)

- MCC 7012 Timeshares

Unless you’re buying tour packages in Germany or timeshares, the first two will probably have the greatest impact.

MCC 4111 includes the KLIA Express, SimplyGo (not that you ever earned any rewards for it in the first place, since Citi has a blanket exclusion on this category for all cards), and surprisingly, certain FavePay transactions.

MCC 4789 includes Car Lite and overseas Grab rides in certain countries. It also used to include CDG rides booked via Kris+, although those have since been updated to MCC 4121.

What’s more concerning is the language Citi has added, which gives them the right to include further, unspecified MCCs into their travel-related blacklist.

For clarity, travel-related transactions refer to transactions which are either wholly or partially related to any form of travel, whether local or overseas and include but are not limited to transactions that fall within the following MCCs

In fact, they may already have been doing this…

Were these MCCs already excluded?

While the T&Cs officially take effect from 1 April 2024, my understanding is that they may already be in play. In the MileChat, I’ve seen numerous data points dating back to early 2023 complaining that Citi Rewards transactions with MCCs 4111 and 4789 were denied the bonus 9X points (3.6 mpd).

When questioned, Citi CSOs claimed that these were “travel-related transactions”, notwithstanding the fact these MCCs were not mentioned in the Citi Rewards T&Cs. Appeals were unsuccessful.

Lending further credence to the idea that Citi is only now correcting a typo that went on for way too long is the fact that the Citi SMRT Platinum Visa Card has, for a while now, listed MCC 4789 (but not 4111) on its travel-related blacklist. It would be strange if two products from the same bank had different definitions of travel-related transactions.

Needless to say, this is poor form if true. Cardholders, through no fault of their own, were denied the bonuses they could reasonably have expected to receive just because Citi couldn’t keep its T&Cs up to date.

If you’ve been previously denied bonus points on MCCs 4111 and 4789 with the Citi Rewards Card, do sound off.

Conclusion

The Citi Rewards Card will be adding four additional MCCs to its travel-related blacklist with effect from 1 April 2024, although based on reports the exclusions could already be in effect. It’s still safe to use the card for Grab, gojek and CDG transactions in Singapore, however, because MCC 4121 is not part of the blacklist (at least, not that we know of!).

While it’s curious this change was announced around the same time that Amaze transactions stopped earning the bonus 9X points, I don’t believe there’s any connection between the two.

Nerfing their only good card. Why would Citi do this?

I wish I could understand Citi’s logic. So they are OK to award 4mpd for online transactions except all these travel related ones. What is Citi’s issue with travel? What would be their logic / business case I wonder for going to all this trouble to catch all these travel related transactions?

Margin

Care to elaborate? As I can’t see how that is the case. They don’t make anything on travel related transactions as people will devert them to other cards. They sure won’t be using the rewards card and receiving a mere 0.4mpd.

Do you know if this travel exclusion also applies if I use the Amaze card?