Hilton has launched its latest points purchase promotion, which offers a 100% bonus that reduces the cost per point to 0.5 US cents each, with a maximum purchase of 320,000 points. Depending on where and when you’re staying, buying points can be an opportunity to save on hotel stays when cash rates are high.

However, it’s definitely worth noting that Hilton has carried out some major award devaluations over the past year, and award nights at its top properties now cost a frightening 250,000 points (a significant increase from the 2024 ceiling of 150,000 points!).

Buy Hilton Points with a 100% bonus

|

| Buy Hilton Points with 100% bonus |

From now till 15 March 2026, 12.59 p.m SGT, Hilton Honors members who buy a minimum of 5,000 points will receive a 100% bonus. Offers may be targeted, so you’ll want to log in to your account and see what’s available to you.

Hilton points usually cost 1 US cent apiece, so with a 100% bonus — the largest we ever see Hilton offering — you’re paying 0.5 US cents per point. A maximum of 320,000 points (post-bonus) can be purchased per calendar year, and points can be pooled with up to 10 other members for the purposes of redemption.

Hilton points expire after 24 months of inactivity. Any earning or redemption activity will reset the clock.

What can you do with Hilton points?

Hilton no longer has a published award chart, but as a rule of thumb, free nights start from 5,000 points and max out at 250,000 points per night. That’s a very wide range, so be sure to use Hilton Points Explorer tool to check how your preferred property prices.

Hilton members with Silver status or higher enjoy the 5th night free on all redemptions. When comparing points redemptions to cash rates, don’t forget that points redemptions also include all taxes and fees.

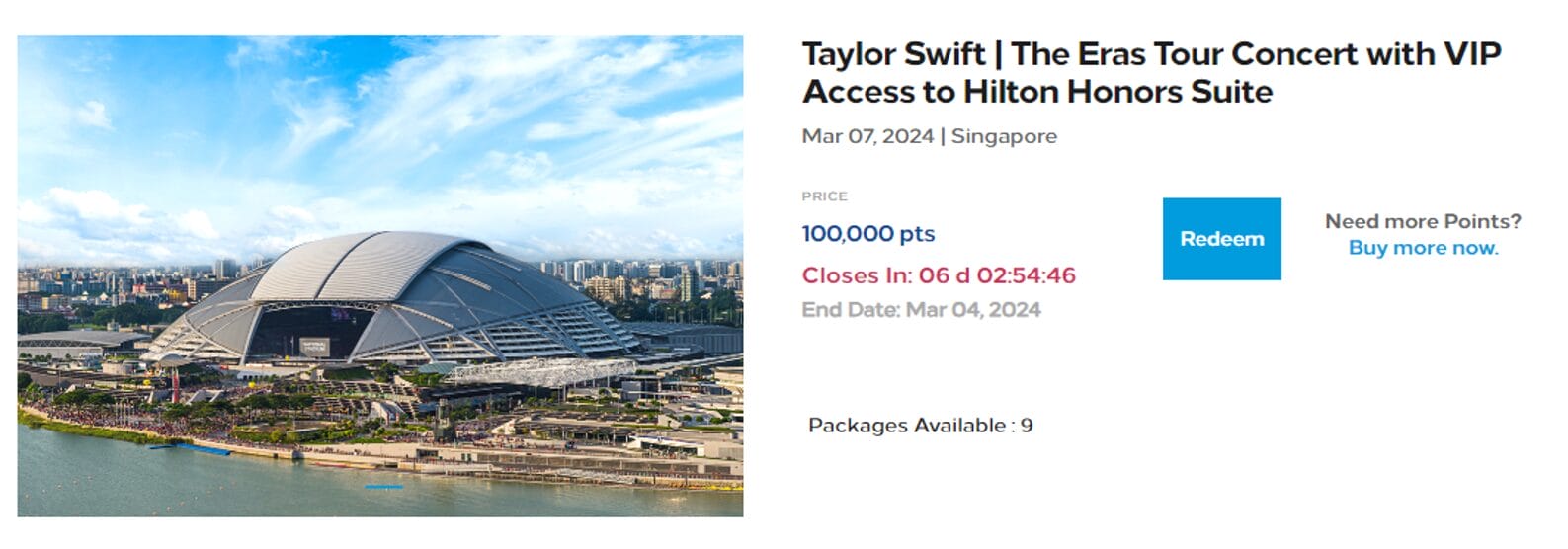

You can also use Hilton points to redeem experiences like sporting events or concerts. In February 2024, Hilton unexpectedly offered 10 pairs of tickets to the Hilton Suite at the National Stadium for Taylor Swift’s Eras Tour, which cost 100,000 points per pair. This was an insane redemption, and those who had points in their account could quickly jump on it (Hilton even refunded the points afterwards, which was a nice gesture to put it mildly). In March 2024, Hilton offered tickets to Bruno Mars’ sold-out Singapore tour from 70,000 points per pair, which was again a great deal.

Hopefully there’ll be more such offers to come!

What card should you use to purchase Hilton points?

Purchases of Hilton points are processed by Points.com in USD as MCC 7399 (i.e. they won’t code as hotel transactions).

Here are the best cards to maximise miles on this purchase.

| Card | Earn Rate | Remarks |

Citi Rewards Card Citi Rewards CardApply |

4 mpd | Cap of S$1K per s. month |

DCS Imperium Card DCS Imperium CardApply |

4 mpd | Min. S$4K FCY spend per c. month, otherwise 2.4 mpd |

Maybank XL Rewards Maybank XL RewardsApply |

4 mpd | Min S$500 per c. month, cap of S$1K per c. month |

UOB Visa Signature UOB Visa SignatureApply |

4 mpd | Min S$1K, max S$1.2K FCY spend per s. month |

StanChart Beyond Card StanChart Beyond CardApply |

3-4 mpd | 3 mpd for regular, 3.5 mpd for PB, 4 mpd for PP. No cap |

Maybank World Mastercard Maybank World MastercardApply |

3.2 mpd | Min. S$4K per c. month, no cap. Earn 2.8 mpd with min. S$800 per c. month |

Maybank Visa Infinite Maybank Visa InfiniteApply |

3.2 mpd | Min. S$4K per c. month, no cap, otherwise 2 mpd |

StanChart Visa Infinite StanChart Visa InfiniteApply |

3 mpd | Min S$2K per s. month, no cap, otherwise 1 mpd |

BOC Elite Miles Card BOC Elite Miles CardApply |

2.8 mpd |

No min. spend or cap |

Maybank Horizon Visa Signature Maybank Horizon Visa SignatureApply |

2.8 mpd | Min S$800 per c. month, no cap, otherwise 1.2 mpd |

| S. Month= Statement Month | C. Month= Calendar Month | ||

Remember, you can pair the Citi Rewards Card with Amaze to earn 4 mpd on Points.com purchases, while paying lower FCY fees than banks.

Do not use HSBC cards or the DBS Woman’s World Card for Points.com purchases, as MCC 7399 will not earn bonus points. You should also avoid using the Chocolate Visa Card, as MCC 7399 is now considered a “bill payment” and can only earn up to 100 Max Miles each month.

Conclusion

|

| Buy Hilton Points with 100% bonus |

Hilton Honors is now selling points with a 100% bonus, which might be a way of saving on hotels around peak periods. The purchase cap this time round allows you to buy up to 320,000 points, and you can pool points with other members to make a redemption.

That said, Hilton award prices have significantly increased over the past two years, and you definitely want to check the prices before buying points. Never buy them speculatively- Hilton runs these sales very often, so you don’t need to worry about missing out.

Thanks for the lead Aaron. I’m planning to add some points for my trip to Paris in May for the French Open.

Is the 100% bonus targeted. I clicked the link above and logged in to my hilton honor account and it shows 80% bonus only.

Same, shows 80% bonus only. Fyi, Gold member.

Ah, interesting. Thought it was programme wide. I’m not a buyer at 80%, only at 100%

I’m Diamond and being offered 80% bonus.

I am Diamond and got 100%

Gold and 80% too.

Gold and 100%

I am offered 100% and can purchase 160k points

Thanks Aaron for sharing this.

Can I clarify is it not all the time using points ate cheaper? I am looking at hilton surfer paradise, the 2 bedroom cos 130,000 pts which make up to USD650 if we buy the bonus points. But if I pay only in cash is only Aud409. Not sure if I make a mistake in calculating. Thanks

of course it depends on what the revenue rate is. points are not always the better option.

i try to book Conrad BKK but realised is not much cheaper just that if you stay 4 nights, it has a 5th night free…and their booking engine is strange cos it doesnt show the total points needed before you buy the points

Few days ago I was checking out Hilton Orchard & the cash rate in app is slightly cheaper than using points assuming one values points at 0.5 cents (some May value it differently). So yeah, points not always worth it.

Hey Aaron, seems I’m being capped at 80K points pre bonus (i.e. 80K + 80K bonus). Not sure if everyone else is getting 160K pre-bonus but i’m still at the outdated cap it seems haha

thanks for the dp! maybe they’re targeting different accounts differently

Another dp: Gold member, 100% bonus, capped at 80k pre-bonus.

Gold, 100%, 160k +160k

Bought some at the same rate last year too.

I’ve nv bought H.H points before. Current campaign, I am offered to buy 80K+80K(bonus 100%) at $800 I am on H.H Gold Status

Can we pair OCBC Mastercard with amaze?

Just received the email from Hilton. Silver member. 100% bonus for max 160k points

Thanks Aaron, quick question, was it worth using HSBC Revolution to purchase the points? would I be still entitled 4pmd with this purchase?

+1

Was thinking of using citi rewards (visa & master) to buy to max out the 4mpd on each card.

any idea if i have to buy $1600 usd one time or split into 2 transactions on each visa/master? Thanks

You can buy in multiple transactions

Hi, Surprised to see Citi Rewards on the list as I always thought travel related transactions do not qualify?

Hi Aaron, I clicked on the link but it said ” Sorry, purchasing Points is not available at this time”. I am Hilton Gold member

since its MCC 7399, this means i will be charged 1% when using Amaze + Citi Rewards, right? If so, would that still be cheaper compared to simply using Citi Rewards and paying the FCY charge?

Hello, the extra 1% charge for MCC 7399 is only when the transaction is charged in SGD. For FX charges, the extra 1% does not apply.

I get an error message on my Hilton account that I had upgraded to silver status with Amex KF Ascent saying that no points are available for purchase at this point. However the points promo is offered on my other un-upgraded Hilton account. Any idea what’s going on?

Hi, is it possible to pair Citibank Reward Card with Amaze for 4mpd?

Your article didn’t specific mention

It’s now 2 Jan 2025, and Hilton is back selling points with 100% bonus, capped at 160k points pre bonus. Any chance the % bonus and cap will go up this year?