Ever since the HSBC TravelOne Card launched back in May 2023, it’s been running a 20,000 miles welcome offer. The minimum spend was originally set at S$800, but was later hiked to S$1,000 in September 2023, where it’s remained ever since.

Well, HSBC has now decided to cut the minimum spend by 50% to S$500, with all other criteria remaining the same.

HSBC Travel One Cardholders have access to the widest range of transfer partners in Singapore (21 airlines and hotels), and even though the S$196.20 annual fee must be paid, the price per mile is a very competitive 0.98 cents. However, the possibility of a 10,000 points conversion fee from June 2024 puts a dampener on things, so we’ll need to keep an eye on that.

HSBC TravelOne Card 20,000 miles welcome offer

|

|||

| Apply |

Applicants for the HSBC TravelOne Card can choose from two different offers:

- Fee-paying option

- Fee-waiver option

Fee-paying option

From 23 February to 30 June 2024, customers who apply for a HSBC TravelOne Card will receive 20,000 bonus miles (in the form of 50,000 HSBC points) when they:

- Pay the annual fee of S$196.20

- Spend at least S$500 by the end of the month following approval

- Provide marketing consent during application

This offer is open to all applicants, regardless of whether or not they currently hold a HSBC credit card. However, if they have cancelled a HSBC TravelOne Card in the past 12 months, they will not be eligible to receive the welcome offer again.

Bonus miles are on top of the base miles that TravelOne Cardholders normally earn, namely:

- 1.2 mpd for local currency spend

- 2.4 mpd for foreign currency spend

For example, if you spend the full S$500 in local currency, you’ll receive a total of 20,600 miles (20,000 bonus, 600 base).

Since the S$196.20 annual fee must be paid, you’re basically paying 0.98 cents per mile (another way of viewing it is that you’re enjoying 40 mpd on the first S$500 spent).

Fee waiver option

As an alternative, applicants can choose to receive a first year fee waiver for the HSBC TravelOne Card. If this option is chosen, they will not be eligible for the 20,000 miles welcome gift.

However, they’ll still receive the usual card benefits including four lounge visits per calendar year. Remember, your first membership year will straddle two calendar years, so that’s actually eight free visits at no charge to you.

If this is your plan, I’d recommend applying towards the middle of the year so you’re not so rushed to redeem the second calendar year’s visits. For example:

- Card approved in March 2024

- 4x lounge visits to be used from Mar-Dec 2024

- 4x lounge visits to be used in Jan-Feb 2025

- Card approved in June 2024

- 4x lounge visits to be used from Jun-Dec 2024

- 4x lounge visits to be used from Jan-May 2025

What counts as qualifying spend?

Cardholders must make a minimum qualifying spend of S$500 by the end of the month following card approval.

| Card Account Opening Date | Qualifying Spend Period |

| 23-29 Feb 2024 | 23 Feb to 31 Mar 2024 |

| 1-31 Mar 2024 | 1 Mar to 30 Apr 2024 |

| 1-30 Apr 2024 | 1 Apr to 31 May 2024 |

| 1-31 May 2024 | 1 May to 30 Jun 2024 |

| 1-30 Jun 2024 | 1 Jun to 31 Jul 2024 |

| 1-14 Jul 2024 | 1 Jul to 31 Aug 2024 |

You basically have anywhere between 1-2 months to meet the minimum spend, depending on when your card is approved. Try to get approved early in the month so you have more time to make the minimum spend.

Qualifying spend includes all online and offline retail transactions, excluding the following:

|

The key exclusions to note here are insurance, utilities, education, government transactions as well as CardUp/ipaymy. These were all excluded from 1 July 2020 onwards as part of HSBC’s revised rewards terms and conditions.

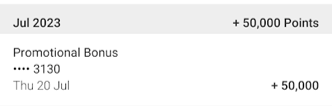

When will bonus miles be credited?

The 20,000 bonus miles will be credited (in the form of 50,000 HSBC points) within 90 days from the card opening date, provided the eligibility criteria is met.

In my personal experience, I applied in early May and received the bonus points on 20 July 2023.

Terms & Conditions

The terms & conditions of this welcome offer can be found here.

What can you do with HSBC points?

HSBC points earned on the TravelOne Card can be transferred to 21 airline and hotel partners, following the recent addition of United MileagePlus.

Airlines

| ✈️ HSBC TravelOne Airline Partners | |

| Frequent Flyer Programme | Conversion Ratio (HSBC Points : Partner) |

| 50,000 : 10,000 | |

| 40,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

|

30,000 : 10,000 |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 |

|

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

|

25,000 : 10,000 |

Hotels

| 🏨 HSBC TravelOne Hotel Partners | |

| Hotel Programme | Conversion Ratio (HSBC Points : Partner) |

|

30,000 : 10,000 |

| 25,000 : 5,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

Conversions can be done via the HSBC Singapore app (Android | iOS) and are processed instantly, with the exception of the following:

- Club Vistara: Within 5 business days

- Hainan Fortune Wings Club: Within 5 business days

- Japan Airlines Mileage Bank: Within 10 business days

Transfers are free of charge till 31 May 2024, after which something else may happen…

New conversion fee from June 2024?

Back in November 2023, HSBC announced that it would be adding a hefty 10,000 points conversion fee to the TravelOne Card, which would take effect from 25 January 2024.

The backlash was fierce (and predictable), and HSBC eventually kicked the can down the road by extending free conversions till 31 May 2024.

However, HSBC has not committed to abandoning the fee altogether, and this should concern you. Bonus points will take up to 90 days from the date of approval to post (which based on today’s date would be 9 June 2024), and assuming HSBC goes ahead and introduces the 10,000 points fee on 1 June 2024, then 20% of your welcome bonus will be burned on the conversion fee alone!

Let’s be clear: a 10,000 points conversion fee is just ludicrously expensive, and whoever proposed that needs a serious reality check. It works out to 4,000 KrisFlyer miles, worth at least S$60 by my valuation, and 2.5X the usual S$25 fee that other banks charge.

I certainly hope HSBC provides some clarification soon, because this possibility would weigh on any would-be applicant’s mind.

SingSaver alternative

|

| Apply Here |

If the potential conversion fee concerns you, alternative gifts are available via SingSaver.

Instead of 20,000 welcome miles, applicants can choose from:

- Dyson Supersonic (retail price: S$699)

- Nintendo Switch OLED (retail price: S$549)

- Apple iPad 9th Gen 10.2″ WiFi 64GB (retail price: S$508.30)

- S$350 eCapitaVoucher

- S$300 cash

You must pay the S$196.20 annual fee if you apply via SingSaver, so you’ll need to net that off from the value of the gifts above. The same S$500 minimum spend within 1-2 months of approval still applies.

| ❓ New-to HSBC? |

|

If you meet the definition of a new-to-HSBC customer, you might want to consider applying for a different HSBC credit card first, such as the: These cards offer the same welcome gift as the TravelOne, but do not require you to pay an annual fee. You can then apply for the HSBC TravelOne Card and still enjoy the gifts mentioned in this post, because HSBC does not include the TravelOne Card in its definition of a new/existing customer. |

As a reminder, SingSaver is currently running its March Madness promotion which automatically upgrades every 10th applicant’s gift to an iPhone 15 128GB model. More details can be found in the post below.

SingSaver March Madness: 220x iPhone 15s and Business Class tickets to Tokyo up for grabs

Conclusion

The HSBC TravelOne Card has cut the minimum spend for its 20,000 miles welcome offer from S$1,000 to S$500. While you’ll still need to pay the first year’s S$196.20 annual fee, this is the lowest minimum spend we’ve seen- when the card first launched, the minimum spend was S$800.

The key thing to remember is that HSBC may or may not introduce a 10,000 points conversion fee from 1 June 2024. If they do, that’s 20% of your welcome bonus gone, so hopefully common sense prevails.

If that’s too much uncertainty for you, an alternative option is available via SingSaver, which trades the 20,000 miles for cash, eCapitaVouchers or gadgets.

Just to confirm. This sign up bonus does not have the strange existing cardholders clause? I don’t see it in the T&Cs. I had Revo since July 2023, so in most promos, I am neither new nor existing for T1. Does it apply here?

Hello! With the upcoming changes to the HSBC rewards system with points now pooling across cards from end of May, is there any information on how redemption works? Could we use either the TravelOne or Revolution card to redeem? And any idea if the fees change for either?

Please note you can’t waive the annual fee for this card. So xfer out the points ASAP.