The HSBC TravelOne Card launched back in May 2023, bringing with it 12 airline and hotel partners, fee-free instant conversions, four lounge visits per year and a welcome offer of 20,000 bonus miles.

The welcome offer was supposed to lapse on 31 August 2023, but has now been extended till 31 December 2023. However, the minimum spend requirement (which was previously S$800) has been increased to S$1,000. As before, the welcome offer is available to both new and existing HSBC cardholders.

In addition to this, HSBC has also added a first-year fee waiver option, for those who do not wish to pay the S$194.40 annual fee. In that case, you won’t be eligible for the 20,000 welcome miles, but will still enjoy the other benefits of the card including the free lounge visits.

Customers can select which option they prefer at the time of application.

HSBC TravelOne Card 20,000 miles welcome offer

|

|||

| Apply |

Customers can now choose from a fee-paying or fee waiver option when they apply for a HSBC TravelOne Card.

Update: SingSaver has suspended the S$40 cash campaign until further notice

Regardless of which option they choose, they will receive an extra S$40 cash when they apply via SingSaver by 1 October 2023, provided they:

do not currently hold a principal HSBC credit cardhave not cancelled a principal HSBC credit card in the past 12 months

No minimum spend is required for the SingSaver gift.

Remember to complete the SingSaver Rewards Redemption Form, and forward the card approval email from HSBC to info@singsaver.com.sg using the same email you used to complete the Rewards Redemption Form.

Fee-paying option

From 1 September to 31 December 2023, customers who apply for a HSBC TravelOne Card will receive 20,000 bonus miles (in the form of 50,000 HSBC points) when they:

- Pay the annual fee of S$194.40

- Spend at least S$1,000 by the end of the month following approval

- Opt-in for marketing communications during sign-up

This offer is open to all applicants, regardless of whether or not they currently hold a HSBC credit card. However, if they have cancelled a HSBC TravelOne Card in the past 12 months, they will not be eligible to receive the welcome offer again.

The bonus miles are on top of the base miles that TravelOne Cardholders normally earn, namely:

- 1.2 mpd for local currency spend

- 2.4 mpd for foreign currency spend

For example, if you spend the full S$1,000 in local currency, you’ll receive a total of 21,200 miles (20,000 bonus, 1,200 base).

Since the S$194.40 annual fee must be paid, you’re basically paying 0.97 cents per mile (or 0.77 cents per mile, once the SingSaver S$40 cash is factored in). That’s one of the better options available on the market right now.

Fee waiver option

As an alternative, applicants can choose to receive a first year fee waiver for the HSBC TravelOne Card. If this option is chosen, they will not be eligible for the 20,000 miles welcome gift.

However, they’ll still receive the usual card benefits including four lounge visits per calendar year- and remember, your first membership year will straddle two calendar years, so that’s actually eight free visits at no charge to you.

What counts as qualifying spend?

Cardholders must make a minimum qualifying spend of S$1,000 by the end of the month following card approval. Do note that this is an increase of 25% compared to the previous requirement of S$800.

| Card Account Opening Date | Qualifying Spend Period |

| 1-30 Sep 2023 | 1 Sep to 31 Oct 2023 |

| 1-31 Oct 2023 | 1 Oct to 30 Nov 2023 |

| 1-30 Nov 2023 | 1 Nov to 31 Dec 2023 |

| 1-31 Dec 2023 | 1 Dec to 31 Jan 2024 |

| 1-15 Jan 2024 | 1 Jan to 29 Feb 2024 |

You basically have anywhere between 1-2 months to meet the minimum spend, depending on when your card is approved. Try to get approved early in the month so you have more time to make the minimum spend.

Qualifying spend includes all online and offline retail transactions, excluding the following:

|

The key exclusions to note here are insurance, utilities, education, government transactions as well as CardUp/ipaymy. These were all excluded from 1 July 2020 onwards as part of HSBC’s revised rewards terms and conditions.

When will bonus miles be credited?

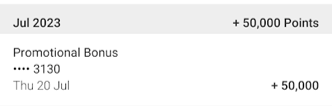

The 20,000 bonus miles will be credited (in the form of HSBC points) within 90 days from the card opening date, provided the eligibility criteria is met.

In my personal experience, I applied in early May and received the bonus points on 20 July 2023.

Terms & Conditions

The terms & conditions of this welcome offer can be found here.

What can you do with HSBC points?

HSBC points earned on the TravelOne Card can be transferred to nine airline and three hotel partners.

Conversions can be done via the HSBC Singapore app (Android | iOS) and are processed instantly, with the exception of Accor Live Limitless which takes five business days.

| ✈️ HSBC TravelOne Airline Partners | |

| Frequent Flyer Programme | Conversion Ratio (HSBC Points : Partner) |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 |

|

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

|

25,000 : 10,000 |

| 🏨 HSBC TravelOne Hotel Partners | |

| Hotel Programme | Conversion Ratio (HSBC Points : Partner) |

| 25,000: 5,000 | |

| 25,000: 10,000 | |

| 25,000 : 10,000 | |

| ⚠️ HSBC TravelOne Exclusive |

|

Unfortunately, these additional partners will not be available to HSBC Revolution and HSBC Visa Infinite Cardholders, who will only be able to convert their HSBC points to KrisFlyer and Asia Miles for the time being. While there are plans to eventually make these new partners available to the rest of HSBC cardholders, it won’t be happening in the near future. |

All conversion fees will be waived until 31 December 2023.

Overview: HSBC TravelOne Card

|

|||

| Apply | |||

| Income Req. | S$30,000 p.a. | Points Validity | 3 years |

| Annual Fee (Including GST) |

S$194.40 (FYF option) |

Min. Transfer |

25,000 points (10,000 miles)^ |

| Miles with Annual Fee | N/A | Transfer Partners |

|

| FCY Fee | 3.25% | Transfer Fee | Free (till 31 Dec 23) |

| Local Earn | 1.2 mpd | Points Pool? | No |

| FCY Earn | 2.4 mpd | Lounge Access? | Yes: 4x Dragon Pass |

| Special Earn | N/A | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

| ^Subsequently 2 miles | |||

The HSBC TravelOne Card has a minimum income requirement of S$30,000 and an annual fee of S$194.40.

Cardholders will earn 1.2 mpd on all local currency spend, and 2.4 mpd on all foreign currency spend with no minimum spend or caps. Points earned on this card can be transferred to 12 airline and hotel partners, with no transfer fee applicable till 31 December 2023.

Other perks include:

- Four complimentary DragonPass lounge visits per calendar year

- Complimentary travel insurance coverage (including COVID-19) of up to US$100,000

- Complimentary ENTERTAINER with HSBC membership

For a full review of this card, refer to the post below.

Conclusion

The HSBC TravelOne Card has extended its 20,000 miles welcome offer till 31 December 2023, but has also increased the minimum spend from S$800 to S$1,000. Both new and existing HSBC cardholders are eligible, and the former can get an extra S$40 cash when applying via SingSaver.

You will need to pay the first year’s S$194.40 annual fee to enjoy this offer, but should you not wish to do so, a fee waiver option (sans miles) is available. You’ll still receive the S$40 cash provided you’re a new HSBC cardholder, as well as the complimentary lounge visits.

Hope we can get point pooling before 31 December

Hi, fee waiver option got no minimum spending requirement right?

first year: no min spend

second year onwards: spend $25k to get a fee waiver. remains to be seen how strictly this is enforced.

There’s a better offer in shopback for 20k miles and $250 cashback capped at first 7k applicant.

Have checked with hsbc, who tell me the shopback offer does not include the 20k miles

Ahh right. Forget that 20k miles is a sign up gift not an annual fee bonus. My bad.

@Woo T, read previous HSBC PSA article from here

Can confirm if Shopback is applicable to existing HSBC cardholders? I read the T and C one part it says excluding existing TravelOne Card holder, but the other section says excluding existing HSBC cardholders

Hopefully the Aeroplan will be added prior to 31 Dec 2023.

Given the earn rate and transfer partners, is there any compelling reason to move my spend from Citi Premier Miles to HSBC TravelOne? I already get lounge access through Amex, so Dragon Pass not useful to me.

I tried to apply for the card with HSBC. Got rejected even though income is much more than required. Provided all the information as requested. I asked for the reason of rejection and they refused to reveal. HSBC is not a transparent organization. Working in financial institution, we will reveal to the clients the reasons for say loan rejections. Maybe it is age or they don’t think it will be more business for them. Oh well, HSBC no longer make sense for me and better to move on to other organizations.