Citi Rewards Cardholders will hopefully be familiar with its mantra by now: 4 mpd on all online spend, excluding mobile wallet and travel-related transactions.

Citi Rewards Card Citi Rewards Card |

||

| Component | Awarded | Cap |

| Base: 1X points 0.4 mpd |

Awarded when transaction posts | No cap |

| Bonus: 9X points 3.6 mpd |

$1,000 per statement month | |

This rule is laid out clearly in the Citi Rewards Card T&Cs at point 6(ii):

10X Points Eligible Transaction refers to:

…a Qualifying Charge made at an online retail merchant, excluding mobile wallet and travel-related transactions

What isn’t so clear is how Citi defines a “mobile wallet transaction”. Unlike the exclusion for travel, which I’ve addressed in a separate post, there’s no explicit definition provided for the term “mobile wallet”.

So what exactly does Citi mean?

How does the Citi Rewards Card define “mobile wallet”?

What does not count as a mobile wallet transaction

Let’s first clarify what Citi does not mean by a mobile wallet transaction.

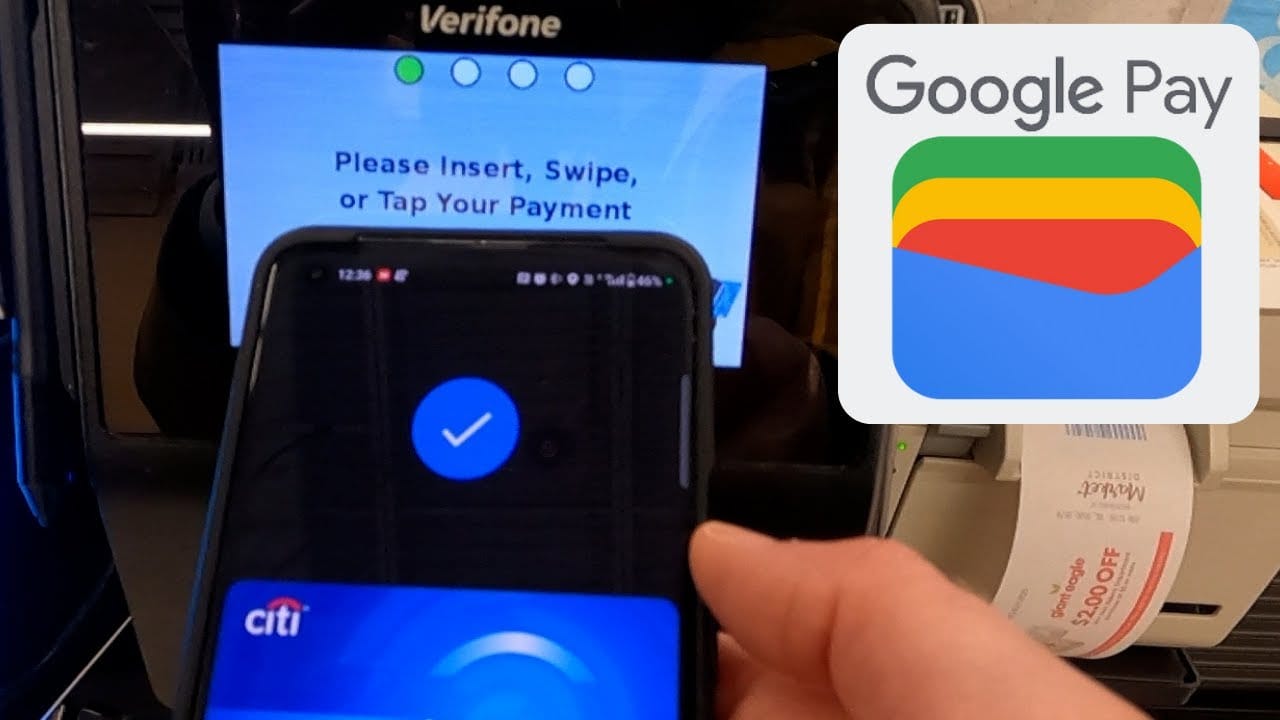

Citi does not mean situations where you add the Citi Rewards Card to your Apple, Google or Samsung Pay wallet and make in-store payments at brick and mortar merchants by tapping your phone or watch.

These transactions will earn 4 mpd, assuming it falls under one of the whitelisted MCCs:

| MCC | Description |

| 5311 | Department Stores |

| 5611 | Men’s and Boy’s Clothing and Accessories Stores |

| 5621 | Women’s Ready to Wear Stores |

| 5631 | Women’s Accessory and Specialty Stores |

| 5641 | Children’s and Infant’s Wear Stores |

| 5651 | Family Clothing Stores |

| 5655 | Sports and Riding Apparel Stores |

| 5661 | Shoe Stores |

| 5691 |

Men’s and Women’s Clothing Stores |

| 5699 | Misc. Apparel and Accessory Shops |

| 5948 | Luggage and Leather Goods Stores |

What counts as a mobile wallet transaction

What Citi means by a mobile wallet transaction are situations where you add the Citi Rewards Card to your Apple, Google or Samsung Pay wallet and make in-app or online payments at virtual merchants. All such transactions will only earn 0.4 mpd.

For example, Deliveroo gives you a choice to make payment with your credit card, or with Google Pay:

- If you pay with your Citi Rewards Card directly, you earn 4 mpd

- If you pay with your Citi Rewards Card via Google Pay, you earn 0.4 mpd

Keep in mind that this restriction only applies to the Citi Rewards Card. If you were to use a different Citi card, like the Citi PremierMiles Card, you’d earn 1.2 mpd regardless.

So, long story short, you should use a “naked” Citi Rewards card whenever you transact in-app or online, which will ensure you earn 4 mpd (provided the merchant doesn’t fall into the Travel-related blacklist either).

What if I don’t have a choice?

There are some apps like Kris+ and XNAP (RIP?) which do not give you the option of using a “naked” credit card, and require you to use Apple or Google Pay.

Thankfully, there’s still a simple workaround in the form of Amaze. All you need to do is:

- Pair your Amaze with Citi Rewards

- Add Amaze to your Google Pay wallet

- Make payment in-app with Amaze

Going about it this way will allow you to earn 4 mpd with the Citi Rewards Card, even with in-app or online mobile wallet payments.

Conclusion

Citi Rewards Cardholders will not earn 4 mpd on in-app mobile wallet transactions, but fortunately there’s a simple enough workaround: just use the Citi Rewards Card directly wherever possible, or else pair it with Amaze.

This restriction has no bearing on in-store mobile wallet transactions, so you can continue to tap your phone and pay with your Citi Rewards Card at department stores or clothing stores which fall under the MCC whitelist.

Same for CRV?

applies to both.

Does someone know if phone purchases at an M1 store earn the 10 points per dollar spent? My monthly phone bills seem to have gotten that rate, but I am not sure about brick-and-mortar store purchases. My wife is on the way there now to get a new phone, and we are still not sure, so would appreciate some swift advice from someone who knows. 🙂

No. If payment is not made online, only certain shopping MCC gives 10x points. Telco is not one of these MCC.

Thank you!

Would have been faster to ask on Telegram no?

Am confused…if i use gpay (mapped to my citibank card) to pay for my shoes purchase, will i be eligible for 10x points?

Yes, if the shoes purchase fall under one of the selected MCCs for shopping. The “mobile wallet” exclusion affected online spend only.

Oh man. Lol I had to read this article 2 times. Lol 😂 why is Citibank making it so tough .

Thank you Aaron. I think it’s so ridiculous and complex. Sigh

this is why i never use any mobile payments. I take physical card every time

I’m surprised you didn’t know this. There was some big hoo-ha few years ago because Apple wanted to be charged lower commissions like a chip credit card (their argument was Apple pay is just as secured as the physical card), instead of higher commission like an online purchase. So using Apple pay or Google pay is as if you are paying with a physical card.

The Citi rewards perk for 10x points for online and shopping transactions. Those members would also get 10x when using their physical card for shopping…

Ahh… I thought I read somewhere that using CRV to top-up Shopee wallet actually gets 10x too. Am I mistaken and/or getting on with age?

As much as I tried to understand this issue, my experience is different. I’ve only used CRV thru Apple Wallet, and have not carried the physical card with me for years. I’ve always meticulously checked my reward points credited (w statement, excel spreadsheet & citi login), and over the years all the expenditure and points credited reconciled properly (a few points here and there excepted, and a few boo-boos on my part when I used the card wrongly on bonus-ineligible spends). Generally Citi has awarded bonus points on all my in-person contactless spend at the Departmental stores (CK Tangs mainly).… Read more »

This refers to online spend.

What about for transactions made by Kris+ (mobile transaction) and those PayWave payments at restaurants at hotel outlets using the Citi Rewards card? Would these be entitled to 4 miles per dollar earning?

Made a payment for predeparture ART on Raffles Medical app and did not get 10x.. only 1x was awarded, is it same issue as above?

will i be eligible for 10x rewards if i perform a contactless payment using apple watch for the Citi Rewards card at a physical merchant? getting a little confused here thanks!

What if you use Kris+ app in-store and it opens up the Apple Wallet?

Just wanna clarify if using Amaze+Citi then adding Amaze to GPay, and paying via contactless using GPay with Amaze in-store, does it still count as an online transaction and earns 4mpd? Thanks!

Currently apple support amaze

Check on points works there and update the information accordingly

Hi, if you use Amaze card on mobile wallet does it still count?

Hi! I just checked with Citi regarding this:-

“In-store mobile wallet transactions will still earn 4 mpd, subject to the transaction falling on the Citi Rewards Card’s bonus whitelist”

As I wasn’t awarded bonus points for a transaction using mobile payment at a physical store, I was informed by Citi that regardless in-store or online, ALL mobile wallet transactions are ineligible for bonus points. (!!!)

This is incorrect. The exclusion is only for in-app transactions. If points were not received, there is likely to be another reason, such as incorrect MCC, or bonus cap having been reached already.

Exactly what I told the officer. My previous transactions at this store using physical card had been awarded with bonus points; and I hadn’t maxed out the bonus cap for this.

which store was it, out of curiousity?