Last month, HSBC announced that it would be ending the HSBC Visa Infinite Card’s step-up earn rates permanently, with effect from 20 May 2024.

The step-up earn rate, which required a minimum cumulative spend of S$50,000 in the previous membership year to activate, offered cardholders an enhanced earn rate of 1.25/2.25 mpd on local/overseas spend, instead of the regular (and mediocre) 1/2 mpd.

As the carrot to the stick, the bank did promise to offer the step-up earn rate to all existing cardholders for a limited time.

For HSBC existing Visa Infinite credit cardholders, we will be running an exclusive promotion to enjoy the step-up earn rate for a limited period of time. We will provide the details soon, thank you for your support

-HSBC

Now, my interpretation of this was that all HSBC Visa Infinite Cardholders, regardless of previous membership year activity (or lack thereof), would be offered the step-up earn rate for a certain period.

Unfortunately, that interpretation was wrong. HSBC has now released the details of this “last hurrah”, and it’s all stick, no carrot.

HSBC Visa Infinite phasing out step-up earn rates

The HSBC Visa Infinite landing page has been updated with details on how the step-up earn rate will be sunset.

In short, if your HSBC Visa Infinite was:

- approved before 20 May 2023, and

- you spent at least S$50,000 in qualifying transactions in your previous membership year

you’ll be eligible for the step-up earn rate of 1.25/2.25 mpd till the last day of the month in which your next card anniversary falls.

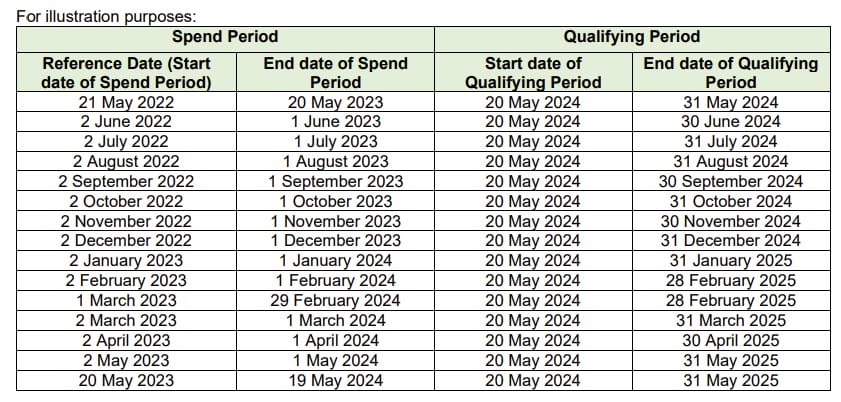

HSBC has provided the following illustration:

It’s not what I expected, quite frankly. HSBC is basically saying that they’ll let existing HSBC Visa Infinite Cardholders finish out their current year of Step-Up Earn Rates, but I’m not giving them any kudos for doing something that should have done in the first place.

In fact, the real headline here is how unfair this is to HSBC Visa Infinite Cardholders approved after 20 May 2023. I can imagine you’d be especially aggrieved if you were approved in June 2023, for example, and spent the past 11 months dutifully clocking transactions towards the S$50,000 mark in anticipation of enjoying the step-up earn rate from your second membership year onwards

Mind you, I don’t think anyone should be doing that in the first place since S$50,000 is a lot of spending that could have been put on 4 mpd cards, but I’m sure there are people out there in this position.

Given that HSBC only announced the termination of the step-up earn rate in April 2024, a much fairer way of implementing this would be to remove the feature for cardholders approved from May 2024 onwards, since this group would have been fully aware of the situation going in.

So all things considered, I’m rather unimpressed by how HSBC is handling this- probably even more so had I paid the S$662 annual fee (the highest among the $120K segment!).

What counts as qualifying spend?

To enjoy the step-up earn rate, cardholders must have spent at least S$50,000 in qualifying transactions in the previous membership year.

HSBC has published a list of non-qualifying transactions, which includes the usual suspects such as:

- Charitable donations

- Education

- Government transactions

- Hospitals (new exclusion from 20 May 2024 that shouldn’t count retroactively, but who knows?)

- Insurance premiums

- Utilities

HSBC also excludes CardUp/ipaymy from qualifying spend, and does not award any base points on these transactions.

When will bonus points be credited?

HSBC Visa Infinite Cardholders will earn the regular rate of 1/2 mpd on local/overseas spend initially.

The bonus 0.25 mpd for the step-up earn rate will be credited (in the form of HSBC Rewards Points) by the last day of the following calendar month.

Terms & Conditions

The T&Cs for the HSBC Visa Infinite Card’s step-up earn rates can be found here.

How does the HSBC Visa Infinite compare to the competition?

As I mentioned previously, the HSBC Visa Infinite’s regular earn rate of 1/2 mpd on local/overseas spend is simply not competitive enough for the $120K segment which it occupies. Even the step-up earn rate would be middling at best.

| 💳 Earn Rates for General Spending Cards (income req.: S$120K) |

||

| Card | Local Spend | FCY Spend |

SCB Visa Infinite SCB Visa Infinite |

Up to 1.4 mpd* | Up to 3 mpd* |

DBS Vantage DBS Vantage |

1.5 mpd | 2.2 mpd |

OCBC VOYAGE OCBC VOYAGE |

1.3 mpd | 2.2 mpd |

UOB VI Metal Card UOB VI Metal Card |

1.4 mpd | 2.4 mpd |

Citi Prestige Citi Prestige |

1.3 mpd | 2 mpd |

Maybank Visa Infinite Maybank Visa Infinite |

1.2 mpd | 2 mpd |

HSBC Visa Infinite HSBC Visa Infinite |

1 mpd | 2 mpd |

AMEX Plat. Reserve AMEX Plat. Reserve |

0.69 mpd | 0.69 mpd |

| *Min. S$2,000 spend per statement month, otherwise 1 mpd for both SGD and FCY | ||

That’s all the more so following the nerfs to the HSBC Everyday Global Account. Previously, HSBC Visa Infinite Cardholders could supplement the earn rates with an extra 1% cashback from the EGA, but since 2 May 2024 this is no longer possible.

Conclusion

The HSBC Visa Infinite Cardholders who were approved before 20 May 2023 will continue to enjoy their step-up earn rates until the end of their current membership year, provided they met the minimum spend in their previous membership year.

However, cardholders who were approved more recently will not enjoy a similar concession, and that’s not going to sit well with those who were clocking spend in good faith based on the promise of a better earn rate in the following year.

It’s hard to believe that HSBC believes that a S$662 credit card with a 1/2 mpd earn rate is competitive enough in the current market, but there you have it.

You would think HSBC would offer some enhancement to offset the step down in miles earning but it looks like they’re intent on screwing their old loyal cardmembers … really cheap of HSBC