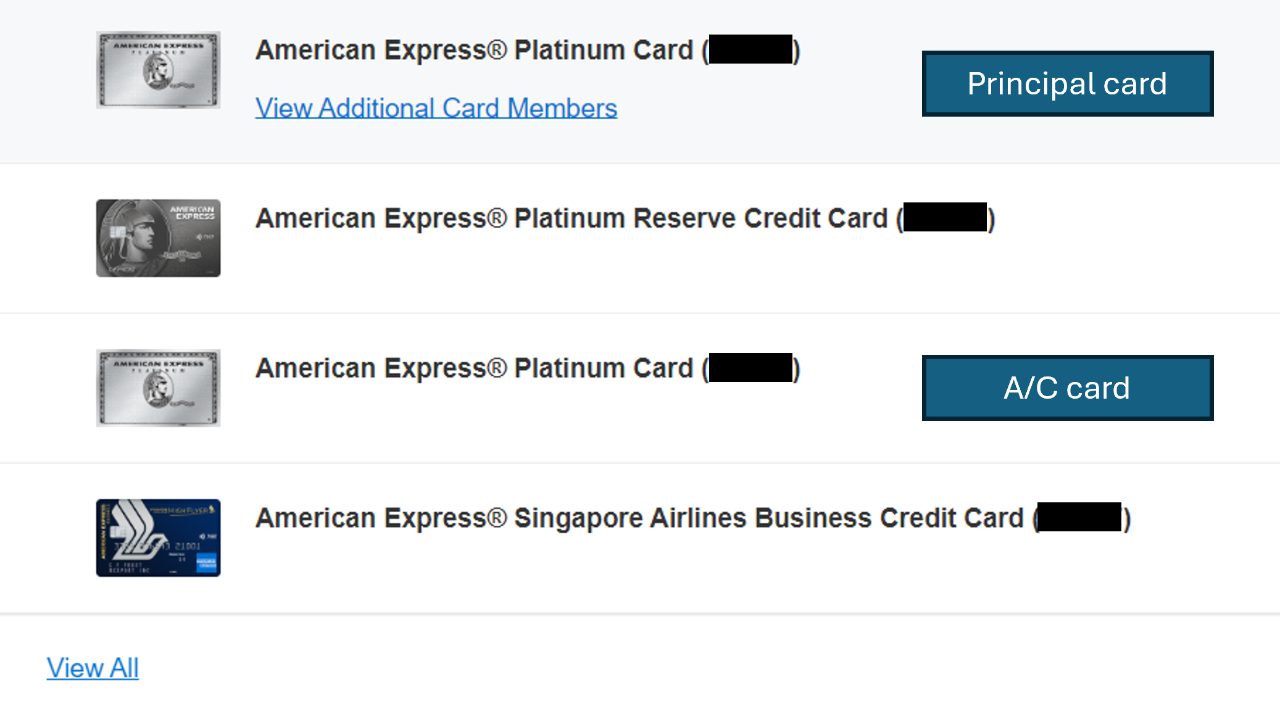

AMEX Platinum Charge cardholders have the option of applying for what’s known as an “Additional Card”, or A/C card for short.

While the A/C doesn’t offer any additional credit limit (not that the Plat Charge has a credit limit in the first place!), nor does it add to the S$1,354 of dining, lifestyle, entertainment, airline and fashion credits that principal cardholders receive, it can still come in useful for one thing: extra AMEX Offers.

Here’s how the A/C works, and how to get one.

| 🏃♂️ To the comments section! |

| Yes, I’m fully aware that the C in A/C stands for “card”, so saying A/C card is like saying ATM machine. Save your pedantry for the comments section. |

What is an A/C card?

The easiest way of describing an A/C is like a supplementary card you give yourself.

The A/C has its own unique card number, and all transactions made on the A/C will be billed to the principal cardholder’s account (so any existing GIRO arrangement you have will automatically cover the A/C too).

There is no annual fee for an A/C, and it does not count towards your two free supplementary card limit, so an AMEX Platinum Charge cardholder could have the following and still pay the same S$1,744 annual fee as anyone else:

- 1x principal card

- 1x A/C card

- 2x supplementary cards

The A/C is unique to the AMEX Platinum Charge; there is no A/C option for other AMEX cards in Singapore.

Why get an A/C card?

The official purpose of an A/C is to allow cardholders to segregate personal and business expenses.

For example, I may want to use my AMEX Platinum Charge for both personal and business dinners, but it’d be very messy to have to go through the statement each month and try to remember which is which. So I get an A/C for the business expenses, and when my statement comes at the end of the month, I’ll see everything neatly compiled into one section.

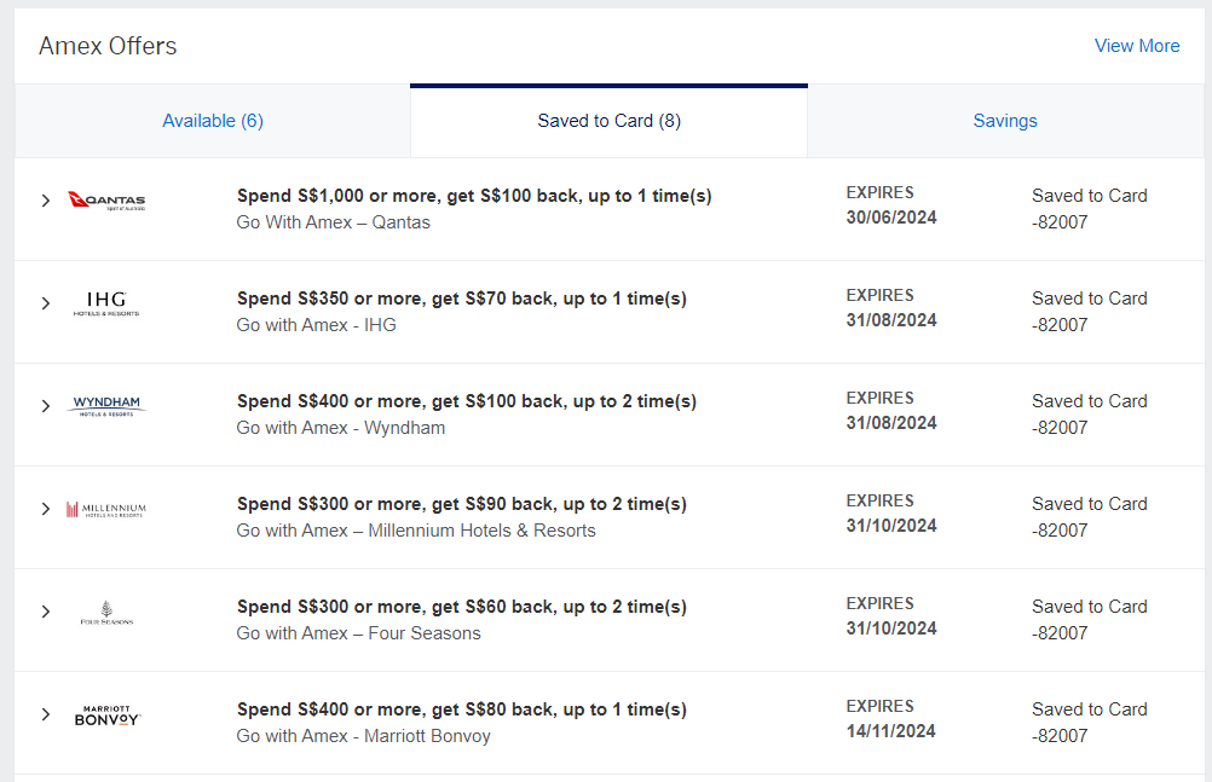

But the real reason most people get an A/C has to do with AMEX Offers. AMEX Offers, for the uninitiated, are opportunities to earn bonus Membership Rewards points or statement credits with certain merchants.

Having an A/C allows you to enjoy the same offer multiple times. For example, the Conrad Singapore Orchard recently offered S$105 off a minimum spend of S$350, capped at one use per card. If you could see the offer under both your principal card and A/C, you could register each card and use it two times in total- once on the principal and once on the A/C.

Do note that AMEX Offers are tracked on an individual card basis. Using our Conrad Singapore Orchard as an example, if I registered both the principal and A/C, and spent S$200 on the principal and S$150 on the A/C, I would not trigger the offer. I would need to spend S$350 on either the principal or A/C (or both) to trigger the offer.

| ⚠️ Other points to note |

| A/C cards are not eligible to receive an extra Comoclub C5 membership, and you can’t register for extra hotel/rental car elite status either. These benefits are available to supplementary cardholders, however. |

How do you apply for and setup an A/C card?

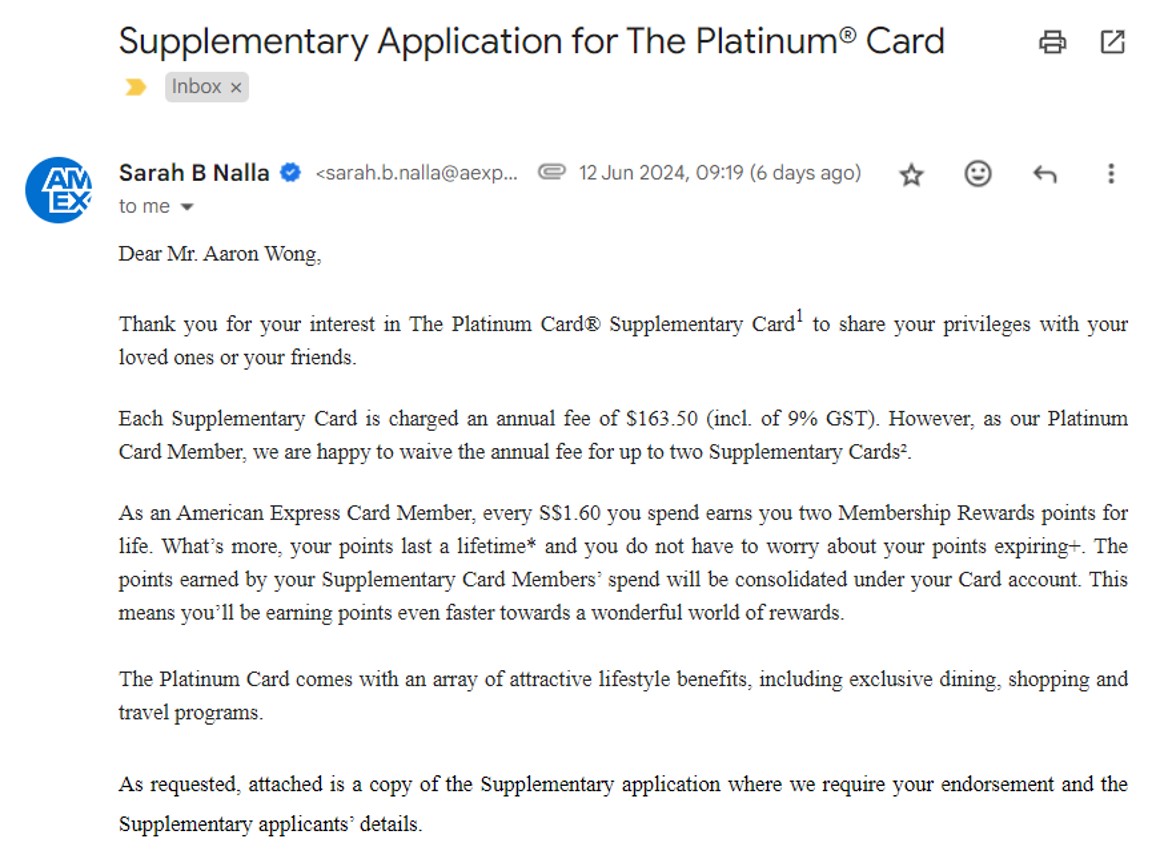

The annoying thing about applying for an A/C is that there’s no way of doing it online; you’ll need to contact AMEX customer service. Tell them you want to apply for an A/C, and they’ll send you an email with an application form.

Where it gets confusing is that there’s no such thing as an A/C application form; you’ll receive a regular supplementary card application form where you fill in yourself as both the principal and supplementary cardholder (hence my earlier description of the A/C as a “supplementary card you give to yourself”).

The application team will tag it as an A/C so it won’t count towards your two free supplementary card limit, but I do wish they’d use a different email template. As it is, they send the same one they do for regular supplementary cards, resulting in unnecessary confusion.

Approval took just one day for me, and the card arrived two days later.

Now, a word of warning: if you try to immediately add your new A/C to your existing AMEX account, you will be prompted to create a brand new AMEX ID. You don’t want to do this, because it means that every time you wish to add an AMEX Offer to your A/C, you’ll need to sign out of your main account and switch to this new account.

Instead, wait a few days for the system to update, then try to add the card to your AMEX account.

- Desktop: Click on cards in top right hand corner > Add a Card

- Mobile: Account > Add or Activate a Card

Follow the instructions, and you’ll be able to select your A/C card in the same account where you manage the rest of your AMEX cards.

After linking, you can register for AMEX Offers like you normally do. Do note that AMEX Offers may take up to a week to start populating from the time you add a new card to your account.

Conclusion

AMEX Platinum Charge cardholders can get an A/C card to segregate their personal and business expenses, or, more commonly, register for additional AMEX Offers. There is no charge for an A/C, nor does it count towards the two free supplementary card limit.

If you’ve just received your A/C, do wait a few days before trying to tag it to your existing AMEX account. Creating a brand new ID just for the A/C will result in a lot of unnecessary hassle!

Brilliant alpha. Exactly the kind of “did not know that” info that keeps readers coming back. [thumbsup]

#TIL

Just applied a Plat Charge card weeks ago and currently hold an KF Blue card also.

I want to understand how is one able to chat with AMEX customer service? I always do that for my KF Blue card and chat with their CSO in the app but for Plat Charge, its strange that I cant seem to find it in the app or desktop version.

(Yes I know you can call them but but I am on a biz trip these weeks and dont wanna incur any foreign call charges)

Oh it’s a known bug that once you add a/c card to your account the chat icon on the app disappears

Does having an AC also increase the limit of the 10x accelerator?

If the aim is to segregate personal from personal charges, why not just apply for the Business/Corporate Platinum?

I get two sign up bonuses, double offers, etc through this. The downside is that I have to pay 2 annual fees but the economics work out for me.

How long will Amex offers start to show after successfully adding the AC card to my Amex account? There are still no offers showing for my AC card.

Called Amex customer service and they said A/C has no extra offer. Once you use the offer on principal card, you cannot use the offer on A/C….so I guess you advised the wrong stuff above.

Have you tested this to confirm the CSO shared the right info?

“The A/C is unique to the AMEX Platinum Charge; there is no A/C option for other AMEX cards in Singapore.”

For many years now, I’ve have a green Charge card AC that I didn’t even ask for…