UOB cardholders have to be on their toes about a good number of things, one of which is the yearly ritual of an automatic UNI$ deduction to cover their credit card’s annual fee.

That may come as a surprise to you, but buried away in the T&Cs is a clause that gives UOB the right to dock your UNI$ balance, in lieu of a cash payment. In fact, that’s the default option so long as you have sufficient UNI$!

| 📝 UOB Rewards Terms & Conditions |

|

14. Priority will be given for the deduction of UNI$ for full or half waiver of your UOB Credit Card annual fees. UNI$ for a full or half waiver of the UOB Credit Card annual fees will be automatically deducted on the first day of the following month when your annual fees are due upon the annual renewal of Card membership. Any UNI$ balance shall expire 2 years from the last day of each periodic quarter (“UNI$ period”) in which the UNI$ was earned. To enjoy the fee waiver, the Cardmember has to set aside sufficient UNI$ in reference to UOB Cardmembers Agreement under Fees and Charges Guide/ Annual Fees and Waiver with UNI$. |

UOB is the only bank in Singapore with such a practice, and those not in the habit of monitoring their statements may find themselves inexplicably short of miles come redemption time.

In this post, I’ll walk you through the ins and outs of this practice, what to look out for, and how you can protect yourself.

How many UNI$ are deducted?

Here’s how many UNI$ are charged for a credit card fee waiver. I’m only going to highlight the cards that are relevant to the miles and points game; if you want the full listing, you can find it here under Appendix 1.

| 💳 UNI$ deductions for annual fee |

||

| Card | Annual Fee | Full Waiver* |

UOB Lady’s Card UOB Lady’s Card |

S$196.20 | UNI$6,500 |

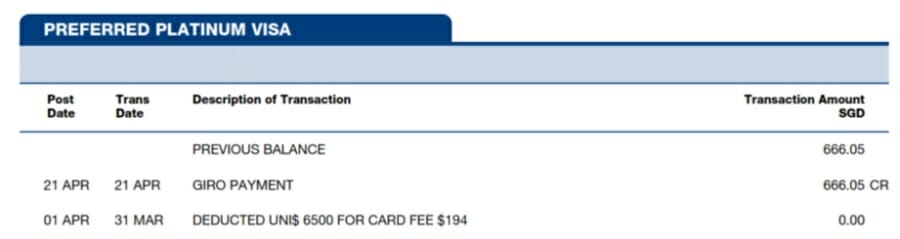

UOB Pref. Plat. Visa UOB Pref. Plat. Visa |

S$196.20 | UNI$6,500 |

UOB Visa Signature UOB Visa Signature |

S$218 | UNI$6,500 |

UOB PRVI Miles Card UOB PRVI Miles Card |

S$261.60 | UNI$6,500 |

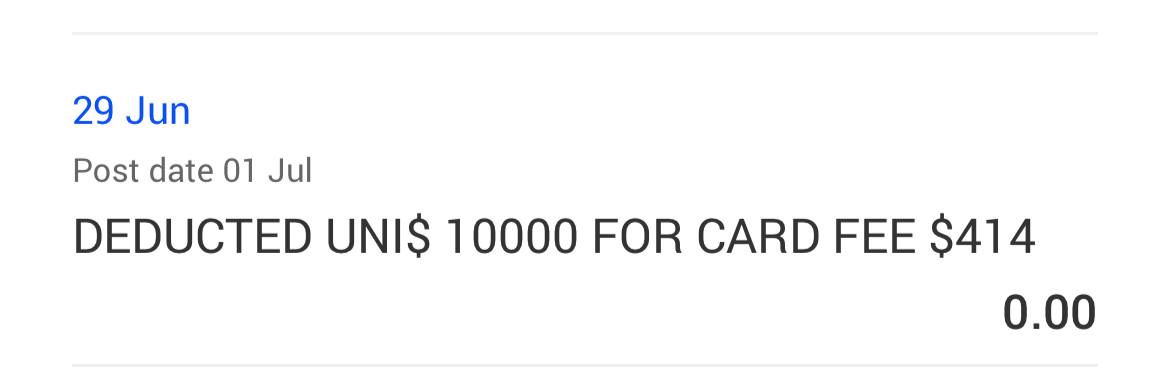

UOB Lady’s Solitaire Card UOB Lady’s Solitaire Card |

S$414.20 | UNI$10,000 |

| *Half waiver requires 50% of the UNI$ for a full waiver and 50% of the annual fee cash |

||

No fee waivers are available for the following cards:

- UOB Reserve Card

- UOB Reserve Diamond Card

- UOB Visa Infinite

- UOB Visa Infinite Metal Card

As the KrisFlyer UOB Credit Card earns KrisFlyer miles instead of UNI$, you’ll be automatically billed the annual fee in cash.

Here’s the logic behind how deductions work:

- If you have sufficient UNI$ for a full waiver, the full waiver option will be automatically selected

- If you do not have sufficient UNI$ for a full waiver but have sufficient UNI$ for a half waiver, the half waiver option will be automatically selected

- If you do not have sufficient UNI$ for a full or half waiver, the annual fee will be billed in cash

Some of you might be working the sums in your head and thinking, well, if I have a UOB PRVI Miles Card, the S$261.60 annual fee can be waived with UNI$6,500 (13,000 miles). That gives a value of ~2 cents per mile; isn’t that rather decent?

But that’s missing the bigger picture: you shouldn’t be paying the annual fee on most cards anyway (unless we’re talking about cards in the $120K segment, where fees are generally not waivable). Banks earn money every time you swipe their card to pay for something; should you really be paying for that privilege?

The way I see it, the first best solution should always be to request for an annual fee waiver. And if that’s not granted, I’d much rather cancel the card and reapply sometime down the road.

How to get an annual fee waiver

When you see a UNI$ deduction for payment of an annual fee, you should request a waiver right away. This can be done via the TMRW app (Android | iOS).

- Login to the UOB TMRW app

- Tap Accounts at the bottom of the screen

- Select the card you wish to request a fee waiver for

- Tap Settings, then Waive Fees

- Select Annual Fee and confirm

For avoidance of doubt, you can request a fee waiver this way regardless of whether you’ve been billed in cash, or via a deduction of UNI$.

Do note that you must wait for the for UNI$ deduction to change from “pending” to “posted” before you can request for a fee waiver. If you try to attempt a fee waiver before the status changes to “posted”, you will get an error message saying “there is no fee to waive”.

What if a waiver is granted?

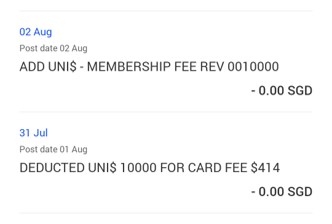

Assuming the fee waiver request is approved, you’ll see a reversal of the deduction in your transaction history.

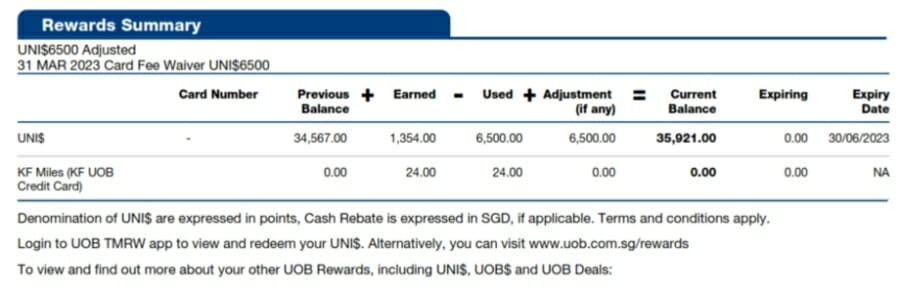

This will also be reflected in your monthly card statement under the “Rewards Summary” section.

You will not see a separate line item in the Rewards section of the UOB TMRW app reflecting the waiver. This is normal. However, your total UNI$ balance will increase once the waiver is granted.

The refunded UNI$ do not follow the original UNI$ expiry. Instead, they come with a fresh 2-year validity. I suppose that’s the silver lining to all this!

What if a waiver is denied?

Assuming the waiver request is rejected, it’s not quite game over yet. Call up UOB customer service and tell them you wish to cancel your card. Sometimes, the CSO can magically conjure a fee waiver out of thin air to retain you!

But even if they don’t, I’d lean towards carrying through with the threat to cancel. Like I said, it just doesn’t make sense to pay the annual fee for most entry-level cards.

Here’s how it works if you’re cancelling the card:

- If this is your last UNI$-earning card, you’ll get a certain number of days (the CSO will state this) to transfer out the UNI$ before the account is closed

- If this isn’t your last UNI$-earning card, you don’t need to do anything since UNI$ all pool into a central account

Refer to this article for more information.

Conclusion

UOB’s automatic UNI$ deductions for annual fees are a unique quirk of the bank, and tend to catch out many first-time cardholders. There’s nothing more annoying than an unexpected points deduction, especially if you’re on the brink of a transfer.

Fortunately, these can be waived just like an annual fee charged in cash. You just need to be vigilant in monitoring your statement and spotting when it happens!

Hi Aaron,

Thanks. My UNI$ points have been deducted on my Pref Plat card for the annual fee. Using the waiver method above, I get a notification that my waiver request was unsuccessful because “there are no charges to waive for the past 3 months”. It seems that there the app does not recognize a waiver request if UNI$ points have already been deducted. Would you know a way round this?

Best,

Graham

I have the same problem. I suspect you have to wait for the statement to generate?

Was it ok after Ur statement comes? I have the same problem but I tried immediately when it was deducted from my rewards account

It happened to me too! Any solutions?

i’ve never encountered this issue. once i see the deduction on my statement i go to the app to request a waiver

If waiver in app fails, just call them. The CSO can do the fee waiver plus you get the deducted UNI$ back. That was happened for me in 2022.

Data point: uob deduct 5k uni$ for uob lady solitaire full af for Aug24 instead of 10k

datapoint: uob deduct 10k uni$ for uob lady solitaire and 6.5k uni$ for prvi for Dec24.

So helpful thank you!!!!

Hi Aaron

like to check when the Annual fee will be appeared in my UOB lady card….let’s said my expired date on Sep…but now already on Sep…and generated Sep statement. but still not see the fee item show….

best

Thanks,SUccessful return of $uni. Followed your steps 1 until Tap on Settings, Had to choose Services instead and managed to see “waive “

thanks so much for this lifesaver!!!

So question.. if the waiver is unsuccesful, and you call CSO and they dont waive, when you cancel the card – you still have to pay that fee amount right? Or can you not pay that next years fee when you cancel?

You will not pay, they will refund the amount and also the points too if it is paid in points.

The payment is for next card year