DBS has launched a new promotion for the DBS Altitude Card, which offers cardholders 5 mpd on online travel and foreign currency (FCY) spend from September to December 2024.

A minimum spend of S$1,000 is required each month, and a monthly bonus cap of S$2,000 applies, so you could earn a total of 40,000 miles over the four-month promo period.

The structure of the promotion, unfortunately, is needlessly complicated, and DBS’s website does a rather poor job of explaining things. I stared at this infographic for a good 10 minutes and ended up none the wiser.

The tl;dr is that:

- you start by earning 5 mpd on online travel for September and October 2024

- you then switch to 5 mpd on FCY spend for November and December 2024

DBS basically wants you to buy plane tickets and book hotels with your Altitude first, then use your Altitude when overseas for the year-end holidays.

It’s a good, if somewhat convoluted deal, and gives some much-needed oxygen to the DBS Altitude Card (which as I highlighted in my recent review could really use some of that!).

DBS Altitude Card offering 5 mpd on online travel & FCY spend

|

| Campaign Details |

From 1 September to 31 December 2024, DBS Altitude AMEX and DBS Altitude Visa Cardholders can enjoy 5 mpd on online travel bookings and FCY spend. There are different eligibility periods for online travel bookings versus FCY spend though, so you won’t enjoy both concurrently- more on that below.

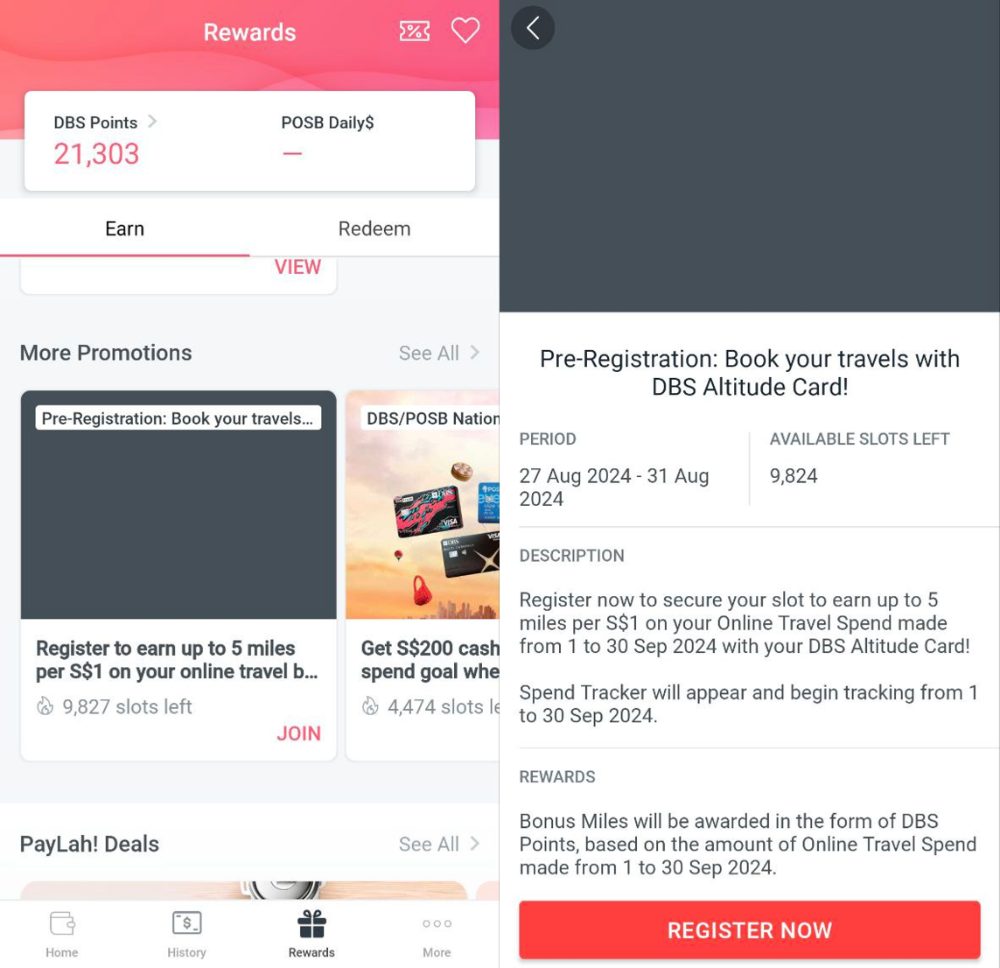

Registration is required, and can be done via the DBS PayLah! app. Look for the campaign banner under the Rewards tab.

A maximum of 10,000 slots are available each calendar month, but don’t worry, a tracker will show you how many slots still remain.

You must re-register each month of the campaign to continue participating. To make matters more confusing, the registration opening date differs from month to month!

| Register opens on… | For promo period… |

| 27 August 2024 | 1-30 September 2024 |

| 1 October 2024 | 1-31 October 2024 |

| 25 October 2024 | 1-30 November 2024 |

| 1 December 2024 | 1-31 December 2024 |

Minimum spend and eligible spend will only start accumulating from the time of registration, so do make a point of getting it done sooner rather than later.

For example, if you register on 15 September 2024, the any spending made from 1-14 September 2024 will neither count towards minimum spend nor eligible spend.

Online travel spend (September & October)

From 1 September to 31 October 2024, registered DBS Altitude Cardholders will enjoy up to 5 mpd for online travel spend, as summarised below.

Bonus for Online Travel Spend Bonus for Online Travel Spend |

|||

| Base | Bonus | Total | |

| SGD (online) |

1.3 mpd | 3.7 mpd | 5 mpd |

| FCY (online) |

2.2 mpd | 2.8 mpd | 5 mpd |

This is subject to cardholders meeting a minimum retail spend of S$1,000 within each calendar month, and is capped at S$2,000 per calendar month.

Cardholders can choose to meet the minimum spend and enjoy the bonus miles in September, October, or both months together. Therefore, if you max out this promotion in both September and October, you’ll earn a total of 20,000 miles from online travel spend.

DBS defines online travel spend as online transactions made in SGD or FCY in any of the following categories.

| Category | MCC | Examples (non-exhaustive) |

| Airlines |

MCC 3000-3299, 4511 | Air Asia, Cathay Pacific, Emirates, Qantas |

| Hotels / Lodgings |

MCC 3500-3999, 7011 | Hilton Hotels & Resorts, Marriott International, Pan Pacific Hotels Group |

| Tour Agencies |

MCC 4722 | Agoda, Booking.com, Expedia, Klook |

Do note that DBS has only provided the information in the “Category” and “Examples” columns. The “MCC” column is my own addition. It is a best guess, and may not be accurate.

It’s very annoying since the bank recently took a step in the right direction by updating its welcome offer T&Cs to explicitly list eligible MCCs. Why not make this consistent across all T&Cs; shouldn’t we be aiming for less ambiguity and not more?

Remember: the spend must be online, so paying in-person at the front desk of a hotel, or swiping your card at a brick and mortar travel agency won’t count.

Foreign Currency Spend (November & December)

From 1 November to 31 December 2024, registered DBS Altitude Cardholders will enjoy up to 5 mpd for in-store and online FCY spend, as summarised below.

Bonus for Foreign Currency Spend Bonus for Foreign Currency Spend |

|||

| Base | Bonus | Total | |

| FCY (Both in-store and online) |

2.2 mpd | 2.8 mpd | 5 mpd |

This is subject to cardholders meeting a minimum retail spend of S$1,000 within each calendar month, and is capped at S$2,000 per calendar month.

Cardholders can choose to meet the minimum spend and enjoy the bonus miles in November, December, or both months together. Therefore, if you max out this promotion in both November and December , you’ll earn a total of 20,000 miles from FCY spend.

DBS defines FCY spend as any online or in-person spend made in foreign currency, excluding the following:

- any transaction made overseas but effected or charged in Singapore dollars;

- payments made with the Merchant Category Codes (“MCC”) listed in Table 1 and transactions matching the terms listed in Table 2 in accordance with the DBS Rewards Terms and Conditions;

- posted 0% interest-free instalment plan monthly transactions (“IPP”);

- posted My Preferred Payment instalment plan monthly transactions (“MP3”);

- interest, finance charges, cash advance, cash withdrawal, balance transfer, smart cash, AXS

payments (except Pay+Earn), SAM online bill payments, bill payments via internet banking and all fees charged by DBS; - any transaction that is subsequently cancelled, voided, refunded, or reversed (“Refunded

Transactions”) for any reason; and - any other transactions determined by DBS from time to time

This would exclude the usual suspects, like charitable donations, education and insurance.

Is it worth it?

For SGD spending, it’s a no-brainer because 5 mpd beats the current maximum of 4 mpd available through other cards for airline, hotel and travel agent bookings.

For FCY spending, the DBS Altitude AMEX and DBS Altitude Visa have an FCY transaction fee of 3% and 3.25% respectively, so there’s a bit of math to be done.

| Card | Earn Rate | FCY Fee | Cost Per Mile |

DBS Altitude AMEX DBS Altitude AMEX |

5 mpd | 3% | 0.6 cents |

DBS Altitude Visa DBS Altitude Visa |

5 mpd | 3.25% | 0.65 cents |

With a 5 mpd earn rate, your cost per mile is 0.6 and 0.65 cents respectively. Assuming your alternative is a 4 mpd card + Amaze (which has an implicit FCY fee of 2%), then Amaze is marginally better with a cost per mile of 0.5 cents.

But remember that usefulness of Amaze is limited by the bonus caps of your paired cards, and when it comes to general foreign currency spending, that cap will be a mere S$1,000 (with the Citi Rewards). Having an extra S$2,000 to play with, thanks to the Altitude, will be useful indeed.

What counts as minimum spend?

The minimum spend requirement refers to all retail transactions charged to the card, excluding the following:

- posted 0% interest-free instalment plan monthly transactions (“IPP”);

- posted My Preferred Payment instalment plan monthly transactions (“MP3”);

- interest, finance charges, cash advance, cash withdrawal, balance transfer, smart cash, AXS

payments (except Pay+Earn), SAM online bill payments, bill payments via internet banking and all fees charged by DBS; and - any transaction that is subsequently cancelled, voided, refunded, or reversed (“Refunded

Transactions”) for any reason.

Retail spend can include your eligible spend, so your spend on air tickets/hotels (September/October) or FCY (November/December) would count too.

For avoidance of doubt, supplementary cardholder spend will count towards the minimum spend requirement, and be eligible to earn 5 mpd provided the principal cardholder successfully registers for the campaign.

However, supplementary cardholders do not have a bonus cap of their own.

What if I have both the DBS Altitude AMEX and Visa?

If you have both a DBS Altitude AMEX and DBS Altitude Visa, I’ve confirmed with a DBS spokesperson that you can take advantage of the deal on both cards.

In this case, you would need to meet the minimum spend of S$1,000 on each Altitude card to enjoy the 5 mpd rate, with the same S$2,000 monthly cap per card.

For avoidance of doubt, there is no “cross accumulation”. If you spend S$600 on the Altitude AMEX and S$400 on the Altitude Visa, for instance, you won’t meet the minimum spend requirement notwithstanding the fact you’ve spent S$1,000 in total.

When will bonus miles be credited?

Cardholders will initially earn the DBS Altitude’s usual earn rate of 1.3 mpd for local spend, or 2.2 mpd for FCY spend.

Bonus miles will be awarded (in the form of DBS Points) by the 16th of the following calendar month.

Terms and Conditions/FAQs

The T&Cs for this campaign, as well as FAQs can be found via the links below:

What can you do with DBS Points?

DBS Points earned on the Altitude Card never expire, and can be converted to any of the following frequent flyer programmes with a S$27.25 admin fee.

| Frequent Flyer Programme | Conversion Ratio (DBS Points: Miles) |

| 5,000: 10,000 | |

| 5,000: 10,000 | |

| 5,000: 10,000 | |

|

500: 1,500 |

Conclusion

The DBS Altitude Cards are offering 5 mpd on online travel spending for September and October, and 5 mpd for foreign currency spending for November and December, with a minimum spend of S$1,000 and cap of S$2,000 per month.

Do remember that you’ll need to register for each month of the promotion, and the registration opening date changes each month (seriously, guys?). Only the first 10,000 registrations are eligible, and minimum/eligible spend won’t count until registration is done, so do it sooner rather than later.

For a detailed rundown of the DBS Altitude Card, refer to my review below.

FCY fee 3% cost per mile is higher than FCY fee 3.25%?

updated, thanks.

Thanks for the thorough write-up!

So, to qualify for the 5MPD in Nov and Dec, we need to select “pay in SGD” at hotels or other overseas merchants? Has that always been true for overseas transactions?

No, the article and promotion state that you earn 5mpd on payment in the foreign (“local”) currency in Nov and Dec.

Certainly no, we don’t pay SGD at overseas, you will lose much more than paying the local currency.

Unfortunately it will capture a lot of people and DBS will end up paying out very little. Far too complicated.

I am confused by the term minimum retail spend. If I spend $2,000 on air tickets and nothing else, does that mean I have met the min retail spend requirement?

My goodness it’s like they purposely make it complicated so that less people will know about it. Why must people register. just make it by default.

Does the registration only apply to the existing Altitude cardholder? I am not a cardholder, and I don’t see this promotion in my Paylah app.

Does the online travel spend count towards the $1K retail spend requirement for the month?

does this mean that to ‘unlock’ the nov/dec retail spending, there’s a requirement to spend a minimum $1k of travel related products in sep/oct?

Just for avoidance of doubt. Does the “minimum retail spend of S$1,000” include local spend in SGD too?

Do you know if we can combo this with the ongoing sign up bonus? i.e., for those of us who are new to DBS, can we get a DBS Alt Amex this month, spend $1,000 in FCY as soon as November comes around, and get both the 5mpd on the FCY spend as well as the 25k miles welcome bonus?

Hi, I made a hotel booking via Agoda website, but the transaction record on DBS shows payment type says “Manual Key Entry”. Does this mean DBS will not consider it to be an online payment? And it will not get 5 miles?

I just spent tons of money in Hong Kong, non travel related. But seems the foreign currency spending still fulfilled the spending requirement according to the tracker on Paylah.

@DBS Does Klook count as online travel?

Does Royal Caribbean Cruises count as Travel or Transport lol

I hope someone can tell me. Does airbnb count as hotel bookings for Sept/oct?

is cruise mcc 4411 part of the eligible spend?

Scenario: I will be booking with Singapore Airline in October. Due to the nature of my booking, it will be charged in NZD, and above $1,000.

Query: Do the SIA booking count towards the $1,000 minimum spend and do I get rewarded with 5 MPD?

Thanks!

If my tracker shows that I exceed spend goal does it mean that my spending qualify for bonus miles?

i read it as i can just spend the required amt in october, and spend the fcy in november without going through the required spend in the 4 months. right?

what happens if you go over the 2000 SGD FCY? Is it back to 2.2 MPD?

As you may have heard, despite confirmation by a DBS spokesperson, DBS did not award 5mpd on both cards and it’s capped at $2000 across both cards. Hope you can clarify with DBS whether there was misinformation on the part of the spokesperson, thanks!

I did not get 5 mpd on both cards at first, only on one Altitude card. I followed this with a call to DBS. After a few days, a rep got back to me to confirm that 5mpd would be awarded on both cards but there was a glitch in the system and that I would be awarded the missing miles on the second Altitude card when the glitch was fixed. A few days later the missing miles came in. So it may help to follow up with a call.

If I never activate the promo for Sept and Oct, but I activate it in Dec. Do I still get the 5mpd?

I think, you will get. But I don’t see Paylah started taking registration for Dec month.

Has anyone managed to get the bonus miles from November? According to the T&C’s and FAQs, it’s supposed to be in by 16th of this calendar month right? I’m still not seeing mine credited yet.