Earlier this month, I wrote about some complications with using CardUp rental payments to meet the minimum spend for DBS welcome offers.

In short, DBS would count these payments if they coded under MCC 6513 (Real Estate Agents and Managers), but not if they coded under MCC 7399 (Business Service Not Elsewhere Classified).

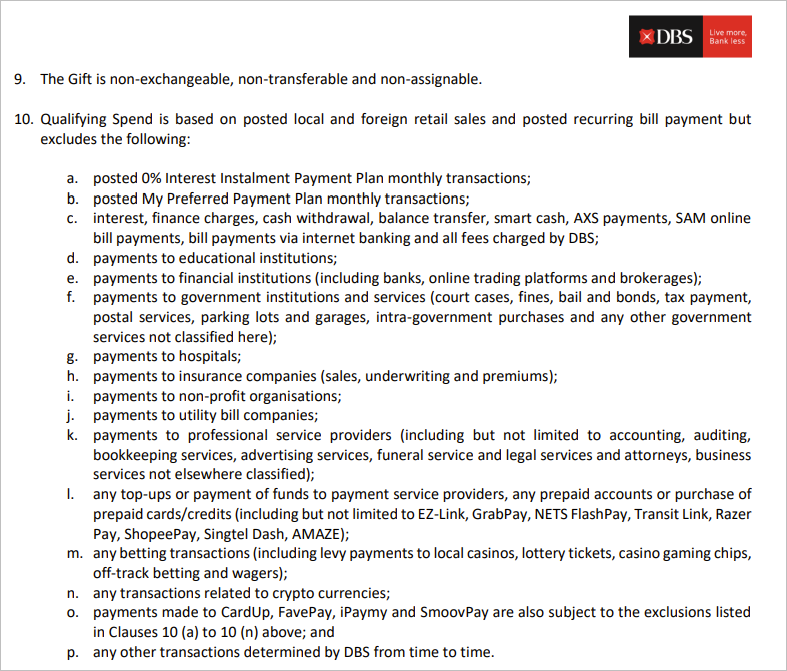

The problem is: DBS’s T&Cs don’t actually mention specific MCC ranges. Instead, the list of excluded spend is provided in descriptive terms, as shown below.

CardUp payments, as addressed in clause (o), were subject to the exclusions in (a) to (n), which made no mention of rental. Therefore, I made the point to DBS that it was unfair for those who relied on CardUp rental payments to meet their minimum spend to miss out on their welcome offer. DBS agreed, and my understanding is that the majority of those cases have been resolved by now.

I also suggested to DBS that qualitative descriptions weren’t the best way of disclosing exclusions, since they had the potential to create ambiguity. DBS said they’d look at this, and now an updated set of T&Cs has gone live that makes everything a lot more clear.

DBS welcome offer exclusions

DBS has updated the T&Cs for its welcome offers for the DBS Altitude and DBS Vantage Card, which now clearly state which MCCs are excluded from qualifying spend.

| ❌ Ineligible Spend for Welcome Offers (based on MCC) |

|||||||||||

| MCC | Description | ||||||||||

| 0763 | Agricultural Co-operatives | ||||||||||

| 4784 | Toll and Bridge Fees | ||||||||||

| 4829 | Money Transfer | ||||||||||

| 4900 | Utilities – Electric, Gas, Water, Sanitary | ||||||||||

| 6010 | Financial Institutions – Manual Cash Disbursements | ||||||||||

| 6011 | Financial Institutions – Automated Cash Disbursements | ||||||||||

| 6012 | Financial Institutions – Merchandise, Services and Debt Repayment | ||||||||||

| 6051 | Non-Financial Institutions – Foreign Currency, Non-Fiat Currency, Liquid and Cryptocurrency Assets, Money Orders (not Money Transfer), Account Funding (not Stored Value Load), Travelers Cheques, and Debt Repayment | ||||||||||

| 6211 | Security Brokers/Dealers | ||||||||||

| 6300 | Insurance Sales, Underwriting, and Premiums | ||||||||||

| 6381 | Insurance Premiums | ||||||||||

| 6399 | Insurance, Not Elsewhere Classified | ||||||||||

| 6540 | Non-Financial Institutions – Stored Value Card Purchase/Load | ||||||||||

| 7261 | Funeral Service and Crematories | ||||||||||

| 7276 | Tax Preparation Service | ||||||||||

| 7311 | Advertising Services | ||||||||||

| 7322 | Collection Agencies | ||||||||||

| 7339 | Stenographic and Secretarial Support | ||||||||||

| 7372 | Computer Programming, Data Processing, and Integrated Systems Design Services | ||||||||||

| 7375 | Information Retrieval Services | ||||||||||

| 7393 | Detective Agencies, Protective Services and Security Services Including Armored Cars and Guard Dogs | ||||||||||

| 7399 | Business Services (Not Elsewhere Classified) | ||||||||||

| 7523 | Parking Lots, Parking Meters and Garages | ||||||||||

| 7995 | Betting including Lottery Tickets, Casino Gaming Chips, Off-track Betting, Wagers at Race Tracks and games of chance to win prizes of monetary value | ||||||||||

| 8062 | Hospitals | ||||||||||

| 8111 | Legal Services and Attorneys | ||||||||||

| 8211 | Elementary and Secondary Schools | ||||||||||

| 8220 | Colleges, Universities, Professional Schools, and Junior Colleges | ||||||||||

| 8241 | Correspondence Schools | ||||||||||

| 8244 | Business and Secretarial Schools | ||||||||||

| 8249 | Vocational Schools and Trade Schools | ||||||||||

| 8299 | Schools and Educational Services (Not Elsewhere Classified) | ||||||||||

| 8398 | Charitable and Social Service Organizations | ||||||||||

| 8661 | Religious Organizations | ||||||||||

| 8911 | Architectural, Engineering, and Surveying Services | ||||||||||

| 8931 | Accounting, Auditing, and Bookkeeping Services | ||||||||||

| 8999 | Professional Services (Not Elsewhere Defined) | ||||||||||

| 9211 | Court Costs, Including Alimony and Child Support | ||||||||||

| 9222 | Fines | ||||||||||

| 9223 | Bail and Bond Payments | ||||||||||

| 9311 | Tax Payments | ||||||||||

| 9399 | Government Services (Not Elsewhere Classified) | ||||||||||

| 9402 | Postal Services – Government Only | ||||||||||

| 9405 | Intra-Government Purchases – Government Only | ||||||||||

In addition to this, transactions with the following descriptions are also excluded from qualifying spend (mainly crypto platforms and stored value facilities, though there’s also Amaze and Kopitiam).

| ❌ Ineligible Spend for Welcome Offers (based on trxn description) |

|

|

|

| * Transactions beginning with these terms are included in exclusions e.g. AMAZE* will include AMAZE.com | |

It’s great that we finally have more clarity about just how DBS defines things like education, professional services providers and non-profits, and there’s some interesting MCCs in there- I didn’t know that detective agencies and guard dogs had their own category!

With regards to CardUp specifically, CardUp has informed me that rental payments can code under two different MCCs:

- DBS Vantage, DBS Altitude Visa: MCC 6513 (Real Estate Agents and Managers)

- DBS Altitude AMEX: MCC 7399 (Business Services Not Elsewhere Classified)

Therefore, CardUp rental payments made with the DBS Vantage or DBS Altitude Visa should count towards the minimum spend for welcome offers, while it won’t for the DBS Altitude AMEX. I want to caveat that this is the situation at the time of publishing; it’s always possible that CardUp changes the way it processes transactions at some point in the future.

All other CardUp transactions code as MCC 7399 regardless of card, and will not qualify for welcome offers. Also note that there is a blanket exclusion for all ipaymy transactions under the revised T&Cs.

At this time, there’s no update yet to the general DBS Rewards T&Cs, nor the DBS Woman’s World Card T&Cs, which continue to define their exclusions by description instead of MCC. I’m told that these will be updated in due course too.

Different from regular exclusions

Somewhat confusingly, DBS has a different set of exclusions for welcome offers as it does for day-to-day spend (though Citi has a similar practice).

While there’s a good deal of overlap, the key thing to note is that there’s no exclusion for CardUp at all. In other words, all CardUp transactions will earn base points with DBS cards (i.e. 1.3 mpd with the DBS Altitude AMEX/Visa, 1.5 mpd with the DBS Vantage).

Likewise, there is no exclusion for professional services providers, so I guess you can earn miles on those guard dogs.

Conclusion

DBS has updated its welcome offer T&Cs to explicitly state the MCCs which are excluded from qualifying spend. This should reduce the ambiguity going forward, and that can only be a good thing.

Remember: if you need to check the MCC of a particular transaction, there’s several ways of doing so without needing to spend.

Does this mean all cardup transactions besides rental also count towards qualifying spend?

How about ipaymy ? i assume it will also earn base points similar to cardup ?

Does using CardUp to pay for car insurance counts towards dbs altitude Amex qualifying spend for $3000 for the welcome rewards?

Is DBS own payment facility – Preferred Payment Plan, considered as eligible spend for welcome bonus?