It’s no secret that Amaze is basically living by the good graces of banks, who dole out rewards for transactions while having their lunch eaten on FCY fees.

But we always knew it wouldn’t last forever, and from 1 October 2024, UOB will update its rewards programme T&Cs to exclude Amaze transactions from earning UNI$. It becomes the second bank to have a blanket exclusion on Amaze transactions, after DBS did so in June 2022.

It’s a particularly bitter pill to swallow, because UOB had several excellent options for Amaze pairing. That said, it’s not quite game over yet, though the ground is rapidly shrinking.

UOB excluding Amaze transactions from 1 October 2024

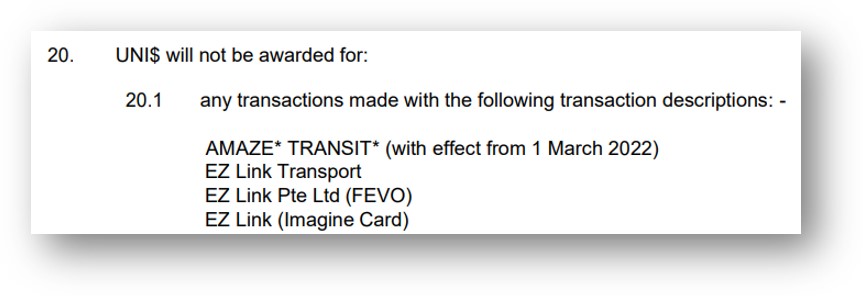

UOB has always had an Amaze exclusion in its T&Cs, which caused countless panicky emails and messages on the MileChat (guys, UOB excluded Amaze!). However, this exclusion only covered a very specific situation: AMAZE*TRANSIT*. This was added because some naughty people were using Amaze to circumvent the exclusion on EZ-Link card top-ups, and manufacturing spend in the process.

However, this exclusion only covered a very specific situation: AMAZE*TRANSIT*. This was added because some naughty people were using Amaze to circumvent the exclusion on EZ-Link card top-ups, and manufacturing spend in the process.

From 1 October 2024, however, the Amaze exclusion will be absolute. At the moment, only the UOB Reserve Card’s website has been updated with this information, though it will filter to the rest of the UOB cards shortly.

With effect from 1 October 2024, transactions with Merchant Category Codes 4900, 5965, 5993, 8062, 8699, and 8999 or transaction description “AMAZE*” will be excluded from the awarding of UNI$, cashback, and KrisFlyer miles.

I’ll talk about the other MCCs in a separate post, but the headline here is that any transaction starting with AMAZE* will be ineligible for rewards, which kills three of the best UOB pairings for Amaze:

- UOB Lady’s Card

- UOB Lady’s Solitaire Card

- KrisFlyer UOB Credit Card

It’s bad enough to lose the Lady’s Cards, but the KrisFlyer UOB Credit Card will be even more painful. Amaze, as I’m sure you know, turns all offline transactions into online ones, so pairing the KrisFlyer UOB Credit Card with Amaze would trigger its uncapped 3 mpd for online shopping. You could visit a Prada or Rolex outlet, buy a five-digit handbag or watch, and earn 3 mpd on the whole transaction.

If it’s any consolation, you have one month left to make hay, so if you were planning any big ticket foreign currency purchases that would qualify for bonus miles with these cards (or a big ticket SGD purchase with the KrisFlyer UOB Credit Card, though note the 1% fee above S$1,000), get it done soon.

Be sure not to leave it till the last minute, as UNI$ are awarded based on posting date, not transaction date. Try and leave a buffer of three days just to be safe.

Which cards still work for Amaze?

Now that UOB has joined DBS in excluding Amaze, the remaining options are Citi, HSBC, and OCBC (of course you could use the other banks too, but none of them have any great miles options on the Mastercard network).

This leaves the following possibilities.

| 💳 Potential Amaze Pairings |

||

| Card | Earn Rate | Cap |

Citi Rewards Citi RewardsApply |

4 mpd1 | S$1K per s. month |

OCBC Rewards OCBC RewardsApply |

4 mpd2 | S$1.1K per c. month |

Citi Prestige Citi PrestigeApply |

1.3 mpd | None |

OCBC 90°N MC OCBC 90°N MCApply |

1.3 mpd | None |

Citi PremierMiles Card Citi PremierMiles CardApply |

1.2 mpd | None |

HSBC TravelOne Card HSBC TravelOne CardApply |

1.2 mpd | None |

| 1. All transactions except travel (airlines, hotels, rental cars, tour agency, cruises etc.) (T&Cs) 2. Clothes, bags, shoes and shopping (T&Cs) |

||

My first choice for pairing will remain the Citi Rewards, which earns 4 mpd on all transactions except travel. After that, I guess it’ll have to be the OCBC Rewards, though its bonus whitelist is much tighter- mainly department stores, fashion boutiques and outlet mall shopping.

It’s frustrating that there won’t be an option for air tickets and hotels though, as neither the Citi Rewards nor OCBC Rewards includes this as a bonus category.

Now, the next question is whether I’d go down to the level of general spending cards, say the OCBC 90°N. Think about it this way:

- Use naked OCBC 90°N: 2.1 mpd + 3.25% FCY fee

- Use Amaze + OCBC 90°N: 1.3 mpd + 2% FCY fee (Amaze has no explicit FCY fee, but it does have a ~2% spread over Mastercard)

I’m basically paying an extra 1.25% for 0.8 mpd more, which works out to just under 1.6 cents per mile. That’s slightly above what I’d be willing to pay, so in that sense it Amaze + general spending card would still be better than a general spending card alone.

But hold up- what if we bring in specialised spending cards into the picture?

- Use Amaze + OCBC 90°N: 1.3 mpd + 2% FCY fee

- Use UOB Visa Signature: 4 mpd + 3.25% FCY fee

In this case, I’m paying an extra 1.25% for 2.7 mpd more, which works out to just 0.46 cents per mile. Therefore, the way I see it, using a specialised spending card without Amaze makes more sense than a general spending card with Amaze.

Of course the first best solution is still to use a specialised spending card with Amaze, but with the Citi Rewards and OCBC Rewards as the last remaining options, you won’t have a lot of cap to play with.

More to come?

Sadly, I’m quite certain that UOB won’t be the last bank to nerf Amaze.

We already had a scare with Citibank back in January, which thankfully turned out to be a false alarm, though something tells me it’s only a matter of time before Citi decides to pull the plug too.

I’ve heard similar rumours for OCBC, and given HSBC’s trigger-happy stance towards bans (they’re the only ones who exclude CardUp), I’m surprised they haven’t taken action already (it could be because the only miles-earning Mastercard they have is the HSBC TravelOne, which at 1.2 mpd isn’t a popular option for Amaze pairing).

Conclusion

From 1 October 2024, UOB will add Amaze transactions to the rewards exclusion list, which means the end of UOB Lady’s Card/KrisFlyer UOB Credit Card pairings.

Truth be told it was only a matter of time, and like all miles games nerfs, we take it on the chin and move on. Do spend the next month clocking whatever big ticket expenditures you were planning to do with the KrisFlyer UOB Credit Card, and pray that we get through the rest of 2024 unscathed.

Also there’s no guarantee of an 2% spread with Amaze, I’ve seen worse, sometimes creeping towards 3%. So I think the only use case really worth it that remains is 1000$ / month on local spend.

Unfortunately a lack of certainty which frustrates me in whether to use Amaze or not.

So will UOB KF still honor the 1.8 mpd for my previous Amaze spendings on the bonus category? Expecting the lump sum on Oct’24 which is my 1 year mark. 😦

This is not so bad.. the harder it is to earn miles for the average joe, the greater availability for redemptions 🙂

Might also be useful to compare specialiased card (without Amaze) vs actual Visa/Mastercard rate using YouTrip or Revolut.

Likely the specialised card would be better if we value miles at more than 0.75mpd, but useful for reference.

Instarem could just do a name change, launch a new card with a different name or just start their transaction description with another word to circumvent such rules. Having a description with a very common word used in retailers’ names e.g. “Singapore” would make it harder for banks to exclude such transactions as many other unrelated transactions would also be thrown out with the bath water.

Or are they just accepting their fate?

Just a thought…

Yes, you do wonder whether Amaze could play cat-and-mouse with the banks. But it may also be possible for the banks to completely withdraw their support of amaze, meaning they don’t allow a transaction by amaze even being accepted on their cards……….

So it may be a case that Amaze have to chose between a very limited business case or no business at all………..

Can I still use amaze with UOB lady’s card in September?

The concern is that the bonus UNI$ are credited at the start of the following calendar month, which means the bonus UNI$ for transactions in September will only be credited in October.

If Citi pulls the plug I would be so done. Most of my purchases are done on JP websites and charged in JPY, but I am not paying 3% currency conversion fee for the miles.

Understand that travel category is excluded from bonus points. Is this also the case even if you loop it through Amaze for payment on travel such as Agoda and Trip .com?

Using Amaze does not change the MCC. It merely makes it online.

Instarem will eventually go the way of the dodo bird. All financial payment exist to earn a spread… the cost of earning that spread is customer acquisition and customer retention (rewards). Amaze probably did not earn money from the start and they are gradually trying to increase their ‘spread’. DBS, UOB and the other banks were willing to pay whatever rewards they were paying to retain their customers and maybe have a chance to earn a forex spread… it was probably not noticeable when there was small volumes of customers going to Amaze and denying UOB their spread… when the… Read more »

The Singapore banks have grown greedier over the years with their forex fee reaching an average of 3.25 per cent and in a few cases even more. Plus the merchant fees, it became a tidy sum. Then came Revolut, Youtrip, Trust Card and Amaze and most fellow Singapore travellers whom I met on overseas trips have abandoned the direct bank cards to avoid paying these ridiculous fees. I did a google on the Malaysian bank charges and it seems Hong Leong Bank is charging about 2 percent? Not surprised there is a huge chunk of outflow to cards with lower… Read more »

All it does is to push all this spend to the new competitors. 1% CB at v/mc rates isn’t bad.

The miles “game” is pretty much over – as I predicted a few months back.

congrats, do u want a prize?

Yes please. Can you send me 100,000 miles?

go convert all your rewards points to cashback then it that’s the case

This is a MAJOR hit. For a very long time now the UOB Lady’s Card could earn you 4mpd for ALL spend. Simply do a transaction with certain travel providers using Amaze linked to your UOB Lady’s Card. Earn 4mpd on the transaction. Then cancel the booking, after setting your Amaze card back to Wallet, and hey-presto the refund came back to your wallet, which you could then spend as you wish.

What about UOB Prvimiles?