DBS has launched a new campaign which offers DBS/POSB cardholders an extra S$88 cashback on shopping, dining and travel expenses, on top of the usual credit card rewards.

Cardholders will need to register via the DBS PayLah! app and meet their personalised spend goal by 31 October 2024, after which the cashback will be automatically credited.

The lucrativeness of this offer boils down to what your personalised spend goal is, but what sweetens the deal is that it’s stackable with other ongoing DBS campaigns such as 5 mpd with the DBS Altitude Cards, and S$500 cash for salary credit and card spend.

DBS Wonderful Cashback 2024

|

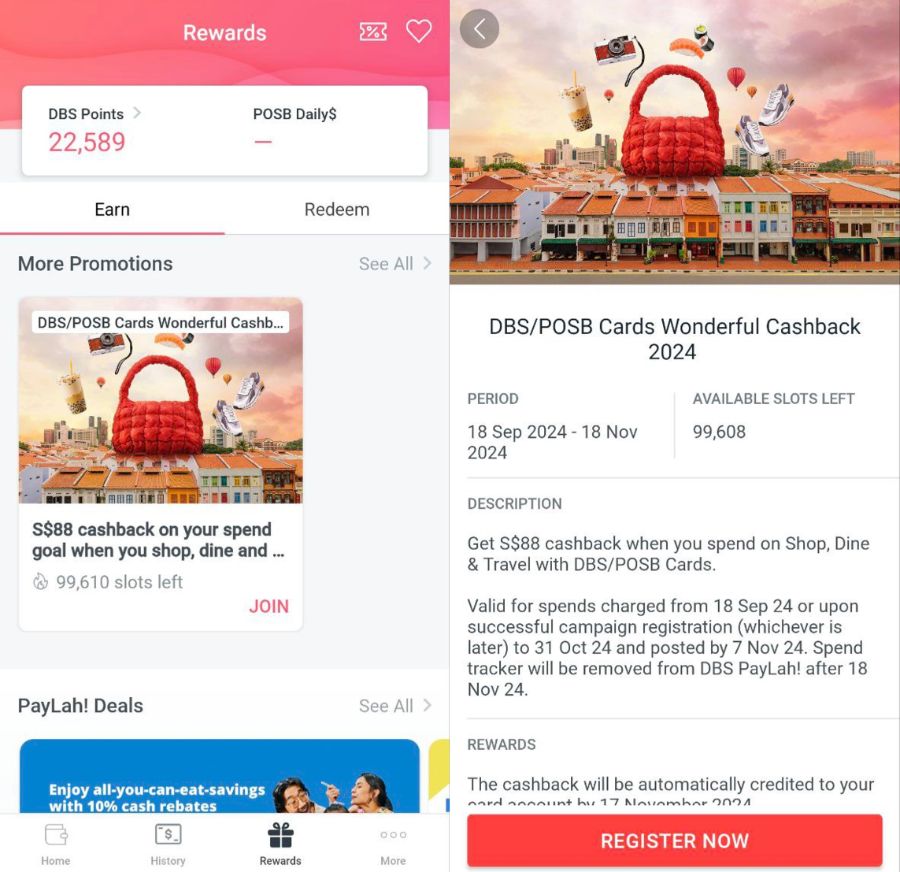

| Campaign Details |

From 18 September to 31 October 2024, DBS cardholders can register for this promotion via the DBS PayLah! app. Tap on the ‘Rewards’ tab and look for the ‘DBS/POSB Cards Wonderful Cashback 2024’ banner.

Registration is capped at 100,000 cardholders, and while that’s a sizeable number, why not register sooner rather than later all the same?

Upon registration, you’ll receive your personalised spend goal, which must be met by 31 October 2024. For me, this was S$1,500, but other reported figures include S$3,500 and S$5,000.

What counts as qualifying spend?

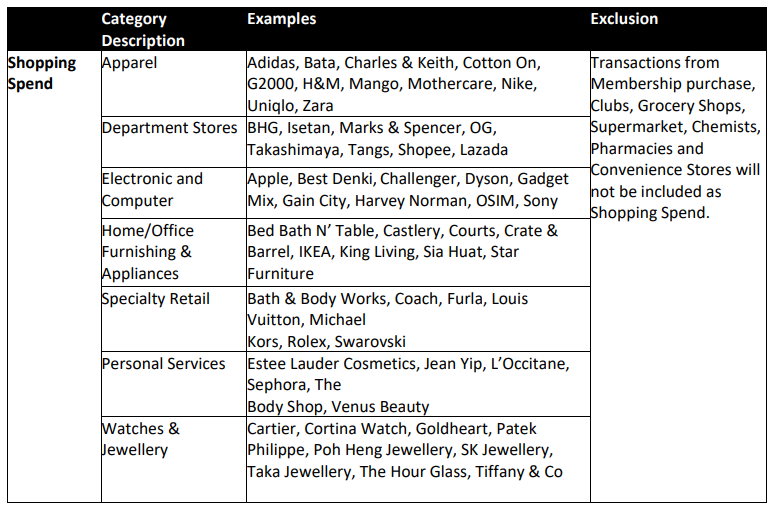

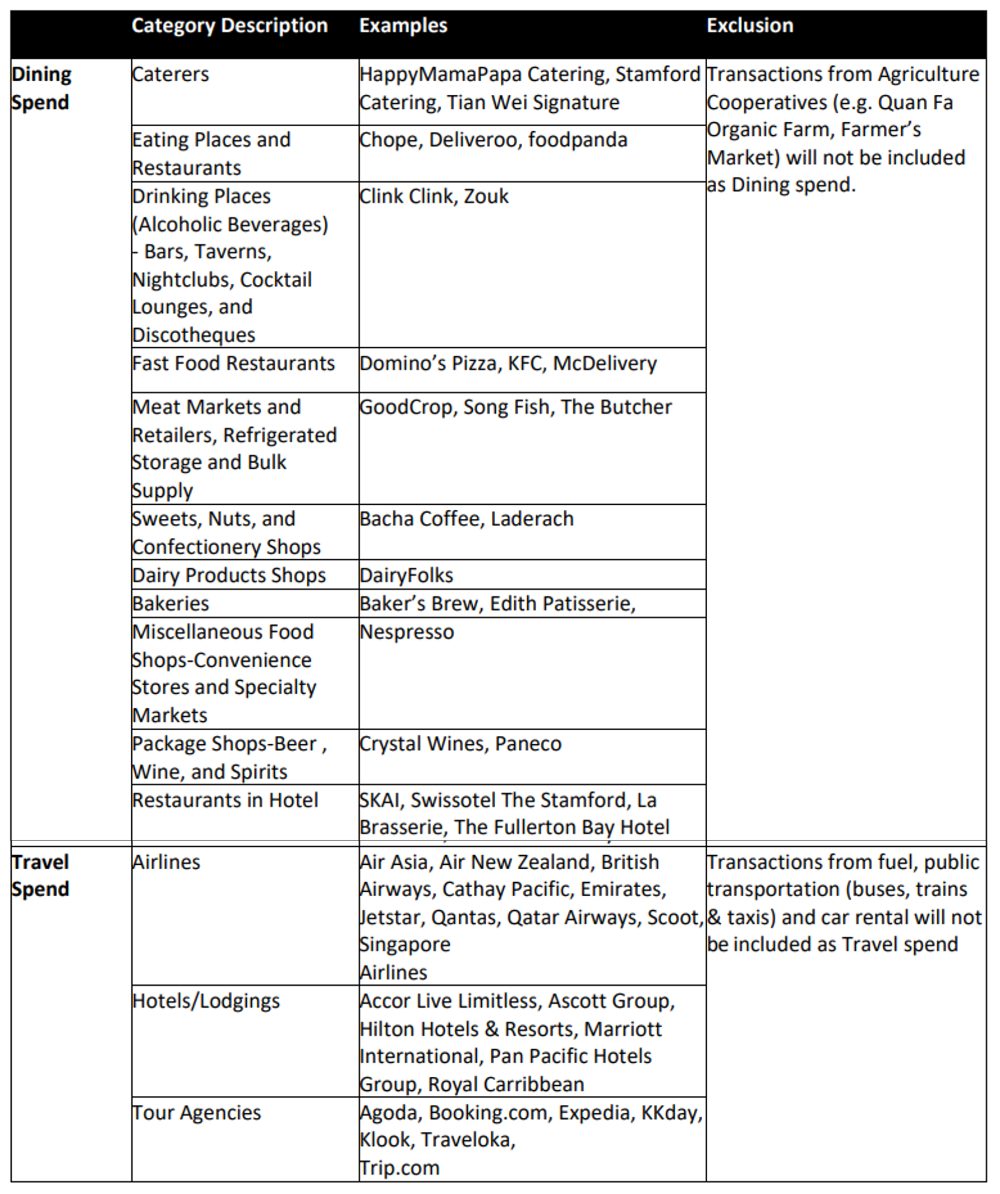

Your personalised spend goal must be met entirely by qualifying spend, defined as online and offline transactions in SGD or FCY on shopping, dining and travel.

Category descriptions and examples have been provided below.

The full list of eligible MCCs can be found here- it’s very long so I won’t bother to copy it over.

Qualifying spend is cumulative across all DBS/POSB credit cards, so you’re not limited to spending on just one. Also note that qualifying spend is only counted from the date of registration; any spending prior to that will be disregarded, even though it falls within the promotion period.

Qualifying spend must be charged within September or October 2024, and posted by 7 November 2024. This means that you should be able to safely spend towards the end of October as well, because seven days is more than enough time for transactions to post.

When will the cashback be credited?

Eligible cardholders will receive S$88 cashback credited to the card that was last transacted on within five working days (FAQs say 15 days, but I’d defer to the T&Cs here) of receiving a push notification from the DBS PayLah! app that 100% of the spend goal has been met.

Terms & Conditions/FAQs

T&Cs for this campaign can be found here.

FAQs are available here.

Which card should you use to spend?

Those interested in earning miles and points will probably be defaulting to the following DBS cards.

| Card | Local Spend | FCY Spend |

DBS Altitude AMEX DBS Altitude AMEXApply |

1.3 mpd | 2.2 mpd |

DBS Altitude Visa DBS Altitude VisaApply |

1.3 mpd | 2.2 mpd |

DBS Treasures Black Elite DBS Treasures Black EliteApply |

1.2 mpd | 2.4 mpd |

DBS Vantage DBS VantageApply |

1.5 mpd | 2.2 mpd |

DBS WWMC DBS WWMCApply |

0.4 mpd Offline 4 mpd* Online |

1.2 mpd Offline 4 mpd* Online |

| *Capped at S$1,500 per calendar month | ||

Since this campaign spans over two calendar months, those with a spending goal of S$3,000 or less could meet it entirely with the DBS Woman’s World Card, earning 4 mpd in the process.

But there’s also good reason to use the DBS Altitude Cards too, as we’ll see in the next section.

DBS Altitude 5 mpd campaign

|

| Campaign Details |

From 1 September to 31 December 2024, DBS Altitude AMEX and DBS Altitude Visa Cardholders can enjoy:

- 5 mpd on online travel for September and October 2024

- 5 mpd on FCY spend for November and December 2024

This is subject to cardholders meeting a minimum retail spend of S$1,000 within each calendar month, and is capped at S$2,000 per calendar month.

For the full details of this offer and how to register, refer to the post below.

DBS Altitude offering 5 mpd on online travel and foreign currency spend

DBS Salary & Spend campaign

|

| Campaign Details |

From 7 August to 31 October 2024, DBS/POSB customers can get S$500 cash by completing the following activities:

- S$300 cash: Crediting a minimum salary of S$1,600 per month for three consecutive months to a DBS/POSB SGD-denominated account

- S$200 cash: Spending at least S$500 per month on their DBS/POSB cards for three consecutive months

This offer is valid for anyone who did not have a salary crediting arrangement linked to any DBS/POSB account from 1 February to 31 July 2024. For avoidance of doubt, you cannot have just the card spending component without the salary crediting. The salary crediting is a pre-requisite for the card spending component.

For the full details of this offer and how to register, refer to the post below.

DBS offering easy S$500 cash for salary credit and card spend

Conclusion

DBS/POSB cardholders can now register to earn an extra S$88 cashback on top of their usual credit card rewards, by meeting their personalised spend goal by 31 October 2024.

If you’re a DBS Altitude Cardholder, there’s a great chance to triple stack by combining it with the ongoing 5 mpd offer for online travel and S$500 cash offer for salary crediting and card spend.

What other spend goals have you been targeted for?

Not sure if it’s for me only, but Woman’s card is not eligible to me under this challenge/ promo.

Read T&Cs. all cards eligible.

This wasn’t covered in the FAQ – do you know if cards you apply for and received AFTER registration can be used?

Was thinking to combo this with DBS alt amex welcome offer, the alt 5mpd for travel, and the $500 salary crediting combo, if only just to get 4 promos all at once…

Spend goal 5k lol

5k is like 1.75% cashback

Must be careful with spending on the last day. The previous promo my 31st Jul spending were sent for processing on the 1st Aug and had to appeal to DBS for the rebate. Lesson learnt and this time shall spend earlier.

not sure what happened in your case, but the T&Cs of that campaign state clearly that transactions need to be posted by the 7th of the following month. so long as transaction date falls within the promo period it’s fine. one possibility is that your transaction may have been on 31 july local time but not in SG.

It was that specific merchant, all the other spendings on 31st had the correct transaction date. I guess that’s why after showing sms/proof of transaction date, DBS did credit me the rebate, but I would avoid that, and just spend at least 1 day earlier.

Any indication on the reason(s) behind the different personalised spending goals?

Pity supermarkets MCC does not qualify

even 1500 cannot meet….

5K lol

Might as well don’t do the promotion at all

Same, 5K too. What’s the point then.

taka card not even there lol

I kena 5k. So not worth it for me as I only got the dbs womens world.