Back in June 2024, the HSBC Travel One Card received an enhanced welcome offer of 30,000 bonus miles, a 50% increase from the previous 20,000. Given the minimum spend of S$500, it was one of the best welcome offers in Singapore, on a spend-to-miles ratio.

Unfortunately, this offer has now run its course, and HSBC has pared it back to 20,000 bonus miles, while keeping the minimum spend the same.

It’s still a good card to have for at least the first year, given its other perks like four free lounge visits per calendar year (so eight in the first membership year), fee-free conversions with small enough blocks to avoid orphan miles, and the widest range of transfer partners in Singapore. However, the time to apply was really the past few months, so I hope most of you hopped on then.

HSBC TravelOne Card 20,000 miles welcome offer

|

|||

| Apply |

HSBC TravelOne Cardholders who apply between 1 October and 31 December 2024 will receive 20,000 bonus miles (in the form of 50,000 HSBC points) when they:

- Pay the annual fee of S$196.20

- Spend at least S$500 by the end of the month following approval

- Provide marketing consent during application (an important step that people sometimes forget!)

There used to be a first year fee waiver option, without the bonus miles, but that has been discontinued.

This offer is open to all applicants, regardless of whether or not they currently hold a HSBC credit card. However, if they have cancelled a HSBC TravelOne Card in the past 12 months, they will not be eligible to receive the welcome offer again.

Bonus miles are on top of the base miles that TravelOne Cardholders normally earn, namely:

- 1.2 mpd for local currency spend

- 2.4 mpd for foreign currency spend

For example, if you spend the full S$500 in local currency, you’ll receive a total of 20,600 miles (20,000 bonus, 600 base).

Since the S$196.20 annual fee must be paid, you’re basically paying 0.98 cents per mile, which is a good price, though obviously not as good as when the welcome offer was 30,000 miles.

| 🎁 Alternative SingSaver offer |

|

Do note that gifts rotate frequently, and the abovementioned ones are valid till 1 December 2024. The S$196.20 annual fee must be paid, and a minimum spend of S$500 is required (full T&Cs here). If you’re interested in this offer, apply via the link below |

| SingSaver Offer |

What counts as qualifying spend?

Cardholders must make a minimum qualifying spend of S$500 by the end of the month following card approval.

| Card Account Opening Date | Qualifying Spend Period |

| 1-31 Oct 2024 | 1 Oct to 30 Nov 2024 |

| 1-30 Nov 2024 | 1 Nov to 31 Dec 2024 |

| 1-31 Dec 2024 | 1 Dec 2024 to 31 Jan 2025 |

| 1-14 Jan 2025 | 1 Jan to 28 Feb 2025 |

You basically have anywhere between 1-2 months to meet the minimum spend, depending on when your card is approved. Try to get approved early in the month so you have more time to make the minimum spend.

Qualifying spend includes all online and offline retail transactions, excluding the following:

|

The key exclusions to note here are insurance, utilities, education, government transactions as well as CardUp/ipaymy. These were all excluded from 1 July 2020 onwards as part of HSBC’s revised rewards terms and conditions.

When will bonus miles be credited?

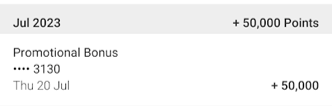

The 20,000 bonus miles will be credited (in the form of 50,000 HSBC points) within 90 days from the card opening date, provided the eligibility criteria is met.

In my personal experience, I applied in early May and received the bonus points on 20 July 2023.

Terms & Conditions

The terms & conditions of this welcome offer can be found here.

What can you do with HSBC points?

HSBC points earned on the TravelOne Card can be transferred to 21 airline and hotel partners, as shown below.

Airlines

| ✈️ HSBC TravelOne Airline Partners | |

| Frequent Flyer Programme | Conversion Ratio (HSBC Points : Partner) |

| 50,000 : 10,000 | |

| 40,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

|

30,000 : 10,000 |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 |

|

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

|

25,000 : 10,000 |

Hotels

| 🏨 HSBC TravelOne Hotel Partners | |

| Hotel Programme | Conversion Ratio (HSBC Points : Partner) |

|

30,000 : 10,000 |

| 25,000 : 5,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

Do remember that not all partners share the same ratio, so your effective mpd and size of the welcome offer depends on which partner you choose.

The quoted figures of 1.2/2.4 mpd and 20,000 miles only apply if you choose a partner with a 25,000 points = 10,000 miles transfer ratio. Otherwise, it can go as low as 0.6/1.2 mpd and 10,000 miles on the other end of the spectrum if you pick a partner with a 50,000 points = 10,000 miles transfer ratio.

| Transfer Ratio (Points : Miles) |

HSBC T1 (Local)* |

HSBC T1 (FCY)^ |

| 25,000 : 10,000 | 1.2 mpd | 2.4 mpd |

| 30,000 : 10,000 | 1 mpd | 2 mpd |

| 35,000 : 10,000 | 0.86 mpd | 1.71 mpd |

| 40,000 : 10,000 | 0.75 mpd | 1.5 mpd |

| 50,000 : 10,000 | 0.6 mpd | 1.2 mpd |

| *3 points per S$1 on local spend ^6 points per S$1 on FCY spend |

||

Conversions must be done via the HSBC Singapore app (Android | iOS) and are processed instantly, with the exception of the following:

- Club Vistara: Within 5 business days

- Hainan Fortune Wings Club: Within 5 business days

- Japan Airlines Mileage Bank: Within 10 business days

Transfers are free of charge till 31 January 2025.

While the minimum transfer block is 10,000 miles/points (Accor: 5,000 points), the subsequent block is just 2 miles (Accor: 1 point). In other words, you could choose to transfer 10,002 miles or 20,958 miles, which helps you avoid orphan points.

HSBC points are now pooled across all cards, ever since May 2024.

Other card benefits

Four complimentary lounge visits

|

|

| Lounge Benefit T&Cs |

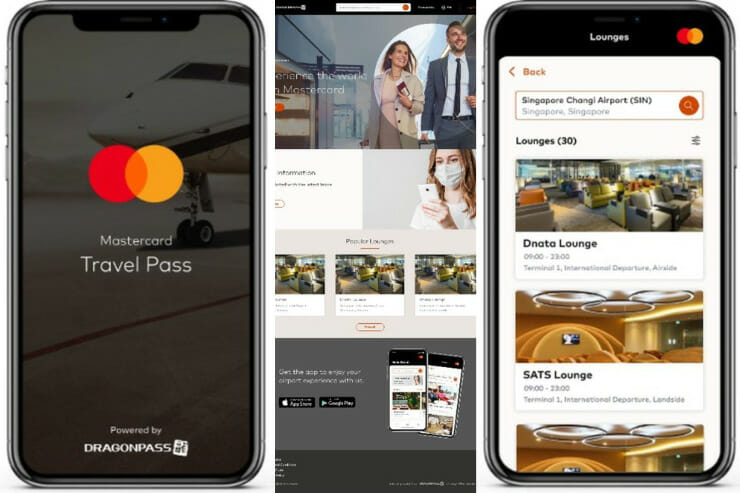

Principal HSBC TravelOne Cardholders enjoy four complimentary lounge visits per year, provided via DragonPass.

Allowances are awarded by calendar year, which means you basically enjoy eight visits in your first membership year. For example, if your card is approved in October 2024, you will be awarded:

- On date of approval: 4x visits (expires 31 December 2024)

- On 1 January 2025: 4x visits (expires 31 December 2025)

Allowances cannot be rolled over to the following year, so be sure to fully utilise your visits by the end of the calendar year. For avoidance of doubt, using the second calendar year’s allotment does not preclude you from cancelling the card at the end of the first membership year, if that’s what you wish to do.

Here’s how to start enjoying the benefit:

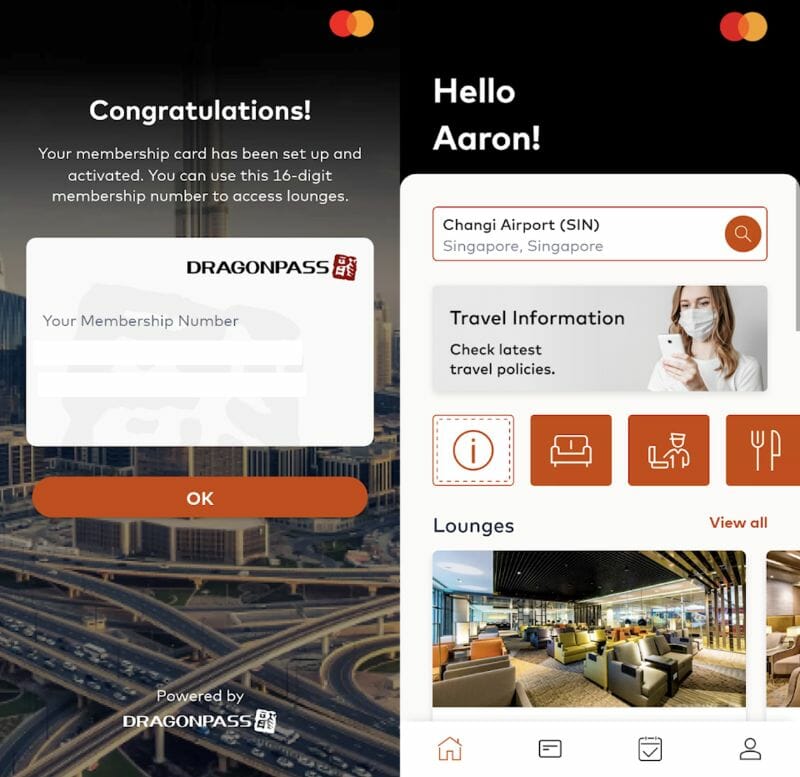

- Step 1: Download Mastercard Travel Pass app (Android | iOS)

- Step 2: Select ‘Sign up’ to register for the programme, or log on to your account if you’re already a member

- Step 3: Enter your HSBC TravelOne Card details for a one-time verification

- Step 4: Complete your personal details for Mastercard Travel Pass account registration (enter your name as shown in your passport)

- Step 5: Set your account password

The main catch is that these visits cannot be shared with a guest.

Entertainer with HSBC

|

| ENTERTAINER with HSBC |

Principal HSBC TravelOne Cardholders receive a complimentary ENTERTAINER with HSBC app membership, which includes:

- 1-for-1 dine-in offers at more than 150 merchants across Singapore, including Sushi Jiro @ PARKROYAL COLLECTION, Bangkok Jam, Paul Bakery and more

- 1-for-1 takeaway offers at more than 50 merchants including Canadian 2 For 1 Pizza, Andersen’s of Denmark and more

- Up to 50% off leisure, attraction and wellness offers at BOUNCE Singapore, Spa Infinity, Virtual Room and more

- 1-for-1 stays in rooms at over 175 hotels around the world

You’ll need an activation key to start using your ENTERTAINER membership. This should have been emailed to you; if not you’ll need to call 1800 4722 669 to get it from customer service.

Complimentary travel insurance

| Accidental Death | S$75,000 |

| Medical Expenses | S$150,000 |

| Travel Inconvenience | Flight Delay: S$150 Baggage Delay: S$1,500 Lost Baggage: S$1,500 |

| Policy Wording | |

HSBC TravelOne Cardholders receive complimentary travel insurance when they:

- Use their TravelOne Card to purchase air tickets, or

- Use their TravelOne Card to pay for the taxes and surcharges on a ticket redeemed with airline miles

This provides coverage of S$75,000 for accidental death, S$150,000 for overseas medical expenses, S$1 million for emergency medical evacuation, as well as coverage for travel inconveniences like flight delays and lost luggage.

Do note that there is no coverage for personal liability or rental vehicle excess, so you may need to purchase supplementary coverage if this is important to you.

Conclusion

|

|||

| Apply |

The HSBC TravelOne Card has cut its welcome offer to 20,000 miles, which is valid for applications submitted by 31 December 2024. The minimum spend and other eligibility criteria remain the same.

Don’t forget that you can apply for both a TravelOne Card and a Live+/Advance Card and enjoy new-to-bank gifts for both, since HSBC sees the two as separate types of products.

For a detailed review of the HSBC TravelOne Card, refer to the post below.

Anyone has any idea when does HSBC usually charge the annual fee to be able to qualify for the bonus miles?

within 3 months, based on #dp in the chat

applied and approved in early Jul’24, fee was charged on 30 Sep’24.

Generally, I have moved almost entirely from HSBC. Too many regular changes of their grounds and hard to keep track. AMEX for their hotel cashback promotions. UOB for their travel to get more miles. DBS is based on their occasional travel deal like 5 mpd. Trust Cards for overseas payment without the 3.25 percent. Citibank for their Rewards card. But most CC expenditures goes to UOB and Trust Bank.