With 2024 almost over, it’s time to take a look back at the biggest stories on The MileLion this year.

I used to publish an annual list of “top 10 most read MileLion articles”, but in the past few years I’ve had to modify the selection a bit by excluding reviews and “best card” guides. Why? Because the top 10 list would look really boring otherwise:

| ⬆️ Top 10 MileLion Posts for 2024 | ||

| 1 | Review: UOB Lady’s Card | 238K views |

| 2 | Review: Citi Rewards Card | 217K views |

| 3 | Review: UOB Preferred Platinum Visa | 214K views |

| 4 | Review: KrisFlyer UOB Credit Card | 167K views |

| 5 | Review: DBS Woman’s World Card | 166K views |

| 6 | The MileLion’s 2024 Credit Card Strategy | 158K views |

| 7 | Review: HSBC Revolution Card | 150K views |

| 8 | What’s the best card to use with Amaze? | 126K views |

| 9 | Review: UOB Visa Signature Card | 122K views |

| 10 | UOB One Account cutting interest rates to 4% pa. from May 2024 | 99K views |

Don’t get me wrong; I’m delighted that the community values reviews and guides, and I’ll work hard to keep updating them and producing more in 2025. But for this post, I want to focus on stories– what made the news in the world of miles and points for 2024, and why?

(1) UOB One Account cutting interest rates to 4% p.a. from May 2024 (97K views)

UOB One Account cutting interest rates to 4% p.a. from May 2024

The biggest story this year, surprisingly, had nothing to do with miles- though it no doubt affected miles chasers.

The UOB One Account has long been the best bank account to pair with a miles strategy. A minimum monthly spend of S$500 on the UOB Lady’s Card/UOB Lady’s Solitaire, together with a salary credit of at least S$1,600, would earn 5% p.a. interest on a maximum balance of S$100,000.

But with interest rates coming down, the account was nerfed in May 2024, and the interest rate is now 4% p.a. on a maximum balance of S$150,000. For better or worse, however, I’m sticking with the UOB One Account because it makes the most sense for me.

| Account | Max. Interest* | Cap |

| Maybank SaveUp | 1.17% p.a. | S$75K |

| DBS Multiplier | 1.8-2.2% p.a. | S$50K |

| StanChart Bonus$aver | 2.88% p.a. | S$100K |

| BOC SmartSaver | 4.2% p.a. | S$100K |

| OCBC 360 | 4.6% p.a. | S$100K |

| *Assumptions: Max out salary credit and bill payment bonuses, where applicable, and spending only on miles-earning cards. | ||

The BOC SmartSaver and OCBC 360 offer theoretically higher rates, but the BOC SmartSaver means having to deal with the BOC Elite Miles Card, which is…an adventure in itself (not to mention its usual earn rates are a dismal 1/2 mpd on local/overseas spend).

As for the OCBC 360 Account, what’s good about it is that spending on the OCBC 90°N and OCBC Rewards Cards will earn you bonus interest. However, a big chunk of the bonus interest (1.5% p.a.) comes from the Save criteria, which requires you to increase your average daily balance by at least S$500 monthly.

If you use this as your day-to-day account, with money flowing in and out all the time, there will be a lot of finicky micromanagement involved to ensure you reach this goal without “overshooting” too much and impacting future months. Plus, it also means that you won’t really be earning 4.6% p.a. on the full S$100,000, it’s just not practically attainable.

(2) Singapore Airlines modifies cabin service routines following turbulence incident (60K views)

Singapore Airlines modifies cabin service routines following turbulence incident

As I’m sure everyone knows by now, Singapore Airlines had a severe turbulence incident in May 2024 with SQ321 from London, resulting in the first fatality since the crash of SQ006 in 2000.

In the immediate aftermath, the airline modified its cabin service routines to suspend all service whenever the seatbelt sign came on. On inbound long-haul flights from Europe that pass over the Bay of Bengal, the pre-landing meal service was also brought forward to the midway point.

Some felt the adjustments were a good step, akin to a safety timeout, while others felt it was a gross overreaction to what was essentially a black swan event. I personally understood the need to be seen to be “doing something”, but felt the changes ended up causing more harm than good, as cabin crew were noticeably more stressed and faced additional complaints when meal service was disrupted by intermittent turbulence.

In any case, Singapore Airlines restored regular inflight services in August 2024, and we’re back to the status quo for all intents and purposes.

(3) Great deal: AMEX giving new customer welcome offers to existing customers (57K views)

Extended: AMEX giving new customer welcome offers to existing customers

It’s a well-known fact that banks tend to lavish the gifts on new-to-bank customers when they sign up for credit cards, but give existing customers the cold shoulder.

That changed for a few months this year, as American Express decided to offer new customer bonuses even to existing cardholders. It was an excellent opportunity to make some hay, and I hope as many of you took advantage of this as possible.

Incidentally, American Express is currently offering new and existing customers the same welcome gift for the AMEX Platinum Charge, though applying for this card at the end of the year means a lot less time to spend the first year’s statement credits.

(4-6) The HSBC Revolution’s 2024 nerf fest

(4) HSBC Revolution nerfs 4 mpd for contactless payment and travel transactions (57K views)

HSBC Revolution nerfs 4 mpd for contactless payments and travel transactions

(5) HSBC Revolution nerfing bonuses for groceries, food delivery and fast food (56K views)

HSBC Revolution nerfing bonuses for groceries, food delivery and fast food

(6) HSBC Revolution: A designated survivor guide (56K views)

With the wretched year that the HSBC Revolution Card had in 2024, is it any surprise they’re occupying slots 4, 5 and 6?

The year already started badly, with travel agencies, AirBnB and most hotels getting the cut in January 2024. That was then followed in May 2024 by nerfs to grocery stores, food delivery and fast food restaurants, then all offline transactions in July 2024.

And worse is still to come in 2025, with travel transactions getting the chop in January 2025, followed by complimentary travel insurance in April 2025 (stop! stop! he’s already dead!).

It doesn’t take a rocket scientist to figure out that HSBC has fallen out of love with the Revolution, with its marketing budget squarely behind the Live+ instead (its 8% cashback rates were recently extended till 31 March 2025). I don’t think there’s any reason to expect that to change in the coming year, and while the HSBC Revolution isn’t completely useless, its use cases will be mostly for those who max out the caps on other specialised spending cards.

(7) The AMEX Platinum Credit Card’s first year sweet spot (55K views)

At the start of 2024, the AMEX Platinum Credit Card added a new feature: an annual S$200 lifestyle credit, valid for dining and shopping at selected merchants.

This new perk can effectively be enjoyed twice in the first membership year (since it’s issued on a calendar year basis), and together with the welcome offer and the Comoclub C4 membership (which gives up to S$390 in no-min-spend vouchers on your birthday), allows a cardholder to enjoy outsized value for their first year’s annual fee.

Think of it like a discounted version of the AMEX Platinum Charge’s first year sweet spot, for those who don’t want to pay a four-digit annual fee.

(8) World of Hyatt offering instant Explorist and Globalist fast track for MNC employees (52K views)

World of Hyatt offering instant Explorist and Globalist fast-track for MNC employees

World of Hyatt has been offering a status challenge for employees of selected companies for several years now, so I was surprised to see this post — an update of a 2020 article — perform so well.

Perhaps that’s because World of Hyatt is the best hotel loyalty programme at the moment, at least in terms of elite benefits: a full hot breakfast (none of this coffee and pastry continental breakfast chicanery), suite upgrades, guaranteed 4 p.m check-out, executive lounge access, Guest of Honor and waived parking fees on award stays, to name a few. And unlike Hilton and Marriott, which give away top-tier elite status with credit cards in the USA, Hyatt is sticking to its standards.

A rare concession is made for employees of companies like Apple, Ernst & Young, Google, IBM, PWC, and LinkedIn, who can enjoy instant Explorist status for a 90-day period, with a further upgrade to Globalist by completing 20 qualifying nights during this time.

You’ll unfortunately need to requalify via the usual route of 60 nights, but tasting Globalist benefits for a year might prove too tempting.

(9) UOB Lady’s Savings Account: Is 6 mpd worth a S$10,000 deposit? (41K views)

UOB Lady’s Savings Account: Is 6 mpd worth a S$10,000 deposit?

The UOB Lady’s Cards called time on their incredible 6 mpd promotion in April 2024, but immediately followed it up with a new offer called “The Unstoppable Pairing”, designed to reward UOB Lady’s Cardholders who also hold a UOB Lady’s Savings Account.

The general idea is that accountholders earn an extra 2-6 mpd on their UOB Lady’s Card spending, based on their Monthly Average Balance (MAB).

I don’t think the 4 and 6 mpd tiers are worth the opportunity cost (you have to deposit S$50,000 and S$100,000 respectively), but the 2 mpd tier requires a modest S$10,000, and that’s just alright with me.

I’m sure many people had similar questions about whether the math worked out, resulting in this post being particularly popular.

(10) How to get KrisFlyer Elite Gold with just four flights (38K views)

Towards the end of 2023, Singapore Airlines and Marriott partnered up to offer a two-way status match and accelerator programme. This allowed Solitaire PPS, PPS Club and KrisFlyer Elite Gold members to qualify for Marriott Bonvoy Platinum with just 10 nights (instead of the usual 50), and Marriott Bonvoy Platinum, Titanium and Ambassador members to qualify for KrisFlyer Elite Gold with just four flights (instead of the usual 50,000 Elite miles).

Surprisingly, most of the interest was in the direction of Marriott Bonvoy to KrisFlyer (although to be fair, I’m sure there’s more Marriott Bonvoy Platinums than KrisFlyer Elite Golds worldwide), so I penned a guide on how to do this.

| Marriott Bonvoy Tier | Instant Match To… | Status Accelerator Challenge |

KrisFlyer Elite Silver KrisFlyer Elite Silver |

KrisFlyer Elite Gold KrisFlyer Elite Gold(4 flights in 6 months) |

|

| N/A |  KrisFlyer Elite Silver KrisFlyer Elite Silver(2 flights in 6 months) |

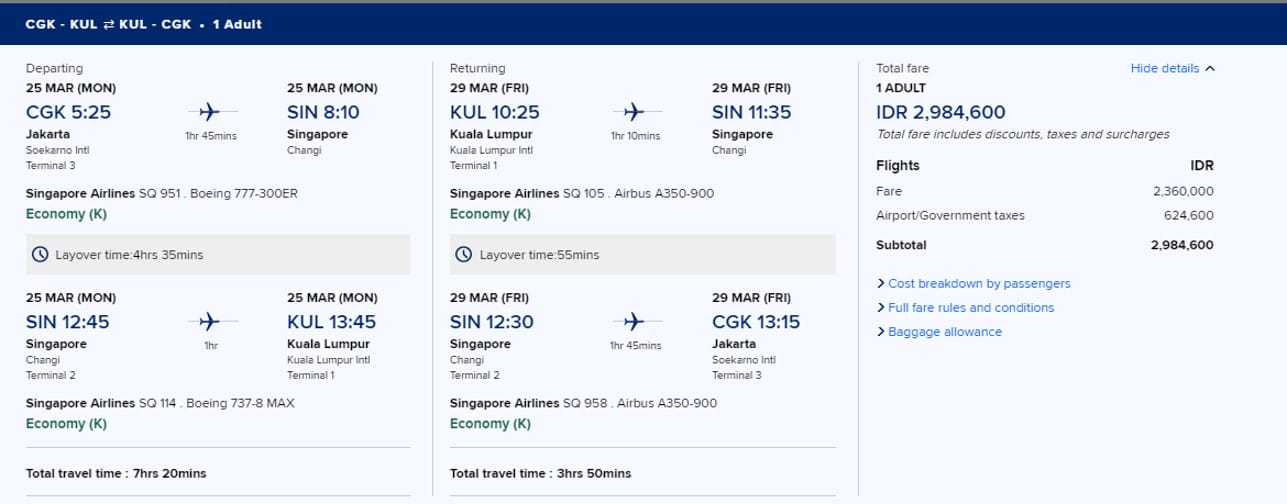

It really is a very good offer, since qualifying flights even include the cheapest Economy Lite tickets, and you could complete the challenge with a relatively cheap CGK-SIN-KUL round-trip itinerary, for instance (each leg counts as one qualifying flight). The cheapest option I found was a mere ~S$256!

In that sense, the real hurdle is having Marriott Bonvoy Platinum, Titanium or Ambassador status, not so much the flights themselves.

The status accelerator is still available, and completion grants you KrisFlyer Elite Gold status for a 12-month period. However, you can only do the accelerator once, so if you’ve completed it and lost your KrisFlyer Elite Gold status, or failed to complete it, you won’t be able to do it again.

Conclusion

2024 was an eventful year in the miles and points game (aren’t they all!) and there isn’t even space in the top 10 for other blockbuster stories, like UOB finally awarding UNI$ at UOB$ merchants, the DBS yuu Card’s 10 mpd buff, the DBS Woman’s World Card nerf, and Singapore Airlines finally announcing the timeline for their next generation cabin products.

Here’s a 2025 that’s just as eventful, and hopefully in a good way!