Citi Prestige Cardholders currently enjoy two separate complimentary travel insurance policies: one provided by Citi, and the other by Mastercard.

While you can’t be reimbursed twice for the same expense (e.g. medical bills), if the coverage on one policy is insufficient, the second policy will step in to make you whole. Also, benefits like delayed luggage, flight delays or death claims can be paid out across both policies.

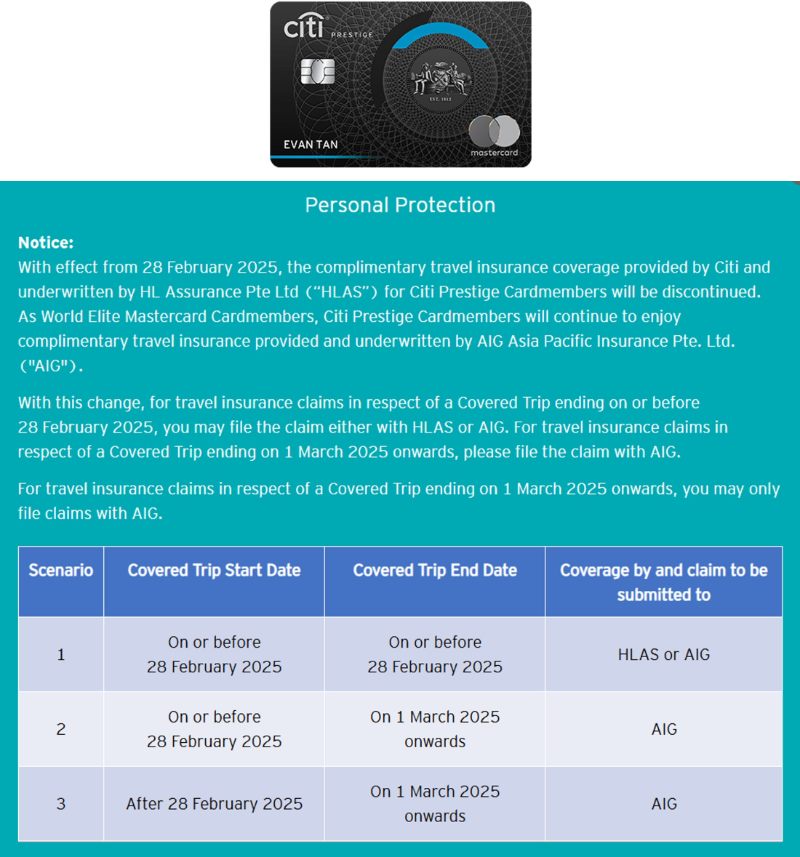

Unfortunately, Citi has announced that it will be eliminating its own policy from 28 February 2025 onwards.

Citi Prestige Card reducing complimentary travel insurance coverage

Citi Prestige Cardholders currently enjoy complimentary travel insurance when they pay for air tickets with their card, or redeem air tickets using frequent flyer miles, and pay the taxes and surcharges using their card.

The cardholder is covered by two separate insurance policies:

From 28 February 2025, the complimentary travel insurance coverage provided by Citi will be discontinued.

- If your trip ends on or before 28 February 2025, you may submit claims to HLAS or AIG

- If your trip ends from 1 March 2025 onwards, you may submit claims to AIG only

Both policies have different benefits and claim limits, as illustrated in the table below.

| HLAS | AIG | |

| Accidental Death & Permanent Disablement | S$1M | US$500K |

| Overseas Medical Expenses | S$50K | US$500K |

| Emergency Medical Evacuation | S$100K | US$500K |

| Repatriation of Mortal Remains | S$50K | US$500K |

| Hospital Cash Benefit | N/A | US$100 per day |

| Baggage Loss | S$1,000 | US$3,000 |

| Baggage Delay | S$400 | US$500 |

| Flight Delay | S$400 | US$500 |

| Loss of Travel Documents or Personal Money | N/A | US$500 |

| Trip Cancellation, Postponement and Curtailment | N/A | US$7,500 |

| Personal Liability | N/A | US$500,000 |

| Policy |

Policy | |

| Coverage amounts refer to cardholder. Spouse and children enjoy reduced coverage under both policies | ||

I personally feel the AIG policy offers better coverage however, as the HLAS policy is missing protection for trip cancellation, postponement and curtailment, as well as personal liability. However, AIG does not cover post-trip medical expenses in Singapore, so take note of that.

Both policies offer coverage for the cardholder, spouse and children, though the AIG policy has a slight edge again in extending coverage to domestic helpers.

Is this coverage adequate?

While the AIG policy offers a reasonable amount of coverage, I should point out that it does not cover the loss of miles and points.

For example, KrisFlyer Spontaneous Escapes awards are non-refundable, so if you book a ticket and cannot travel due to illness or some other reason, AIG will not compensate you for the lost miles. Likewise, if you make an award night booking at a hotel and have to cancel your plans after the free cancellation deadline has passed, AIG will also not compensate you.

Because of this, I always advise people to find a travel insurance policy which covers miles and points.

Which travel insurance policies cover miles and points bookings?

I’d also like my travel insurance to cover things like rental car excess, and post-trip medical expenses in the country of residence, so those are features to look out for too.

Conclusion

From 28 February 2025, Citi will be reducing the complimentary travel insurance coverage for Citi Prestige Cardholders by removing the HLAS policy.

This leaves the generic World Elite Mastercard insurance underwritten by AIG, and while the coverage is decent, you should review the policy carefully and ensure it’s sufficient for your needs.

Hi, would anyone know whether this means we will need to separately activate the AIG insurance, or will cover be automatic under the AIG policy as long as we’ve charged the full fare to the Prestige card?

I’d like to know too.

Hello Aaron,

I am assuming the policy coverage is based on air tickets for the trip being charged on the Citi P card. Does it cover trips starting outside from SG and will the policy be applicable for redemption tickets where the tax / fees have been charged to the Citi P card?

I received an email yesterday that Citibank is also ending its complimentary travel insurance for Premiermiles, Cashback cards as well. Will end by end March 2026. Citibank is really cutting back its perks on credit cards to save cost now.