The UOB Preferred Platinum Visa and UOB Visa Signature are two of the easiest cards to use in the miles game.

Why? There’s no need to fret over MCCs. So long as you make contactless payments, you’ll earn 4 mpd, whether it’s a restaurant, supermarket, department store, hairdresser, or anywhere else. It’s an idiot-proof solution to pass to a disinterested spouse or family member, especially since the UOB$ merchant issue is now a thing of the past!

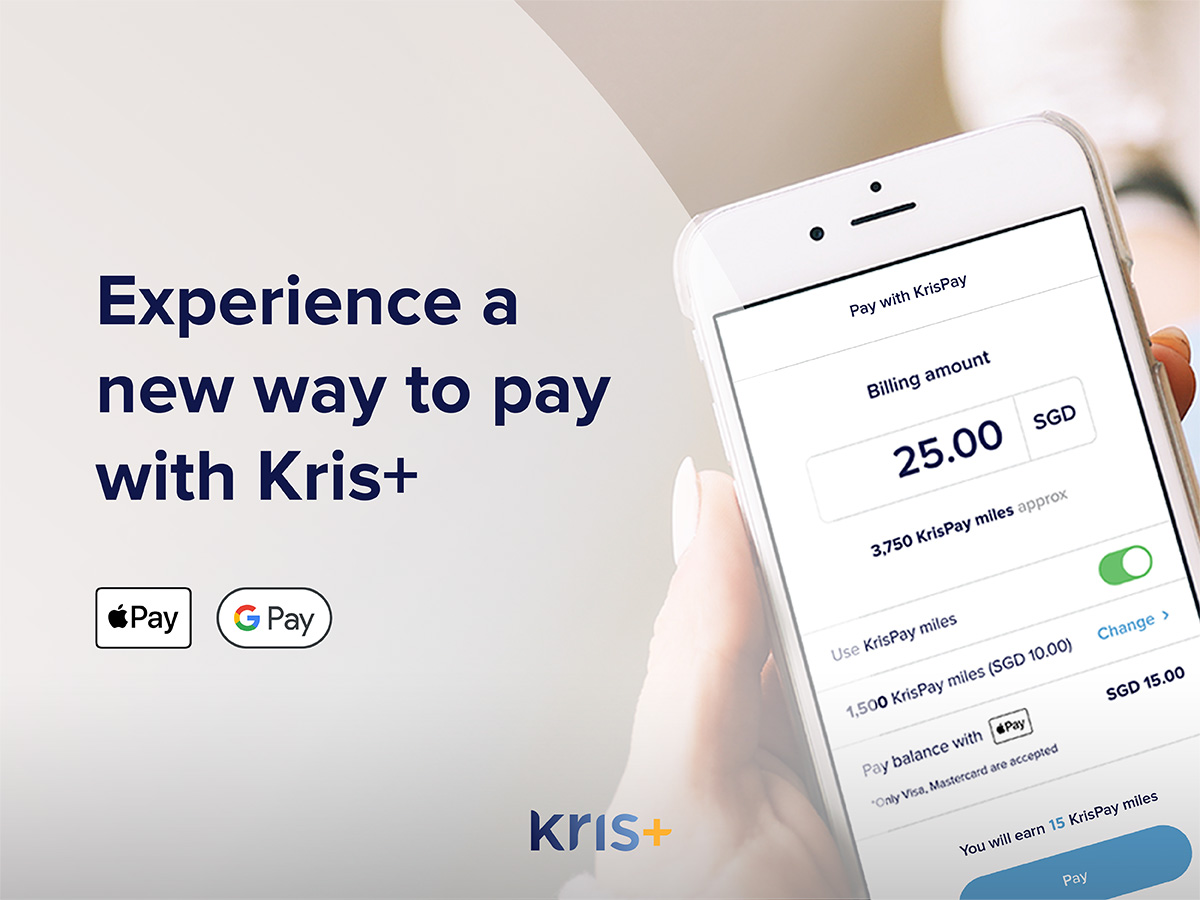

However, based on the emails I receive and questions I see in the Telegram community, “contactless” can still be a source of confusion. Tapping your phone to pay in a store? OK, sure. But what about making in-app payments with Apple or Google Pay? What about on websites which support the feature? Aren’t they both contactless payments too?

Not quite— but that doesn’t mean you can’t earn bonuses still.

Recap: UOB Preferred Platinum Visa and Visa Signature contactless bonuses

The UOB Preferred Platinum Visa earns 10X UNI$ for every S$5 (equivalent to 4 mpd) spent on contactless transactions, capped at S$1,110 per calendar month.

Cardholders will receive the base 1X UNI$ (0.4 mpd) and bonus 9X UNI$ (3.6 mpd) together, at the time the transaction posts.

The UOB Visa Signature also earns 10X UNI$ for every S$5 (equivalent to 4 mpd) spent on contactless transactions. This is subject to a minimum spend of S$1,000 in SGD per statement month, and capped at S$2,000 per statement month.

| ❓ Confused about the minimum spend? |

|

The UOB Visa Signature’s minimum spend requirement is often confusing, but here’s the key thing to note:

For a detailed guide to the minimum spend requirement, refer to this post. |

Cardholders will receive the base 1X UNI$ (0.4 mpd) separately from the bonus 9X UNI$ (3.6 mpd). The base component is credited when the transaction posts, and the bonus component is credited (as a lump sum) at the start of the following statement month.

How are contactless payments defined?

Contactless payments refer to in-person transactions made using one of the following payment methods.

|

|

|

| UOB PPV | UOB VS | |

| ✅ | ✅ | |

| ✅ | ✅ | |

| ✅ | ✅ | |

Tapping physical card Tapping physical card |

❌ | ✅ |

| ⚠️ Important note |

|

In case you’re cross-referencing this article with the T&Cs, I want to highlight that I’m using slightly different terminology than UOB, in order to simplify things. In the UOB Visa Signature T&Cs, UOB defines “contactless transactions” as those using the physical card, Apple Pay, Google Pay and Samsung Pay (as well as the now-discontinued Android Pay and UOB Mighty). However, in the UOB Preferred Platinum Visa T&Cs, UOB defines “contactless transactions” as those using the physical card, and “mobile contactless transactions” as those using Apple Pay, Google Pay and Samsung Pay. In this post, I’m using “contactless transactions” to describe Apple Pay, Google Pay and Samsung Pay transactions on the UOB Visa Signature and UOB Preferred Platinum Visa, as well as tapping the physical card for the UOB Visa Signature. |

The main difference between the two is that tapping the physical UOB Preferred Platinum Visa card will not earn you the contactless bonus, while tapping the physical UOB Visa Signature card will.

To keep things simple, digitise your UOB Preferred Platinum Visa or UOB Visa Signature into your mobile wallet and tap your device to pay. This ensures you’ll earn 4 mpd everywhere contactless payments are accepted (except merchants on the general exclusion list, of course).

What is not a contactless payment?

In-app or online payments

Certain apps and websites support in-app or in-browser payments via Apple or Google Pay. These do not count as contactless payments, because they fail to satisfy the “in-person” requirement.

However, it may still be possible to earn 4 mpd on in-app or in-browser payments nonetheless- but not because of the contactless payments bonus.

Remember, the UOB Preferred Platinum Visa and UOB Visa Signature don’t just reward contactless payments. The UOB Preferred Platinum Visa also earns 4 mpd on online shopping and entertainment under the following MCCs.

| Category | Merchant Category Codes (MCCs) |

| Department and Retail Stores | 4816, 5262, 5306, 5309, 5310, 5311, 5331, 5399, 5611, 5621, 5631,5641, 5651, 5661, 5691, 5699, 5732-5735, 5912, 5942, 5944-5949, 5964-5970, 5992, 5999 |

| Supermarkets, Dining and Food Delivery | 5811, 5812, 5814, 5333, 5411, 5441, 5462, 5499, 8012, 9751 |

| Entertainment and Ticketing | 7278, 7832, 7841, 7922, 7991, 7996, 7998-7999 |

Likewise, the UOB Visa Signature also earns 4 mpd on petrol and FCY spend, assuming the minimum spend criteria I mentioned earlier is met.

To illustrate some scenarios:

I’m not going to list everything, but I hope you get the idea by now.

If the MCC falls under the bonus whitelist, you can earn 4 mpd with the UOB Preferred Platinum Visa even for in-app Apple/Google Pay transactions. If the transaction is in FCY, you can earn 4 mpd with the UOB Visa Signature even for in-app Apple/Google Pay transactions.

Either way, you’re not earning the bonus because it’s “contactless”; you’re earning it because you’ve triggered another bonus category for the card.

How different are the two cards?

While the UOB Preferred Platinum Visa and UOB Visa Signature both offer 4 mpd on contactless transactions, they differ in many important ways like minimum spends, other bonus categories, points crediting and rounding.

I’ve written a detailed guide breaking down the differences.

Head-to-head: UOB Preferred Platinum Visa vs UOB Visa Signature

Conclusion

“Contactless payments” is a term that can trip up first-timers to the miles game. Although it’s pretty intuitive that tapping your phone to pay in a store earns bonuses, many don’t understand why in-app and website transactions are hit and miss.

The answer to this apparent inconsistency can be found in the fact that the UOB Preferred Platinum Visa and UOB Visa Signature have other bonus categories too. In-app and website transactions aren’t contactless — at least by UOB’s definition of the term — but you can still earn 4 mpd if the MCC or payment currency is right.

The easiest way of avoiding confusion is to ask yourself this: do I hear a beep sound when I pay? If you don’t, it’s not a contactless payment. If you do, it is.

What does paywave in foreign currency count as for visa signature? Does it default to foreign currency or paywave?

For example if I spend 1100 on foreign currency of which 100 was in paywave and I spend 900 on local paywave, do I get 2k worth of 4mpd? Or only 1100 counts for 4mpd?

What about the other way round?

Read Aaron’s article on UOB VS. Its spelt clearly there.

https://milelion.com/2024/03/23/review-uob-visa-signature-card/

Thank you

Read the UOB Visa Signature Review to get your answer

>>> https://milelion.com/2024/03/23/review-uob-visa-signature-card/

1100 in foreign currency = go into the foreign currency pool

Thank you

Which part of “foreign currency” is too difficult to understand?

If this term is so hard to understand, go with Cashback cards instead

You obviously don’t understand the question.

There 2 buckets. FCY bucket and local contactless, petrol bucket. As long as it is in FCY, don’t care tap, insert, online, it falls under FCY bucket. In each bucket got to 1k to activate 4mpd.

“There’s no need to fret over MCCs. So long as you make contactless payments, you’ll earn 4 mpd, whether it’s a restaurant, supermarket, department store, hairdresser, or anywhere else.”

Hi, how about using contactless payment for medical bills in government hospitals? I doubt that… 😀

Common sense is not so common these days

Milelion might not have said it explicitly but anyone that have been in the game knows long enough when he says “everything earns miles” he means everything excluding the usual suspects like govt service, insurance, grab topups etc

yeah, and some specialist in Mt E hospital also use Hospital MCC, i tried paywave use PPV and turn out not get 10x point due to it

I cancelled the card because i didn’t get the 4mpd despite using apple pay at the same merchants on some occasions. Uob said it depends on the merchants terminals to show contactless payment. Even online shopping with shopee don’t always get 4pmd. Is like playing Russian roulette.

Seek advice. If charge utilities (SP, Geneco) on recurring basis to UOB VS, does it count towards the $1000 minimum spend? Though clear does not earn bonus. Thanks.

no, i believe utilities all are excluded for UOB Cards

Utilities charges are accepted in UOB ONE credit card. I have been getting cashback on my SP Svcs bill.

What if it’s those restaurants whereby you need to scan a QR code for online menu and make payment via their browser which allows Google Pay. UOB PPV will earn the bonus miles since it includes dining MCC, but what about UOB VS

Does FairPrice (5411) in SGD include inside the Fairprice App Scan and Go?

Can UOB Preferred Platinum Visa earn 4mpd for petrol with contactless payment?

Does paying public hospital bills over the counter via contactless (paywave) qualify for 4 mpd using the UOB VS?

Hi, is krispay using Apple Pay considered contactless?

Hi, is krispay using Apple Pay considered as contactless?