Back in April 2024, UOB launched a new offer called “The Unstoppable Pairing”, designed to reward UOB Lady’s Cardholders who also hold a UOB Lady’s Savings Account.

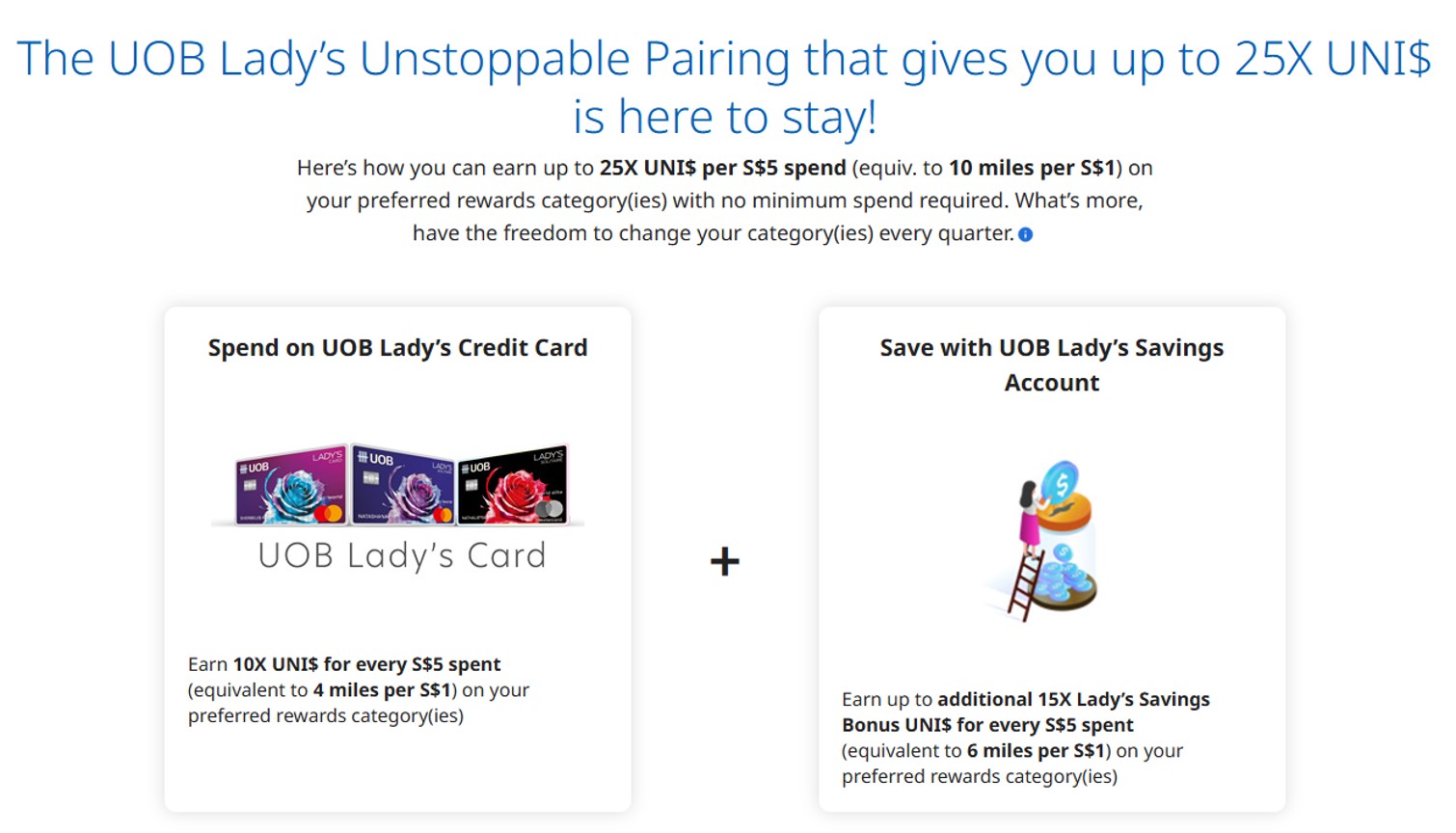

This pairing allows customers to earn 6-10 mpd on their UOB Lady’s Card spend, consisting of the usual 4 mpd from the UOB Lady’s Card, plus an extra 2-6 mpd from the UOB Lady’s Savings Account, depending on the Monthly Average Balance (MAB).

While it does come at the expense of interest — since the UOB Lady’s Account earns a miserly 0.05% p.a. — most people will find the sweet spot to be a S$10,000 deposit for an extra 2 mpd.

The Unstoppable Pairing was initially positioned as a limited-time promotion that would end on 31 March 2025. However, the good news is that UOB has now decided to make the offer evergreen.

Earn an extra 2-6 mpd with the UOB Lady’s Savings Account

UOB has updated the UOB Lady’s Savings Account webpage to say that the Unstoppable Pairing is “here to stay”. The T&Cs have also been updated to remove references to a promotion period, and to edit the dates in the illustrations to 2025 (old version here for comparison).

This means that UOB Lady’s Accountholders can continue to earn an extra 2-6 mpd when they spend with the UOB Lady’s Card on their bonus category or categories, until further notice.

I’m quite pleased with this extension, as I’ve been regularly maxing out the bonus cap on my UOB Lady’s Solitaire Card over the past year. With a S$10,000 deposit in my UOB Lady’s Savings Account, I’m earning an extra 4,000 miles each month, which I personally value at S$60. So unless I can find a savings account which gives me a superior return (which would work out to at least 7.2% p.a., assuming simple interest), the trade-off is more than worth it in my book.

Of course, I prefer the good old days of March 2023 to March 2024 when you could earn 6 mpd without the need for a savings account, but this isn’t too bad an outcome either.

Recap: UOB Lady’s Savings Account

Here’s a brief refresher of how the UOB Lady’s Savings Account works.

UOB Lady’s Cardholders will earn bonus UNI$ on their card spending based on the Monthly Average Balance (MAB) in their UOB Lady’s Savings Account.

| Monthly Average Balance | UNI$ from Lady’s Savings Account | UNI$ from Lady’s or Lady’s Solitaire Card | Total |

| <S$10K | N/A | 10X UNI$ (4 mpd) |

10X UNI$ (4 mpd) |

| S$10,000 to S$49,999 | 5X UNI$ (2 mpd) |

15X UNI$ (6 mpd) |

|

| S$50,000 to S$99,999 | 10X UNI$ (4 mpd) |

20X UNI$ (8 mpd) |

|

| S$100K and more | 15X UNI$ (6 mpd) |

25X UNI$ (10 mpd) |

For example, a UOB Lady’s Solitaire Cardholder who has an MAB of S$15,000 would earn an extra 5X UNI$ (2 mpd), on top of the regular 10X UNI$ (4 mpd) earned from spending on his/her bonus categories.

The maximum bonus miles you can earn from the UOB Lady’s Savings Account follows the cap on your UOB Lady’s Card:

- UOB Lady’s Card: S$1,000 per calendar month

- UOB Lady’s Solitaire Card: S$2,000 per calendar month

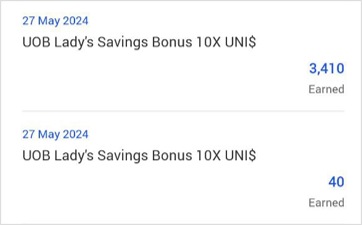

Bonus miles from the UOB Lady’s Savings Account are credited (in the form of UNI$) on the 27th of the following calendar month.

You can view this in the UOB TMRW app by tapping on Rewards+ > My Rewards > UNI$. You will see a line item(s) called “UOB Lady’s Savings Bonus [X] UNI$”, where [X] is the tier you qualify for based on your MAB.

There will be one (UOB Lady’s Card) or two (UOB Lady’s Solitaire) line items; each relates to one bonus category, though the app does not specify which one.

As a reminder, the bonus miles from the UOB Lady’s Cards are credited separately, on the 1st of the following calendar month.

First month sweet spot

If you’re new to all this and only now getting around to opening your UOB Lady’s Savings Account, do note that there’s a “first month sweet spot” to take advantage of.

This arises from the way UOB derives MAB:

| Sum of day-end balance in UOB Lady’s Savings Account ÷ Number of calendar days in each calendar month |

| Source: UOB FAQs |

In the account opening month, the MAB will be derived based on the number of calendar days from the account opening date till the end of the calendar month.

For example:

- You open your account on 20 April 2024

- You deposit S$20,000 on 20 April 2024 and maintain the balance until 30 April 2024

- MAB for April 2024 is S$20,000 [(20,000 x 11)/11]

Remember, there’s 11 calendar days from 20 April 2024 to 30 April 2024, not 10. The day of opening also counts!

What this means is that you would ideally minimise opportunity cost by opening your UOB Lady’s Savings Account as late in the month as possible, since you could deposit the funds for as little as one day and still earn bonus miles for the entire month.

Or to put it another way: you might want to open your UOB Lady’s Savings Account as late in the month as possible, deposit S$50,000 or even S$100,000 to earn the maximum possible bonus, then withdraw the funds as soon as the subsequent month begins.

For example, someone with a spare S$100,000 could open a UOB Lady’s Savings Account on 30 April 2024, deposit S$100,000 before 10.30 p.m, withdraw S$90,000 on 1 May 2024 and then enjoy:

- An extra 6 mpd for bonus category spending from 1-30 April 2024 (based on S$100K MAB)

- An extra 2 mpd for bonus category spending from 1 May 2024 onwards (based on S$10K MAB)

| ⚠️ Important Note |

| Do remember that account opening may not be instant, especially outside of working hours. From data points in the MileChat, most existing UOB customers should get approval within an hour if they open their account during working hours. |

To make this absolutely clear: it does not matter when in the month you opened your UOB Lady’s Savings Account; the bonus will be calculated based on all your UOB Lady’s Card spending in that particular month.

Do note that this is a purely one-time opportunity, only available in the opening month. You can’t repeat it from the following month onwards. Think of it as a joining gift of sorts!

There’s one important caveat here.

|

Inward Funds Transfer via FAST/PayNow performed after 10.30pm on a business day (Mondays to Saturdays, excluding Sundays and Public Holidays) will carry the value date of the next business day. Inward Fund Transfers received on a non-business day (Sundays, Public Holidays) will similarly carry the value date of the next business day. Such transfers may lower your MAB, and you are encouraged to review the transaction details on Personal Internet Banking / TMRW App regularly and make funds top up if necessary to maintain your MAB at the preferred level |

|

| Source: UOB FAQs | |

Therefore, you should open your UOB Lady’s Savings Account on the last working day of the month, before 10.30 p.m. Any later and the funds, even though they may be deposited instantly, will carry the value date of the next working day which falls in the following calendar month.

In subsequent months, I would recommend withdrawing the excess and keeping an MAB of S$10,000 in the account.

Why S$10,000? Because the opportunity cost of keeping S$50,000 or S$100,000 in the UOB Lady’s Savings Account for an entire month is simply too high. Of course, it all boils down to how much you value a mile, and how much you spend each month on your UOB Lady’s Cards.

Unstoppable Pairing FAQs

For a complete guide to the ins and outs of the UOB Lady’s Card and the UOB Lady’s Savings Account, do have a read of my detailed FAQs below.

Conclusion

UOB Lady’s Cardholders can continue to earn an extra 2-6 mpd with the UOB Lady’s Savings Account for the rest of 2025 and beyond, as the Unstoppable Pairing has now become an evergreen feature.

This means an earn rate of up to 10 mpd, though a 6 mpd figure is more realistic, given the hefty MAB required for the higher earning bands.

With the UOB Lady’s Account and Cards open to both men and women, this is an opportunity that any miles chaser should be seriously studying.

Do note if you are UOB private bank customers you are not eligible for this promotion with the lady account . Yes you are penalised for being their top tier customer.

yeah i read about that, and it’s super weird. did you ever ask your RM why?

How does this compare to UOB’s own Krisflyer Saving Account (pair with card) which also required to main MAB to earn bonus miles.

you tell me: https://milelion.com/2024/12/19/krisflyer-uob-account-review-do-not-resuscitate/

Are the bonus points from spending based on transaction date or posting date? E.g. if I make a spend on 31st March but it posts only in April, does the UOB Lady Saving’s account bonus take my March MAB or April MAB?

Is it worth to put $10k for UOB lady’s if my spending is around $500-700 per month?

So in order to take advantage of the first month promo, ideally I should already have the max amt in another UOB savings account of mine one day before I open the UOB Lady’s savings account so that I am 100% sure I can do inward transfers (across my own UOB accounts) within the same day when I open the Lady’s savings account – am I correct?

Hi Aaron, would you know if this ‘perk’ to open new Lady’s account on last working day to max the ADB , only for new card holder ?

Or existing cardholder can also do it , provided the Lady’s account is new to me ?