Citi PayAll has officially launched its promotion for the 2025 income tax season, and unfortunately, it’s not what we were expecting.

Last week, a leaked document hinted that Citi was going to repeat its 2024 offer of 2 mpd on tax payments, and 1.6 mpd on non-tax payments.

Sadly, there’s been a change of heart. Citi is still offering 1.6 mpd on non-tax payments, but the earn rate on tax payments has been cut to 1.8 mpd (you can compare the leaked and final T&Cs here).

This change means the cost per mile now ranges from 1.44 to 1.63 cents, depending on the overall mix of tax and non-tax payments. Unless you have a Citi banking relationship, you’ll also need to spend at least S$6,000 on non-tax payments to qualify—up by 20% from last year.

Frankly speaking, most people would be better off with offers from CardUp (for Visa and Mastercard), Standard Chartered (via the Income Tax Payment Facility and EasyBill) or even just paying via GIRO with the UOB One Account.

If you’re new to Citi PayAll, or simply need a refresher, be sure to refer to my comprehensive guide for everything you need to know.

Earn 1.6 or 1.8 mpd on Citi PayAll transactions

|

| Citi PayAll |

The 2025 Citi PayAll income tax season promotion offers eligible cardholders:

- 1.8 mpd on all Citi PayAll tax payments (income and property tax)

- 1.6 mpd on all Citi PayAll non-tax payments

Eligible cardholders refer to principal cardmembers of the following cards:

- Citi ULTIMA Card

- Citi Prestige Card

- Citi PremierMiles Card

- Citi Rewards Card

No registration is required. The payment setup date must be from 18 April 2025 to 31 August 2025, while the payment charge date must be by 4 September 2025. If you have already set up an existing recurring or one-off payment prior to 18 April 2025, you will need to cancel it and set it up again to benefit from this promotion.

The maximum bonus points or miles that can be earned is capped at S$150,000 (excluding the 2.6% service fee) on one eligible card for the entire promotion period. If you spend on multiple cards, only the card with the highest accumulated spend will earn bonus points. In other words: stick to a single card!

Do remember that the Citi Mobile app (where Citi PayAll payments are set up) shows the base earn rates by default, and does not reflect any bonuses. This has always been the case even for past promotions, and since Citi has shown no interest in fixing the UX, you’ll have to take it on faith that the bonus miles/points will follow.

Minimum spend

If you have any of the following banking relationships with Citi, then no minimum spend is necessary for this promotion:

- Citibanking, Citi Priority or Citi Plus

- Citigold with AUM ≥ S$250,000

- Citigold Private Client with AUM ≥ S$1,500,000

Otherwise, you must spend at least S$6,000 on non-tax payments on a single eligible card to qualify for the promotional rates. If you fail to meet this minimum spend, you will only receive the regular base points or miles. For the avoidance of doubt, the S$6,000 does not include the 2.6% service fee, and can be made in one or more transactions.

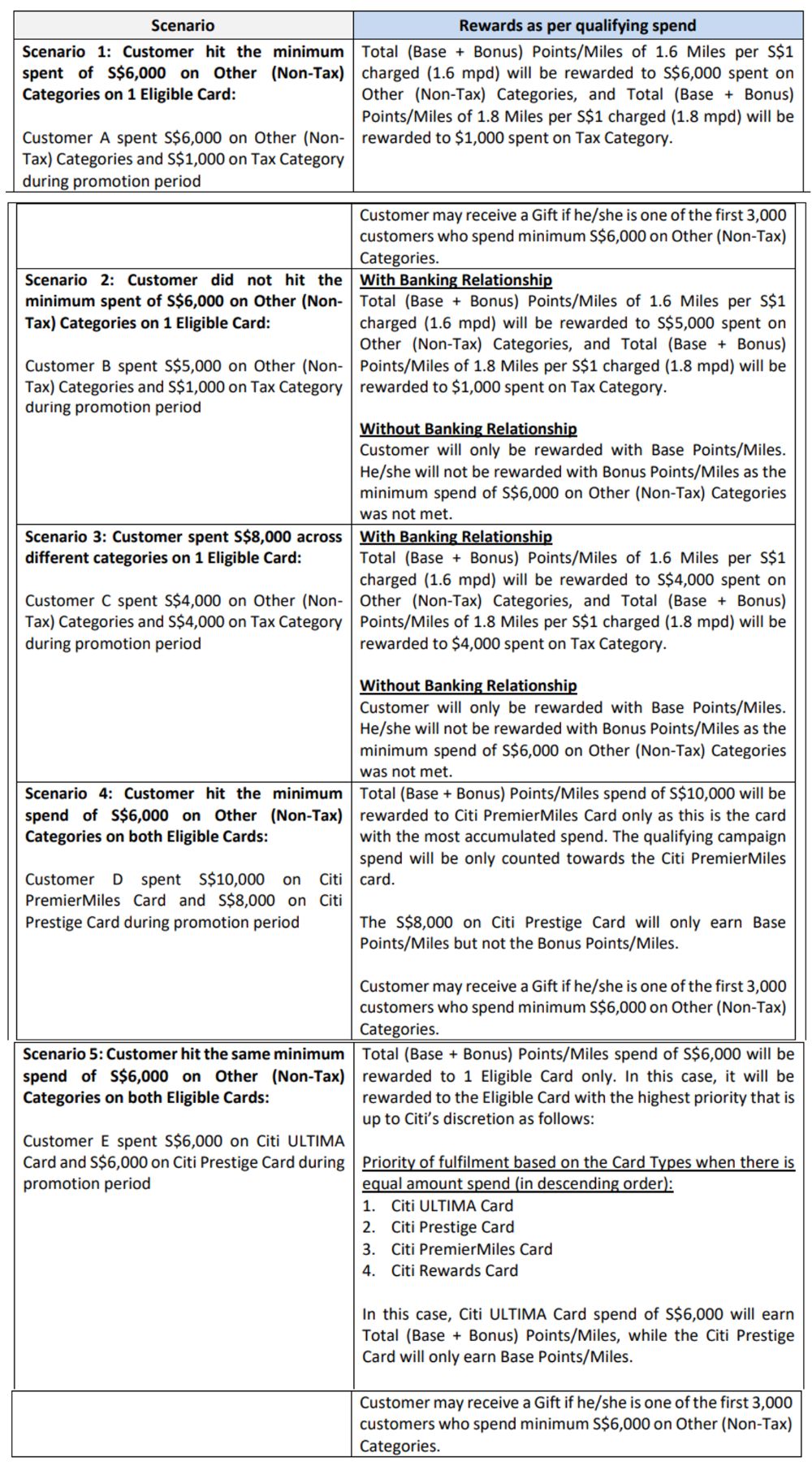

Citi has provided the following illustrations as to how the minimum spend works.

What’s the cost per mile?

Citi PayAll’s usual 2.6% service fee remains unchanged, and therefore the cost per mile under this promotion will range from 1.44 to 1.63 cents, depending on the overall mix of tax versus non-tax payments.

| 💰 Tax Payments (1.8 mpd) | |||

| Card | Base | Bonus | Cost Per Mile (@ 2.6% fee) |

Citi ULTIMA Citi ULTIMA |

1.6 mpd | 0.2 mpd |

1.44¢ |

Citi Prestige Citi Prestige |

1.3 mpd | 0.5 mpd | 1.44¢ |

Citi Premier Miles Citi Premier Miles |

1.2 mpd | 0.6 mpd | 1.44¢ |

Citi Rewards Citi Rewards |

0.4 mpd | 1.4 mpd | 1.44¢ |

| 💰 Non-Tax Payments (1.6 mpd) | |||

| Card | Base | Bonus | Cost Per Mile (@ 2.6% fee) |

Citi ULTIMA Citi ULTIMA |

1.6 mpd | N/A |

1.63¢ |

Citi Prestige Citi Prestige |

1.3 mpd | 0.3 mpd | 1.63¢ |

Citi PremierMiles Citi PremierMiles |

1.2 mpd | 0.4 mpd | 1.63¢ |

Citi Rewards Citi Rewards |

0.4 mpd | 1.2 mpd | 1.63¢ |

To illustrate how this works, suppose you spend S$6,000 on tax payments, and S$6,000 on non-tax payments during the promotion period:

- You will earn 20,400 miles (S$6,000 x 1.8 mpd + S$6,000 x 1.6 mpd)

- You will pay an admin fee of S$312 (S$12,000 x 2.6%)

- The cost per mile is therefore S$312/20,400 miles = 1.53 cents

Keep in mind that even though the bonus component varies by card, the overall earn rate is the same for all eligible cards, i.e. 2 mpd for tax, 1.6 mpd for non-tax.

Additional gift: S$100 eCapitaVoucher

The first 3,000 Citi cardholders who spend at least S$6,000 on non-tax payments on a single eligible card will receive a S$100 eCapitaVoucher, on top of the bonus miles. Each customer is only eligible for a single gift, regardless of how many Citi cards he/she holds.

In my opinion, this is a pretty decent promotion to gun for, as a S$100 eCapitaVoucher would significantly offset the S$156 admin fee payable on a S$6,000 Citi PayAll transaction, lowering the cost per mile to 0.6 cents (assuming you take the vouchers at face value).

The catch here is the cap, so you’ll want to act quickly once the promotion kicks off on 18 April 2025. From my reading of the T&Cs, what’s important is the charge date, not the setup date (though obviously you can’t charge until you’ve set something up), so hopefully you’ve got a payment that’s due soon.

When will bonus miles be credited?

Cardholders will receive their regular base rewards when the Citi PayAll transaction initially posts. The bonus component will be credited within 12 weeks from the end of the promotion period, i.e. by 23 November 2025.

Therefore, the higher your base earn rate, the more miles you get upfront. For example, when making tax payments:

- a Citi Prestige Cardholder would enjoy 1.3 mpd upfront, and 0.5 mpd later

- a Citi Rewards Cardholder would only enjoy 0.4 mpd upfront, and 1.4 mpd later

If you have multiple Citi cards, it’s better to use the one with the highest base rate, in order to receive more miles sooner.

The S$100 eCapitaVouchers will also be credited by 23 November 2025.

Terms and Conditions

The T&Cs for this promotion can be found here.

Is it worth it?

It’s no big secret that Citi PayAll promotions have been getting less and less generous over the years— gone are the days when you could buy miles for less than one cent each!

This year’s promotion is the weakest one yet, and only really makes sense for those who have a Citi banking relationship (and even then it’s marginal).

If you have a Citi banking relationship

If you have a Citi banking relationship, then you can bypass the minimum spend requirement on non-tax payments altogether and earn a flat 1.8 mpd on tax payments.

This gives you a cost per mile of 1.44 cents, though it’s worth noting there are cheaper alternatives (see below).

If you don’t have a Citi banking relationship

If you don’t have a Citi banking relationship, then this is pretty much a non-starter.

First, the minimum non-tax spend has been increased to S$6,000 this year compared to S$5,000 last year,

Second, even if you can cross that hurdle, the work’s just begun. Making S$6,000 of non-tax payments at 1.6 mpd puts your cost per mile at a relatively unattractive 1.63 cents. You need to bring that figure down by making tax payments at 1.8 mpd, and it’d take at least S$11,000 worth of tax to reduce the blended average down to 1.5 cents, the threshold at which I’d generally consider buying miles.

The table below shows how the blended cost per mile (CPM) changes as the amount of tax you pay increases. Because of the drag created by the S$6,000 of non-tax payments, you’d have to pay a significant amount of tax to get closer to the 1.44 cents per mile that those with a Citi banking relationship enjoy.

| Tax (1.8 mpd @ 2.6% fee) |

Non-Tax (1.6 mpd @ 2.6% fee) |

Blended CPM |

| S$0 | S$6,000 | 1.63¢ |

| S$1,000 | S$6,000 | 1.60¢ |

| S$2,000 | S$6,000 | 1.58¢ |

| S$3,000 | S$6,000 | 1.56¢ |

| S$4,000 | S$6,000 | 1.55¢ |

| S$5,000 | S$6,000 | 1.54¢ |

| S$10,000 | S$6,000 | 1.51¢ |

| S$15,000 | S$6,000 | 1.49¢ |

| S$20,000 | S$6,000 | 1.48¢ |

| S$144,000 | S$6,000 | 1.45¢ |

Of course, if you’re able to get your hands on the S$100 eCapitaVoucher, then the equation might change somewhat. But given the 3,000 cap, it’s going to be a bit of a gamble.

What can you do with Citi points?

Citi Miles and ThankYou points are amongst the most versatile in Singapore, and can be converted to 11 frequent flyer programmes and one hotel programme.

| Frequent Flyer Programme |

Conversion Ratio (Citi: Partner) |

|

| Citi Miles | TY Points | |

|

1:1 | 2.5:1 |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

|

1:1 | 2.5:1 |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

| 1:1 | 2.5:1 | |

|

1:1 | 2.5:1 |

| 1:1 | 2.5:1 | |

| All conversions in blocks of 10,000 partner miles/points |

||

All conversions have a flat fee of S$27.25.

Citi Miles, and Citi ThankYou points earned on the Citi ULTIMA and Prestige Cards do not expire. Citi ThankYou points earned on the Citi Rewards Card are valid for up to five years.

Citi PayAll transactions count as qualifying spend

Citi PayAll transactions will count towards the qualifying spend required for welcome offers and card-related benefits, provided the service fee is paid.

This means that you could use your Citi PayAll transaction to meet:

- The S$12,000 quarterly spend required to unlock 2x limo rides with the Citi Prestige Card

- The minimum spend required to earn the welcome bonuses for the Citi Rewards, Citi PremierMiles and Citi Prestige Card

Citi PayAll transactions also count towards the aggregate sum to which the Citi Prestige’s Relationship Bonus is applied.

What payments does Citi PayAll support?

Here’s a reminder of the full list of payments that Citi PayAll currently supports:

| 💰 Citi PayAll: Supported Payments | |

|

|

Some categories are rather nebulously defined, which means it really isn’t difficult to find something to pay.

Just remember, however, that Citi PayAll T&Cs explicitly prohibit you from sending money to yourself, or using it as a cash advance facility. In other words, whatever payment you make must have some underlying economic substance.

|

|

10.1 When accessing and using the Service, you must comply with any prescribed verification procedures, or other procedures, directions and instructions communicated by us to you. Further, you hereby represent and warrant that you shall not, in connection with your use of the Service: (b) send money to yourself or recipients who have not provided you with goods or services (unless expressly allowed by us); (c) provide yourself or any other party a cash advance from your card (or help other parties to do so); |

What are the alternatives?

The lowest possible cost per mile achievable with this Citi PayAll offer is 1.44 cents, but as the table below shows, there are many alternatives which can beat that.

| 💰 Summary of Tax Payment Options |

|||

| Card | Pay Via | Fee (MPD) |

CPM |

StanChart Beyond StanChart Beyond(PB/PP) Apply |

CardUp (New) |

1.55% 2 mpd |

0.76¢ |

| CardUp (Existing) |

1.67% 2 mpd |

0.82¢ | |

Chocolate Visa Chocolate VisaApply |

CardUp |

1.75% 2 mpd |

0.86¢ |

Citi ULTIMA MC Citi ULTIMA MCApply |

CardUp (New) |

1.55% 1.6 mpd |

0.95¢ |

| CardUp (Existing) |

1.67% 1.6 mpd |

1.03¢ | |

OCBC VOYAGE OCBC VOYAGE (Premier, PPC, BOS) Apply |

CardUp (New) |

1.55% 1.6 mpd |

0.95¢ |

| CardUp (Existing) |

1.73% 1.6 mpd |

1.06¢ | |

StanChart Beyond Card StanChart Beyond Card (Regular) Apply |

CardUp (New) |

1.55% 2 mpd |

1.02¢ |

| CardUp (Existing) |

1.67% 2 mpd |

1.10¢ | |

Citi ULTIMA Visa Citi ULTIMA VisaApply |

CardUp | 1.75% 1.6 mpd |

1.07¢ |

DBS Insignia DBS InsigniaApply |

CardUp | 1.75% 1.6 mpd |

1.07¢ |

UOB Reserve UOB ReserveApply |

CardUp | 1.75% 1.6 mpd |

1.07¢ |

UOB PRVI Miles MC UOB PRVI Miles MCApply |

CardUp (New) |

1.55% 1.4 mpd |

1.09¢ |

| CardUp (Existing) |

1.67% 1.4 mpd |

1.17¢ | |

DBS Vantage DBS VantageApply |

CardUp | 1.75% 1.5 mpd |

1.15¢ |

OCBC VOYAGE OCBC VOYAGEApply |

CardUp (New) |

1.55% 1.3 mpd |

1.17¢ |

| CardUp (Existing) |

1.73% 1.3 mpd |

1.31¢ | |

OCBC 90°N MC OCBC 90°N MCApply |

CardUp (New) |

1.55% 1.3 mpd |

1.17¢ |

| CardUp (Existing) |

1.67% 1.3 mpd |

1.26¢ | |

OCBC 90°N Visa OCBC 90°N VisaApply |

CardUp (New) |

1.55% 1.3 mpd |

1.17¢ |

| CardUp (Existing) |

1.75% 1.3 mpd |

1.32¢ | |

Citi Prestige Citi PrestigeApply |

CardUp (New) |

1.55% 1.3 mpd |

1.17¢ |

| CardUp (Existing) |

1.67% 1.3 mpd |

1.26¢ | |

OCBC Premier Visa Infinite OCBC Premier Visa InfiniteApply |

CardUp (New) |

1.55% 1.28 mpd |

1.19¢ |

| CardUp (Existing) |

1.73% 1.28 mpd |

1.33¢ | |

UOB PRVI Miles Visa UOB PRVI Miles VisaApply |

CardUp | 1.75% 1.4 mpd |

1.23¢ |

UOB Visa Infinite Metal UOB Visa Infinite MetalApply |

CardUp | 1.75% 1.4 mpd |

1.23¢ |

StanChart Visa Infinite StanChart Visa InfiniteApply |

CardUp | 1.75% 1.4 mpd* |

1.23¢ |

KrisFlyer UOB KrisFlyer UOBApply |

CardUp (New) |

1.55% 1.2 mpd |

1.27¢ |

| CardUp (Existing) |

1.67% 1.2 mpd |

1.37¢ | |

Citi Premier Miles MC Citi Premier Miles MCApply |

CardUp (New) |

1.55% 1.2 mpd |

1.27¢ |

| CardUp (Existing) |

1.67% 1.2 mpd |

1.37¢ | |

DBS Altitude Visa DBS Altitude VisaApply |

CardUp | 1.75% 1.3 mpd |

1.32¢ |

Citi Premier Miles Visa Citi Premier Miles Visa |

CardUp | 1.75% 1.2 mpd |

1.43¢ |

Maybank Visa Infinite Maybank Visa InfiniteApply |

CardUp | 1.75% 1.2 mpd |

1.43¢ |

StanChart Journey StanChart JourneyApply |

CardUp | 1.75% 1.2 mpd |

1.43¢ |

| *With a minimum spend of S$2,000 in a statement month. Minimum spend includes CardUp payments, SC EasyBill and StanChart Tax Payment Facility | |||

More crucially, note how every Citi card (with the exception of the Citi Rewards) could enjoy a lower cost per mile by paying taxes through CardUp instead.

With CardUp:

- Visa customers pay a 1.75% fee with the code MLTAX25

- Mastercard customers pay a 1.55-1.67% fee with the code MCTAX25N or MCTAX25

The Visa offer has no cap on payments nor redemptions, but the Mastercard offer is capped at S$5,000, with a 1,500 redemption limit. And even if the Mastercard offer is fully utilised, I’d sooner use a Visa card to pay the balance to enjoy a lower cost per mile.

Moreover, miles earned through CardUp are credited as soon as the transaction posts, but where Citi PayAll is concerned, you’ll need to wait till November to get the bonus component.

The MileLion’s 2025 Income Tax Guide

If you’re looking for the best ways of paying income tax with your credit card, be sure to check out my detailed post on the topic, which covers the lowest cost options for many popular miles and points cards.

2025 Edition: How to earn credit card miles on IRAS income tax

Conclusion

Citi PayAll has rolled out its 2025 income tax promotion, but unfortunately, it’s rather disappointing.

To earn 1.8 mpd on tax payments, customers must first spend at least S$6,000 on non-tax payments at a less appealing rate of 1.6 mpd. That’s a 20% increase in the minimum spend compared to 2024, for an unattractive 1.63 cents per mile.

While customers with a Citi banking relationship can bypass the minimum spend requirement altogether and earn 1.8 mpd on tax payments from the get go, the cost per mile of 1.44 cents is still unattractive compared to CardUp and other alternatives.

The main advantage Citi has is its wide range of transfer partners, including alternatives to KrisFlyer like EVA Air’s Infinity MileageLands and Qatar Privilege Club. And if you’re one of the first 3,000 customers to score that S$100 eCapitaVoucher, the math becomes more favourable—but it’s essentially a gamble.

What’s your take on Citi PayAll’s 2025 offer?

I suppose just holding Citi SG credits is not considered as having a Citibanking relationship? 🙁

I need to pay a tax of 70k and 50k in school fees per year. What strategy is best to get the maximum miles?

If I unlock the 6k non tax payments, can I still get the 2mpd tax payments IF the payments are made on a monthly basis instead of a lump sum? Do I have to keep unlocking 6k every month?

this is for the entire promo period.

when you say “minimum spend” is this on non-tax payments using Citi PayAll or just spend billed to the credit card (e.g. normal groceries, travel etc.)?

read the damn article dude don’t be lazy

Thanks the feedback, “dude”. You may notice my comment was 6 days ago when the article had different content.

Does it mean I can just go to Citibank branch open an account and waive the SGD6000 spending requirement?

but where to find a citi branch? 🙂

Hi, just checking…the screen cap you uploaded on the illustrative examples all say “2mpd”. Is that correct? Thought it was reduced to 1.8mpd?

Yes it should be 1.8 mpd. I will get that updated