The UOB One Account is often considered the best bank account for miles chasers. Unlike other “hurdle accounts” which require customers to spend on cashback cards, purchase overpriced investment or insurance products, or take out a mortgage, the UOB One Account is refreshingly straightforward.

Customers can earn up to 3.3% p.a. on a maximum balance of S$150,000 by simply meeting two requirements:

- Crediting a monthly salary of at least S$1,600

- Spending at least S$500 per month on selected UOB cards

The list of eligible cards includes two popular miles-earning options— the UOB Lady’s Card and UOB Lady’s Solitaire Card— and the S$500 spending requirement easily fits within their monthly bonus cap.

Unfortunately, UOB is not immune to the global decline in interest rates, and after one round of reductions in May 2025, which saw the maximum interest cut from 4% to the current 3.3% p.a., UOB will further slash rates to 2.5% p.a. from September 2025.

| 🏦 UOB One Account | ||

| Maximum EIR | Balance | |

| Prior to May 2024 | 5% p.a. | S$100K |

| May 2024 to April 2025 | 4% p.a. | S$150K |

| May 2025 to August 2025 | 3.3% p.a. | S$150K |

| From September 2025 | 2.5% p.a. | S$150K |

UOB One Account cuts interest rates from September 2025

Current interest rates

The UOB One Account currently offers customers up to 3.3% p.a. on a maximum balance of S$150,000.

| 🏦 UOB One Account (Till 31 Aug 2025) |

||

| Card Spend + GIRO | Card Spend + Salary Credit | |

| First S$75K | 1.5% | 2.3% |

| Next S$50K | 2.5% | 3.8% |

| Next S$25K | 0.05% | 5.3% |

| Above S$150K | 0.05% | 0.05% |

| Max. Effective Interest |

1.9% | 3.3% |

| Cap | S$125K | S$150K |

Revised interest rates

From 1 September 2025, UOB will be revising the interest rates on the UOB One Account as follows.

| 🏦 UOB One Account (From 1 Sep 2025) |

||

| Card Spend + GIRO | Card Spend + Salary Credit | |

| First S$75K | 1% | 1.5% |

| Next S$50K | 2% | 3% |

| Next S$25K | 0.05% | 4.5% |

| Above S$150K | 0.05% | 0.05% |

| Max. Effective Interest |

1.4% | 2.5% |

| Cap | S$125K | S$150K |

If you’re a customer meeting the card spend and salary credit requirements, the maximum effective interest you can earn on the first S$150,000 will decrease from 3.3% p.a. to 2.5% p.a.

If you’re a customer meeting the card spend and GIRO requirements, the maximum effective interest you can earn on the first S$125,000 will decrease from 1.9% p.a. to 1.4% p.a.

What’s not changing?

For what it’s worth, UOB is keeping the One Account simple by not changing any of the activities required to unlock bonus interest:

- Min. card spend of S$500 per calendar month, and

- At least 3 GIRO debit transactions or credit salary of at least S$1,600 per month (with the transaction reference code “SALA” / “PAYNOW SALA”)

The list of eligible UOB cards remains the same.

|

|

No prizes for guessing that most miles chasers will meet the minimum spend with either the UOB Lady’s Card or UOB Lady’s Solitaire Card, as the S$500 requirement is well within the monthly bonus cap of S$1,000 (Lady’s Card) or S$1,500 (Lady’s Solitaire Card- split into S$750 per bonus category).

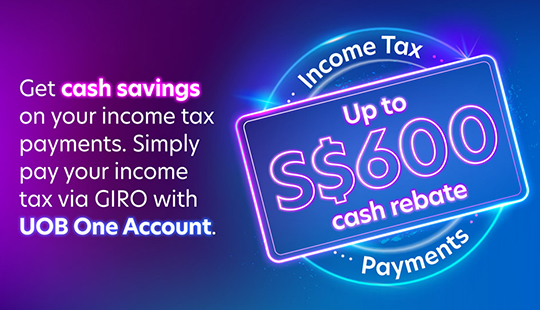

Reminder: 6% rebate for tax payments

During the last round of interest rate nerfs, UOB softened the blow with a new promotion that offers a 6% rebate on GIRO income tax payments made between 1 April 2025 and 31 March 2026.

This promotion continues unchanged, and as before, the rebate cap depends on the monthly average balance (MAB) in your UOB One Account.

| UOB One MAB | Monthly Cap (Equivalent deduction based on 6% rebate) |

Total Cap |

| ≥S$30K and <S$75K | S$10 (S$167) |

S$120 |

| ≥S$75K and <S$150K | S$25 (S$417) |

S$300 |

| ≥S$150K | S$50 (S$833) |

S$600 |

To earn this rebate, customers will need to complete the following three steps:

- Register your mobile number for PayNow on UOB TMRW

- Activate Money Lock on UOB TMRW (minimum S$1 lock amount)

- Apply for GIRO Monthly Tax Payment Plan through IRAS portal, selecting UOB One Account for deduction

No further actions are required if you’ve already performed the above three activities prior to 1 April 2025.

To illustrate, a customer who has a MAB of S$150,000 and completes the steps above will receive a 6% rebate (capped at S$50) on each month’s GIRO deduction. This is equivalent to an S$833 monthly tax bill.

Assuming you max out this promotion, the extra cash works out to an incremental 0.4% p.a. in interest. This, of course, assumes that you keep at least S$150,000 in your UOB One Account and have a personal income tax bill of at least ~S$10,000.

Alternatives for miles chasers

If you’re pursuing a miles collection strategy and don’t want to take up a mortgage or buy insurance or investment products, here’s a quick rundown of the alternatives on the market:

| Account | Max. Interest* | Cap |

| 1.17% p.a. | S$75K | |

| 1.8-2.2% p.a. | S$50K | |

| 2.55% p.a. | S$100K | |

| 2.45% p.a. |

S$100K | |

UOB One UOB One |

3.3% p.a. Till 31 Aug 25 2.5% p.a. From 1 Sep 25 |

S$150K |

| *Assumptions: Max out salary credit and bill payment bonuses, where applicable, and spending only on miles-earning cards. | ||

As you can see, things aren’t great. The UOB One Account will probably remain the best option for miles chasers, unless perhaps you want to dabble with BOC and its shenanigans for an extra 0.05% p.a. per year (hey, every little bit, right?).

I’m personally sticking to the UOB One Account and trying to limit the damage by taking advantage of the income tax payment promotion. But I also keep a secondary balance in Maybank SaveUp, because my home mortgage enables me to jump to the next rung of 3.08% p.a.

Conclusion

From 1 September 2025, the UOB One Account will cut its interest rates from 3.3% p.a. to 2.5% p.a. on a maximum account balance of S$150,000.

This is bad news for miles chasers, as the UOB Lady’s Card + UOB One Account combo was a great way of getting the best of both miles and interest. It also makes me wonder how long the UOB Lady’s Savings Account can maintain its current earn rates, though the nerf to the UOB Lady’s Solitaire Card effectively nerfs the Savings Account too.

Miles chasers: any change to your banking strategy?

“global decline in interest rates”

hahahhaahhah HARHARHARHA ARHASHDSADHArio

borrowing rates still high as f

Exactly!

There has been a huge decline in interest rates. I had a fixed rate mortgage until recently at 3.30%. Fortunately that fixed rate period ended and my interest rate fell by a massive 43% and now I am paying a mere 1.90%. Borrowing rates high? Rubbish. Borrowing rates have tumbled.

which bank is offering loan 1.9%

Both OCBC and HSBC. 1.9% is the floating rate. Fixed is ~2.1%. You can easy enough go to the mortgage related sites (Redbrick is 1, there are others) and they can also assist.

yeah floating lol

Yeah lah. Floating. And in my opinion the best rate to have right now, given that interest rates are looking to fall further with anticipated cuts to interest rates later this year by the Fed. But if you want a fixed rate, you can get that for ~2.1% – and still 36% lower than the earlier 3.3% fixed rate that I had.

Huat ah next year UOB boss 20m bonus incoming

you may want to check out scb bonus saver account which is actually higest interest now

I was going to make this same comment. The SCB Bonus Saver can get 4.05% for up to $100k by meeting 2 requirements – salary credit and $20k investment – the 2 easiest in my view. Of course you could earn even more than 4.05% by meeting further requirements. So SCB Bonus Saver is by far the best account now – definitely surpassing UOB One – only question is now long until the nurf…… I would expect it is a matter of time……….

Who would have thought, but suddenly the CPF OA account is attractive again. Back in 2021 and 2022, CPF OA was outstanding as rates were under 1% outside of CPF. Then with rates soaring, funds outside of CPF were earning way better than 2.5%. Now, we are back to CPF OA rates. Any further falls, and CPF OA will be the best place once again!