Rental car insurance is a common headache for travellers.

Purchasing the rental company’s Collision Damage Waiver (or CDW, technically not insurance but practically the same thing) can be very expensive, adding as much as S$50 per day to the cost of the rental. Travel insurance can offer some coverage, but usually in the range of S$1,000-S$2,000, which many travellers may find inadequate.

That’s why I was intrigued to read about the launch of Singapore’s first third-party car rental insurance policy, AAS RoadPlus+. Priced from S$198 per year, it offers up to S$10,000 of coverage for damage to overseas rental cars.

Unfortunately, it’s not quite what I was hoping for, and travellers looking for cheaper rental car coverage have much better options at their disposal.

What is RoadPlus+?

|

|

| RoadPlus+ | |

| 👍 The Good | 👎 The Bad |

|

|

AAS RoadPlus+ is underwritten by ECICS Insurance Singapore, and available for purchase any time before the rental begins by anyone aged 19 to 99, regardless of whether they have an AAS membership.

What does it cover?

RoadPlus+ provides coverage for the named driver on the rental contract, as well as any additional drivers who are authorised to operate the vehicle.

The following events are covered.

| Category | Examples |

| Vehicle Damage & Repairs |

|

| Rental Company Fees |

|

| Other Covered Events |

|

In the event of any damage, you will be required to pay the rental company first, then file a claim for reimbursement with RoadPlus+.

How much does it cost?

RoadPlus+ is offered as an annual plan, with the pricing dependent on trip duration and location.

| Trip Duration | Asia Pacific | Worldwide |

| First 7 Days | S$198 | S$268 |

| Every Additional 7 Days | S$50 | S$70 |

|

Asia Pacific: Includes Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Thailand, Vietnam, China, Hong Kong SAR, Macao SAR, Taiwan, Korea, Australia, New Zealand, Japan, India, Sri Lanka, Mongolia, Timor-Leste. Worldwide: Excludes United States of America, Afghanistan, Belarus, Cuba, Democratic Republic of Congo, Iran, Libya, Liberia, North Korea, Somalia, South Sudan, Sudan, Syria, Yemen, and the territories of Crimea (including Sevastopol), Donetsk, Luhansk, Zaporizhzhia, and Kherson. |

||

It’s worth highlighting that the worldwide plan explicitly excludes the United States, so you’ll have to look for an alternative if you’re planning to rent a car there.

As for the pricing, think about it this way: the premium is dictated by the cost of your most expensive trip.

For example, if I have three trips in a year:

- Trip 1: Australia, 6 days

- Trip 2: Thailand, 3 days

- Trip 3: Italy, 16 days

I will need to purchase the Worldwide plan, with coverage for 21 days (there’s no pro-rating of premiums), at a cost of S$408.

The problem with this model is that it forces you to decide upfront what the longest trip in the next 12 months will be. If you initially purchase a RoadPlus+ plan that covers two weeks, and later decide to take a 15-day vacation, that trip won’t be covered.

This is quite different from a typical annual travel insurance plan, which covers all trips up to a fixed number of days (usually 90).

How much coverage is provided?

RoadPlus+ has a limit of one claim per policy, up to a maximum of S$10,000.

If you make a claim, you will have to purchase a new policy to get protected again.

How fast are claims processed?

RoadPlus+ quotes a 10 working day timeframe for reimbursements, but also caveats that it’s not guaranteed.

What’s the problem?

The problem with RoadPlus+ is that it’s intended to provide coverage beyond basic CDW, such as the deductible, or damage to the underbody, tyres and windscreen.

When you rent a car overseas, rental companies often only offer Basic Collision Damage Waiver (CDW) or similar coverage, which typically only covers damage to the vehicle but leaves you with a high excess charges or deductible.

With RoadPlus+, we cover the excess charge and related fees, ensuring you’re not stuck with large bills if something goes wrong.

-AAS

In other words, RoadPlus+ still requires you to purchase CDW from the car rental company.

Note: RoadPlus+ Excess Protector requires you to have at least the basic Collision Damage Waiver (CDW) or equivalent rental insurance provided by the rental company.

RoadPlus+ works alongside your rental coverage – it does not replace it.

-AAS

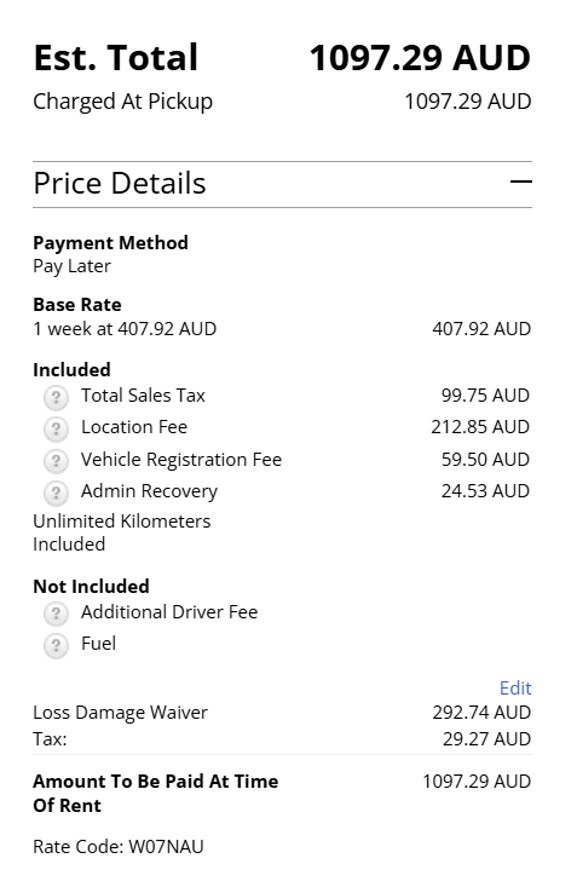

And that, to me, basically defeats the purpose. Rental company CDW can be very expensive. For example, Hertz Australia charges A$292.74 for LDW (another name for CDW) coverage on a week-long rental. That’s more than 70% the cost of the base rate!

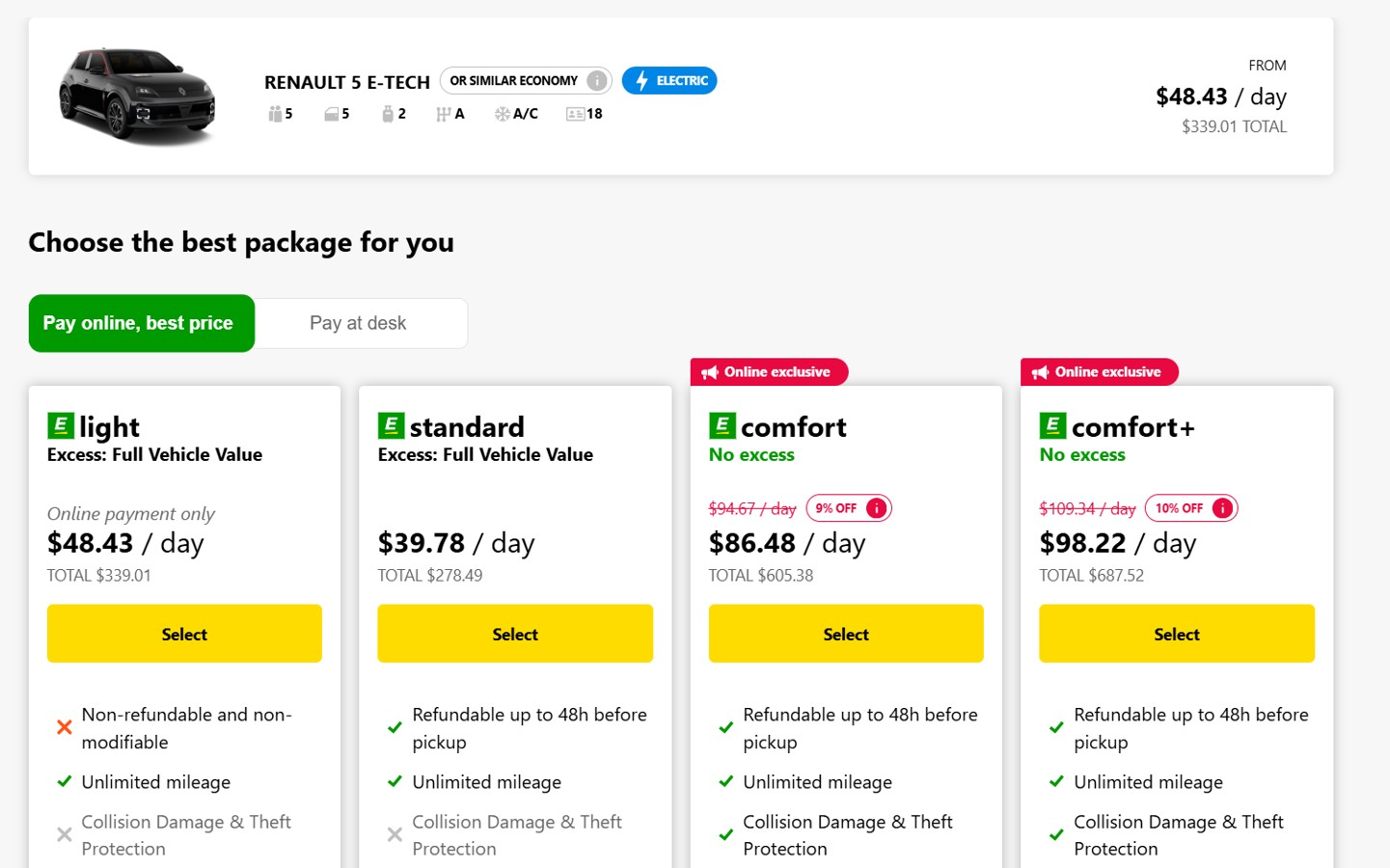

Here’s another example from Germany with Europcar, where adding CDW turns a $48.43 daily rate into $86.48.

I’m not going to say that CDW is always crazy expensive— I have done a few rentals with smaller car companies like Apex in New Zealand and Burswood in Australia where basic CDW was included in the rate.

That said, what I really want is a product that removes the need to buy CDW altogether, which means it’s time to look at alternatives…

What are the alternatives?

Travel insurance

Most travel insurance policies will cover some amount of rental vehicle excess, though the coverage limits are much lower than the S$10,000 offered by RoadPlus+.

| Policy | Coverage |

| Singlife Travel Insurance |

|

| MSIG Travel Easy |

|

| Allianz Travel Hero |

|

| HLAS Travel Protect360 |

|

| Great Eastern TravelCare |

|

| FWD Travel Insurance |

|

Unfortunately, most of these policies require you to purchase CDW from the rental car company as well, so we run into the same problem as with RoadPlus+.

As part of the hiring arrangement, You must take up comprehensive motor insurance against loss or damage to the Rented Vehicle during the rental period.

-Singlife

Note: “Comprehensive” doesn’t mean you need to buy the highest tier of CDW, otherwise this benefit would be of no use! Buying basic CDW will suffice.

Third-party rental car insurance

Given the limitations of RoadPlus+ and travel insurance, my preferred solution is still to purchase third-party rental car insurance from outside of Singapore.

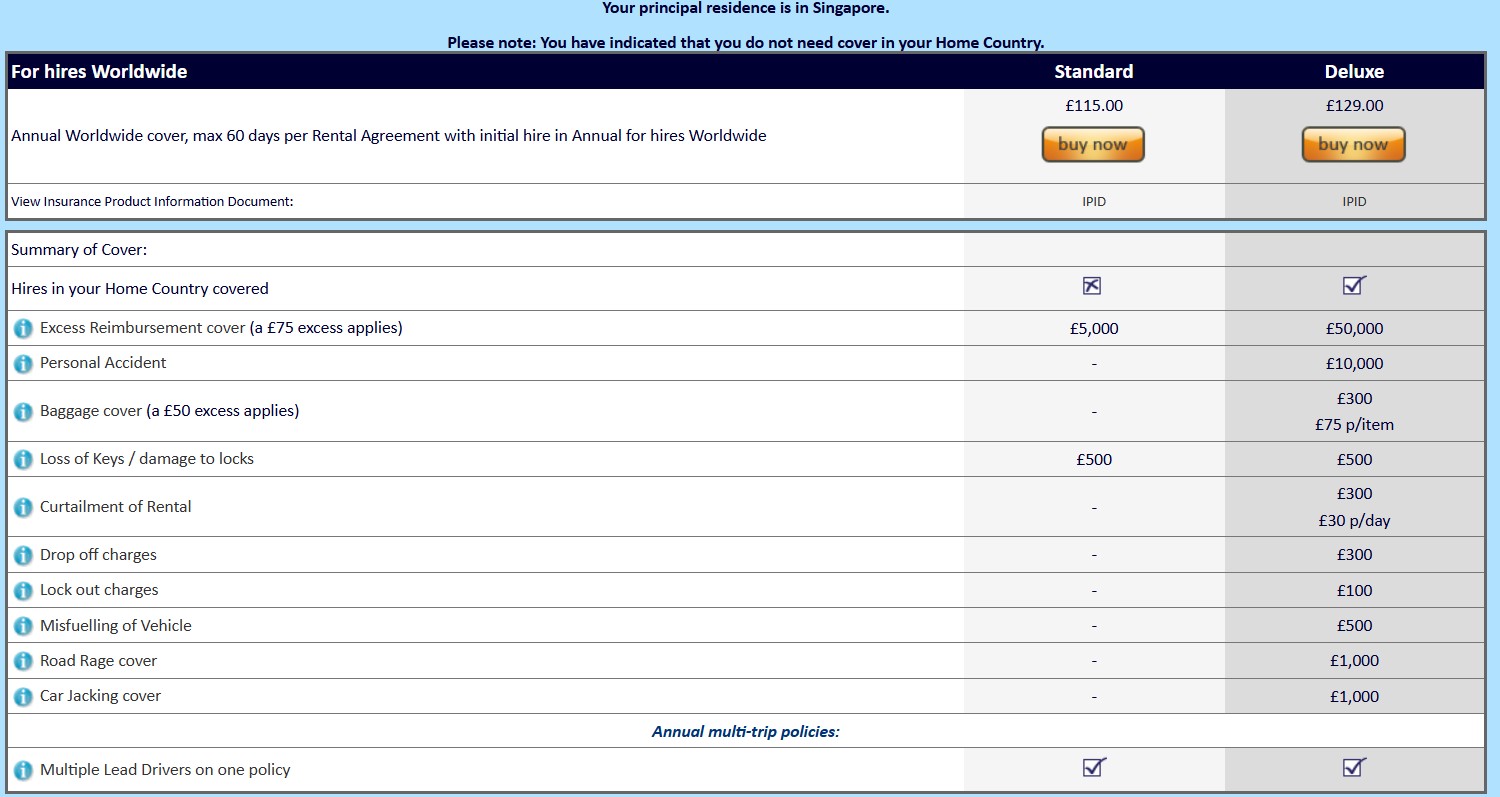

One company I’ve used before is Worldwide Insure, which offers single trip plans, or an annual plan for £129 (~S$225) that covers rentals of up to 60 days. The Deluxe tier will reimburse any excess up to £50,000 (~S$87,000), with a deductible of £75 (S$130).

The main thing to flag is that Iceland is excluded from coverage. Also, I’ve never had to make a claim before, so I can’t speak to how easy the process is— that said, there are a few success stories in the MileChat from other users.

Another option is RentalCover.com, which quoted me US$9.70 per day for a car rental in the USA, with no deductible.

| 🚗 RentalCover.com coverage |

|

Both policies can be purchased by Singapore residents, and the way I see it, offer superior coverage to RoadPlus+ at a better price.

I wish credit cards here offered car rental insurance!

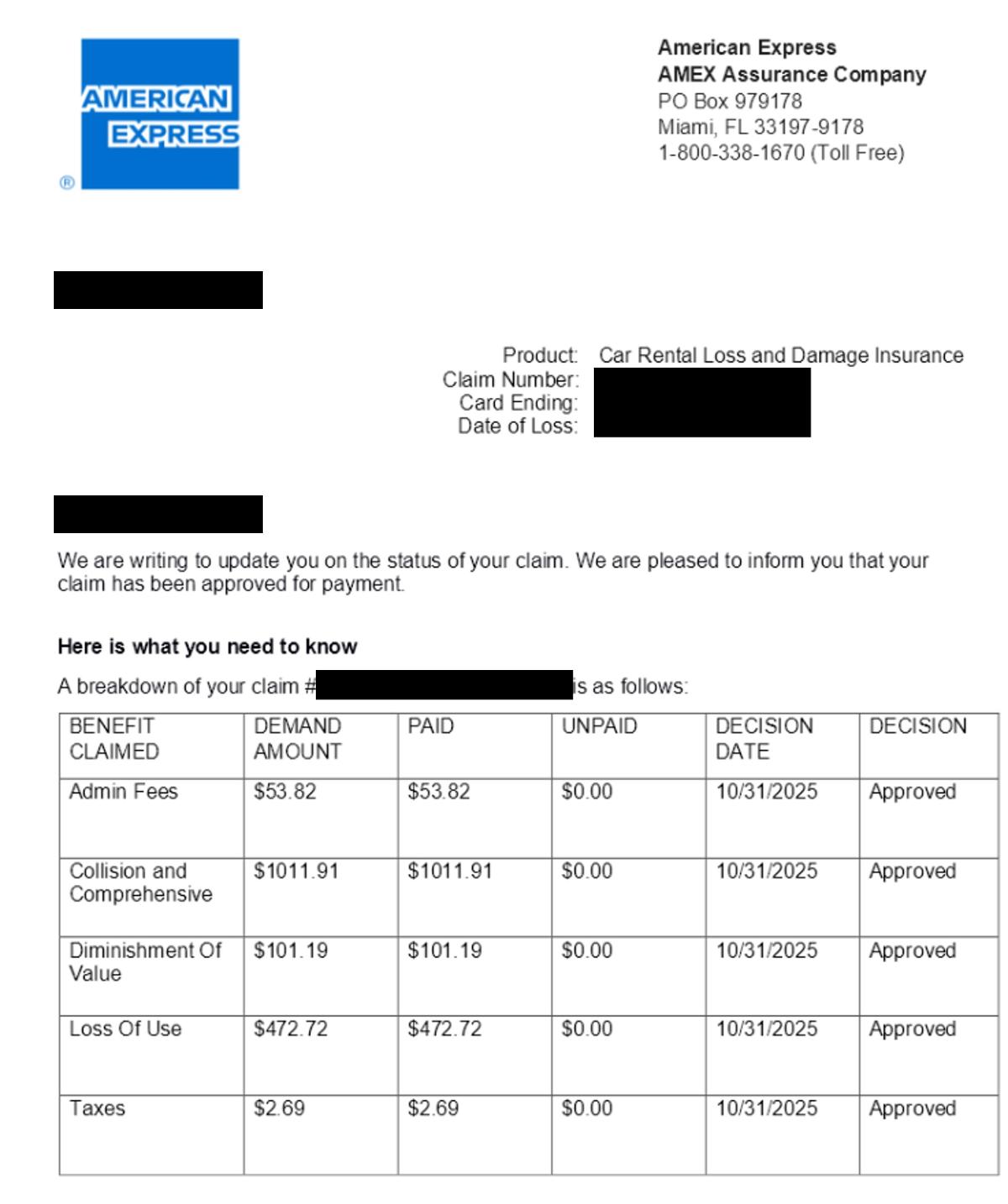

Some time ago, I was driving around Canada with a friend. A truck backed into our car in a parking lot, damaging the paint and leaving a big dent.

The rental company (National) sent a bill for C$2,288.75 worth of repairs and loss of use. Fortunately, my friend had paid for the rental with his US-issued American Express Marriott Bonvoy Brilliant Card, so it was a simple matter of filing a claim. A few weeks later, American Express paid the bill in full. We didn’t have to purchase CDW— in fact, if we did, then American Express coverage would not apply.

I was very impressed by how smooth the process was, and it made me wish we had something similar in Singapore!

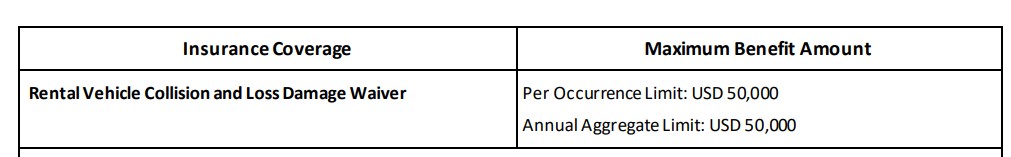

And actually, we used to. Once upon a time, the complimentary travel insurance provided by World Elite Mastercard would cover rental car damage of up to US$50,000, provided you paid for the rental with your card.

Unfortunately, this was removed some years back, and at the moment I’m not aware of any credit card in Singapore offering this benefit.

Conclusion

RoadPlus+ offers Singapore’s first third-party rental car insurance option, but unfortunately, it’s not the product I’ve been waiting for. That’s because RoadPlus+ is not a substitute for buying CDW. Instead, it’s designed to cover the things that CDW doesn’t.

Given how expensive rental company CDW can be, my preference would be a product that removes the need for it completely. Thankfully, there are cost-effective third-party insurance options sold by Worldwide Insure or RentalCover.com which provide exactly that.

Do you know any other options for affordable rental car coverage?

I’d strongly recommend worldwide insure. I’ve used it for several years on an annual policy. Barring the oddities mentioned above, their claim process is good.

Punctured tyre on a volvo, ended up whole car was towed to another part of Spain as the tyre size was not available. Total bill Eur3x00.

With the standard excess of 75 quid, worldwide reimbursed me with no issues for the remaining EUR3x00. No issues at all.

as an AA member, when i received the edm announcing this new policy, i was scratching my head over what was the selling proposition for this too? not sure how this even got approved as a product.

and it’s such a weird pricing where you buy an annual plan, but yet still top up for more days. it requires me to figure out how many days of driving i plan to do in my upcoming trips

yes the pricing structure is very weird because you may not even know at the time of purchase what the length of your longest trip is. I wish they’d simplify it and have one annual price that covers trips of up to X days

It’s practically useless as the cap is 10k SGD.

Aaron: That sounds like the base Amex coverage, not the premium, correct?

the canada rental? yes it was just the regular one.

Very “smart” of them to not include CDW. that’s usually the most ex in an accident…

Hi Aaron, I was considering RentalCover but before payment I noticed under their Protection Terms, that I have to also get CDW with the rental company?

Full Protection is sold by our partner RentalCover.com. To be eligible for this coverage, you are required to have at least the most basic collision damage waiver (“CDW”, “LDW” or similar basic protection package) offered by the car rental company. Please read the rental terms carefully as CDW is not always included at the time of booking.

Appreciate if you can help clarify pls

where do you see that on the website? I dont see it on my side.

Once I got a quote and before paying – under “what’s not covered” there’s a link on “Protection Terms” which leads to here:

https://rentalcover.com/en/pds/E8AV-SN4Y-INS

maybe it depends on what country you’re renting in? For the USA, I don’t see that under protection terms

https://rentalcover.com/en/pds/KZ5U-7SW2-INS

Ah ok. Thanks for clarifying! I’ll proceed in that case for Japan