Once upon a time, airport limo transfers were a fairly common perk of credit cards in Singapore, and not just the elite ones. You could even earn free rides on mass market miles cards like the ANZ Travel Visa Signature (remember that?).

Fast forward to today, however, and the benefit has all but vanished from any credit card with an income requirement below S$120,000 (with the notable exception of the UOB PRVI Miles AMEX). And even where the benefit has remained, the noose has been tightening on minimum spends and allowances.

| Card | Airport Limo Changes |

Citi Prestige Citi Prestige |

|

OCBC VOYAGE OCBC VOYAGE |

|

Maybank Visa Infinite Maybank Visa Infinite |

|

UOB Lady’s Solitaire Metal Card UOB Lady’s Solitaire Metal Card |

|

But what’s behind this trend, and does it mean the end of the airport limo benefit in Singapore? I spoke to a few contacts in the industry to find out.

Why are airport limo benefits being nerfed?

It all boils down to economics.

Prior to COVID, the cost of a one-way airport limo transfer was around S$45. Those prices are now much closer to S$80. You might have seen this yourself, for banks that charge your card first then offer a reimbursement later on. Citi Prestige Cardholders have reported being charged as much as S$140 for a ride with midnight surcharges!

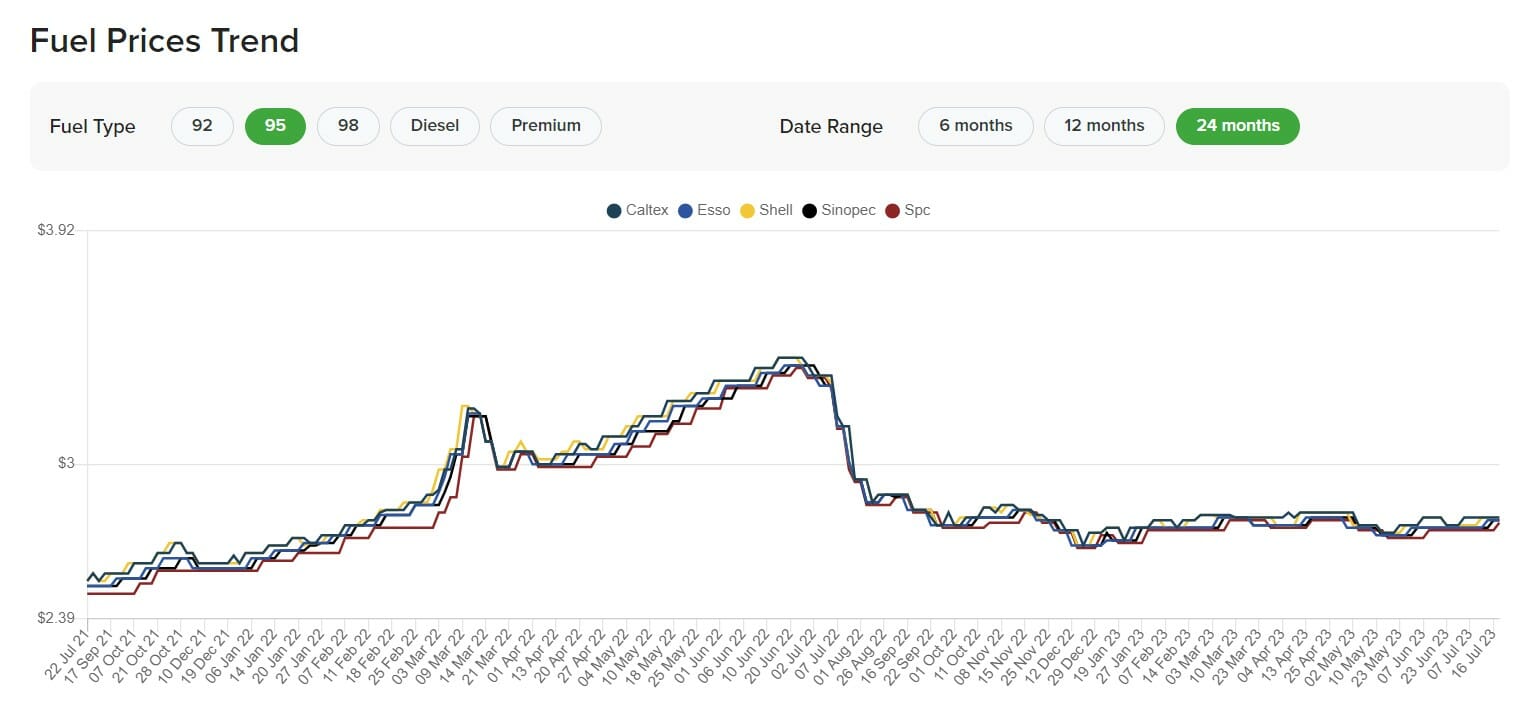

A lot of this is supply driven. During the pandemic, the industry lost a lot of drivers and vehicles. It didn’t help that petrol prices in Singapore went on a bull run from late 2021 to mid 2022, with pump prices touching as high as S$3.40 a litre.

But demand has also skyrocketed. Singapore’s initial crop of VTLs in late 2021 were predominantly long-haul destinations such as Canada, Germany, France, Italy, Spain, the United Kingdom and United States. This led to a clustering of airport limo demand around the evening slots when these flights are banked, a situation that only worsened when work-from-office resumed in January 2022 (since increased peak hour congestion had a knock-on effect on limo ride scheduling).

Anecdotally, contacts in the industry also report an increase in “bad behaviour”. For example:

- Cardholders booking rides for friends and family, when they themselves are not part of the travelling party. When the driver can’t find the passengers, he/she has to call the cardholder, who then needs to liaise with the actual passengers, leading to further delays

- Cardholders insisting that drivers make multiple unscheduled “along the way” stops on a trip, and refusing to pay for it. Even a 15-20 minute delay has a knock-on effect on the rest of the driver’s schedule

- Cardholders spending excessive time on duty-free shopping or at the airline lounge upon arrival

- More cardholders making last-minute cancellations (just outside the chargeable window), which often leaves little time for the vehicle to be redeployed elsewhere

Taken in aggregate, this means a longer “block time” per ride, which means fewer rides can be scheduled per day, which means higher costs per ride, which means reduced limo allowances or increased minimum spend requirements for cardholders.

Interestingly enough, I was also told that the opening of Changi Jewel has given cardholders an increased incentive to max out their ride allowance, when before those rides would have gone unutilised.

Why not move to ride credits?

Back in the day, the Standard Chartered Visa Infinite offered a unique approach to the limo benefit. Instead of contracting with a third party for limo access, cardholders received Uber ride credits and rebates, which they could then use to offset their own rides.

If you ask me, this really is the way to go. Even if airport limo transfers have increased to S$80 a pop, the cost of a taxi ride from Jurong to Changi Airport is roughly around S$30-35 (I realise that can increase with surge pricing, but probably not to S$80 levels). Surely that’s a win win?

In fact, that’s exactly what the KrisFlyer UOB Credit Card does, offering cardholders 2x S$15 Grab vouchers for rides to and from Changi Airport. No minimum spend is required, and while there is a cap on redemptions, I’ve always been able to max out my allowance.

Offering credits instead of limo rides would ease the logistical burden, and to the extent you only care about getting from Point A to B, still solves the underlying problem. Faster, cheaper, better, right?

I put the question across to a few product managers, and the consensus was that “affluent cardholders won’t like it.” Really? Maybe I’m just naïve, but I would have thought the mass affluent segment might favour convenience rather than image. Is it that important to be picked up by a guy holding a sign with your name on it?

If that’s the concern, I suppose the credits could be for Grab Premium or some similarly extinguished service, but in my mind this is as good a compromise as you’ll get.

Which credit cards still offer airport limo benefits?

As a reminder, here’s the six credit cards in Singapore that still offer an airport limo benefit.

| Card | Qualifying Spend (QS) |

Cap |

UOB Lady’s Solitaire Metal Card UOB Lady’s Solitaire Metal Card |

None | 1 per year (can be used overseas) |

UOB PRVI Miles AMEX UOB PRVI Miles AMEX |

S$1K (FCY) per quarter for 2 rides | 2 per quarter |

HSBC Visa Infinite HSBC Visa Infinite |

S$2K per month for 1 ride* |

24 per year |

Maybank Visa Infinite Maybank Visa Infinite |

S$3K per month for 1 ride | 8 per year |

Citi Prestige Citi Prestige |

S$12K per quarter for 2 rides | 2 per quarter |

OCBC VOYAGE OCBC VOYAGE |

S$12K per quarter for 2 rides |

2 per quarter |

| *First 2 [Regular] or 4 [HSBC Premier] per year are free |

||

It may surprise you to know that the card with the most generous benefit is also the easiest to obtain: the UOB PRVI Miles AMEX, available to anyone earning at least S$30,000 per year. Cardholders enjoy two complimentary rides to the airport when they spend at least S$1,000 on overseas, in-person transactions during a given calendar quarter.

I do wonder how long UOB can sustain this, however, given the direction the industry is moving in.

Conclusion

Airport limo benefits have been tightened significantly in recent years. Minimum spends have risen, allowances nerfed, and unfortunately it doesn’t look like we’ll be seeing a reversal of the trend anytime soon.

I personally wouldn’t mind if banks looked to ride-hailing platforms like Grab and gojek as the solution, providing cardholders with promo codes for airport rides instead. However, it’s argued that this would detract from the premium branding that cards with airport limo perks are going for.

Is an airport limo ride an important perk to you, or would ride credits work just as well?

Not going to signup for a credit card for $15, and in ride credits. As attractive as toasters for cc signup bonuses.

Did so for limo rides.