Update 20/1/17: So there have been some lively discussions on the comments and a lot of uncertainty about which cards do and don’t earn 10X on Cardup and iPayMy.

All I can say is that Cardup earned me 10X points when I used my DBS Woman’s World Card to make a payment back in November 2016. I have not tested any of the other cards mentioned here and can only go on what I’m hearing from other people. And I’m hearing a lot of conflicting things. I think the main takeaway from this should be: YMMV. Although it’d be amazing if we could get the certainty of 10X, at the end of the day it’s up to the banks what categories they want to give this on.

One additional clarification that people may find useful is that Cardup payments can be split across multiple cards so you can max out your bonus exactly on one before moving to another.

In any case, I’d prefer that the comments not become an advertising space for any platform, so I’m going to close them at this point. If you have questions for the good people at Cardup or iPayMy, I suggest you contact them directly-

Cardup: hello@cardup.co

iPayMy: support@ipaymy.com

Cardup is another Singapore startup that’s looking to help you earn more miles on things you couldn’t normally earn miles on. Its model is conceptually similar to iPayMy in that in exchange for a small transaction fee (2.6%, the same across both platforms), you get the chance to use your credit card for merchants who normally don’t take credit cards.

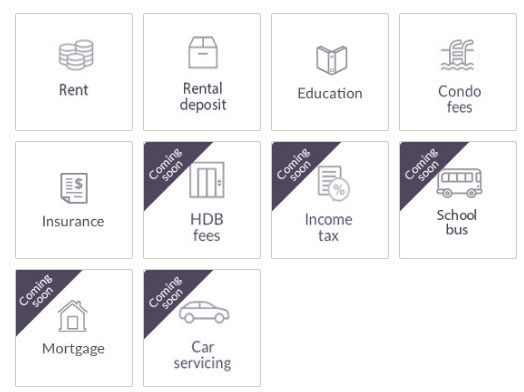

As of today, you can pay rent, rental deposits, school fees (mostly international schools plus some preschools like EtonHouse), condo fees and insurance (AIA, Aviva, AXA, Manulife, Great Eastern and Tokio Marine) through Cardup. This will eventually be expanded to include HDB fees, income tax, school bus, mortgage payments and car servicing.

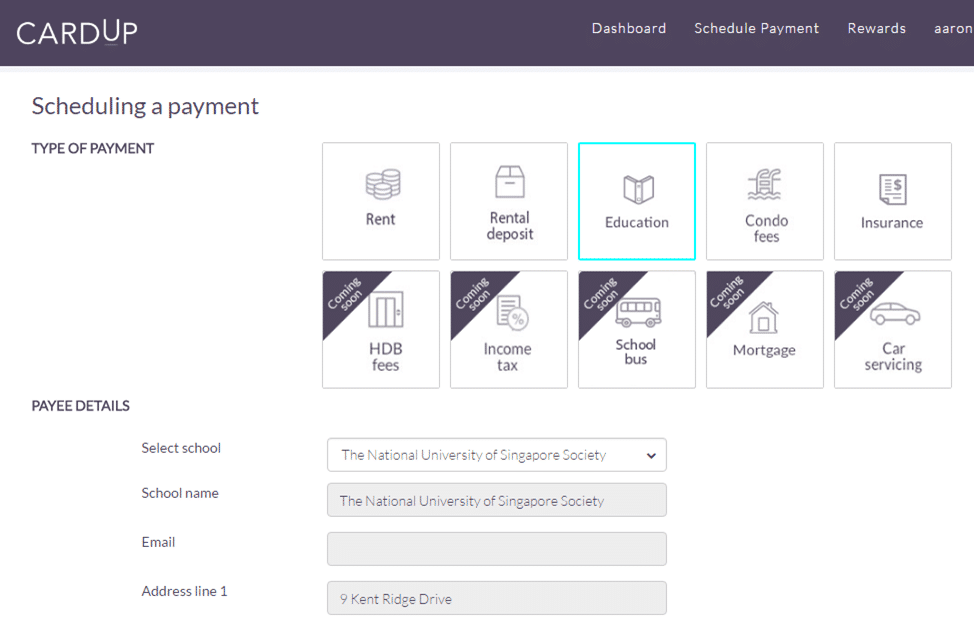

My experience using Cardup to pay my NUSS monthly membership fees was fairly painless. I just entered my membership details in the dashboard….

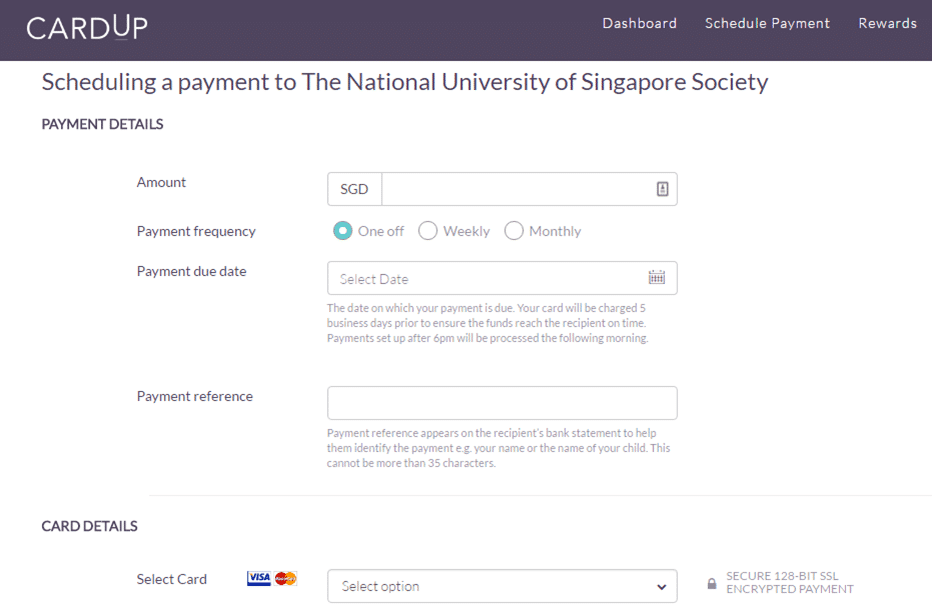

Provided my payment details…

And that was it. A few days later, I got an email notification that my payment had been processed.

Does it get 10X?

I suppose this is the question on everyone’s minds. I reached out to the Cardup team for some clarification and here’s their answer as to which cards earn 4mpd with Cardup

- UOB Preferred Platinum Visa- Yes

- Citibank Rewards- No

- OCBC Titanium Rewards- No

- DBS Woman’s World Card- Yes (edit: updated after Cardup team’s confirmation)

- HSBC Advance- No

But when I checked my DBS points statement (I did the transaction back in November), my 10X posted successfully. So I’m unsure now. Either it’s a new development that Cardup transactions don’t get 10X with DBS anymore, or there is some confusion even on the Cardup side about what does and doesn’t qualify (Cardup has since confirmed that 10X is possible with DBS WWMC)

You can also have a read of this thread on FT (see posts 6575 + 6549) where someone claims to have been in touch with the Cardup team and provides some FAQs for mile collectors.

Granted, these situations are always in flux (and banks can easily reclassify merchants if they want to) but given how fundamental the 10X points is to people like me when deciding whether to use such services, it is really to their advantage to try and establish some certainty here.

Addendum: iPayMy has been in touch to confirm that the following cards earn 10X rewards points with their platform: UOB PPV, Citibank Rewards, HSBC Advance, DBS Woman’s World Card

Of course, platforms like Cardup market themselves on more than just the ability to earn points. They talk about the convenience of being able to set up transactions once and never worry about them again and the ability to schedule payments in advance. I know iPayMy is trying to build a property management ecosystem where you can seamlessly upload documentation like repair bills and what not to your tenant, keeping a digital trail of all the information in one place. I’m sure some people may find that useful, but I’m not really sold on the convenience because (1) I don’t rent a place and (2) you can get all the convenience of one-time set up and never missing a payment with a GIRO arrangement

To me, the only thing that justifies paying a 2.6% fee is the ability to earn 10X/ 4 mpd. I’ve done the working before, but it bears repeating. If you can get 10X points, you pay-

2.6 cents= 4 miles or 0.65 cents per mile

If you’re earning regular spending rates of 1.4 mpd (UOB PRVI), you equation becomes-

2.6 cents=1.4 miles or 1.86 cents per mile

Is 1.86 cpm a bad price to buy miles at? No, insofar as it’s below the magical 2 cpm threshold we’ve talked about before. But remember that you could potentially be buying miles for less through annual fees.

| Card | Renewal/ Sign Up | Annual Fee (S$) | Renewal Bonus (miles) | Cost of 1 mile |

| DBS Altitude | Renewal | 192.60 | 10,000 | 1.9 cents |

| ANZ Travel | Renewal | 200 | 10,000 | 2 cents |

| HSBC Visa Infinite | Sign Up | 488 | 30,000 | 1.6 cents |

| OCBC Voyage | Sign up | 488/ 3,210 | 15,000/ 150,000 | 3.3 cents/ 2.1 cents |

| Citibank Premiermiles | Renewal | 192.60 | 10,000 | 1.9 cents |

| Citi Prestige | Sign up | 535 | 25,000 | 2.1 cents |

| SCB Visa Infinite | Sign up | 588.50 | 35,000 | 1.7 cents |

0.65 cpm, however, is a very hard proposition to turn down. And that’s why this 10X or no 10X is so fundamental to my decision whether or not to use these services.

The thing about 10X cards is that they’re amazing if they give you 10X, and punitive if they don’t. Imagine if you paid for a Cardup/iPayMy transaction with a 10X card but ended up earning only 1X. Your effective cost then is

2.6 cents= 0.4 miles or 6.5 cents per mile!

So I can absolutely understand why people are paranoid about this. I think it’s important for both Cardup and iPayMy (and whoever else s intending to enter this space) to have, on their sites, a resource that’s updated monthly with whether or not transactions are qualifying for 10X. This would help nudge people who are still on the fence.

If you fancy your luck (or have a UOB PP Visa), Cardup is currently running a New Year promotion that offers a $0 fee on a user’s first payment (max $5,000). This is valid till 19 Feb and the first 250 users (promo code: Hello2017 (I do not earn anything from this link)).

Conclusion

Given the similarities between iPayMy and Cardup, one might be wondering which platform is “better”.

Assuming both iPayMy and Cardup qualify for the same 10X bonuses with the various online spending cards (something that has yet to be established), then the average miles collector should be indifferent between either platform insofar as they charge the same 2.6% admin fee.

Where these platforms will end up differentiating themselves will be on things like

- Lists of merchants each platform offers (eg Cardup lets you make insurance payments while iPayMy lets you pay car park charges)

- Platform rewards program (eg Cardup’s website talks about giving frequent users rewards like 1 month’s free rent, $50 school supplies vouchers)

- The ability to create a “rental ecosystem” and whether consumers find that useful (eg iPayMy’s creation of a property portal that allows tenants and landlords to upload documents to each other)

It should also be noted that both iPayMy and Cardup do not currently take AMEX but will be offering it soon. However, because there is no 10X online rewards card that comes in an AMEX variety, this isn’t really a concern for me.

[For the purposes of full disclosure I should mention that this site has worked with iPayMy before. However, given the number of questions I’ve been getting about Cardup, I felt it would be beneficial to readers to do an article on the topic. I did reach out to Cardup for clarification on some of the points in the article but all opinions are my own. Cardup offered to waive my first transaction fee on their platform, which I declined]

Just a question.. Am I able to get 4mpd on HSBC Advance on iPaymy?

Hi D,

Yes, our customers have confirmed that they have been receiving 4mpd on their HSBC Advance Credit Card.

Regards,

Chrystie from the iPaymy team.

Christie,

Do you folks plan to cover more categories in future in addition to rent payments?

Hi Invisible

Yes, we are able to cover more categories in iPaymy thru My Other Payments. Do contact us at iPaymy.com

Cheers

Hi, are they consider online payment and earn cash rebates as well? Thanks

that’s sort of the entire crux of the article- to me this whole business model only makes sense if you can get 10X (i imagine they’ll disagree with me and point to the convenience of being able to schedule payments etc but my pov is always a miles earning pov). cardup has confirmed uob ppv gets 10x, for what it’s worth. my experience suggests dbs wwmc gets 10x too, or at least it did when i paid in nov 16.

Hi Victor,

Yes payments on CardUp are considered online payments and earn additional cash rebates on some cards. Some of the best cashback cards we’ve found include:

1) UOB One Card – Up to 5% cashback, capped at $300 per quarter

2) Standard Chartered SingPost Card – 7% cashback for online spend capped at $60 per month

3) OCBC Frank Card – 6% cashback for online spend capped at $60 per month

4) OCBC 365 Card – 3% cashback for online spend capped at $80 per month

Do check with the respective banks for T&Cs such as minimum spend requirements that apply with each card.

Cheers,

Diana from the CardUp team

Hi Diana- someone from OCBC reached out to me to tell me that Cardup is excluded from OCBC’s online rebates computation for both the 365 and FRANK card as it is listed as a payment services provider. might want to verify that on your end as well.

Hi Aaron,

Thanks for bringing this to our attention. We are in touch with OCBC to clarify as we have tested the cards previously and they did receive the online bonus on CardUp. We will provide another update in due course.

Cheers,

Diana from the CardUp team

Hi all,

After further investigation, we can confirm that CardUp transactions will unfortunately no longer get the online bonus rebates for the 365 Card and the Frank Card.

However discussions are underway to bring further benefits to OCBC Cardmembers when they spend on CardUp and we look forward to sharing more on this in future.

Cheers,

Diana from the CardUp team

Hi Victor

You could try iPaymy.com.

Cheers.

Hi, may I know how do you check the DBS points statement? When I look at my DBS credit card statement, I can only find the total points I get, but not per transaction. Thanks.

you got to call them up and talk to the cso. it’s a very manual process.

Hi Aaron. Having been reading your posts for a while. No need to emphasize that you don’t earn anything. Even if u earn a fee from the vendor by providing the information to us, you deserve it and I don’t think we readers should have opinion about it. U have an opportunity cost by spending time on all the useful information to readers. Cheers.

haha thanks. as my uni ethics prof used to say “sunlight is the best disinfectant”

I think it’s just good practice for a blogger to state affiliate links. Same as paid reviews, free products for review, and any personal connections with the people behind whatever you’re reviewing. Prevents having to deal with accusations down the line.

On a separate note, Aaron – just curious to know how you’re utilising your NUSS membership. I hardly ever use mine and am contemplating cancelling it.

agreed with what you said here. what happens when you down the murky route of no disclosure? you end up with ridiculous articles like this

nuss i use for tennis mostly. i suppose it’s also nice to have a clubhouse at suntec where i can take people for drinks.

if i had friends.

I just read the article you linked and LOLed for real.

There, there, you have us, your loyal readers. As good as friends, if not better :p

http://forums.salary.sg/income-jobs/8029-sponsored-best-air-miles-credit-card-amex-singapore-airlines-krisflyer.html#.WHcTt1V97Dc

ugh.

I remember engaging in some pointless debate on Facebook with MoneySmart on their articles saying that the KrisFlyer cards are the best. I’m all for being paid to write stuff but not when it’s bordering on lying!

Funny thing, I recently analyzed my miles breakdown and was in the process (and still am) blogging about it and this is exactly what I wrote:

“For the record, my favourite site by a million miles is [The MileLion](https://milelion.com/). Unlike many other crappy sites, The MileLion writes articles that are full of actual real-life experiences and honest reviews. Instead of raving about how awesome First Class or Suites is (probably a paid article on some other site, or some other site referring to some other site, etc.), The MileLion’s writers get on the flight, and review about it. They’d be praising UOB in one article for an excellent card, and bashing UOB in another article for a lousy card. Excellent resource and I always recommend others to check that site out first before anything. I don’t recommend any other site after that. That’s how good I think The MileLion is.”

try not to love too much.

it will make my inevitable betrayal more painful.

Yeah I remember MoneySmart wasn’t always bad :(. On the lookout for the next blog now!

It seems weird that Cardup or ipaymy is able to know or confirm (or influence?) which card gets the 4mpd. I would have thought it is the bank’s unilateral decision which transactions are included or excluded. If it’s Expedia-type promo, then it’s a specific tie-up and promo (and openly advertised so by bank – and in this case, no). Otherwise it’s just a generic spend “over an online merchant” (bank excluding it in its TnCs is a separate matter).

i don’t think it’s a question of influence. as you pointed out, awarding 10X is ultimately up to the bank. at best, cardup/ipaymy can say that last month, people who used XYZ cards got 10X. it is always possible that this happens to be the month that banks decide to change their minds.

How do they know their customers got 4mpd? Customers tell them?

Hello Blue Panda,

Yes, we have a loyal customer base who will advise us what they have been able to earn with their Credit Cards using our platform.

Regards,

Chrystie from the iPaymy team

Hi Aaron,

Do you know if the OCBC Titanium Rewards would qualify for iPayMy? I’ve checked your other articles and there were no clues. I know it only provides bonuses for online shopping, but one can hope, no?

nope, doesn’t get to my knowledge.

The challenging for getting 4miles by large payment is the limited bonus for almost all cards ( UOB 48000 miles, Citi Rewards 48000 miles, DBS 8000 miles per months, HSBS unlimited is just short term promotion). So how should we take full benefits from this limitation?

One school of thought is we should do it sparingly so that it last longer. If you whack one time say a million bucks (just exaggerating), the bank will close it down immediately.

In terms of UOB – can it be 48K miles awarded in one transaction, which I’d assume is $12k/max, or it has max transaction limitation per month like DBS has?

One transaction, same as Citi Rewards.

I had the card three years ago and closed it.

Any thought if I will have a problem reapplying again?

There should not be any problem. Most banks consider it a new application if its more than 6 months since closing the previous card.

The only reason I would consider open it again if any of these two would offer proxy services for tax payment and only in case if it is confirmed that the card earns 10x.

what, you mean you didn’t do your civic duty by contributing to the working capital of iras via a certain rewards card? 😛

Dear Aaron,

Which rewards card are u referring to?

How do you think I flown my wife to Christchurch in SQ’s C for this Christmas holidays?

Well, over now.

Plus, even when the benefit was there, for me limiting factor was 120K points per year…

Any idea what payment service provider CardUp uses, iPayMy uses smoovpay.

Hi there!

CardUp does not use a third party payment provider, we have developed our own payment solution which is managed in house. As such, we have built in functions to make CardUp convenient for our users, such as the ability to set up recurring payments and also edit upcoming payments via our platform.

Please feel free to drop us a line at hello@cardup.co if you have further questions.

Cheers,

Diana from the CardUp team

Hi Diana, does CardUp allow splitting of rental payments? For example can I use more than one card to pay the rent?

Also, is there a feature to track the status of payments? Is it cleared on T+3 basis?

Hi Spk307,

Yes you can store multiple cards on our platform and split your rental payment over different cards to maximize the rewards.

After you log in, you will be able to view all past, future and in progress payments via your CardUp dashboard including the status of these payments. Payments take 5 business days from the date on which your card is charged, to arrive at the end recipient. You’ll also receive emails throughout the 5 days to notify you of the payment status.

Feel free to reach out at hello@cardup.co if you need more info!

Cheers,

Diana from the CardUp team

Thanks for the information. Really appreciate your effort in transparency, I’m an instant fan!

I’m pretty new to this miles by credit cards game so I’m sorry if this is a stupid question but are we able to combine miles earned from a few cards for a trip to get around the limits set by each card?

Or are we limited to miles earned from any one card for any one trip?

hi there winn- for UOB/DBS your points are pooled into one central balance that can then be redeemed into krisflyer miles. citibank does not pool

Ah, I see. Cool. That’s good news. Time to apply for a dbs card then! Thanks for replying. 🙂

I can confirm that UOB PPV works. Transaction on Cardup was billed 6 Jan 2017, 10x UNI$ credited today (8 Jan 2017).

How about using UOB PPV for IPayMy payment ? is it work as well for 10x UNI ?

Hi Rio

Users of iPaymy are able to receive the 10x UNI.

Thanks…Adrian from iPaymy

Hi All,

Just wanna share that I’ve been using FEVO card to make insurance payment through e-AXS. FEVO only charges 1% convenience fee much lower than 2.6% Cardup charges. Another option to consider. 🙂

Hi Anonymous,

Do you receive any benefits (miles or cash rebates) by paying to your FEVO cards? If so, please share the cards you used. Thanks.

Is there incentive for Citibank cards like Premiermiles and Prestige card?

Hi Terence,

Both these cards do not have any online spend bonuses and the normal earn rate will apply for CardUp transactions.

Cheers,

Diana from the CardUp team

Hi Diana

How about Citibank rewards card?

C

Hi C,

The normal earn rate applies on CardUp transactions as Citibank has confirmed that the 10X rewards is only awarded on shoes, bags, clothes and departmental stores. Any other transactions not on these items or categories will not be awarded the bonus.

Cheers,

Diana from the CardUp team

Diana, can i check if 10x points is awarded to hsbc advance for payment made on cardup??

Hi Athen,

HSBC has confirmed that unfortunately transactions of this nature are not eligible for bonus rewards points on the HSBC Advance Card.

Cheers,

Diana from the CardUp team

Hi Athen

iPaymy users are able to receive the 10x points from the HSBC Advance Platinum Visa card.

Thanks….Adrian from iPaymy

Hi C

Users of iPaymy are able to receive the 10x reward points from the use of Citibank Rewards card.

Cheers…Adrian from iPaymy

this post by itself will just open the can of worms for all bank

I’m really torn about CardUp.

On one hand, it has so much potential to unlock miles/rebates on big ticket items such as insurance that cannot be paid via CC.

On the other hand, if its popularity does take off, it’s probably gonna be a matter of time until banks start excluding CardUp payments from mile/rebate computation.

Let’s hope it works out in the long run.

It’s hardly a game changer. Just 3 cards give 4 mpd. Not sure about UOB. For DBS the WWMC has always been a loss leader. I spend less than 2k and more than 2k most months which means the bank gains. HSBC might tighten their 30k requirement or cap the 4mpd.

Banks will continue to gain their usual 1.8% from each transaction on CardUp or ipaymy. In fact, they stand to gain more than us.

There are more ways to earn rebate via Cardup beyond just miles, but let’s hope you are right.

Hi Aaron/Cardup,

I just made payment via cardup this morning, weird they only do OTP verification at 1st time but for realy payment setup no OTP. Now the status of my payment is scheduled .How long payment will change from scheduled to charged to my credit card based on your experience ?

Hi Aaron/Cardup,

I just made payment via cardup this morning, weird they only do OTP verification at 1st time but for real payment setup no OTP. Now the status of my payment is scheduled .How long payment will change from scheduled to charged to my credit card based on your experience ?

Hi Rio,

Your payment will be charged to your credit card 5 working days before the payment due date you have entered. Please email us at hello@cardup.co if you need more info.

Cheers,

Diana from the CardUp team

Diana, do you plan to have option to make income tax payments this year?

Suicidal post.

Milelion n its partners should exercise discretion.

disagree. given that the entire value prop of providers like cardup/ipaymy (at least from my POV) is to help people earn online spending bonuses for paying bills, it’s in their interest to coordinate with the banks and make sure their spending is recognized as part of said bonus categories.

this place is for sharing. if you want a closed, insular group, there are many threads on FT/HWZ where people will speak in code.

Aaron,

I’m a new user of your website, but already addicted to it. Thanks for the great work!

I am assessing the possibility of using CardUp and checking my options between using different cards, specifically DBS Woman’s World v DBS Altitude. Can you confirm if my hypothesis below is correct?

Let’s assume I have a monthly rent of S$2000. If I use CardUp with a DBS Woman’s World Card, it would result in the following:

Rent: S$2000

CardUp fees: S$52

DBS Points accrued: 4000

The limit on 10x is $2000, so any value above it would be down to 1 point per $5 spend. Is this assumption correct? If that is the case, then assuming a larger rent of say S$4000:

Rent: S$4000

CardUp fees: S$104

DBS Points accrued: 4400

Given the same two scenarios but using instead the Altitude Card, which I believe gives 1.2 points per $1 (correct me if this is wrong):

Rent: S$2000

CardUp fees: S$52

DBS Points accrued: 4000

Rent: S$2000

CardUp fees: S$104

DBS Points accrued: 2400

If these scenarios/assumptions are correct, then the break-even point for Altitude compared to Woman’s World would be at around S$3600 rent. Can you confirm?

Thanks!

Oops wrote the wrong numbers for Altitude. Instead:

Rent: S$2000

CardUp fees: S$52

DBS Points accrued: 2400

Rent: S$4000

CardUp fees: S$104

DBS Points accrued: 4800

Apologies.

U can use WWMC for first 2k and WMC for next 2k. And yes, u can apply for both.

Thanks Spk307. But can you make a rental payment using 2 credit cards? Never used either CardUp or IPayMy, so I’m trying to figure out how they work, effectively.

Hi jwowa

Yes, you can make split payments to your rent in iPaymy.com. Try us out.

Cheers…Adrian from iPaymy

How come AIG is not in the insurance list