The year’s not even out and already one of my Christmas wishes has been answered

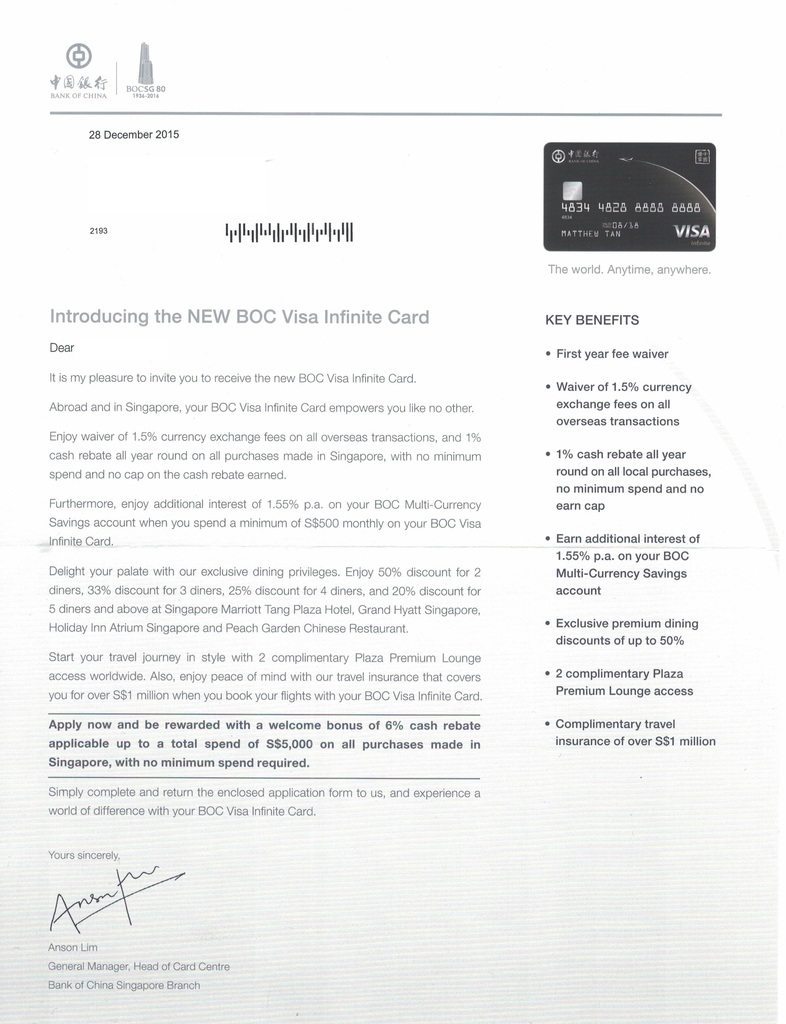

As per the gurus on HWZ, BOC is set to launch a Visa Infinite product in Singapore that does not levy the 1.5% forex fee. This means the only “fee” you get hit with is the rate the bank uses to convert the forex into local currency

I can’t tell you how excited I am about this. Yes, it’s not a miles earning card, but this removes one barrier to overseas purchases. And it might open up some interesting opportunities for manufactured spend… (I’m going to study Kiva a bit more and decide whether it make sense for people based in Singapore)

Unfortunately, it seems to be an invite-only card, and the minimum income for the invitation appears to be S$120,000. I don’t believe there is any Visa Infinite tiered card in Singapore currently that will go below this threshold (though feel free to correct me if I’m wrong)

Hopefully now that BOC has launched a product that does not charge forex fees, other banks will follow suit and this product feature filters down into “lesser” cards.

Good end to 2015/start for 2016!

Hey Aaron,

Looks like it only took 2 days for other banks to follow suit 😛 Read about the changes to CIMB’s Platinum/Signature cards recently and looks like they’re waiving the bank fees too.

Though I’d assume that the 1% visa/MC markup still applies (both for this BOC card and CIMB’s products) so we’re not really getting spot rates… but a step in the right direction, definitely.

More good news to usher in the new year!

you’re right. in my exuberance I forgot that it’s more than just the forex fee- there’s the visa/mc markup + the cross border transaction fee (0.8% in UOB’s case) to consider. so that’s still maybe 1.8%. i’d like to read the T&C to confirm this but if it’s the case then yeah, step in the right direction but not nearly there yet.

Interesting article. I keep meaning to calculate whether the extra points on overseas spend make it worth using the miles cards or whether we should look for a low cost card.

Also cannot pay for Kiva with a Singapore registered Paypal account. I think MAS banned a lot of Paypal operations as a fairly blunt strike against money laundering.

Definitely for bonus spending cards it may make more sense to use them overseas. eg UOB preferred plat amex gives 4 miles per $1 on both local and overseas dining, 4 miles is anywhere between 12-16 cents of value for premium class redemptions, so 12-16% “rebate” versus a total admin fee of 4-5% worst case? You’d come out on top. Maybe for general spending the value proposition is a bit more limited (but remember that most cards give upwards of 2-2.4 miles per $1 for overseas general spending). I am very interested to read the full t&C for this BOC… Read more »

Did this card turn out to be any good?