One of the little-known perks of credit cards is that if you charge your air tickets to them, you get complimentary travel insurance for the duration of your trip. It’s my belief (and the belief of the wise men on HWZ) that you should not rely on this as a primary form of travel insurance. I usually buy an annual plan from DirectAsia which seems to be the cheapest, although my advice in general is to look for direct insurance (ie. not those sold through Banks on behalf of 3rd party companies like MSIG etc) because it’s cheaper, ~$235-$295 for an annual worldwide policy and no middle man.

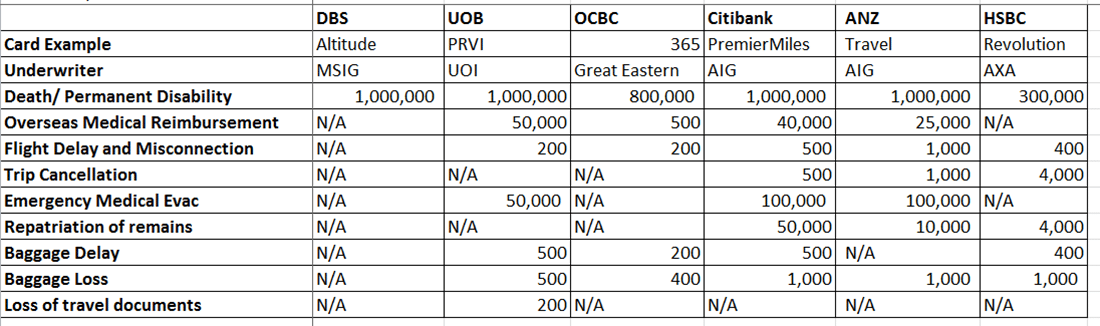

Nonetheless, what I’ve realised is that not all Banks offer the same level of coverage. Some offer Personal Travel Accident Insurance. Others offer Flight Inconvenience Insurance. Apparently that’s not the same thing- the first covers things like losing a limb or dying overseas, the latter covers things like delayed baggage and missed connections.

I’ve tried to build this into something that makes sense- although I think you should just use this as a ballpark range (ie to say that Bank A in general offers better coverage than Bank B) and if you need the specifics click on the policy documents and read them carefully.

Observations

- DBS has straight up the worst coverage of any bank. Their travel insurance (if you can call it that) only covers death or permanent disability. Lose your bag? Passport stolen? Missed a connecting flight? SOL.

- OCBC’s coverage seems rather anemic compared to others- especially on the overseas medical reimbursement limit. To be fair, I could simply have misread the T&C so if anyone feels this is wrong let me know

- I’d say that Citibank and ANZ (both underwritten by AIG, coincidentally or not) have the best coverage in terms of quantum

- It’s important to note that even within individual banks, coverage differs- i.e DBS Altitude cards have higher coverage limits than the DBS Black card

- None of these policies appear to cover rental car excess so you might want to consider one of these options

Resources

cover photo by Ralf Κλενγελ

Great list. But was even more confused now, which is a better choice? To rely on the card for insurance and get lesser mile. Or to get an insurance seperately and max out the miles?

Definitely don’t rely on the card for insurance. at best it’s just a supplementary source. go for maxing out miles

and contrary to popular belief you can make 2 claims for the same incident on 2 separate insurance policies, however the maximum payout you can get is capped at your actual expenses. this is useful when 1 insurance policy does not have sufficient coverage for an expense. Analogy here is from health insurance but applies to travel insurance too

http://www.moneysense.gov.sg/Understanding-Financial-Products/Insurance/Types-of-Insurance/Health-insurance/Things-to-Watch-Out-for.aspx

This is useful, thank you!

Might not be that relevant since your blog is focused on miles earning cards… but good to know that Citi extends a similar level of coverage to its other cards as well (think Clear, Dividend, Rewards). CIMB VI also has a rather comprehensive travel insurance plan as one of its perks – with (albeit small) rental car excess cover to boot!

good point! If you get rental car excess that’s actually making the proposition a bit more worthwhile. off topic, but CIMB keeps rejecting me for their VI card even though i’ve met the income threshold. annoying.

I can’t seem to find the details for AmEx Ascend, but it seems they have travel insurance as well.

details here https://icm.aexp-static.com/Internet/IntlHomepage/pdf/KrisFlyerAscend_Insurance.pdf

Thanks, Aaron!