I don’t normally pay attention to cards issued by banks other than DBS/UOB/Citibank (because these 3 banks have consistently provided the best miles earning cards in Singapore), but Daniel brought my attention to the revised Standard Chartered Visa Infinite sign up offer and I think it presents an interesting opportunity to buy miles cheap.

Welcome Gift

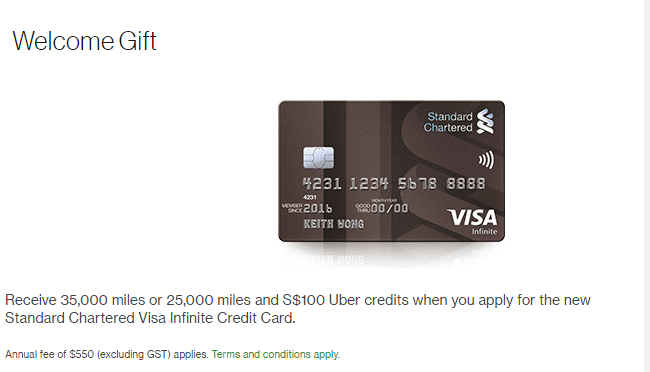

The SC Visa Infinite (S$30,000 income requirement (!) if you’re a priority/private banking customer, S$150,000 if not) has an a choice of 2 welcome gifts in exchange for a S$588.50 annual fee

- 35,000 miles

- 25,000 miles plus S$100 Uber Credit

Sidetrack: Standard Chartered keeps advertising the annual fee as S$550 (excluding GST). Someone needs to write to Standard Chartered and inform them that it’s in violation of the GST Act not to display GST-inclusive prices. Maybe it’s because I’m an accountancy grad, but nothing annoys me more than when I see places that don’t quote GST-inclusive prices. I’ve even written in to IRAS on more than one occasion to report errant merchants (looking at you, Fullerton Healthcare)

If you opt for (1), you are essentially buying miles at 1.68 cents each. This is one of the lowest rates I’ve ever seen for sign up/renewal bonuses. For comparison-

| Card | Fee | Miles | Cost /Mile |

| Citi Prestige | $535 | 25,000 | 2.14 |

| ANZ Travel Card | $200 | 10,000 | 2.00 |

| Citi Premiermiles | $192.60 | 10,000 | 1.93 |

| DBS Altitude | $192.60 | 10,000 | 1.93 |

| OCBC Voyage (snigger) | $488 / $3,210 | 15,000 (Voyage) / 150,000 (Krisflyer)* | 3.25/2.14 |

| HSBC Visa Infinite | $488 | 30,000 | 1.62 |

*I was not aware of this new 150,000 offer. $3,210 is a lot to pay but if you already have a redemption in mind you could get a round trip business saver ticket to New York (good luck clearing the waitlist though) at about half the revenue cost (~$8K) once fuel surcharges are taken into account

What is the value of a mile? Depends on what you spend it on. I’d say that buying Krisflyer miles at or below 2 cents per mile is generally worth it if you intend to redeem for First/Business class travel, as you’ll reliably get 4-8 cents of value doing so. So if you already have a redemption in mind (and confirmed saver space is available), this may be an option for you.

The alternative offer (25,000 miles + S$100 Uber credit) is interesting because it might provide a proxy to how Standard Chartered values miles internally. 10,000 miles for S$100 implies that Standard Chartered is getting these miles for at most 1 cent each (possibly even less, if Uber is giving them some sort of discount on the credit). I’d happily buy miles at 1 cent each!

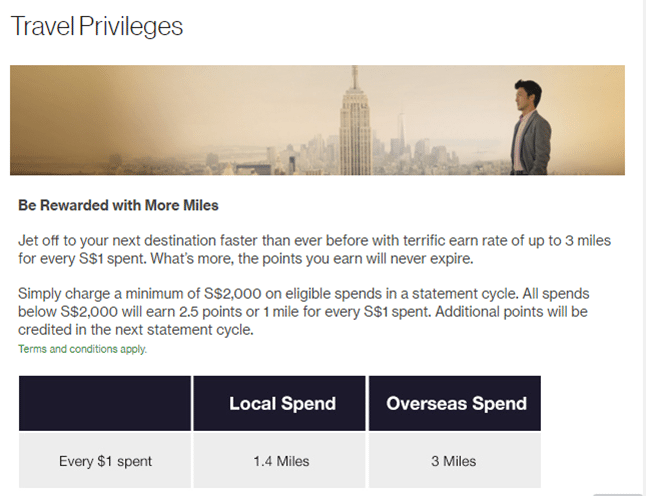

Earning Rate

The earning rate of regular Standard Chartered cards is anemic to say the least. S$1 of local or foreign spend yields 1 mile. However, the SC Visa Infinite gives an additional bonus if at least S$2,000 is spent each month that brings the rate to

- 1.4 (1 base + 0.4 bonus) miles per S$1 of local spend

- 3 (1 base + 2.0 bonus) miles per S$1 of overseas spend

The 1.4 miles rate is on par with other cards like the ANZ Travel and UOB PRVI, neither of which requires any minimum spend. Therefore that can’t be seen as a real perk. 3 miles on overseas spend is decent, but still inferior to the UOB Visa Signature (4 miles per S$1 on overseas spend, subject to min S$1,000 spend per month and capped at S$2,000 spend per month)

The poor earning rates are another reason why you should view this card as simply a tool to buy miles- get the miles, dump the card.

Other Perks

A lot of the perks that SC lists here aren’t really SC Visa Infinite unique, they’re available to anyone holding a Visa Infinite card (and therefore if it’s these perks you’re after you might be better off getting the no-fee CIMB Visa Infinite card)

There are some unique ones though

- Instead of free airport transfers, SC offers 10% rebates on Uber, capped at S$400 each year. For comparison, UOB PRVI offers 2 limo transfers a quarter valued at $45 each, which is a $360 annual value. I don’t know why, but even though I take Uber a lot I’d still prefer an airport transfer…

- Priority pass with 6 complimentary visits (versus 2 for DBS Altitude, 3 for CIMB Visa Infinite, unlimited for ANZ Travel, unlimited for Citi Prestige)

- Access to the fitness centre at Fullerton Spa twice a month. I believe HSBC Visa Infinite has something similar with ESPA

Conclusion

I think the main problem with this card is that it doesn’t offer good stacking opportunities. Apart from the Visa Infinite, SC doesn’t really have any other persuasive rewards/miles cards. Compare this to UOB (PRVI, Pref Plat AMEX, Pref Plat Visa, Visa Signature) or DBS (Altitude, Woman’s) where you can pool your points together by carefully deciding which card to use when.

If your goal is to buy miles at 1.7 cents each, dump them out and move on, this card may be right for you. But it definitely shouldn’t be your day to day spending card.

Anyone going to jump on this? You can sign up via this link (I earn a referral fee)

Thanks Aaron, this is really comprehensive. I am going to take your advice to buy and dump. ;))

My application is already in.

Worth noting that if you have a SC mortgage (I don’t) or savings this card unlocks earning a few points on the balance.

Hi Aaron,

The card can be used to pay income taxes at 1.6% per $ of tax. If your taxes exceed $2,000 per month, you bank 1.4 miles at 0.016 cents or 0.875 cents per mile.

I think this should also stack with their 360 rewards scheme so card holders with high taxes and assets (liabilities) with SCB, it’s a decent proposition.

@Alex,

the T&C for tax payments does not seem to be released yet. I am a bit cautious here as the earn rate for such payments are not usually at the same spend ratio when compared to retail spend, much like how other banks use different earn rates for tax payments.

How did u calculate 0.875 cents per mile ?

reads

Edwin

There are TnCs on their website and they do not stipulate a different mile tiering for tax payments. The other cards that offer tax payments arrangements explicitly state their reward rebates for tax payments so I am inclined to take SCB at face value.

Me bad on the computation of miles per dollar, it should be 1.14 cents per mile. Thanks for pointing that out!

yeah i realised… i’m writing something on this as we speak

I am really looking forward to trying out the Fullerton Spa tomorrow 🙂 As flystaytravel.com points out, you can possibly buy miles at 1.6cents by paying your taxes with the card, depending on the earn rate (tbc).

A much better option would be HSBC’s tax payment. Every $5000 in tax payments gives 2000 miles. For premier members, the admin fee is 0.5% or $25 for 2000 miles. (i.e. 1.25 cents per mile).

If you are a normal credit card holder, admin fee is 0.7% or 1.75 cents per mile.

http://www.hsbc.com.sg/1/2/personal/cards/pay-your-taxes

that’s right. but you need to be a hsbc premier member (min $200k in deposits/investment/insurance) to partake

Hey Aaron,

Just a heads up, ANZ launched some new rewards cards, might want to have a look. Cheers

Sorry, wrong website, went to the Aussie one. False alarm 😛

The mileage rewards on this card is good

local – 1.4 (on par with market best)

overseas 3.0 (beats market best)

but I am unwilling to pay $588.5

Definitely would get it if first year waived

there is 10% rebate on uber rides too

Previously they have the first year waive option but that’s not an option anymore. Anyone managed to get a waiver from April onwards? Please share.

Sign up bonus up to 40k miles

thank you sir. have updated the post

Must use this link to get 40k miles. Lucky, I only just applied 🙂

https://www.sc.com/sg/campaign/visa-infinite-krisflyer/

updated. thanks! 1.47 cents per mile is awesome.

The 40k miles campaign is over unfortunately.

Just got my application rejected…they are pretty strict with the income requirement, probably because I am a foreigner.

anyone has any idea how fast the miles can transferred to krisflyer? redeemed the miles last week and yet to see the miles in krisflyer account, we are pending these miles to book a first class flight from LA to SIN 🙁

I just got a call from SC to talk about my application (that was rejected in April). He informed me that the income requirement has dropped to $80k and offered me the same 40k KF Miles or the other one with uber credits. Did anyone get a call from SC too?

i’m surprised they can drop the VI income requirement below $120k. thought that was set in stone.

Yup. Confirmed they have been reaching out to those rejected applicants with revised income requirement of $80K only. Take up rate must have been real low.

New applications: what’s the income requirement now? 80K or 150K?

Thanks!

Tempted to apply for the miles and dump it

Cardholders beware… Unless you hold the latest generation of the card (9th digit starts with 5, looks identical to the sample here https://www.sc.com/sg/credit-cards/visa-infinite/ ) you do not qualify for the Fullerton Spa privileges. I saw the email from Palak Sood ( SCB Payments Product Manager) giving instructions to Fullerton to bar access to older(loyal) cardholders. Yet to confirm if the other revised privileges apply to older cardholders but I can’t assume given Palak’s email.

Note that 1 stan chart mile = 0.4 kris flyer miles…

It’s not Stan chart mile. It’s Reward Points.

1 RP = 0.4 Krisflyer mile. Wherever SCB refers to miles, it is actually referring to Krisflyer miles.

yup, this one is right.

Just a note, the Priority Visa Infinite card has different terms from the Visa Infinite.

For e.g. you only earn 1 mile per $1 spent on the priority with no multiplier regardless of amount spent. Instead,it gives you additional points based on $ invested with SCB.

The priority card also doesn’t give you access to fullerton hotel facilities. It does however, give you unlimiate priority pass