With tax season upon us, some people are wondering whether they should use their credit card to pay their income tax bill. To my knowledge, only HSBC, ANZ and Standard Chartered offer a special scheme which allows you to pay your tax bill via a credit card in order to earn rewards points. But they do charge a fee for this, so you’re essentially paying to buy miles. The question then is this- is the rate worth it?

Let’s look at the different schemes offered (best rate in brackets)-

ANZ (1.25 cents/ mile)

The earning is as follows-

| Type of Credit Card | Travel$/Rewards Point Earned |

Processing Fee |

Cost/ Mile |

| ANZ Travel Visa Signature Credit Card | 0.5 Travel$ (0.5 Miles) for every S$1 charged |

1% | 2 cents |

| ANZ Platinum & Switch Platinum Credit Card | 1 Rewards Point (2 Miles) for every S$5 charged |

1% | 2.5 cents |

| ANZ Signature Priority Banking Visa Infinite Credit Card |

1 Rewards Point (2 Miles) for every S$5 charged |

0.5% | 1.25 cents |

Not spectacular earning rates by any means. With the ANZ Travel Card, for example, you’d be paying 1 cent to earn 0.5 miles, or 2 cents per mile. Note that this is the rate that quite a few credit card companies allow you to buy miles via paying the annual fee (see here for more examples). The best deal here is if you have a priority banking relationship with ANZ because then you can spend 1.25 cents to earn 1 mile.

HSBC (1 cent/ mile)

| HSBC credit card type | Administration fee (as a percentage of your monthly tax deduction amount) | Cost/ mile |

|---|---|---|

| HSBC Premier MasterCard | 0.5% | 1.25 cents |

| HSBC Visa Platinum / HSBC Advance / HSBC Revolution | 0.7% | 1.75 cents |

| HSBC Visa Infinite* | 1.5% | 1-1.5 cents, depending on tier |

You earn 1 reward point (0.4 miles) for every $1 in taxes paid. In a best case scenario where you hold a HSBC Premier MasterCard, you would pay 1.25 cents per mile.

EDIT: Thanks to Savage+UK_Ship on the comments who have pointed out that the HSBC Visa Infinite earns points according to the tier structure you are on. This can range between 1 mile to 1.5 miles per $1. This implies your cost per mile is between 1 to 1.5 cents which is quite a good deal

*I’m somewhat puzzled why the admin fee is higher for HSBC Visa Infinite cardholders than for HSBC Revolution cardholders, given that you’d think the Visa Infinite cardholders would be more valuable to the bank (given the differential in required income). Has anyone tried using your HSBC Visa Infinite card to make tax payments and if so can you comment on this? Do you still earn 1 reward point for every $1 in taxes?

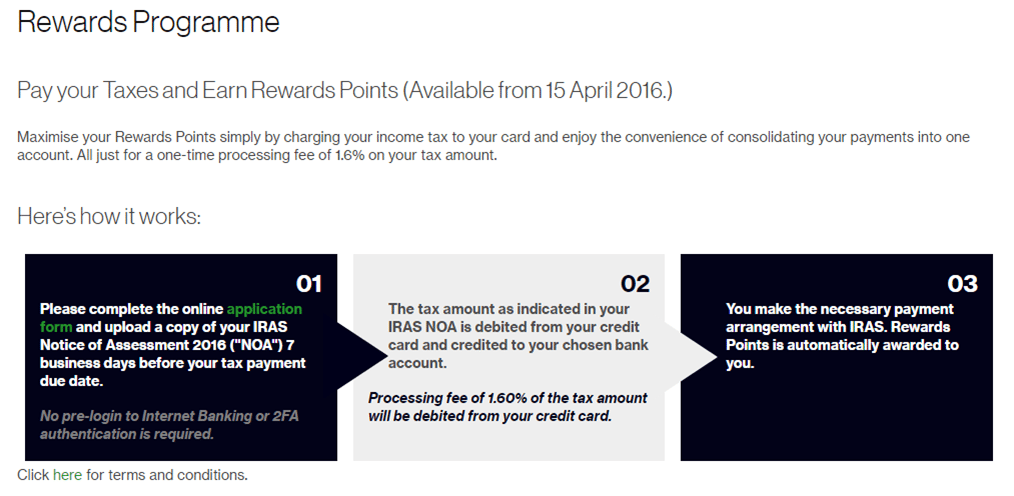

Standard Chartered (1.1 cents/ mile)

Take note that this offer only seems to be for holders of the Standard Chartered Visa Infinite card. For a 1.6% processing fee, you. I don’t see any other details about this so I assume you earn 1.4 miles per $1, the same as other local spend. This means you pay 1.1 cents per mile, which does seem to be a good deal. Do remember that the rate of 1.4 miles per $1 only applies if you spend a minimum of S$2,000 in a month, otherwise it is 1 mile per $1 and a cost of 1.6 cents per mile (still decent)

Conclusion

In all cases you are only allowed to pay your own income tax bill using your credit card. Whether or not you find this scheme useful depends on how you value a mile. I definitely would not pay more than 2 cents for a mile though.

PS: If miles are not your thing, why not look at BOC’s scheme? It appears that you can get S$50 Taka vouchers for a 24 month payment plan with a 1% processing fee. It does say limited to 300 cardmembers though so YMMV.

photo credit: businesstimes

I’ve used the HSBC Visa Infinite to pay taxes the last couple of years. Despite the website saying you earn 1 point per $, you actually earn 1 mile per $ (or 2.5 points per $), which works out to 1.5c per mile. Canceled it this year, so will be doing the StanChart Visa Infinite instead.

thanks for pointing this out! have updated.

does Mossack Fonseca provide a better offer?

i’d like to point out that the milelion has not publicly or otherwise been associated with Mossack Fonseca. We are a respectable, law-abiding shell company incorporated in delaware.

If you’re lucky enough to be an American citizen then welcome gift airmiles from banks are, of course, taxable…

I’ve used the HSBC Visa Infinite tax payment for past few years and yes you earn the miles according to your level of spending in the previous year, so if you are on Tier 3, you get 1.5 miles per $1, so it works out as 1c per mile. Your supplementary cardholder can also pay their taxes on their card as well at same earn rate

thank you for pointing this out. have updated

Can I pay for tax with two or more cards from the same bank, eg the HSBC Advance AND HSBC Visa Infinite?

Bummer! I have been paying tax with cash in the past 4 years! Didn’t know I could use credit card to pay the tax bill.

Can we pay tax using e-AXS? If so, wasn’t there a post in the past saying that it counts as online purchase and therefore can earn up to 4 miles per dollar?

Just wanted to point out that this may not be the best way to accumulate miles. Suppose I have a $10,000 tax bill. Taking the HSBC premier card as an example, 0.5% of this is $50, which translates into a maximum of 4000 miles we can buy, based on a tax bill of $10K.

Hi Aaron,

Would you know what would be a good card to earn miles for things like going to hospital, dentist type of services?

Thank you

this would fall under general spending. just go with whatever you general spending card is (eg uob prvi miles 1.4 per S$1)

Pay using MasterPass on AXS

Maybe am being cheeky but SC is currently running a promo for new customers of Visa Infinite Cards where in, if you sign up and spend $12,000 within 60 days of approval, you get a bonus of 15,000 miles.

Was wondering if paying tax would count towards this spend? One could potentially end up with reward miles as part of tax payment + the 15000 bonus miles.

You cannot pay through the credit card directly. ‘Paying tax’ has, so far, meant the card issuer will deposit the money in your savings account and show a payable on your card. You then use that cash to pay Iras. The ‘payable’ on your card comes from the card issuer, so will not be considered a ‘spend’.

15k miles bonus for 12k spend is quite low. Unless they already provide 3mpd on regular spend, which I doubt.

Does anyone know if you opt for 12-mth installment, you still get the miles, albeit monthly?

yes, the miles come as bank reward points, which come in your monthly bill.

Thanks bro. Can leverage this for counting towards monthly spend then.

The ANZ tax facility is no more as of Mar 2017. As my way of humble contribution.

as of now, u can pay income tax using cardup. Pay using UOB PPV on cardup generate 4 miles/$. I tried 3 days ago and yes it get 4miles/$

Worked for me too, pushed $200 through to test it and it came back 10x, now pushed the rest of the balance through as well today

If I’m on the giro installment plan, can I schedule monthly cardup payments?

If u pay before 6th , the giro wont deduct you anymore

Thanks guys. 2.6% fee though for cardup. I guess it’s worth it for the 10x.

for 2.6% fee that get 4miles/$ basically you “pay” miles for rate 0.65 cents/miles, still much better than buy miles through annual fee with rate 1.9-2 cents/miles

Where do I key in the referral code? I have signed up but I can’t find the field to key in. Thanks

When you enter your credit card number before pay, you will get referral code . You can enter mine RIOI82 : )

Thanks Rio for the info, the cardup sound like a good deal,

Just switch from cash rebate to miles earning games 1 months ago…

Bad thing is HSBC advance card change their T&C

Good thing is I have got the UOB PPV with me now and the income tax just come in…..was wondering how to maximize it…

@Aaron, would you be helping us with a new post for 2018 tax payment ?

Any updates to this on using cards such as Premier miles , PRIV and DBS WWC ?

+1 to that. Season is here.