Update (9 Jun): Would like to draw your attention to the following comment by Christopher:

I called DBS earlier this afternoon to ask about the effective date of the above changes in the T & Cs. Twice. Here are the replies I received:

1. 1st CSO claimed that the T & Cs have always been like this ie. prepaid/insurance transactions etc were all prev excluded under the clause in the last line of the old T & Cs regarding excluded AXS/EZ-Link Reload transactions etc. and that they had just updated it to spell it out specifically. I pointed out that this was not the case. She proceeded to imply that it must have just been updated to reflect the current policy hence not a rel change. Again, I refuted this, saying that the T & Cs as of yesterday as available on their website imply that certain transactions (such as topping up prepaid cards) no longer qualify for 9x bonus points whereas they previously had. As such, this is a real change. She then said perhaps the bank hadn’t yet got around to updating its customers ie. us as this may have been just updated online only. I pointed out that well, I haven’t heard from DBS so..

2. She said she would check with the relevant department regarding the effective date of the new T & Cs and get back to me within 3 working days. From the gist of the entire conversation, it sounds like DBS was planning to just update the T & Cs without prior notice and AS SUCH I would believe that the new exclusions would apply as of YESTERDAY.

3. I called again half an hour later to check on the points accrued for my April transactions, verifying that yes, all EZ-LINK IMAGINE CARD transactions had posted their 9x bonus points on 14/15/16 May. The CSO verified that they had – I got ~3700 bonus 9x points posted on 14 May (go figure) – and that I would only be able to check on the status of my bonus 9x points for May transactions (which include 2k worth of top up for one last hurrah) on/after 15 June when they post. He claimed that, as such, there was no way for him to verify if May transactions (which would be excluded under today’s T & Cs) will be awarded the bonus 9x points or not.

In conclusion, we may just have to wait until the 15/16th of June for our answer, unless someone of higher client status with DBS can get through to their card department and get the answer straight from the horse’s mouth.

For a long time, one of the best cards to use for online spending was the gender-bending DBS Woman’s World Card (WWC), which allowed you to earn the equivalent of 4 miles per $1 on almost any online transaction. Despite its name, applications were open both men and women.

Although there was a cap on bonus earning of S$2,000 spending (or 8,000 miles) per month, most people who carefully managed their spend could clock up 96,000 miles in a year from $24,000 of spending, or enough to get a one way SQ suites ticket to Europe or the USA.

If you didn’t meet the $80,000 income requirement required for the DBS WWC, you could always get the regular Women’s Card, which would still have given you 2 miles per $1 on almost any online transaction, subject to the same S$2,000 cap.

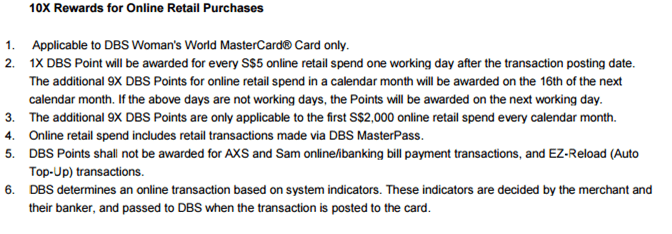

DBS has just released a new set of T&C for our beloved WWC which changes the rules of the game. Note that these changes similarly apply to the regular Woman’s Card as well. For comparison’s sake, I have included the old T&C here as well.

No prizes for spotting the big difference between the terms before and after.

Here’s the good news- the DBS WWC is still the best card to use for most of your online transactions, like general online shopping, buying movie tickets, airline tickets, Amazon, online travel agents like Expedia/Orbitz etc.

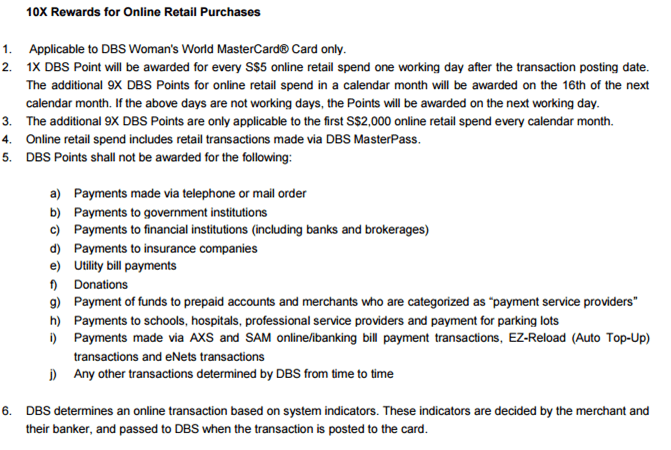

But here’s the bad news- from a certain, unspecified start date (can’t believe the new T&C don’t say when they’re effective from), the following will not earn DBS points (i.e. miles)

Let’s go through the carnage shall we?

- Payments via telephone and mail order

I would have thought these wouldn’t have qualified for bonus spend in the first place because when you give your credit card details over the phone the transaction is usually processed in an offline manner anyway.

- Payments to government institutions

No town council fees, parking fines, library fines, road tax payment, ACRA registration fees etc.

- Payments to financial institutions

No OANDA and other share trading account topups

- Payments to insurance companies

No AIA, AXA, NTUC Income etc insurance payments. An exception might apply for Prudential policies paid under the DBS Recurring Bill Payment plan, see below for details.

- Utility bill payments

No SP Services

- Donations

No SGgives or Community Chest payments (I read this as one-time payments do not earn points. Recurring payments may still earn points, see below for discussion on DBS Recurring bill payments)

- Payments of funds to prepaid accounts and merchants who are categorized as “payment services providers”

This is the one that worries me the most and has big implications because it means that the 4 miles per $1 on everything FEVO trick is dead. After the loss of the Imagine card, it seems that there currently does not exist a method of getting 4 miles on general spend (unless the HSBC Advance Visa allows prepaid top ups-anyone knows?)

Another worrying thing for me- does Paypal count as a payment service provider? An initial read of the T&C suggests yes. But I’ll need to investigate this point with customer service.

- Payments to schools, hospitals, professional service providers and parking lots

No season parking renewal, international school fees, online hospital bills

- Payments made via AXS and SAM online/ibanking bill payment transactions, EZ-Reload

This term was already in the old T&C, but it kills off the whole thread of questions we’ve been getting on whether you can use the AXS machine for income tax payment/utility payment/phone bill payment/other recurring bill payments. This also removes the possibility of getting points for your recurring EZ-Reload transactions.

- Any other transactions determined by DBS from time to time

A deliberately vague term that gives DBS the leeway to exclude some of your transactions at their discretion. I really hope that they do not become liberal in the application of this term, because the wide powers it gives makes me uncomfortable.

My general analysis of the above tells me that DBS does not want to reward non-discretionary spending anymore. They want to reward you for your discretionary lifestyle spending. And from a business point of view that does make sense, no matter how annoying it is. For further analysis you might want to refer to the HWZ thread on the topic.

One caveat to the above- it is my understanding that if you are using DBS’s Recurring Bill Payment plan you will continue to earn points. Whether or not you will earn bonus points (ie the (9X on top of your 1X) I do not know though. Anyone using the recurring bill payment plan care to chime in?

Merchants covered under the recurring bill payment plan include

- Prudential

- Starhub

- SP Services

- California Fitness

- M1

- MSIG

- Town Councils

- Community Chest

This is hardly the end of the world and I’m not going to get rid of my DBS WWC for now. (although if Paypal transactions are excluded that is a major loss for me already). I think it’s still useful for the rest of your online transactions, especially if you’re building the rest of your miles with DBS through its Altitude offerings. However, this development should make you take a long hard look at the HSBC Advance Visa as an alternative for your online spending.

Chin up everyone. Deals come and go. I’m sure something better will come along in the future.

cover photo: credit for the cover photo goes to onthesannyside, who used this image for a completely unrelated article on bad grammar in advertising. As a proud card-carrying grammar Nazi, I completely support his views. Irregardless, please do not revert to me with a list of all the grammatical errors in this post.

Wow… I think the PayPal point is the key one. I usually try and pay via. PayPal whenever possible so as to minimise any chance of a transaction not being deemed an “online” one.

Borrowing the FAQ for DBS live fresh card , which has similar exclusions. Retail spend via paypal still considered online spending, but personal paypal account is excluded under “payment service provider”

the question the, is whether or not the same terms for the livefresh apply for the woman’s world card. if so, it would suggest that paypal transactions to businesses are ok, but transfers to personal accounts would not. that’s bad for me either way because I use paypal a lot at work to pay people. the second question is- is it excluded from earning the bonus, or from earning any points at all?

Lol.. and i just got my FEVO card…zzz

Same here

Same here three ! Omg !

Count me in. Four.

Five. Bummer!

I paid mine, but havent got the FEVO.. lol

I was about to get FEVO. Guess I won’t bother then.

Sad day, still can clock 200 dollars for ez-reload, had to change my card reloading merchant to HSBC :(.

safest bet for paypal right now is DBS altitude

why not uob prvi? assuming it is local spend, you’d earn 1.4 vs 1.2. overseas i agree altitude is better because of the whole payment processing thing

PayPal on UOB preferred platinum still gives u 10x miles, as long as it is not for the list of UOB exclusions such as travel. Have been using UOB ppv for all my online shopping PayPal transactions and can confirm that I get 10x miles

Paypal get 10x for uob ppv ? Last time i buy Xiaomi and charged as paypal xiaomi but not get 10x

same here, i dont always get points on my UOB ppv when using paypal

For teclo bills, you can still pay directly at the telco portals. (confirm for Singtel and Starhub). For SP bills, only e-axs. Currently look for alternative for iras bills.

I tried paying Singtel bill through the myBill function on website. But they had advised that to them it is not considered as online retail spending. As such I was not awarded the 9x, just the 1x.

I had been using HSBC advance so I am not aware for DBS Woman not considered as an online spending. HSBC Advance T & C is quite generous and simply states that any payment through visa gateway is consider as online spending.

Hi All,

Here is a workaround for bill payment those who are interested.

HSBC Revolution + HSBC Advance + Magic Card.

Each card had a capped of 200 dollars towards ez-link pte ltd.

In total this give you a total of 400 dollars to pay your SP bills.

You can pay your telco bills at the telco site directly.

No coverage for IRAS Income tax unfortunately.

Do you know when this T&C came into effect? Would be great to know the cut-off date for the change – mainly to identify previous transactions that were made earlier but now no longer applicable for bonus points.

nope and based on the posts on hwz no one knows yet either. i’d call DBS but i’m overseas now…

I can try to confirm this. I currently have 12000 DBS points on my Woman WMMC. This means that DBS had acknowledge 6001 dollar spent on this card. I had do some calculations and found that I had spent a total of 5200 dollars so far. I had a pending 1.9k spending to imagine card which will get me an additional 10k DBS points this coming 16, so if I had that 10k DBS point, this means that this T&C would be in effect this starting june. I had also throw 5 dollar to top up my fevo card using… Read more »

how do you check/track your dbs points?

1 pt reflected for my $5 m1pp topup done on 9 Jun.

Hope it’s a good news. Got the urge to Max topup my F now.

I called DBS earlier this afternoon to ask about the effective date of the above changes in the T & Cs. Twice. Here are the replies I received: 1. 1st CSO claimed that the T & Cs have always been like this ie. prepaid/insurance transactions etc were all prev excluded under the clause in the last line of the old T & Cs regarding excluded AXS/EZ-Link Reload transactions etc. and that they had just updated it to spell it out specifically. I pointed out that this was not the case. She proceeded to imply that it must have just been… Read more »

I am having second thoughts that they had recently change their t&c but had not update their backend rewards allocation yet! Anyone who dare to takes an gamble can try this!

Well… I already topped up few days back in June. So gotta wait till 16th June for may txn and 16th July for June txn on the 9x bonus.

this is really helpful, thank you. will update article

Main concern for me is the fevo card. It just works so well with the dbs ww and it isn’t long ago since i purchase the fevo. Would be sad to know if it don’t give bonus anymore. Just topped up 500 early this month!

I’ve to say that DBS has had very good card offerings so far in the miles department, and most of us have benefited from it.

In this case, since the DBS Woman’s card is no longer the best for online spending on travel-related items such as hotels and and air tickets, which are the best cards to use for online purchases?

The change in T&Cs do not affect online spending on hotels and airline (from my reading, correct me if I’m wrong) so you still can use it. The sole caveat remains the same: monthly cap of S$2k

Hi, would the UOB Visa Signature Card be a good alternative? I cant seem to find any T&C on the UOB Visa Sig card wrt the constraints of “online” transactions. Unless I’m reading the ” 10X UNI$ on overseas, online, petrol and

Visa payWave transactions” wrongly.

http://www.uob.com.sg/personal/cards/credit/uob_visa_signature_card.html#cash-rebate

For UOB Visa Signature, maximum spend accruing 4x miles would be of S$2k overseas OR S$2k local spend in the categories of overseas (whether online or card-present transactions ie. actually using the card overseas) for the former and paywave transactions/petrol purchases for the latter. For both local and overseas categories a separate minimum spend of S$1k is required for 4x miles to be awarded. So the effective limit is S$2k / statement month. Unless UOB has secretly (and kindly) removed that part of their T & Cs..

Meaning all online spend has to be in foreign currency so no it is not a viable alternative..

UOB Visa Signature is a good card but there are several caveats

1. Any spend in FCY (processed in gateway other than Singapore, regardless of online or retail) gives you 10x points

2. Online spend in SGD or in FCY but processed in a Singapore gateway only gets 1x points

3. Spend on petrol and paywave also gets 10x points

4. 10x points for bonus categories only applies if a minimum of S$1k is spent, and is subject to a cap of S$2k

TLDR: nope, can’t use for FEVO

just want to add on another notorious point that 1k spending has to be within the monthly statement and not calendar month!

UOB Visa Signature card excludes Paypal transactions. Learnt the hard way.

“8. Payments to schools, hospitals, professional service providers and parking lots

No season parking renewal, international school fees, online hospital bills”

“Professional service providers” : does this refer to online payments to the likes of telecommunication companies ie singtel , m1, starhub as well? If yes, what card(s) can we use for this?

Thanks!

m1 + starhub can be payed via dbs recurring bill payment plan.i’m not sure if they fall under the cat of “professional service providers” though, that almost sounds more like accounting/legal firms to me

actually IMO.. No point discussing what would still qualify and what would not..

‘5j) Any other transactions determined by DBS from time to time’

If they do not want to give bonus points for something, they can always put it under 5j.. It’s just up to us to once again slowly probe the new system and see what will post bonus points and what will not..

[…] World MasterCard from a bunch of categories including pre-paid top ups and bill payments. The blogosphere was […]

Would this still be a good card to have for online spending? Or is it better to use another one now?

It is probably still the best online card because it can be used for travel bookings which most alternatives exclude. If you are also collecting miles with DBS Altitude then I think its a simple decision to keep it.

So this card beats altitude for airline booking? 4miles vs 3miles?

Take note some airlines process payment offline through certain payment channels and apps. Then u won’t get 4 miles if it’s not classified as online payment.

yup. but note the caps.

Quoting replies by DBS Bank in HWZ – Travel and Accomodation forum. 1. Yes, there was an update to the T&Cs on our website on 7 June, however we have not made any changes to how additional bonus points for online purchases are awarded, the update was meant to provide greater clarity to all. As such, there was no need to send out service eDMs or SMS. 2. It’s an update to provide better clarity, but the way points are awarded for online purchases have not been changed. Guess need to test if really the way points are awarded for… Read more »

Damn, I had already pay for my income tax.

So judging by this, whatever we have been doing to get what we’ve got thus far, should continue. DBS posted their clarification in public. Notwithstanding clause 5j, we should be expecting any surprises this month or in July going forward.

Is this a fair conclusion?

I reckon so as well. Been holding off to using my ww since the announcement. Can’t hold it any longer!

Ive checked with at least 3 people from DBS (one CSO and 2 staff) regarding the ‘new’ tncs, and they have been consistent with what is said on HWZ by DBS.

Whatever points we have been earning, should not change with this ‘new’ tncs.

but having said that, I would still test water for this and hope for the best. 🙂

I checked the metadata of the PDF uploaded, the PDF was created in Feb this year, but was only uploaded on this month. Quite surprise that they actually took 4 month to get it uploaded.

so it seems consistent with what they said.. it was just to provide clarity with no change to the way they will award for online spends. they may have created it in feb, but perhaps they need to go through many rounds of approval 😛 or maybe they kept it aside but decided to publish because their CSO reported a surge in questions on what does not qualify. the words they used are ambiguous to us (but perhaps not to them). professional services, prepaid accounts. anyway, if their clarification on hwz proves right, then perhaps let’s move on. false positive… Read more »

i give you one clap for this. that’s thinking outside the box. of course it doesn’t mean that the entire PDF was created in Feb right? or does Feb mean the last edit was in Feb?

we should *not* be….

sorry for the omission

I believe we are affected as I have just logged in to check my points and did not see the additional 9x points being credited to me. Unless they will only appear by tomorrow morning, I am sure we are affected.

Check again. Points in.

yes mine also in. seems consistent with what i expect. will review in detail when statement is out. expecting 3600 points if it is maxed out correctly.

Anyone knows if is based on Statement or based on May Spending for this 9x rewards with that 1x in.

based on may 1 – 31 spend, for today’s bonus award.

If I still received those bonus points for my spending, can I safely assumed that moving forward I will still get them until another change comes in place?

Wait till 16th jul to test for spending after TnC changed on 7 Jun.

Any one checked and spotted discrepancy for the “new” TnCs?

nope.

just checked with the CSO and same stand: if you have been getting points before, you will get points after.

I focussed on the FEVO top ups purchases and she clarified that none of the exemptions stated in the tncs applied to FEVO.

[…] (yes, men can apply for it too) but it seems like the terms & conditions of the latter has just been updated to exclude prepaid […]

Hi guys, anyone knows if Facebook Ads Payment will be affected by the new T&Cs? Is it still 4 miles/dollar (Capped at S$2000)? DBS doesn’t seem to be able to confirm this. 🙁

Points in, continue using the card now.

saw that. my paypal came through (i think), others online reporting same old same old

new to this WWC..just to clarify, if i were to pay for my professional memberships or payment to institutes like CFA through paypal, does that constitute online spend?

used to. right now, not so certain.

Just spoke to two separate CSOs from DBS yesterday (25thJul, Mon) about this and both confirmed that as long as I top up the FEVO via FEVO’s website, it will count as Online Spend and thus qualify for the additional 9x bonus points. HOWEVER, today (26thJul, Tues) I called to enquire about whether signing up for and paying for my ERP via a vCashcard account qualifies me for the 10x rewards and was told that because it is a top up to a prepaid account – it will NOT qualify according to the dreaded Point 5g) of the T&C (Payments… Read more »

I think that given that FEVO isn’t the type of once-in-a-lifetime massive spend, perhaps it might better to simply just try with a small $50 topup. Might be better than to keep calling the CSOs.

thanks for sharing this. I think it’s quite obvious the CSOs themselves don’t know. One is probably reading from T&C and one might be speaking from experience… just guessing

Does anyone know if using the recurring bill payment for SPS and Starhub still entitles you to the 9 bonus points? Without the bonus points $1 charged gets youy only 04miles. If not then it would be better to use the DBS Altitude Visa card where you can still get 1.2miles for each $1 charged.

DBS Altitude will not get you 1.2miles if you are paying bills. It is in their terms & conditions

Actually it will. DBS has a “Dbs/posb credit card recurring bill payment application form” which allows you to sign up to pay recurring bills from starhub, m1, town council, california fitness, msig and prudential. In it, it says that you wont earn points for certain cards which they listed (but i cant rmb). DBS Altitude WAS NOT one of them. So i called the customer service to clarify and he said that yes dbs altitude will still earn 1.2 miles even though its a bill payment. I called again another time and spoke to another cso (i usually speak to… Read more »

Anyone still getting 10x points for purchases on ebay via paypal?

Last i called to check on a payment i made via paypal to a merchant, i actually still got 10X! Not sure why but i guess they’re still letting it slide?

Just checking, since the update in TnC, does anyone have experience in paying for IRAS bills via Masterpass (with DBS WWMC) on AXS e-station? Would you be able to earn the 10x points?

Interested to know about this as well. Just applied for the card after CB rewards card no longer allow points for AXS payments.

Hi. Can I check whether fevo still gets the bonus? I’m on the verge of applying so any insight will be very appreciated.

Still working as of now (i.e. received on 16 Jan the bonus for Dec topups).

Not sure about the other bros, but i’m looking at my transactions and it seems like the party has ended for me….

Oh no! I just applied for the card. 🙁

Maybe this louist guy gave wrong info.

Well, all I can really comment on is my most recent bonus points earnings awarded on 16 Jan. 15 Jan: 15849 points 16 Jan: 16501 points Bonus: 652 points Bonus spend awarded: 652 * 2 / 3.6 = $362.22 My total spend in Dec: $383.13 My total FEVO transactions in Dec: $303 As far as I can tell, the only transaction that didn’t earn 9x bonus was a $19.20 test payment I’d made via e-AXS. Additionally the discussion on hardwarezone (check the 16 Jan posts) generally points towards no disruption in this area. So… I invite you to make your… Read more »

I also get the bonus for my top up test last month albeit it is very small amount

Another +1 for the fevo top up – I got my 10x in Jan.

Oh no! I just applied for the card. 🙁

My axs payments didn’t get 4x bonus this time 🙁

AXS payment is dead, period.

do it via fevo then. It will cost you an extra 1% though.

Just to share everyone, I recently made an IRAS property tax payment via AXS e-station using Masterpass (linked to my DBS WWMC) and managed to get 9x points the month after making payment. However I didn’t receive the 1x points in the month I was billed.. So even though it shows as AXS payment on my statement, I still got the 9x points for an IRAS tax payment?!

Anyway I am testing now to see if my FEVO top up (both mobile app and internet online) will earn me 10x points or not…

sorry if this question has been asked before..

dbs wwmc has S$2k limit monthly, how they calculate if i have airline transaction, say S$2,100 ? will they just take the maximum 2000 x 4 and give me 8000 miles or the whole transaction is considered 1X (no 9X bonus).

thanks

You’ll get the 10x reward points on $2000 and 1x reward point for the remaining $100.

If your purchase counts as a 10x transaction, you will get the 10x points for the whole 2k, provided that’s your only transaction for the month.

Thanks for the info…

So i dont need to split my transaction… :))

Anyone got 4x points for AXS payment done in march? I didn’t get 🙁

made 1k on axs in march, didnt get any points in april 🙁

i think AXS has been dead for a while.

I found that it was still working via Masterpass until this February, as Zac described. In February.

The first rule of DBSWWC…

Does hotel booking through the hotels’ own website qualifies for 10x? If not, what is the best card to use?

Dbs women pay insurance no dbs point plus mrt top up also no dbs pointing any form.

https://www.dbs.com.sg/iwov-resources/pdf/cards/rewards_programme_tnc.pdf

Hi. Has anyone similarly experienced a situation where airbnb spend was not considered online retail spend on DBS WWMC for purposes of bonus points? This was what i was just informed by a CSO.

Well, this is DISTURBING. I just made a booking there…. Did not appear to be on the list of exceptions specified by WH

New exclusion being introduced for wwmc wef 1 Oct: The additional 9X DBS Points shall not be awarded for the following: a) Bill payments and all transactions via AXS, SAM, eNETS; b) Payments to CardUp, iPaymy and Mileslife; c) Payments to educational institutions; d) Payments to government institutions and services (court cases, fines, bail and bonds, tax payment, postal services, parking lots and garages, intra-government purchases and any other government services not classified here); e) Payments to hospitals; f) Payments to insurance companies (sales, underwriting, and premiums); g) Payments to financial institutions (including banks and brokerages); h) Payments to non-profit… Read more »

Sigh.. Talk about being late to the party.. I kept seeing this card being mentioned so many times, even of late, that I went to got one for myself (got it’s just a couple of weeks ago).. and now I’m seeing more and more land mines everywhere.. to the point where aside from the few transactions I’ve done so far, I’m really not comfortable using it anymore.. Is it just me, or is this (DBS Woman’s World) card as ‘filled with traps’ as the Citi Rewards card? So.. from what I gathered so far.. spending on the likes of airlines’… Read more »

You might want to take a look at (and bookmark) the HWZ crowdsourced spreadsheet for the answers to most of your queries. It might not be 100% accurate, but for most uses it’s good enough.

Very helpful.. Many thanks, Louis..