Cardup and iPayMy are two Singapore startups that give you the opportunity to use your credit card to pay for things that you normally can’t use your credit card for, like rental, income tax, condo fees, school fees etc., in exchange for a 2.6% processing fee.

[It may be best practice to point out that The Milelion has previously worked with iPayMy to produce two webinar series on miles earning and miles using, for which all remuneration went to World Vision]

Although both platforms will point to convenience, the ability to schedule payments and their own proprietary rewards program as reasons to use their services, I’ve said from the start that the only thing that justifies paying a 2.6% fee is the ability to earn 10X/ 4 mpd.

I’ve done the working before, but it bears repeating. If you can get 10X points, you pay-

2.6 cents= 4 miles or 0.65 cents per mile

If you’re earning regular spending rates of 1.4 mpd (e.g with the UOB PRVI), your equation becomes-

2.6 cents=1.4 miles or 1.86 cents per mile

1.86 cpm isn’t a terrible price to buy miles at, insofar as it’s below the magical 2 cpm threshold, but remember that you could potentially be buying miles for less through annual fees.

This then leads us to the magic question- do iPayMy and Cardup earn 10x?

If you want some amusement, scroll through the comments section of this article, where it seems every other post is someone asking “does (CARD NAME) earn 10x?”

I mean, it’s perfectly understandable why people would ask this. 10X cards are high risk, high reward. If the bank doesn’t consider the merchant to be a 10x-able category, you earn 0.4 mpd. And if you earn 0.4 mpd you’re the loser because of the 2.6% transaction fee.

The answer is: I don’t know for sure. When I used my DBS Woman’s World card and Cardup to pay my NUSS membership fees back in December last year, I did indeed get 10X points. But each month the game can change without notice, and just because something worked last month doesn’t mean it will work this month.

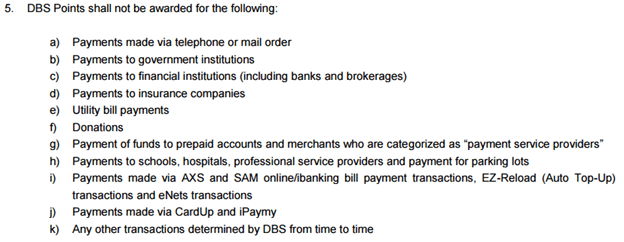

Whatever the case, it now seems confirmed that it won’t work for the DBS Woman’s card, as (someone pointed this out on the comments on 5th May, and I only got around to seeing it now), DBS’s T&C for the Woman’s card have been updated to explicitly exclude payments made to Cardup and iPayMy

Bummer. Why would the banks take this away?

To understand the answer to that question, we need to understand why banks give 10X.

Why do banks give 10X?

Two words: discretionary spend.

Let’s think about all the 10X opportunities that exist right now.

- Citibank Rewards (online and offline shopping)

- HSBC Advance (online and dining)

- UOB Pref Plat Visa (online and Paywave)

- DBS Woman’s World (online)

- UOB Visa Signature (overseas)

Notice anything in common?

Well, all the categories that get 10X are those where banks are trying to drive discretionary consumer spending.

You don’t have to eat out, but the banks hope that by offering you 10X you feel less guilty about swiping your card. You don’t have to indulge in online shopping, but banks give you 10X to encourage you to splurge on Amazon. If you bother to change your money at The Arcade before heading overseas, you don’t have to swipe your credit card overseas, but the banks hope that 10X will change your mind.

(Paywave seems to be less of a discretionary spend category given that you’ll find it at supermarkets, pharmacies and lots of other “utilitarian” places, but I’m guessing that the 10X program was conceptualized when Paywave was relatively new in Singapore and UOB wanted to drive adoption of the technology. Since Paywave transactions are capped at $100 and the overall 10X on the PPV is capped at $12,000 spend per year In any case, UOB doesn’t give UNI$ at merchants that are members of its SMART$ program, which, surprise surprise, is most of the supermarkets + pharmacies)

Banks don’t need to incentivize your non-discretionary spending because they know you’d do it anyway. Groceries need to be bought. Medical bills need to be paid. But they want to encourage you to spend above your baseline, and that’s why 10X opportunities exist.

Now think about what iPayMy and Cardup are offering. They are letting you turn routine, necessary payments into 10X opportunities. That’s great for you, but not so much for the bank, which suddenly realises that it’s having to pay out additional DBS points/UNI $ on payments that were going to happen anyway.

Therefore, from the bank’s point of view, it doesn’t make sense for them to reward this. And I fear that we’re now going to see more and more banks set this out explicitly. I know that HSBC Advance already doesn’t give 10X on iPayMy/Cardup, and to my knowledge only the UOB PPV currently earns 10X.

And that’s a big deal for iPayMy/Cardup, because, looping back to my opening argument, the only way I’ll pay 2.6% is if I get 10X. I’m sure the same goes for a lot of people in the miles community.

(I suspect the platforms themselves aren’t too confident about advertising 10X earning opportunities, because the working on Cardup’s own website illustrates a 1.4 mpd opportunity, not 10X)

The solution? Both iPayMy and Cardup have to go to the banks, sit down with them and say- this is what we offer, this is what people want. How can we make this work?

And whether the answer involves some sort of cost sharing, or joint promotion, or explicit cap on 10X for iPayMy/Cardup, I don’t know. But something needs to happen, because the longer the ambiguity about 10X exists, the fewer miles chasers will use either platform.

For ipaymy, which card would earn us 10x points now? I know for cardup the UOB PP Visa works for 10x points coz UOB does promote cardup…

Hi All,

Had called and checked with DBS CSO, the remaining 9X of reward points for March’s expenses on ipaymy was already credited into my account.

Have to call and check again with them on the April expenses after DBS computed the remaining 9X of point after mid of May.

Time to get UOB PPV. Thought I can manage without any UOB card. But with 2k a month rental, it’s a lot to leave on the table. I just wish they can come up with some sign up offer.

You can’t. Tried to apply last month. Got denied because ‘we don’t market the card any more’.

This is PP Visa

http://www.uob.com.sg/personal/cards/credit/preferred_platinum_visa_card.html

Not PP amex. PPV is still very much available.

As I said. I applied online, got denied. Went to Raffles Place to get some info. Was told: “we stopped marketing this card, you can’t apply in branches”.

I got the PPV very recently, as in no earlier than March from memory (my first payment to this card is due next week).

I think from PPAmex (which I got in Feb or Mar, a few weeks before the PPV), just because UOB does not market the card does not mean they don’t issue it!

I am not surprise that the application was denied. I have been holding PPV for quite some time. And recently UOB CSO called me to offer the UOB Prvi miles card but asking me to give up either my UOB Visa Signature or PPV. I asked for a reason in asking me to give up either of my cards, I was told that UOB intends to stop both the visa signature and PPV, and trying to switch customers to Prvi miles card. As to when, there’s no definite date yet. But they’ve sent me the email for the conversion to… Read more »

I applied in mid-April.

I applied for UOB PPV online late April, and got the card a few days later. Not sure what’s going on at your end.

Hi Tim,

Do you use ur UOB PPV for cardup? Does it still allow the 4 miles for cardup transaction?

Yes

My most recent one that has posted from last week – yes

Wait for this to catch on with the other banks. A lot of T&Cs from different banks look similar to the extent that I think they share the exclusions list to some extent. The LiveFresh card got updated with the same exceptions to CardUp and IPayMy on 1 May, so DBS had caught on. As I mentioned in my comment here (https://milelion.com/2017/03/21/cardup-adds-limited-time-member-get-member-promotion/), the key to this type of business is discretion. You are relying on the generosity of the banks to offer generous rewards for online spend that probably outpaces the cost of the rewards; it is a loophole in… Read more »

I actually had a meeting with an executive of iPayMy. I tried to understand what their business model was, while telling them that no reasonable person who can do some math would be paying their fees to get miles/points when 10x factor is not in place. I was told that their primary goal is not a ‘retail customers’ – like ordinary people paying their rents/bills but rather B2B transactions. I could buy that argument if they’d be marketing their services to that audience. But I don’t see it – I’d rather see the focus on ‘retail customers’. So my estimation… Read more »

I don’t think UOB will close the banks on this one. Would be bad publicity especially since CardUp is in their FinLab accelerator.

DBS is very sneaky. Change tnc without giving 30days notice. Same as their Passion card. Now cap at $100 rebates per quarter.

According to ABS, banks are required to give 30days notice before any changes to tnc.

Sneaky bank!!!

I think websites like Kickstarter and Massdrop also excluded?

Can anyone help to confirm?

I called DBS a couple of times and CSO said they are excluded… only retail online payment will earn 10x.

Getting quiet confuse here haha

any idea why ipaymy has no ONE TIME PASSWORD anymore? hsbc says it will honour as long as have OTP

HSBC won’t honour it regardless. And iPaymy does have an OTP. Just pay without storing your credit card info.

Anyone else not get the full bonus points credited today for the Woman’s card? Is DBS now excluding Ezlink prepaid Credit Card top-ups?

I see the T&Cs says it excludes “EZ-Reload (Auto Top-Up)” but the top-up for FEVO isn’t Auto.

http://www.dbs.com.sg/iwov-resources/pdf/cards/credit-cards/womans-platinum-mastercard/womans_card_tnc.pdf

DBS did not even give my 1X DBS point on my last EZ-RELOAD transaction dated 3 May. Until now i still consider that point as missing.. 🙁

Last Apr 2017 EZ-RELOAD transaction – 1X DBS point received, no 9X bonus point..

Hey, you can always try to reload into Nets Flashpay card by using the Nets mobile app in PlayStore (Android phone user only).

It works and rewards me additional 9X reward point by using Woman Card.

Hi Nobidy,

can I check how many times can u top up using this method per credit card weekly? I just encountered an error saying that I have reached the max weekly top-up per credit card but I didnt have this problem in the past. I used to top up more than 10 times per credit card.

Today I received the full 10x points for an April iPaymy transaction. Guess it’ll be the last time it happens *sob*

Does maxing qualified online spend mean both primary & supplementary WWMC cardholders potentially earn up to 8000 points per month? Or only the primary holder gets the points (4000)?

Its 4000 points for principal + supplementary cards combined.

Fevo is already excluded on 10x womans card 🙁

Yeah it’s goodbye. Now that card has no use after clearing the balance inside.

Hi Martin,

Greetings from CardUp.

We noticed you may have used the UOB Preferred Platinum Visa Card on CardUp and wanted to inform you of the recent updates UOB made to this card’s terms and conditions.

Effective 3 July 2017, the categories eligible for the online bonus have been reduced and CardUp payments will unfortunately not qualify. We have updated the information on CardUp’s website to reflect this but also wanted to let you know directly.

———-

And another tightening of T&Cs.

Do chope vouchers qualify as online spend?

JIANWENT63 -> Promo code for $20 off for Cardsup