A while back I wrote an article about how I felt the rounding down that UOB did on its PRVI Miles card wasn’t that big a deal, assuming you made a good mix of various sized-transactions. Their 1.4 mpd general spending rate is higher than the 1.2/1.3 mpd you’d earn on other cards, and therefore you’d earn back the difference on average.

I hubristically called this article “putting this 1.2/1.4 mpd rounding issue to bed”, but it turns out that if anything it just opened a can of worms. I’m glad my readers know their stuff better than me, because there’s a whole long chain of comments laying out exactly how each bank does its rounding. Turns out I’m guilty of oversimplifying some of the calculations, and I wanted to take this opportunity to lay out the situation for avoidance of doubt.

Let me state something upfront- this is really an article more for the boffins out there. On a practical basis, you’re talking about a difference of a handful of miles. Yes, they build up over time, but if you find it too stressful to track things on an individual card basis you could get away with not taking this into account and you’d still be fine, on an overall basis.

Many thanks to all you commenters out there for helping me make sense of this- johnnyboy, Naro, and the rest who were too modest to leave their names.

DBS Altitude

.png?w=474)

DBS’s T&C for their rewards program states the following

DBS Altitude Cardmembers earn 5 DBS Points for every S$5 equivalent in foreign currency purchase and 3 DBS Points for every S$5 local currency purchase. Cardmembers earn an additional 2.5 DBS Points for every S$5 equivalent in foreign currency online flight & hotel purchase and an additional 4.5 DBS Points for every S$5 local currency online flight & hotel purchase, capped at S$5,000 spend on online flight & hotel purchases per calendar month.

This led me (and many others) to assume that if you spend less than S$5, no points for you. That’s not correct, as DBS does prorate spending.

So if you spend S$3, for example, you earn 3/5*3=1.4 DBS points. DBS rounds points down to the nearest point, so you get 1 DBS point, or 2 miles.

This means that the minimum spending with DBS to earn miles is $1.67, for which you will earn 1 DBS point, or 2 miles for a 1.2mpd rate (The curious thing is that if you spend $2, you earn the same 1 DBS point, but you now have 1.0 mpd). What happens if you spend, say, $8.49? The same prorating kicks in and you earn 5.1 DBS points, rounded down to 5 points or 10 miles.

The interesting thing is- cents matter with DBS because of the prorating. If you spent $8.33, you’d get 4.998 points, which would be rounded down to 4 points or 8 miles.

TL;DR- Minimum spend to earn miles with DBS is $1.67, DBS prorates and awards you points on both dollars and cents spent.

UOB PRVI

Here is UOB’s policy, from their T&C-

UOB PRVI Miles Cardmembers earn UNI$3.5 for everty $5 charged locally and UNI$6 for every S$5 charged overseas. In the event the UNI$ awarded is in decimal points, the final UNI$ awarded for each transaction will be rounded down to the nearest whole figure.

UOB requires a minimum spend of $5 to earn any points. That’s because they don’t prorate. So spend anything less than that and you have bupkis.

This rounding down to the nearest S$5 results in a form of “double rounding”. What does that mean?

Suppose I spend $6 on my PRVI Miles card. You might think- ok, round down to $5, and at 1.4 mpd that’s 7 miles. Wrong. $6 spending will first be rounded down to the nearest $5, which gives you UNI$3.5. But that UNI$3.5 will be rounded down again to UNI$3, so you earn 6 miles for this transaction.

TL;DR- Minimum spend to earn miles with UOB is S$5. UOB does not prorate, and therefore you earn points on dollar spending rounded down to the nearest S$5.

Citibank Premiermiles

.png)

Citibank’s Premiermiles Visa T&C state (emphasis mine)

A cardmember will receive, on a monthly basis, Citi Miles which will be credited to his card account at the rate of 1.2 Citi Miles for every S$1 incurred on local retail purchases charged to his card account and 2 Citi Miles for every S$1 incurred on overseas retail purchases charged to his card account. Citi Miles shall be calculated on the amount of each retail purchase transaction and will be reflected in your statement of account as rounded down to the nearest Citi Mile

(The AMEX version is much the same, except the earn rate is 1.3 mpd instead of 1.2)

Unlike DBS and UOB, Citibank awards points on each $1 of spend. This means your transaction ($2.38, $5.95, $10.24 etc) is rounded down to the nearest $1 ($2, $5, $10 etc), multiplied by 1.2 and then rounded down again.

Therefore a spend of $1 earns 1 Citimile, a spend of $2.38 earns 2 Citimiles etc.

TL;DR- Minimum spend to earn miles with Citibank is S$1. Cents are irrelevant as all earnings are based on dollars.

Comparing Spending

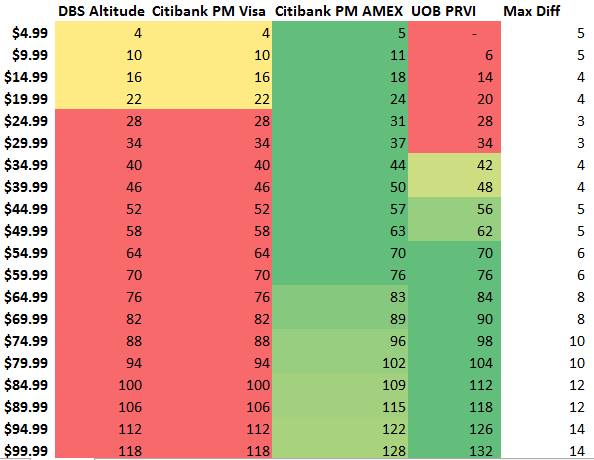

This article wouldn’t be complete without a comparison, so I put 4 different cards to the test- the Altitude, the Premiermiles (both Visa and AMEX versions) and the PRVI. Here’s what came out.

You can see that the Premiermiles AMEX is actually a pretty good card due to combination of its 1.3 mpd base rate and practice of awarding on every $1. Eventually at around the $65 mark the PRVI’s superior 1.4 mpd earn rate allows it to overtake the Premiermiles AMEX though.

However, if you’re comparing the Altitude and the PRVI, the inflection point is around $30. At this point, you’re earning 34 miles with both the Altitude and PRVI, after which the PRVI starts earning you more. So if you need an easy heuristic, remember: >$30, PRVI. <$30, Altitude.

I created the last column just to illustrate a point- if your purchase amounts are below $50, there’s really no point sweating this because you’re losing at most 3-5 miles per transaction. Suppose you do 30 transactions a month. You’re going to lose about 1.4K miles over the course of the year, assuming you got it wrong every single time. Would I rather have those miles? Yes. Am I going to lose sleep for having lost those miles? Probably not. Stick to the rule of $30 and you’ll be fine.

Here’s the excel if you want to play around with the figures yourself.

[gview file=”https://milelion.com/wp-content/uploads/2017/07/rounding-errors.xlsx”]

Other considerations

Rounding is an important piece of the puzzle, but it’s not the only consideration. You should also consider

- The validity of the points earned. Citimiles and DBS points earned via the Altitude card do not expire, UOB UNI$ have a 2 year expiry period. Once transferred to Krisflyer, miles have a 3 year validity

- The choice of airline transfer partners. UOB UNI$ and DBS points can be transferred to SQ and CX. Citimiles can be transferred to those + Qatar, MAS, Thai, Qantas, BA, EVA, Etihad, Air France/KLM and Garuda, plus Hilton, IHG and Club Carlson

- Points pooling. A major weakness of Citibank is that they don’t pool your points together. You cannot redeem Citibank ThankYou points (earned from its Rewards card) with Citimiles and pay one conversion fee, rather you need to convert them separately (sporadic reports of getting CSOs to waive this, but definitely not SOP)

- Annual fees. You shouldn’t be paying annual fees without getting something in return, and to that end the DBS Altitude + Citibank Premiermiles give you 10K miles when you pay the $192.60 annual fee. UOB PRVI Miles gives you 20K miles if you hit $50K spending in a year (AMEX version only), but otherwise does not give you renewal miles. I’d watch this card very closely to ensure they don’t proactively deduct UNI$ from your balance to cover the annual fee, as they are wont to do

From my own calculations my heuristic point for PRIV and Altitude is $20. Because at $20 and $25 exactly, PRIV nets you more, while theres no diffence from the other 20-30.

Going a lil further spending $10, $11, $15 and $16 with the PRIV gives you more marginally as well.

I guess that no longer works as heuristic but shrugg. Every cent counts for me. And then again uni$ expires but dbs points doesn’t.

your math is right. the problem is it’s just too much to remember. we need an app for this…

I created a 2 cell x 6 cell spreadsheet so that I can plug in any value and see which gives the most miles. The formulas was based from your Excel though, but it gives me a quick and easy reference on the go.

Actually, rather than remember heuristics, maybe somone can do a simple 5 cell excel or googlesheets and share publicly. 1 cell to input the transaction amount And 4cells to show the points awarded for dbs alt, citibank premiermiles visa, pm amex and uob privi. So it is clear what to use at whatever price.

digression: so does DBS WW still actually give 4mpd for uber’s and grab rides?

Yes for both Uber and Grab transactions.

for good order, which card to use for uber and grab then?

Anyone know if DBS WW prorates for online spend under S$5? Ie, do you get prorated 5X points if you spend less than S$5 on, say, Uber?

I would like to know too. currently Krisflyer Credit card is offering extra 2 miles per $1. If lets say i have the Krisflyer Blue, i will get 3.3 miles per dollar and there are no rounding policies.

Sorry i mean 3.1 miles for the Blue card. 3.2 miles for the Ascend and 3.3 for PPS.

I’ve said this before, but my beef is with UOB’s marketing which is so shamefully misleading. http://www.uob.com.sg/personal/cards/credit/uob_prvi_miles_visa.html Quote: You’ll Love 6 miles for every S$1 spent on major airlines and hotels 2.4 miles for every S$1 spent overseas 1.4 miles for every S$1 spent locally That is just plain wrong. Wrong wrong wrong wrong wrong wrong. How can you advertise 1.4 miles for every S$1 spent locally? Case 1: Spend $4.99. Per advertising, should be 4x 1.4 miles = 4.6 miles. UOB actually awards zero miles. Case 2: Spend millions of $ at Cold Storage. Per advertising, should be spend… Read more »

Uni$ and DBS points can be transferred to SQ and CX: isn’t it Krisflyer (only SQ) and AsiaMiles (which includes CX but also other partners like Finnair, Qantas, Qatar etc?)

Yes, I’m using shorthand for krisflyer and asiamiles. But even so, remember that different ffps charge different miles for similar routes. So having more transfer partners gives you more flexibility in booking sweet spots on particular airline award charts

It’s not “only SQ”. You can use krisflyer to book on most star alliance carriers.

Hi aaron,

I think CitiMiles can no longer transfer to Delta right? Last month I tried to tranfer some miles to Skymiles to redeem US to EU flight, but cant find the option.

paiseh, you’re right. i copied and pasted the list from a previous article. have updated this

As someone who doesn’t spend much, it does hurt when I don’t earn miles for the odd $4.99 difference but at the end of the day, I’m happy with a UOB strategy thanks to the PPV. I use it more often than I do the PRVI (the SMART$ merchant list has been extremely useful). Plus, it’s *almost* a dining card, given how many F&B establishments now have Paywave terminals 🙂

Of all the general spending cards, SCB Visa Infinite is the best – I believe they round to the nearest dollar at 1.4mpd. Only two catches – first is have to pay $538 annual fees, but you do get miles out of it for the 1st year; second is that the 0.4mpd comes in one month later, which makes for slightly harder accounting.

you forgot the min spend of $2,000. ANZ is THE best at 1.4mpd no restrictions, no min spend, no annual fees. too bad it’s gone in a few days more

Yup, min spend $2k. And yes, I’m using ANZ like mad until then lol

Aaron,

Thanks for pointing this rounding issue out. It certainly is interesting.

I performed a spreadsheet simulation on this to test what the average mpd looks like, on the assumption that your charged expenses range uniformly across both dollars and decimals. I used a range of $0 to $50 spend, in intervals of $0.05.

Results (mpd – local/overseas):

UOB PRVI – 1.08 / 1.90

CitiPremierMiles (Visa) – 1.10 / 1.89

CitiPremierMiles (Amex) – 1.19 / 1.89

Seems like Citi delivers mpd closer to their promise than UOB

Following from my previous post, i had itchy fingers and played around with the ranges (this time in intervals of $0.01). Throwing in SCB V/I now (just because someone else mentioned it) Individual Transactions up to $50 Results (mpd – local/overseas): UOB PRVI – 1.08 / 1.90 CitiPremierMiles (Visa) – 1.10 / 1.89 CitiPremierMiles (Amex) – 1.19 / 1.89 SCB Visa Infinite – 1.31/ 1.89 Individual Transactions up to $100 Results (mpd – local/overseas): UOB PRVI – 1.21 / 2.11 CitiPremierMiles (Visa) – 1.14 / 1.94 CitiPremierMiles (Amex) – 1.24 / 1.94 SCB Visa Infinite – 1.35/ 1.94 Individual Transactions… Read more »

Hello there, I found your mini project to be quite enlightening. I am however wondering if the maths for the SCB Visa Infinite is accurate. I think you might have presumed that it awards 2mpd for Overseas spend, but this is in fact 3mpd.

Hi JT,

Thank you for your itchy finger… can you kindly include altitude card for comparison as well

The AMEX Krisflyer also awards miles on every dollar spent and every single mile is transferred to Krisflyer at the end of each statement month with no transfer fee.

Although it expires after 3 years due to Krisflyer’s rules.

But then again that’s the point of a cobrand credit card: to be linked directly to Singapore Airlines.

Thanks for the timely article; I have been doing a bit of a comparison between PRVI Miles and Altitude card as well. An interesting point to note is that DBS Altitude is (I do stand corrected) the only mile-earning card you can use for SP Services payment via recurring bill payment services. So simply put, for a SP services bill of say $150/mth, you get an additional $150×1.2 = 180 miles, which means an additional spending of $900 on UOB PRVI Miles to catch up. ($900 * 1.4-1.2). Depending of course on your spending pattern, the point above kinda swayed… Read more »

do they award miles for utilities??

shucks, i’ve been missing out. always thought SP was excluded. =p

How doubt OCBC?

is this excel spreadsheet still up to date?