I recently did a review of the so-called “$120K credit cards” in Singapore, which are targeted at the entry level prestige segment of the market. The conclusion I reached was that if I had to pick one, I’d probably go with the Citi Prestige, due to its unlimited lounge access, generous limo policy and fourth night free benefit.

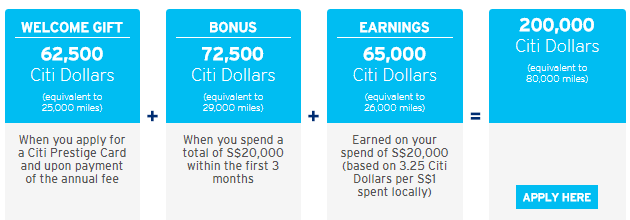

If you’ve been thinking about getting a Prestige card but haven’t pulled the trigger yet, you might be interested to know that from now till 30 November 2017, Citibank is offering a sign up bonus on its Prestige card which allows you to earn the equivalent of 80,000 miles when you spend $20,000 in the first 3 months and pay the $535 annual fee.

The breakdown of the 80,000 miles (creditied in the form of 200,000 Citi dollars…if only this TK deal were still around) is

- 25,000 miles welcome gift (with the $535 annual fee)

- 26,000 base miles ($20K spending @ 1.3 mpd for local*)

- 29,000 miles bonus for hitting $20K threshold

*Note that the workings in Citibank’s example assume that your $20,000 is spent locally. On the other extreme if you spent all of that overseas, you’d end up with 94,000 miles instead of 80,000 miles. In reality, you can expect to hit something in between those two figures.

$20,000 in 3 months is certainly a lot of money, and unless you’ve got a big ticket life event coming up it’s certainly going to be very hard to hit that sum. The good news is that it’s confirmed that spending with Cardup will count towards the minimum spend, so if you have big rental bills or tax payments then this could potentially help you hit the threshold.

I tried going through the HWZ thread to see if I could find any past sign up offers to see how this one compares, but couldn’t find anything of note in the past 12 months. Still, if you’re thinking about getting the card, you should have a read of that thread because people post about some of the unpublished benefits that Citibank sends out from time to time (eg special dinner packages, priority access to shows etc) to Prestige cardholders.

The T&C can be found here. I didn’t find anything to be worried about, but note that you can’t take part in this promotion if you cancelled your Citi Prestige card within the last 6 months and reapply.

Sign up for the 29,000 mile Citi Prestige bonus offer here (I earn a referral bonus)

One last point about Citibank cards. Remember that Thank You points do not pool across cards. That is, you will not be able to combine the points you earn from your Citibank Rewards card with your Prestige card, nor your Premiermiles card with your Prestige card. This means paying multiple conversion fees when you want to cash out. Needless to say I find this extremely infuriating and customer unfriendly, but those are the rules. Citibank somewhat makes up for it by having a much wider range of transfer partners than other banks, but still…

Any non-privileged banking customer manage to get prestige card under 120k p.a income?

I was about to ask that. I wonder how flexible they are on allowing individuals below 120k p.a. to get the card. would be good if we can see some success cases here.

check hwz thread? should be some stories there.

Don’t want to be a k-po but I don’t think its a good habit to be spending 20k in 3 months if you earn under 120k p.a.

#juzsayin’

Could be executed through a down payment for major spend like deposit for car, which would need to happen anyway. Renovation etc.

I managed to get it with $110K. Stable job, and have been a Citi customer for some time, so that may have helped. Interestingly, my first application was declined, but the Citi CSO called me up after my Voyage card was approved, so not sure if they kept an eye on the credit report.

I have the prestige card and always call the prestige number and agents are happy to pool points from my rewards cards to the prestige. Last time 2 weeks ago. Could be that they are willing to do the service only for premium card holders?

When you say “pool points from my rewards cards to the presitge” are you talking about transferring points from the rewards master n visa to the prestige, or making a single redeption from the points in all 3 cards at one go?

Lucky you. I tried and was flatly declined

We arevtalking points transfer (no redemption).

Another point to note is that the 4th night free is not as good as it seems. Hotel taxes are excluded. The concierge also books thru Expedia (the quote form clearly states its Expedia bookings), and the rates quoted are pay-now Expedia rates. There is a 15% coupon code for Expedia on Citi website now, so one might be better off booking thru Expedia direct rather than thru the concierge.

Depends on the per night rate. My experience was the concierge books thru the hotel website. So for instance, a SPG cat 7, you could potentially save a min of SGD 500 and get the points! Having said that, I’ve only used it once cos my travel plans don’t require a 4 night stay.

I struggled and had to pull all stops including paying my income tax via cardup to hit the citi premiermiles 9k in 2 months promo. Seriously can’t think of how to hit 20k in 3 months, short of buying a new car and pay the down payment via cc

You could purchase a revenue Suites return ticket to JFK…

See if any relatives have big medical accessories bills? In my family we managed to hit 10k with combo of hearing aid for grandpa and cpap breathing machine. Both medically necessary.

Is the 29k miles for sign on valid? I clicked on it and it showed a generic 25k application webform..

you don’t see it when you scroll down? when i click on this link i see it reflecting on the splash page

http://adx.io/go/AFGBPTJuly2017

No boss. no splash page for me on edge or chrome or incognito tabs…not sure why

I don’t see any splash page too

do you see this? I see this:

?dl=0

?dl=0

But, this shows 25k in the image. No?

look at the right hand side. the 25K is what you get with paying the annual fee. the 29k is the bonus you get with the $20K spend.

Ok. I think the title is misleading. I interpreted that I will get 29k instead of 25k for “sign up bonus”. Like what you said, the 29k is the bonus for $20k spend. It is not the “sign up bonus”

ah! ok. anyway will still use ur link.

Sigh, what do they do for existing card holders then?

hey…don’t be so hard on citibank

I dont hold the premier cause its over laps with the presitge.

#doublesadness

Any idea when they will confirm the bonus miles for the PremierMiles promo?

I called then about this and they said the bonus miles will be credited 2 mths after promo ends(31 Aug), meaning by end Oct. Watch out for the admin fee in your bill. That should give you some indication of the miles to come.

You never know. They might do the same thing they did for existing cardholders of Premiermiles. First they did the promo for new applicants and ran that for a few months. They they introduced the loyalty card promo. Let’s wait and see if they they do the same to existing Prestige cards.

#prayforprestige

on a sidenote, seems like they are giving out prestige with 1st year free now.

Sigh, this is the start of the end of the dynasty.

Source: hardwarezone.

eh i think i saw the post you’re referring to, but wasn’t it established that singsaver’s site had an error? prestige t&c seem to say very clearly that first year fee cannot be waived.

20k seems to include fevo?

I doubt it. It may be caught under “quasi cash” transactions.

Recently received an invitation letter from Citi to apply for the Prestige card, although my income is short of 120k. Wanted to ask if anyone here also received such a letter – curious if it’s targeted or just a mass mail to Citi cardholders. It’s not specifically addressed to me (‘Dear Citi Credit Cardmember’), nor is there a special channel to apply (visit the usual citiprestige link).

someone’s moving up in life! do you normally spend quite a bit on your other citibank cards? that might be a reason

Well still getting there, but accelerated thanks to you! Learnt a great deal from your articles. I do spend a decent amount on the Premiermiles (>8k/month) for work claims. Anyway I’m gonna give it a try and report back, wish me luck! Oh btw despite what the folks at hwz say, my invitation letter clearly says the annual fee is non-waivable.

I just got the letter too. There seems to be a special channel to apply via SMS for mine though. I did spend quite a bit on my Premiermiles in the past year as well. My income is way short of the 120k though…

Just to report back: I tried the SMS route, was given a call by CSO who said it’s strictly for 120k income, and the letter was likely due to high spending on Citibank cards. Oh well.

I received the letter and sms yesterday.

Today the CSO called and immediately get approval via phone enrolment. I don’t even needs to submit application form.

Is your income 120k or more? If not then I’m gonna try again..

I told the CSO my income around 100k.

However, I spend about 100k a years due to company expenses.

You can try tell the CSO that you received invitations letter.

Wow ok, thanks for sharing. I’m definitely gonna try again. My expenditure is roughly the same amount. Sadly the invitation letter line didn’t work, but my game plan will be to hang up and call again.

I got the invitation letter in the mail today. I like the benefits, but at $535 I’m still not biting.

i’ve often wondered what heuristic banks use when setting income requirements for cards. apart from the $30k mandated by MAS, there is no real reason why one card should be 50, another 80, yet another 120k. I guess it’s a bit of monkey see monkey do.

Will paying insurance premiums through e-AXS count towards the minimum spend?

The miles bonus is really tempting. Tricky part is charging $20k in 3months…

Guys, I found a way to maximise the qualifying period. Based on the T&C: Qualifying Spend Period” refers to the period starting from the Eligible Card approval date to the end of that calendar month (“First Month”) and, three full calendar months immediately after the end of that First Month. Example: if the Eligible Card is approved on 18 October 2017, the Qualifying Spend Period will be from 18 October 2017 (i.e. card approval date) to 31 January 2018 (i.e. three full calendar months starting from November), both dates inclusive. This implies that if you apply for Prestige on 1… Read more »

Do you have the TnC for the 72,500 TY Points? THe linked T&Cs are only referring to the Welcome gift

Aaron – can I find out where or how you received confirmation from Citi that spending with Cardup will count towards the minimum spend?

I am checking with Citi whether some of my spend counted toward the minimum spend now and they are giving me the unwelcome news that a bunch of items have been excluded as “service fees”, e.g. Paypal (even where it’s to a retailer).

there are a few people who have confirmed this in the comments section on other posts and in the telegram group. i’d definitely fight them on the paypal thing

Does anyone have the TnC for the 72,500 TY Points? The linked T&Cs are only referring to the Welcome gift

Eh. The t and c used to link to the 72.5k ty points bonus. But I think when the offer ended they updated the link so now it points to welcome gift.

[…] problem? You hardly ever see any acquisition offers. Some time back we had a spend $20,000 in 3 months and get 29,000 miles bonus, but that’s currently not available. Moreover, SingSaver is giving $200 of NTUC, Grab or Taka […]

[…] Citibank has not run any campaigns on bonus miles in quite a while. For Citibank Premiermiles, there was a promotion in July 2017 where you will get 10k miles when you spend $3k or 42k miles when you spend $9k in 2 months (see post here), and for Citi Prestige, there was a promotion in Sep 2017 where new signups get an extra 29k miles when they spend $20k within the first 3 months (See Milelion’s post here). […]