On and off, the Milelion team hears of readers asking how to get to Citibank’s rewards points page. Well, I mean it is a legit and meaningful question because if you cannot locate or track how many points you get, then how are you going to use those points to convert into miles? So this will serve as a short article to share with like-minded readers who have gotten their Citibank Rewards Visa (or the now discontinued Mastercard) and still do not have how to get there.

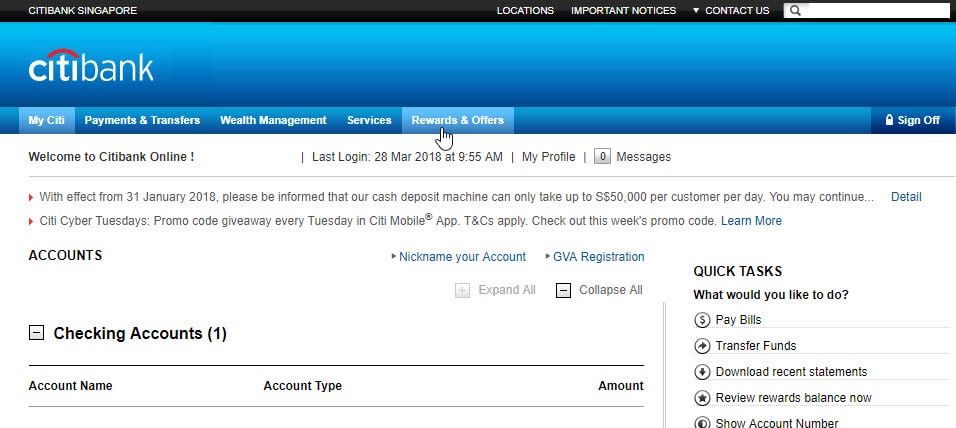

Step 1 – Click on Rewards & Offers after logging in

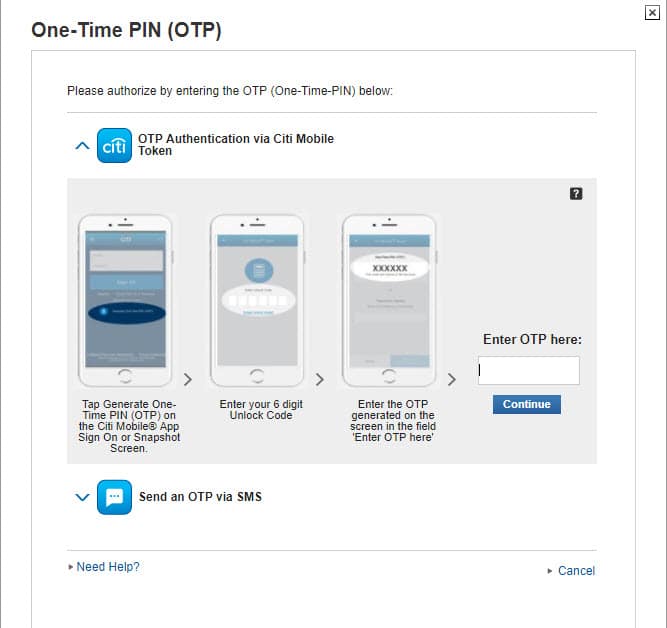

Step 2 – Enter OTP

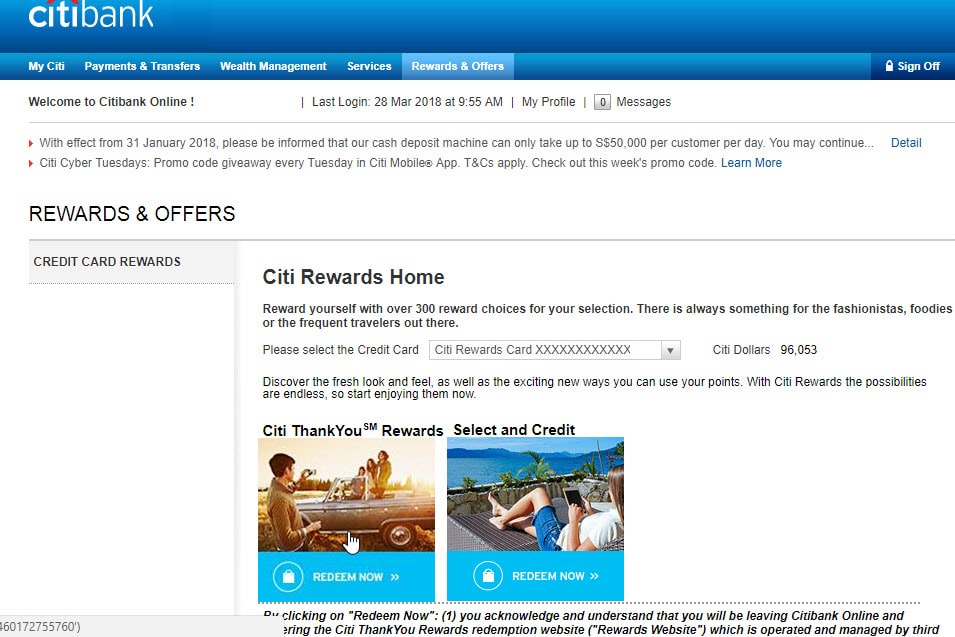

Step 3 – Click Redeem Now after selecting your credit card

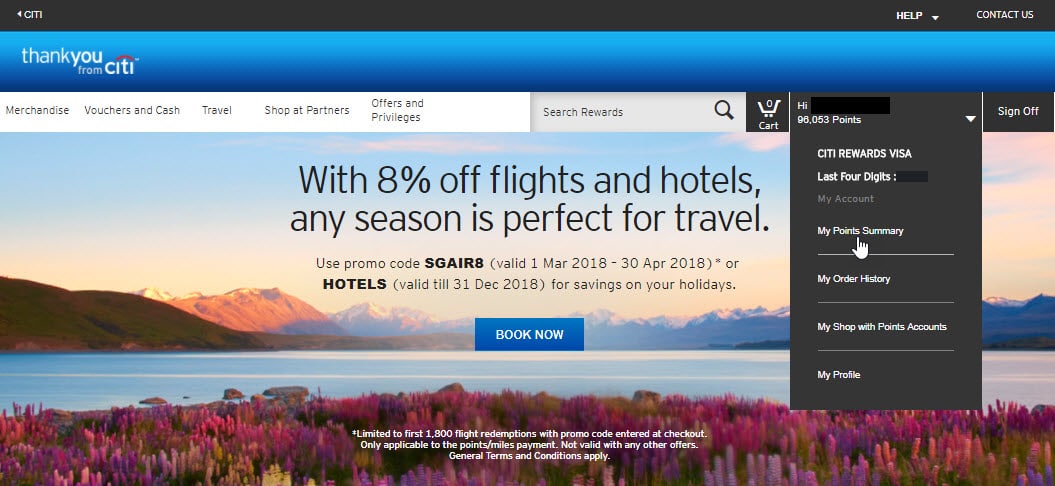

Step 4 – ThankYou rewards homepage

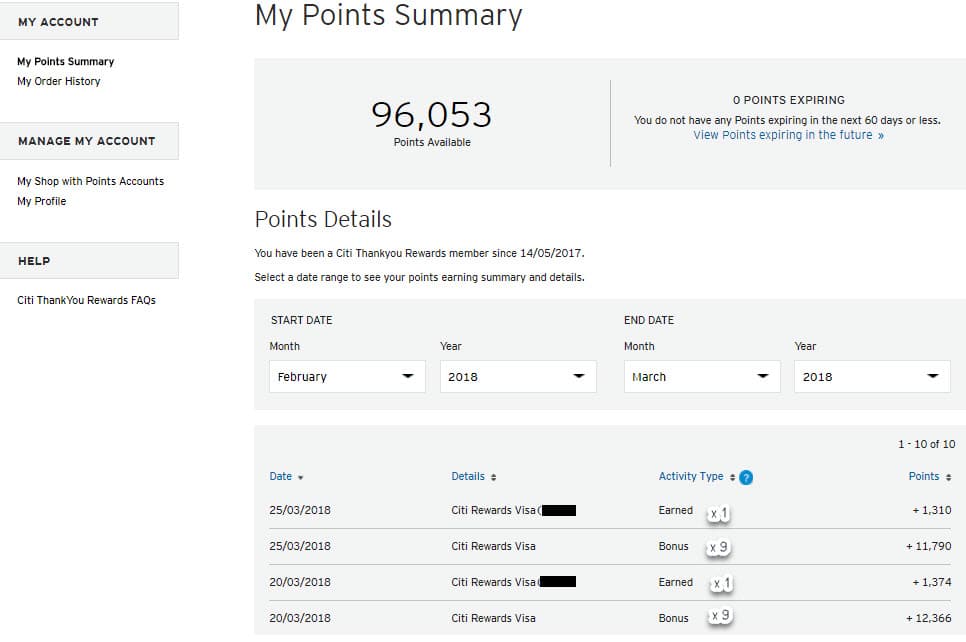

Step 5 – Choose the duration

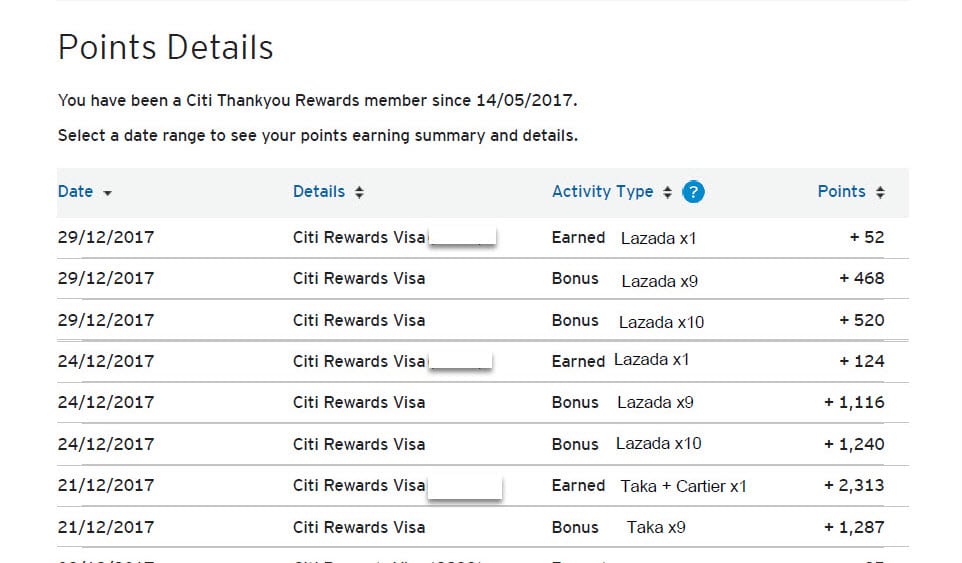

Although Citibank goes much further than DBS or UOB in providing a points level breakdown, it’s still imperfect because it’s not exactly transaction level. It’s more like day level, and if you have several transactions in a single day it may be hard to separate which is which and what got 10X and what didn’t.

From the example above you can see that 1,310 (Earned) is the basic x 1 and 11,790 is the x9, for a total of 13,100 points. Since the points are aggregated on a daily basis, sometimes you may see that your bonus is not exactly x9 of the Earned. This is because you could have used the card on several purchases and some of the merchants or categories do not award the additional x9.

The main disadvantage of Citi ThankYou points is that the points do not pool together for the cardholder. If you have a Visa and a Mastercard version of the Citi Rewards card, the points are separately earned and you have to pay two conversion fees to convert them into FFP miles. It is the same if you have a Citi Rewards card and a Citi Premiermiles card; separate conversion fees as well. That said, Citi ThankYou points have one of the most flexible conversions in terms of FFP partnership so there is good value despite the disadvantage (12 airlines at the last count).

[credit_card_shortcode cc_id=”21829″]

So there you have it. Track those points and reward yourself with an air ticket soon!

What’s the best way of finding out the breakdown of points for DBS and UOB besides calling them and going through each transaction?

No. The article mentions this point too – “Although Citibank goes much further than DBS or UOB in providing a points level breakdown…”

Noted on it being covered. Was just hoping for some alternatives on the best way of getting a breakdown regardless it not being as easy as Citibank’s

Personal opinion: DBS is a black hole for reward points tracking since there is no breakdown whatsoever. Only way is to ownself check ownself, call CSO if you feel the points are not justified. UOB is also another black hole, abeit a lesser one. The rewards summary at the monthly statement gives a very basic summary of what is earned that month and what is adjusted, that’s all. OCBC shows every single x1 reward point transaction via internet banking but the remaining x9 will appear lump sum in the following month’s statement.

Statement Only applies to VS. PPV and PRIV will post at the same time as posting appears

Will you want to try and appeal for your Cartier transaction?

will it work? unless you are a positive data point.

Thanks for this sharing. I also started to track. Just wonder if you know that the earned and bonus point is credited to my account on the same date of transaction? or few days later.?

from experience, the earned and bonus points will be reflected in the system about 2 to 3 working days after the transaction.

Outdated. No longer able to see via website